Karur Vysya Bank FY25 Results: PAT up 20%, FY26 Guidance Supports Growth Continuity

Valuation offers a cushion with strong downside protection, predictable earnings, and re-rating potential — making it an attractive bet for long-term investors

1. Mid-sized Private Sector Bank

kvb.co.in | NSE: KARURVYSYA

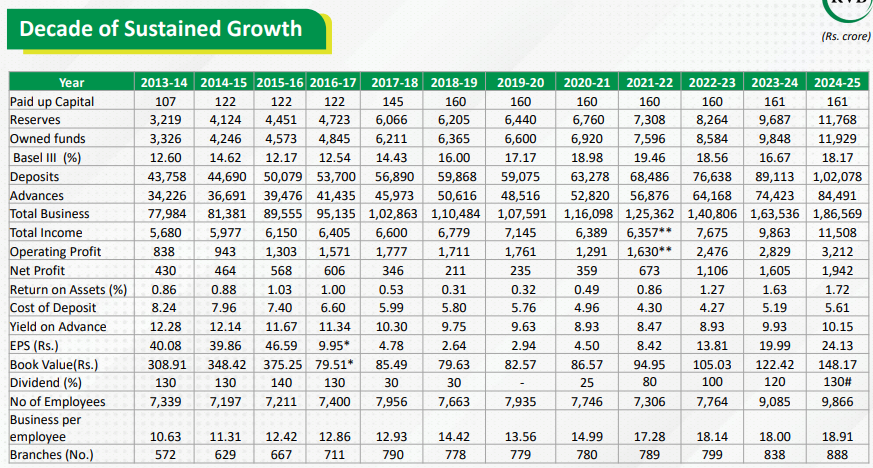

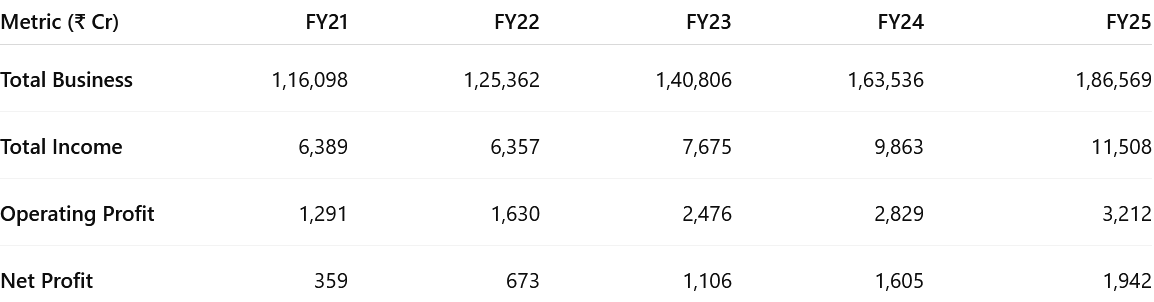

2. FY21-25: Operating Profit CAGR of 27% & Total Income CAGR of 16%

Total Business – CAGR: 12.6%

Expansion driven by RAM segment focus and stable deposit growth.

Total Income – CAGR: 15.9%

Faster than business growth; supported by higher yields and rising fee income.

Operating Profit – CAGR: 27.2%

Strong operating leverage; cost-to-income <50%; NIM held ~4%.

Net Profit – CAGR: 54.2%

Boosted by lower GNPA (7.94% → 0.76%), reduced credit cost, and stable margins.

2.1 What Changed Between FY21 and FY25 – Karur Vysya Bank

Profitability Transformed

Return on Assets (ROA) improved, signaling a shift from average to best-in-class profitability

Stronger Core Earnings

Total Income grew, aided by higher yields and better treasury contribution.

Net Interest Margin (NIM) consistently held above 4% through the period.

Balance Sheet Scaled Efficiently

Advances & deposits grew with a pivot to RAM (Retail, Agri, MSME) lending.

Despite growth, CRAR stayed strong (from 18.98% to 18.17%), with no capital raise.

Asset Quality Clean-Up

Gross NPA dropped, among the sharpest improvements in the industry.

Slippages and credit costs steadily declined, reflecting tight risk controls and quality origination.

Operational Efficiency Improved

Cost-to-Income Ratio improved despite investments in branches, tech, and workforce.

Employee productivity (business per employee) rose

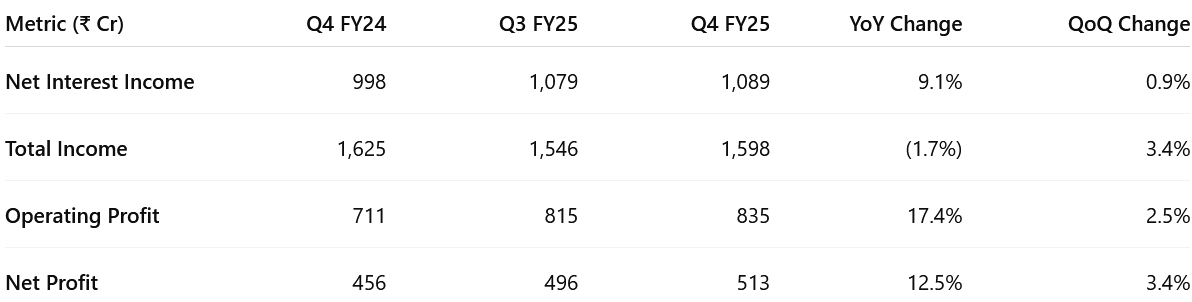

3. Q4-25: Operating Profit up 13% & Net Interest Income up 9% YoY

Operating Profit up 3% & Net Interest Income up 1% QoQ

NII growth — driven by steady loan growth and stable NIM (~4.05%).

Total income — both fee and interest income gains.

Operating profit held firm despite cost increases from branch/tech investments.

Net profit — reflecting lower provisions and strong recoveries

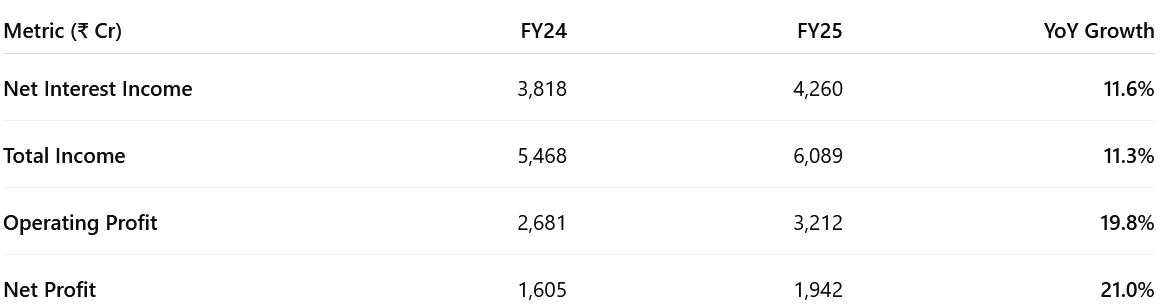

4. Strong FY25: Operating Profit up 20% & Net Interest Income up 12% YoY

Net Profit grew 21%, underscoring improved asset quality, lower credit cost, and higher earnings efficiency.

FY25 marks a year of steady income growth & strong profitability expansion for KVB.

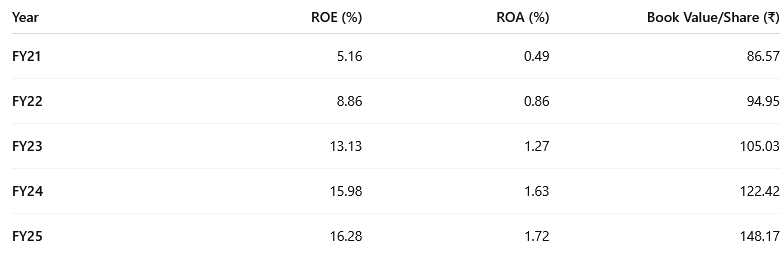

5. Business metrics: Strong & improving return ratios

ROE: Driven by strong profit growth and better capital efficiency.

ROA: Reflects superior asset quality and core profitability.

Book Value/Share: Supported by high internal accruals, no dilution.

A high-quality improvement in returns, placing it among top mid-sized banks.

6. Outlook: Loan growth to be at ~14%

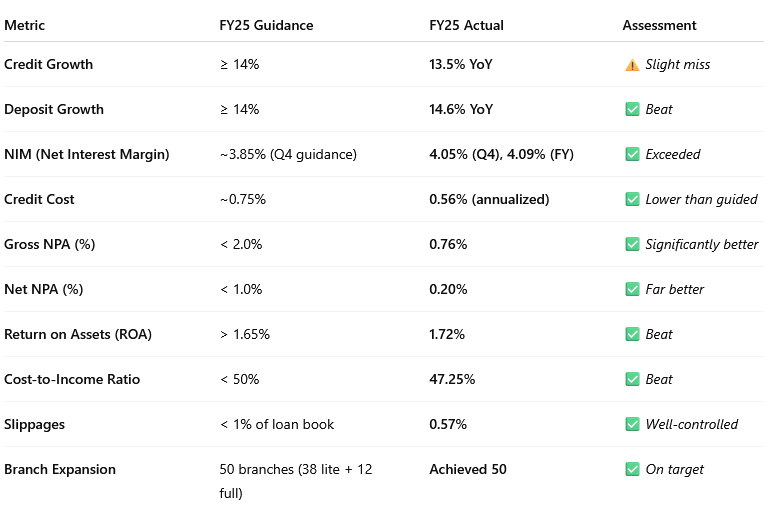

6.1 FY25 Performance vs. Guidance

Emerging Pressure Area — CASA Ratio:

Fell to 27.3% (vs 30.4% in FY24); indicating pressure on low-cost deposits

Not formally guided but a key concern acknowledged by management.

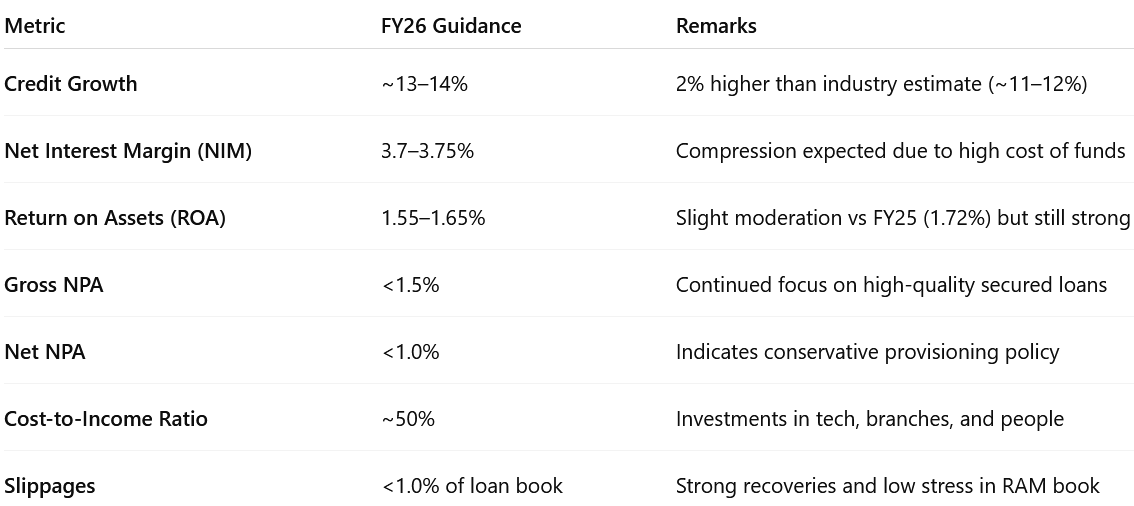

6.2 FY26 Guidance: Muted

Compression of NIM’s & Moderation RoA in FY26

Outlook for the Financial Year ’25-26 remains cautiously optimistic, we need to navigate margin pressures too and monitor asset quality closely.

There may not be any need to raise money in Financial Year ’25-26 for the growth plan.

Strategic Priorities

RAM-Led Growth: Focus on scaling Retail (gold, LAP), MSME (₹50–75L ticket), and secured Agri loans.

CASA Revival: Bank launched 24 new products, hired national sales heads, and targeted gov/institutional accounts.

Branch & Channel Expansion: Plan to open 100 branches (80 lite); enhanced sales team (33% now on CTC); integrated open market and branch sourcing.

Asset Quality Focus: Minimal unsecured exposure; gold-backed retail/agri book; cautious BNPL strategy with FLDG; low slippage trend to continue.

Digital & Operational Efficiency: 98% digital transactions; 5M+ app downloads; scaling analytics-led cross-sell and digital onboarding.

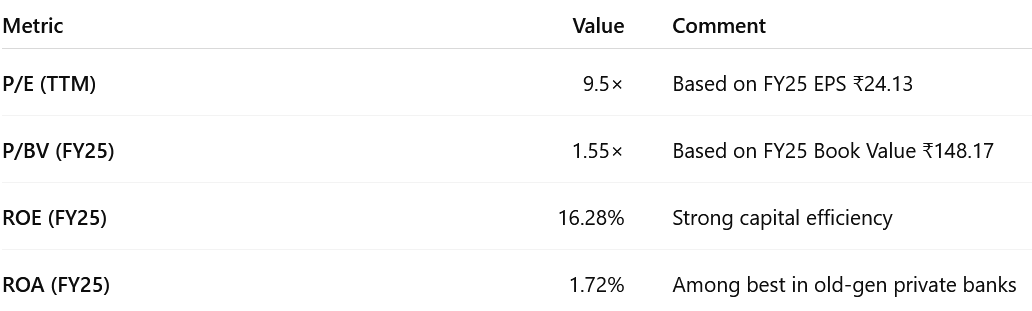

7. Valuation Analysis – Karur Vysya Bank

7.1 Valuation Snapshot

Undervalued relative to earnings power and return ratios

ROE > 16%, ROA > 1.7%, yet trading at <10× P/E

Scope for multiple re-rating if growth sustains and CASA stabilizes

Long-term thesis supported by strong internal accruals, no dilution, and high efficiency

7.2 What’s in the Price?

Return Ratios Re-rating: Market is factoring in 16%+ ROE and 1.6–1.7% ROA as sustainable, supporting 9.5–10× P/E and ~1.55× P/B valuations.

Earnings Base: PAT of ₹1,942 Cr is fully priced in, with slight moderation guided for FY26 (~1.55–1.65% ROA).

Execution Track Record: 5-year earnings CAGR >35% and superior asset quality lend valuation credibility.

Capital Efficiency: 16.3% ROE and strong internal accruals support rising book value without dilution.

Risk-Adjusted Growth: Prudent RAM-led expansion (~13% credit growth) priced in with margin stability.

7.3 What’s Not in the Price? (Upside Triggers)

Valuation Re-rating: Re-rating to 11–12× P/E could follow consistent earnings delivery in FY26.

CASA Stabilization: Improvement in CASA ratio could lower funding cost and lift NIM.

RAM Deepening: Higher growth from high-yielding MSME, gold loans, and LAP can drive NII upside.

Fee Income Levers: Scaling up insurance, digital payments, and corporate salary accounts may boost other income.

P/B Compression with Growth: Book value may cross ₹170 in FY26; valuation could normalize to 1.6–1.8× with visibility.

7.4 Risks and What to Monitor

Key Risks

Deposit Mobilization: Slower CASA improvement may pressure NIMs and ROA.

Loan Growth Lag: Delay in demand pickup or execution (especially in MSME) may cap growth.

Asset Mix Risk: Overexposure to gold loans and LAP could be sensitive to collateral volatility.

Provisions Spike: Any unexpected asset quality slippage may push credit cost above ~75 bps.

Re-rating Delay: Lack of catalyst (e.g., CASA traction, fee income pickup) could defer valuation expansion.

What to Monitor

NIM Trend: Whether NIM holds above 3.7% despite cost pressures from deposit repricing.

ROA Stability: FY26 guidance implies mild moderation—below 1.55% would raise concern.

Book Value Accretion: Watch for continued ~₹20+ annual increase in BVPS via internal accruals.

Loan Growth: Momentum in RAM segments will validate execution capability.

8. Implications for Investors

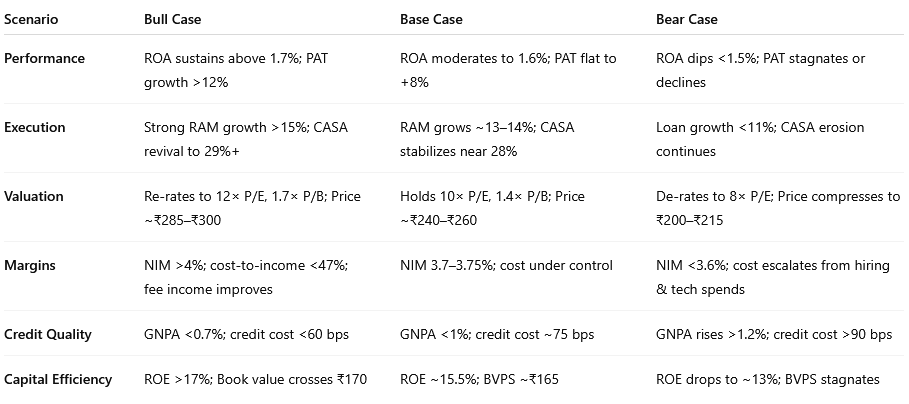

8.1 Bull, Base & Bear Case Scenarios – Karur Vysya Bank

8.2. Overall Margin of Safety: Moderate to High

Karur Vysya Bank offers a moderate-to-high margin of safety, driven by strong ROE, high asset quality, consistent internal accruals, and conservative valuations. While near-term valuation upside may be partially priced in, structural compounding levers remain intact.

What the Market Has Priced In:

FY26 Visibility: Management will performing strongly against FY26 guidance

BV Accretion: Book value growth driving P/B to ~1.3x

Valuation Stability: Consistently trades below peers despite ROA/ROE leadership.

No EPS Re-rating: Valuation reflects continuity, not aggressive upside.

Upside Optionality (Not in the Price):

CASA Revival: Improvement in CASA ratio could boost NIM and ROA.

Fee Income Scaling: Higher non-interest income via digital, wealth, and salary accounts.

P/E Re-rating: Re-rating to 11–12× P/E (from current 9.5×)

Downside Protection Factors:

Superior Asset Quality: GNPA (0.76%) and NNPA (0.20%) among the lowest in peer group.

Earnings Stability: PAT CAGR >35% over 4 years; resilient across rate cycles.

High RoE + Internal Accruals: 16.3% ROE supports compounding without dilution.

Capital Buffer: CRAR at 18.17% ensures no near-term equity raise.

Execution Track Record: 5 years of consistent performance across return and risk metrics.

Previous coverage of KARURVYSYA

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer