Karur Vysya Bank Q2 FY26 Results: PAT up 21%, On-track FY26 Guidance

Valuation offers downside protection when price is near all time highs, steady earnings, and re-rating potential — making it attractive for long-term investors

Confused about analyzing bank stocks? Most investors get confused about NIM’s and CASA. Here’s how to actually do it right.

1. Mid-sized Private Sector Bank

kvb.co.in | NSE: KARURVYSYA

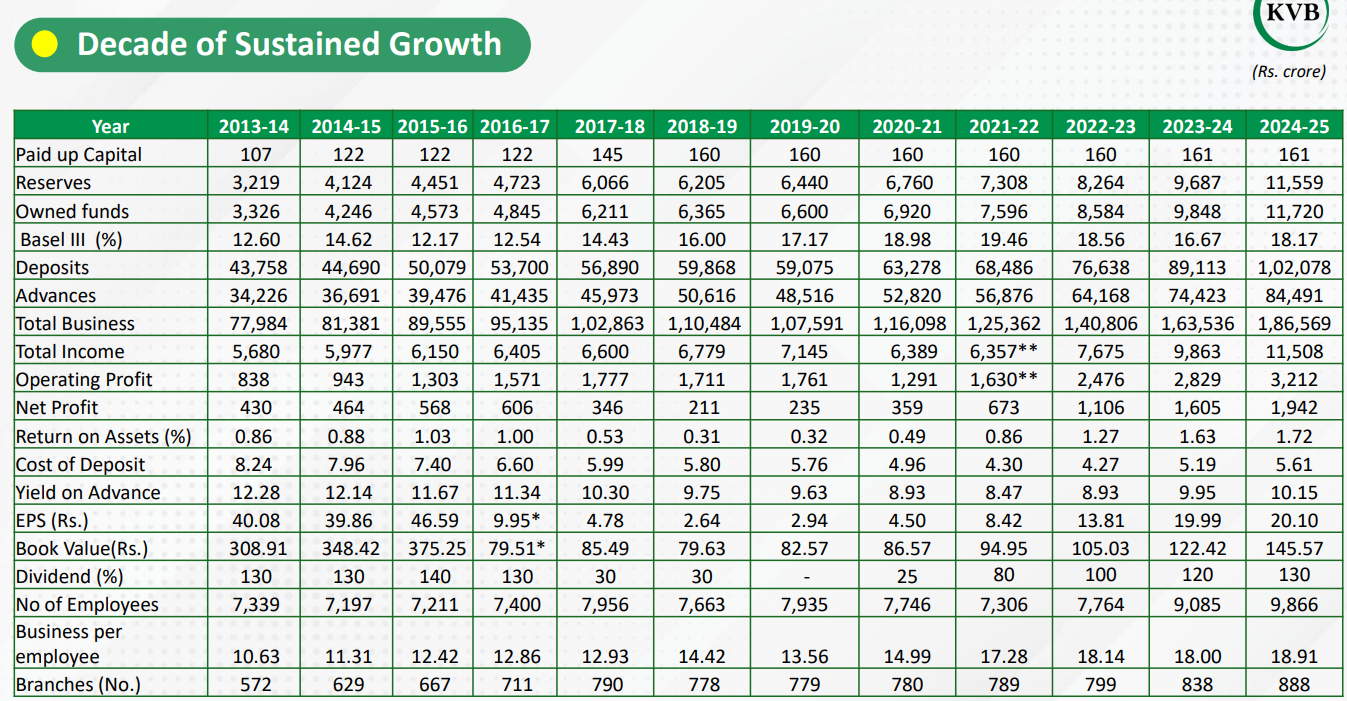

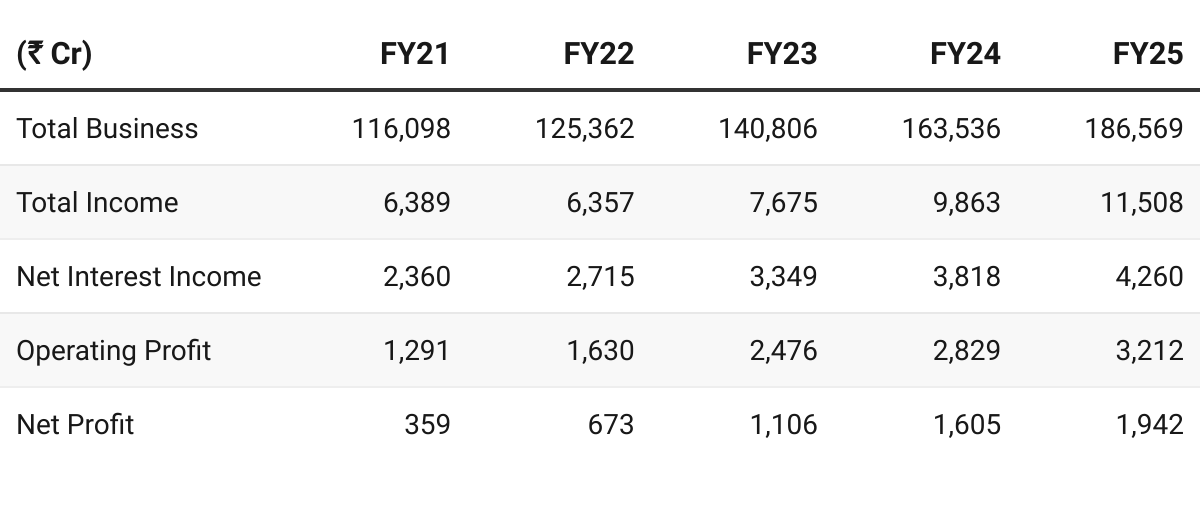

2. FY21-25: Net Profit CAGR of 53% & Total Income CAGR of 16%

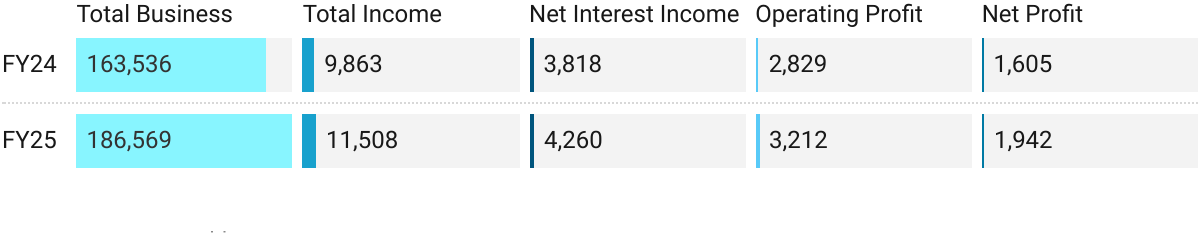

3. Strong FY25: Net Profit up 20% & Net Interest Income up 12% YoY

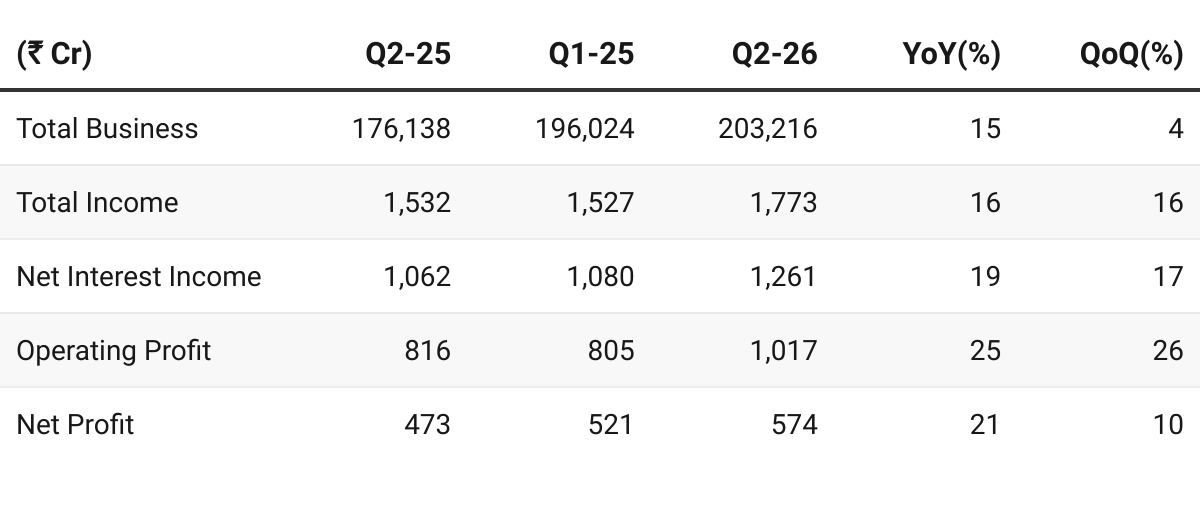

4. Q2-26: Net Profit up 21% & Total Income up 16% YoY

Net Profit up 10% & Total Income up 16% QoQ

Solid growth momentum — Business grwe15 % YoY / 4 % QoQ, driven by balanced expansion in both advances and deposits

Margins resilient amid rate pressure:

modest compression despite deposit repricing.

cost of deposits fell 17 bps sequentially, helping protect spreads;

competition and higher term-deposit rates may trim margins ~10 bps in Q3.

Profitability strong:

Operating profit, aided by ₹295 cr recovery from a written-off account

Ex-one-off, profitability still healthy on core income growth and cost control.

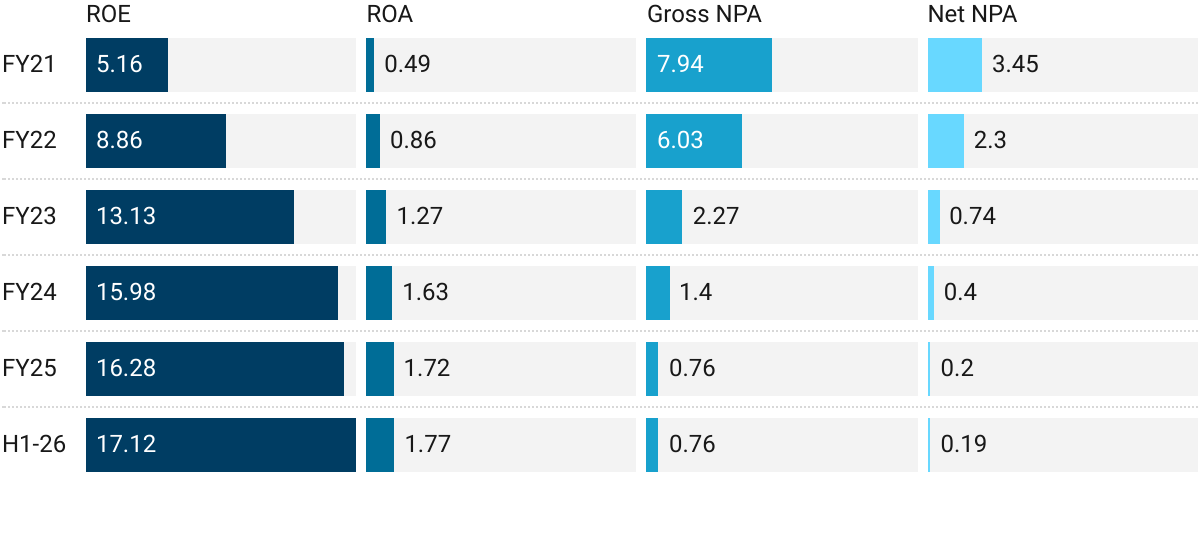

Asset quality robust — GNPA 0.76 %, NNPA 0.19 %, with PCR 96.8 %.

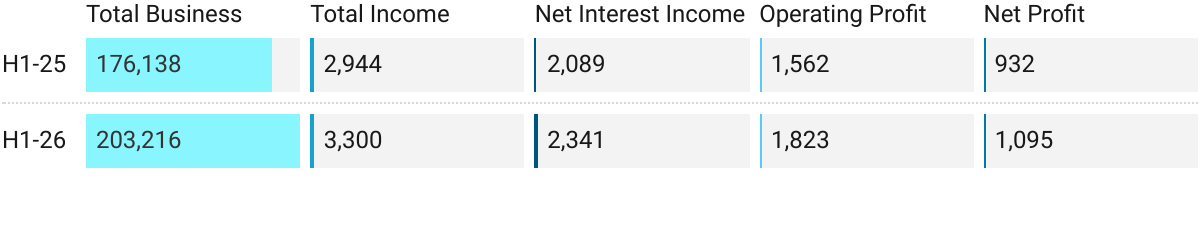

5. H1-26: Net Profit up 17% & Total Income up 12% YoY

Solid H1 with resilient margins, superior asset quality, and steady growth.

Margins may soften slightly in H2 as deposits reprice, yet the bank’s focus on RAM, digital scaling, and tight credit risk keeps the FY26 outlook comfortably on track.

6. Business metrics: Strong & improving ratios

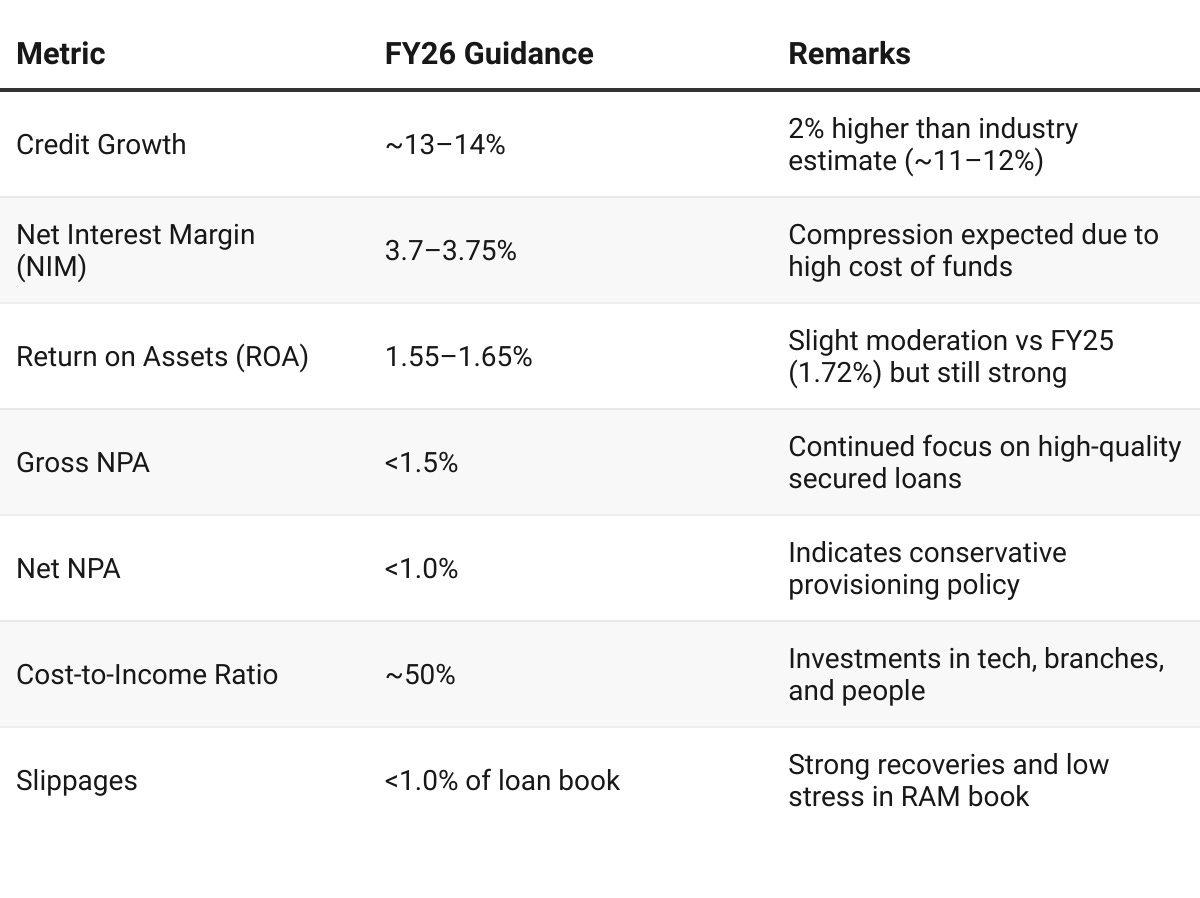

7. Outlook: Loan growth to be at ~14%

7.1 FY26 Guidance: Muted

Compression of NIM’s & Moderation RoA in FY26

To sum up our guidance for credit growth of about 2% over and above the industry growth

NIMs for the full year will be in the range of 3.7 to 3.75

Our gross NPA is expected to be less than 1.5 and net NPA will be less than 1%

Slippage is to be less than 1% of the loan book

ROA will be in the range of 1.55 to 1.65

7.2 H1 FY26 vs FY26 Guidance — Karur Vysya Bank

Ahead or within guidance across nearly all metrics in H1 FY26

Credit Growth: +15 % YoY — Strong;

RAM verticals grew +19 % YoY, corporate +1 %.

Growth likely moderates in H2 to align with guidance

Net Interest Margin (NIM): 3.82% (H1) vs 3.7–3.75% guidance

Slightly above guidance — expects ~10 bps compression in H2 due to deposit repricing.

Return on Assets (ROA): 1.77% (H1) vs 1.55–1.65% guidance

Reported ROA above guidance (bolstered by ₹ 139 cr interest recovery).

Normalized ROA ≈ 1.6% → within guidance range.

Gross NPA: 0.76 % < 1.5% — Well below guidance; strong recoveries

Net NPA: 0.19 % < 1.0% — Strong asset quality; high PCR 96.8 %.

Credit Cost: 0.40% H1 < ~1 % (normalized) guidance

Low so far but includes one-off ₹ 186 cr provision for 2 corporate accounts; normalized trend within range.

Cost-to-Income Ratio: 44.8% (H1) < ~50% guidance

Better than guidance; efficiency gains from digitization and controlled opex.

Slippages: 1.16% (₹ 350 cr fresh slippages in Q2) < 1% of loan book

To comeback to <1% of loan book by end of year

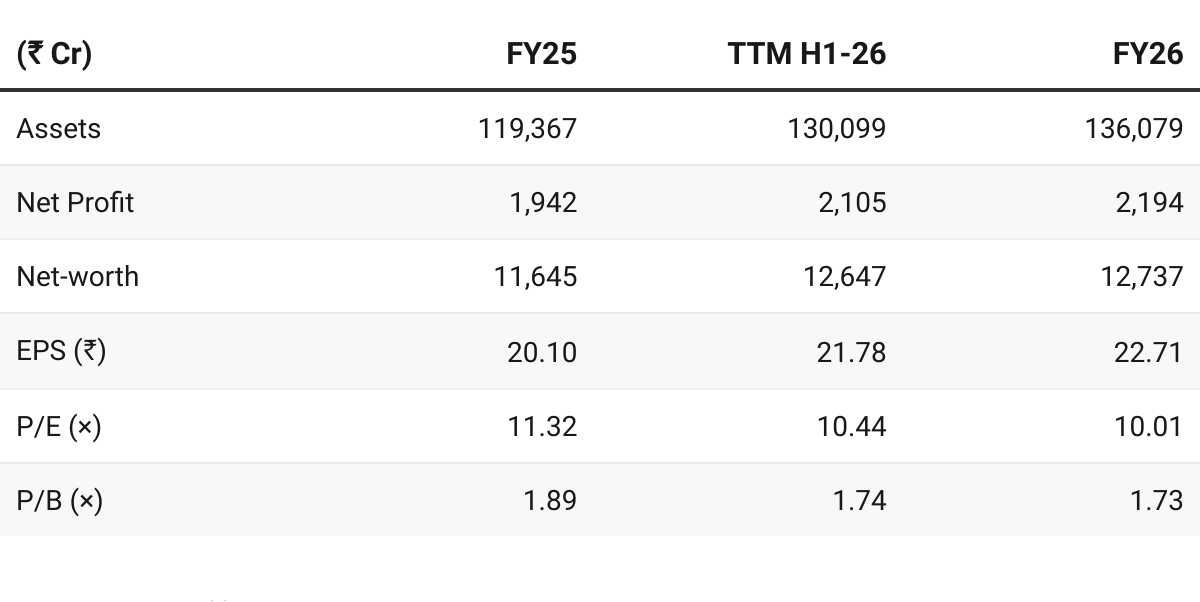

8. Valuation Analysis – Karur Vysya Bank

8.1 Valuation Snapshot

Current valuations offers limited downside as seen in the stock price which has consistently been strong

Re-rating potential if it delivers FY26 guidance and sustains ROA > 1.6 % through FY27

7.2 Opportunity at Current Valuation

Re-rating potential if ROA > 1.6% sustains and margins hold near 3.7%.

Current valuations are not demanding: Opportunity in the stock exists if growth around ~15% is sustained over a longer-term

Steady — not spectacular compounding over the longer term.

7.3 Risk at Current Valuation

Margin pressure: Management expects a NIM’s compression in H2 FY26.

Earnings normalization: FY26 H1 profits included one-off recoveries (₹ 139 crore interest income) that temporarily lifted ROA to 1.8 %; normalized ROA is closer to 1.6 %.

Credit-cost volatility: While asset quality is pristine, any SME or corporate slippage could elevate provisions from current lows.

Previous coverage of KARURVYSYA

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer