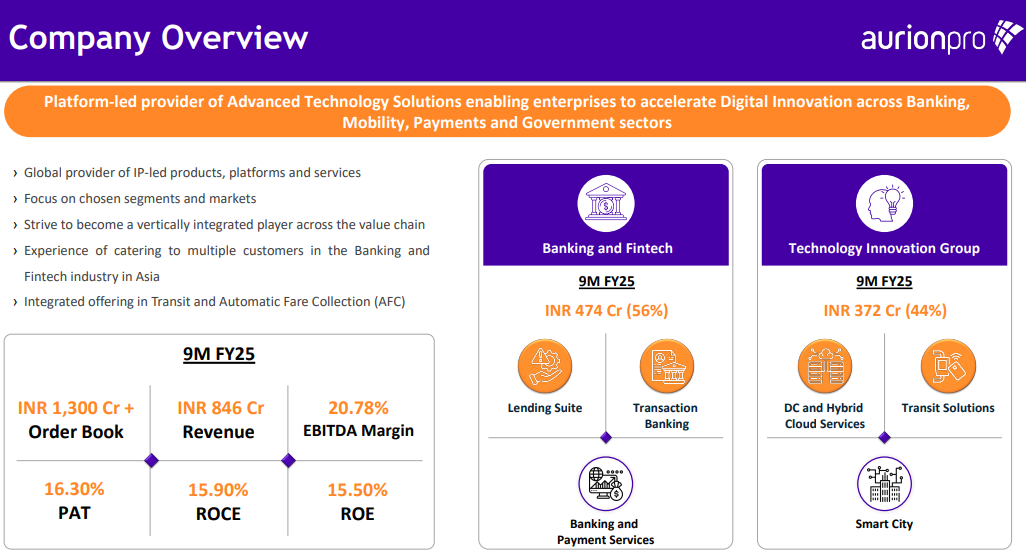

Aurionpro Solutions: PAT growth of 33% & Revenue growth of 32% in 9M-25 at a PE of 45

Guidance of 30-35% revenue growth with EBITDA of 20-22% and PAT of 15-16% by AURIONPRO for FY25. Targeting ROCE of 25% over the long term. Order book in place to support growth

1. IT Solutions provider

aurionpro.com | NSE : AURIONPRO

2. FY20-24: PAT CAGR of 43% & Revenue CAGR of 17%

Strong run in FY22-24: PAT CAGR of 38% & Revenue CAGR of 33%

3. Strong FY24: PAT 40% & Revenue up 35% YoY

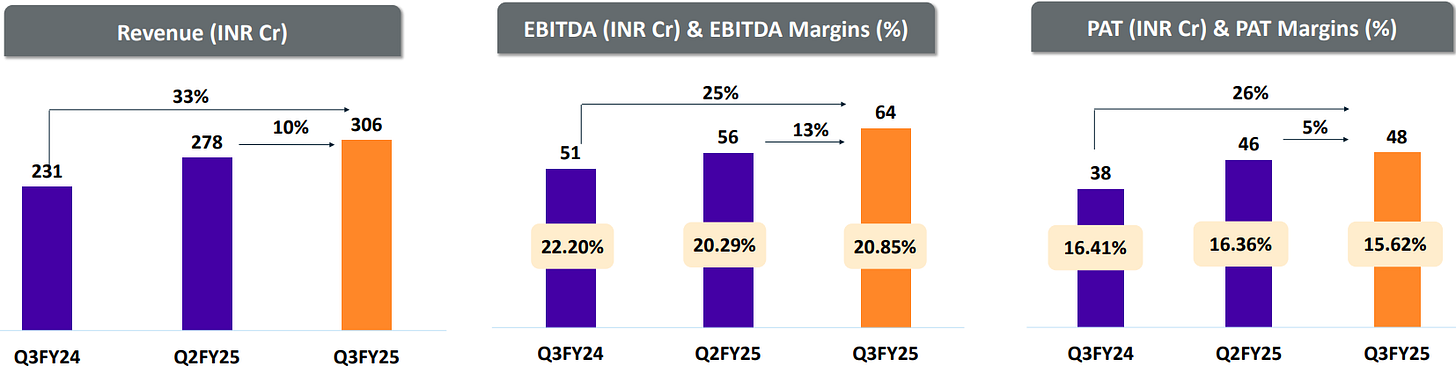

4. Strong Q3-24: PAT up 26% & Revenue up 33% YoY

PAT up 5% and Revenue up 10% QoQ

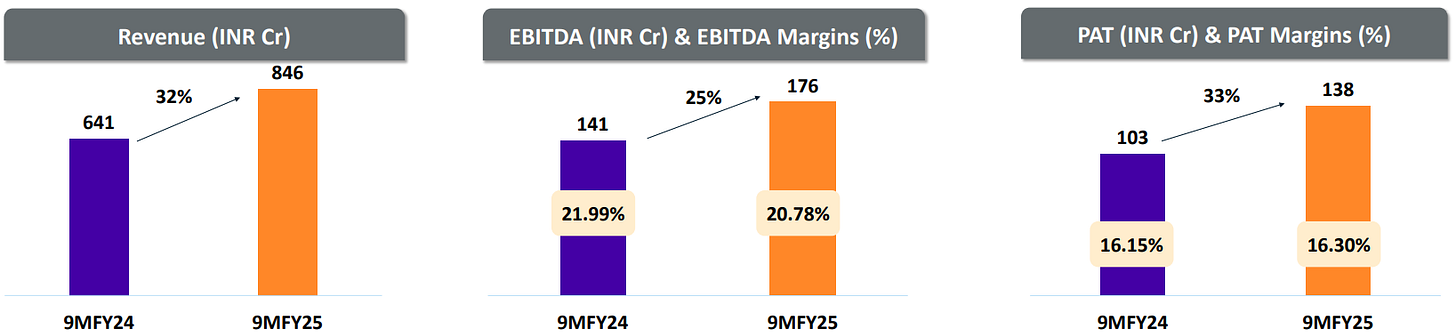

5. Strong 9M-25: PAT 33% & Revenue up 32% YoY

6. Business metrics: Strong return ratios

Targeting ROCE of 25% over the long term.

So, typically, we start with a business plan around the build at a 25% return on capital as the bar which we look at investments for and then over time, we will measure.

7. Outlook: Revenue growth of 30-35%

i. Revenue growth of 30-35%

Growth of 30-35% will be organic. Inorganic growth if any will add to the organic growth.

We expect to continue our growth momentum in FY25, plan to deliver a planned revenue growth of between 30% and 35%.

We are not really planning any of the 30% to 35% growth coming from any new acquisitions into the enterprise. If new acquisitions happen, we will see what impact it has on model.

ii. Maintain PAT margins at 15-16%

So, we have guided to a growth higher than 30% and EBITDA between 20 -22% and PAT between 15 - 16%

iii. Order Book at ~1X FY25 expected revenue

Assuming 30-35% growth implies a FY25 revenue of Rs 1150-1200 cr.

INR 1,300 Cr + Order Book

8. PAT growth of 33% & Revenue growth of 32% in 9M-25 at a PE of 45

9. Hold?

If I hold the stock then one may continue holding on to AURIONPRO.

AURIONPRO based on 9M-25 performance looks on track to deliver the fourth consecutive year where the business grew at 30%+

FY24 performance: It’s the third consecutive year that we grew the business in excess of 30%

Three consecutive years of 30%+ revenue growth in AURIONPRO is supported by the quarterly performance too. AURIONPRO has delivered sequential PAT growth on a QoQ basis since Q1-21 i.e. 19 consecutive quarters of QoQ PAT growth. One should keep riding the business momentum

One could ride the current business momentum as there are indications that the growth of 30-35% could continue into FY26 and FY27.

With the current configuration of business, and let's say you were growing at 30% into FY26 and FY27, and I am certainly not guiding to it. We will guide a firm guide at the end of the financial year. But let's say, hypothetically, if that's what you were doing

The guidance of delivering 30-35% revenue growth could continue into FY26 and beyond is a good enough reason to continue with AURIONPRO

The demand environment remains very good. We are scaling up delivery capacity to build into the demand. The order book is in a very, very strong position. So, I feel very good about how we will finish this year and how we will go on and grow into the subsequent years.

10. Buy?

If I am looking to enter AURIONPRO then

AURIONPRO has delivered PAT growth of 33% & Revenue growth of 32% in 9M-25 at a PE of 45 which makes it fully priced in the short-term.

AURIONPRO is guiding for FY25 revenue growth 30-35% while maintaining margins at a PE of 45 which makes it fully priced from a FY25 perspective.

The outlook of AURIONPRO continuing its trajectory of 30-35% growth in FY26 and FY27 makes it attractive from a longer term perspective.

Previous coverage of AURIONPRO

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer