Punjab National Bank Q4 FY25 Results: PAT up 102%, RoA at 1%, FY26 Outlook Solid

PNB sets guidance for stable NIMs, high recovery, and low slippages in FY26. While PSU overhang persists, operational delivery continues to narrow the valuation gap.

Bank stocks seem complex — until you know where to look. Learn how to read CASA, NIM, and PCR like seasoned investors in this simple, practical guide.

1. Financial Performance: FY25 Results Reflect Clean-Up Gains and Profitability Surge

1.1 Q4-25: PAT up 52% & Net Interest Income up 4% YoY

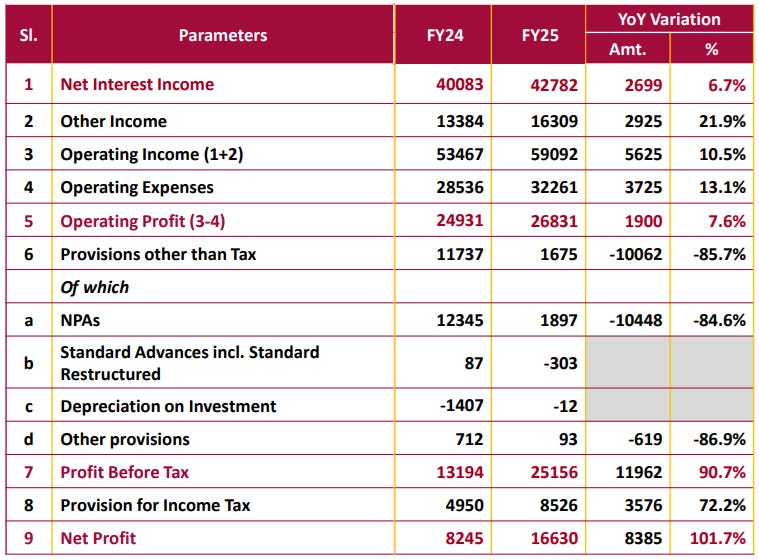

1.2. FY-25: PAT up 102% & Net Interest Income up 7% YoY

1.3. Business metrics: Improving return ratios

2. FY26 Priorities: Strengthen the Core & Scale Profitably

2.1 FY26 Guidance

Punjab National Bank largely delivered on its FY25 guidance, with strong execution on credit growth, asset quality, and profitability.

However, the bank fell short on CASA ratio and income growth.

Slower-than-expected Net Interest Income growth and a dip in operating profit momentum reflect some margin pressure due to rising deposit costs and subdued yield expansion.

Looking ahead, the FY26 guidance reflects a strategy of consolidation over aggression.

Credit and deposit growth targets have been moderated slightly, likely to protect margins.

The bank aims to rebuild its CASA ratio above 38%, sustain RoA above 1%, and bring GNPA below 3% — signaling confidence in maintaining its clean-up gains.

Recoveries are also expected to rise, aiding non-interest income and capital buffers.

2.2 FY26 Priorities: Granular Growth, Digital Push, and Risk Control

PNB's FY26 strategy focuses on profitable, low-risk expansion anchored in four priorities:

Retail & MSME-Led Growth: Drive credit growth through high-margin, low-ticket loans while maintaining underwriting discipline.

Strengthen CASA & Liabilities: Improve current account penetration and reduce bulk deposit reliance to protect NIMs.

Accelerate Digital Execution: Expand digital loan sourcing, mobile banking usage, and AI-driven recovery workflows to boost efficiency.

Preserve Asset Quality: Keep GNPA <3%, credit cost <0.30%, and sustain high provision buffers to avoid fresh stress formation.

3. Valuation Summary: Undervalued or Priced for Perfection?

Punjab National Bank (PNB) continues to trade at deep value multiples despite significant improvements in asset quality, return ratios, and capital strength. The market seems to be assigning a conservative multiple due to PSU overhang, though there is increasing investor recognition of the bank’s execution and financial stability.

At these levels, PNB is trading at a valuation discount to both private banks and re-rated PSU peers, despite now reporting return ratios in line with the sector.

3.1 What’s Built Into the Price Today

At the current valuation (P/E ~5.7x), the market seems to be pricing in:

Stabilized return ratios, assuming RoA stays near 1% and RoE around 17–18%.

Low-to-moderate credit growth, aligned with PSU sector average (11–12%).

Cautious confidence in asset quality, assuming GNPA stabilizes under 3%.

No material re-rating from current levels; investor risk appetite remains conservative.

In other words, the price reflects a bank that’s no longer distressed — but not yet fully trusted to sustain private-bank-level performance.

3.2 What’s Not Fully Priced In Yet (Optional Upside)

There are several upside levers that current valuations may not fully capture:

Further re-rating if RoA sustains above 1% for another 2–3 quarters.

Capital efficiency gains via growth without equity dilution (CET-1 >12%).

Higher-than-expected loan growth, especially in MSME and retail.

Sustained recovery income from written-off NPAs and NCLT resolutions.

Positive sentiment shift toward PSU banks if market rotation continues.

If any of these play out, a P/B re-rating and P/E expansion is possible.

4. Implications for Investors: What to Watch

With earnings normalized, NPAs near historic lows, and return ratios at multi-year highs, Punjab National Bank presents a compelling but nuanced investment case. While valuations remain attractive, investor decisions now hinge on the sustainability of these improvements — and the potential for further re-rating.

4.1 Bull, Bear, and Base Case Scenarios

These price bands factor in trailing earnings, modest growth, and investor sentiment toward PSU banks. Even the bear case implies limited downside from current levels.

4.2 Reasons to Stay Invested or Add on Dips

Structural turnaround is real: Clean book, sub-1% net NPA, and credit cost near historic lows.

Valuations still undemanding: Trading at ~1.1x tangible book and ~5.7x earnings — a bargain for 19% ROE.

Capital adequacy cushion: CET-1 of 12.3% enables growth without near-term dilution.

PSU re-rating tailwind: As investor sentiment improves toward government-owned banks, PNB stands to benefit.

Steady execution: Met or exceeded FY25 guidance across asset quality and return metrics.

4.3 Key Risks & What to Monitor

Deposit pricing pressure: Could erode NIMs if CASA stagnates or bulk funding costs rise.

MSME/Agri stress pockets: These segments, while profitable, carry default risk in a slowdown.

Market risk aversion to PSU ownership: Despite performance, PSU banks still suffer from perception discount.

Execution fatigue: Sustaining low credit cost and high ROA will be critical — even one weak quarter could stall the re-rating.

4.4 Investor Segmentation Outlook: Who Should Buy PNB?

PNB is no longer a deep-value distressed PSU — it’s evolving into a steady-return, capital-efficient lender with limited downside and multiple re-rating triggers. For investors willing to look past the PSU tag, the stock offers a compelling margin of safety with upside potential.

Previous Coverage of PNB

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer