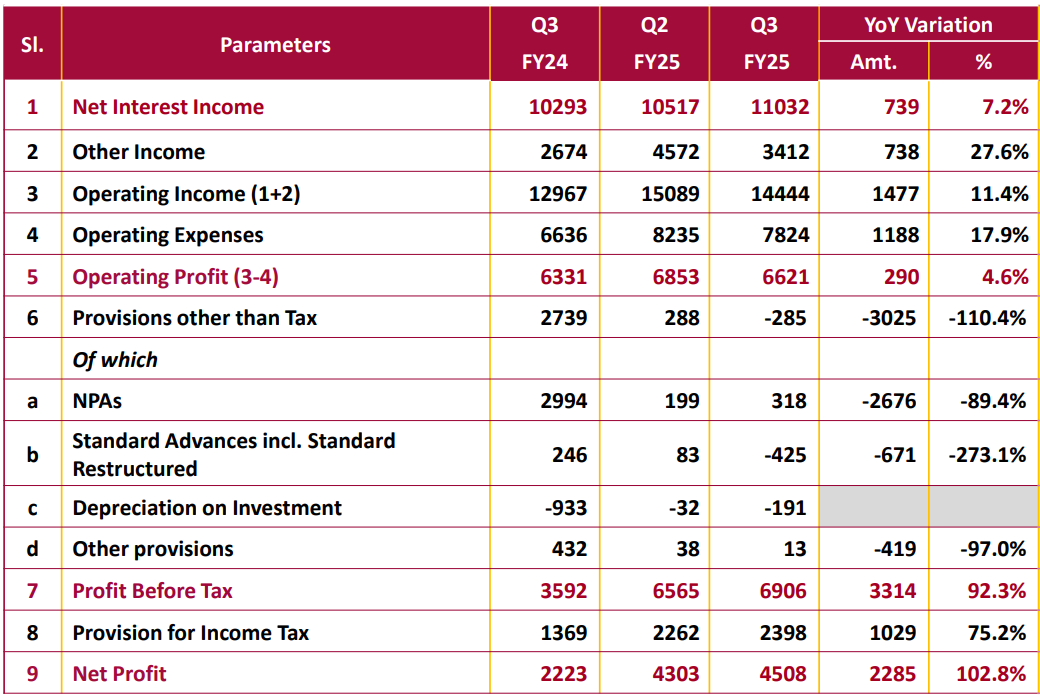

Punjab National Bank: PAT growth of 131% & Net Interest Income growth of 8% in 9M-25 at a PE of 6

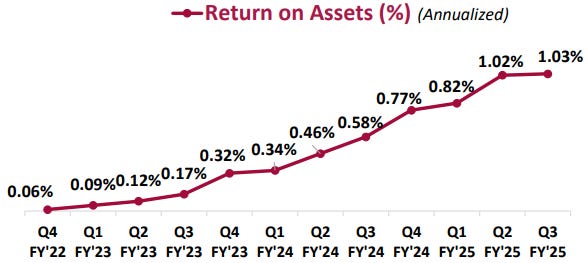

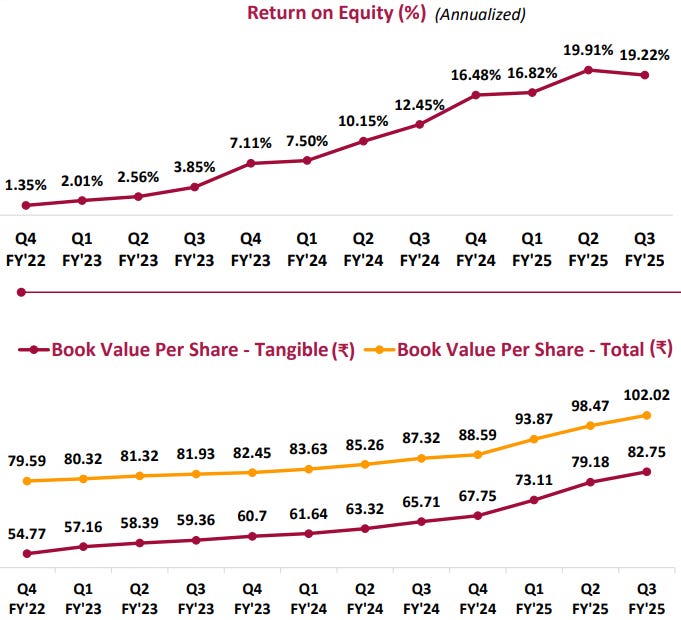

Strong guidance for FY25. On track to deliver as per FY25 guidance. Attractive valuations at 1.1x book and 6x P/E, considering improving ROE (~19%) and ROA (~1%), suggest limited downside.

1. 2nd largest Public Sector Bank

pnbindia.in | NSE : PNB

Second Largest Public Sector Bank in terms of Total Business and Deposits

2. FY22-24: PAT CAGR of 51% & Net Interest Income CAGR of 17%

3. FY24: PAT up 229% & Net Interest Income up 16%

4. Q3-25: PAT up 103% & Net Interest Income up 7% YoY

5. 9M-25: PAT up 131% & Net Interest Income up 8% YoY

6. Business metrics: Improving return ratios

7. Outlook: Strong PAT growth in FY25

PNB will continue on its current growth path and profitability strategy.

Adjustments and tweaking will occur regarding the cost of deposits and yield on advances to improve profitability.

The bank can maintain a Net Interest Margin (NIM) in the range of 2.9% to 3% due to a high provision coverage ratio.

Recovery is expected to be higher than slippages, leading to write-backs of provisions.

Credit growth is expected to be in the 13% to 14% range. Focus will increase on the RAM sector, particularly the MSME segment.

A technical write-off (TWO) recovery of around Rs. 1,500 to 1,600 crore is expected in the upcoming quarter.

The bank is poised for digital transformation, with increased digital transactions and various digital journeys for customers.

The bank is adequately provisioned, with write-backs of provisions expected to continue.

Treasury Operations Outlook:

Decisions by the Reserve Bank of India (RBI), such as open market operations, are expected to add to the profitability of the treasury.

Some improvement in treasury performance is expected in the coming quarter.

NIM and ROA Outlook:

The Net Interest Margin (NIM) guidance for the financial year is 2.9% to 3%.

The bank is repricing its corporate book to improve yield on advances.

The bank expects some improvement in treasury income in the interest income.

The bank will wait for the budget announcement and MPC outcomes before disclosing growth and NIM plans for FY26.

Asset Quality Outlook:

Confident in sustaining gross slippages at around Rs. 1,700 to Rs. 1,800 crore.

Write back of provisions is expected to continue in subsequent quarters.

CASA Growth and Operating Expenses:

The bank believes interest rates do not significantly impact CASA growth and will continue with the current rates.

The bank aims to be competitive in CASA growth by offering additional facilities and segment-based CASA products.

Employee-related costs are expected to remain fixed.

Emphasis will be placed on improving non-interest income through cash management services, supply chain, and vendor management.

Recovery Targets:

The bank is aiming for Rs. 18,000 crore in recovery, with a conservative estimate of Rs. 5,000 to Rs. 6,000 crore in the current quarter.

Recoveries are expected to come from both TWO and write-back of provisions.

Loan Book Growth:

The guidance for loan book growth for the current year is 11% to 12%, with expectations of 12% to 13% growth in Financial Year ‘25.

NCLT Recoveries:

Recovery through NCLT in Q3 was Rs. 380 crores.

Expecting around Rs 570 crore recovery through NCLT route in this particular quarter and around Rs 500 crore of recovery through NARCL route in this particular quarter.

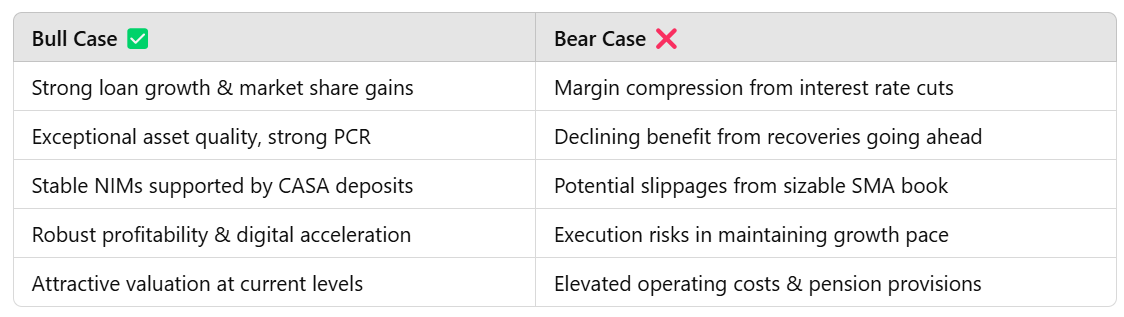

8. PAT growth of 131% & Net Interest Income growth of 8% in 9M-25 at a PE of 6

9. Hold?

If I hold the stock then one may continue holding on to PNB

Robust Business Growth: Strong deposits (15.6% growth) and advances (14.8% growth).

Stable NIM Outlook: Despite rate pressures, PNB maintained domestic NIMs (~3.1%), aided by strong CASA (~38%) and effective deposit management.

Asset Quality Improvement: Gross NPA sharply improved to 4.09% (down from 6.24%), and Net NPA at 0.41% shows exceptional asset quality.

High Provision Coverage: PCR at 96.8%, well above management guidance (95%), provides strong protection against potential credit risks.

Low Credit Cost: Slippages are well-controlled (₹1,774 crore this quarter vs. ₹2,181 crore QoQ), while recoveries outpace slippages, indicating sustained low credit cost.

Comfortable Capital Position: Capital Adequacy Ratio (CAR) at 15.41% provides ample room for growth without dilution risks.

Strong Liquidity: Healthy CASA deposits and comfortable CD ratio (72.58%) support profitable loan growth potential.

Attractive valuations at 1.1x book and 6x P/E, considering improving ROE (~19%) and ROA (~1%), suggest limited downside.

PNB is in the middle of a very strong run. It has delivered sequential growth in PAT on QoQ in all the 4 quarters of FY23 and FY24. The trend continues in Q3-25. One should keep a watch on the operating profit as it has de-grown on QoQ basis after a long trend of sequential growth.

The YoY growth in Operating profit was supported by IT refund of Rs 350 cr or else one would have seen a de-growth in Operating profit on YoY basis. One can wait for another quarter to see the FY26 guidance and the trend in business operations to take a longer call on PNB

Impact of Other Income in Operating Profit: Yes, there is one IT refund component is there. I think Rs. 350 crore, one component is there in this.

10. Buy?

If I am looking to enter PNB then

PNB has delivered PAT growth of 151% & net interest income growth of 8% in 9M-25 at a PE of 8 which makes valuations quite reasonable.

PNB has delivered Operating Profit of 8% in 9M-25 against a FY25 guidance of 10-12% at a PE of 6 which makes valuations quite reasonable.

Outlook for PAT growth of 50%+ for FY25 at a PE of 8 makes the valuations quite attractive.

With a tangible book value of Rs 82.75 against a current price of Rs 94.09 as of Q3-25 end implies that PNB is available a tangible price to book of 1.14 which makes the valuations reasonable

While valuations on tangible price to book look very attractive and provide margin of safety, tepid business as expressed through a Net Interest Income growth of around 8% and Operating Profit growth of 8% limits the upside for PNB

PNB benefited significantly from write-backs and recoveries, supporting profitability. The management's guided recoveries of ₹18,000 crore may normalize in future, impacting profitability growth rate.

Previous Coverage of PNB

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer