Aurionpro Solutions: PAT growth of 40% & Revenue growth of 35% in FY24 at a PE of 38

Guidance of 30-35% revenue growth by AURIONPRO for FY25. FY24 margins to be maintained in FY25. Targeting ROCE of 25% over the long term.

1. IT Solutions across Banking, Mobility, Payments & Government sectors

aurionpro.com | NSE : AURIONPRO

2. FY20-24: PAT CAGR of 43% & Revenue CAGR of 17%

Strong run in FY22-24: PAT CAGR of 38% & Revenue CAGR of 33%

3. Strong FY23: PAT up 35% and Revenue up 31% YoY

4. Strong 9M-24: PAT 37% & Revenue up 37% YoY

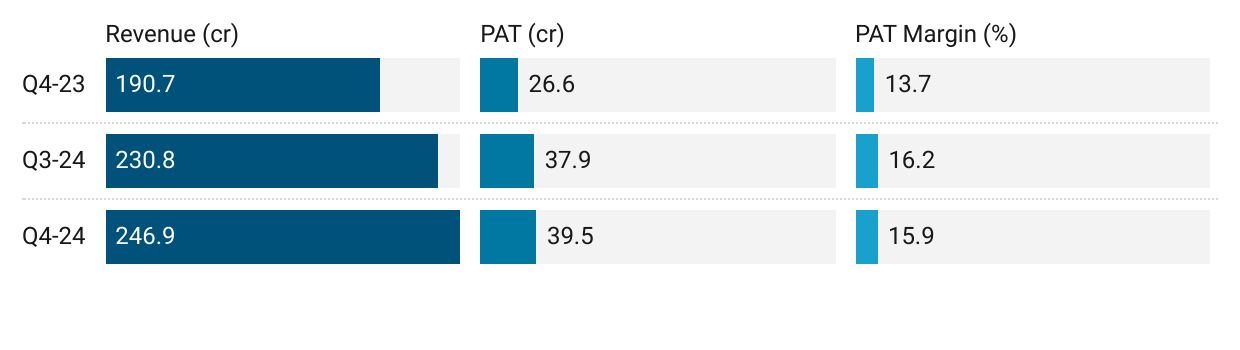

5. Strong Q4-24: PAT up 48% & Revenue up 29% YoY

PAT up 4% and Revenue up 7% QoQ

6. Strong FY24: PAT 40% & Revenue up 35% YoY

7. Business metrics: Strong return ratios

Targeting ROCE of 25% over the long term.

So, typically, we start with a business plan around the build at a 25% return on capital as the bar which we look at investments for and then over time, we will measure.

8. Outlook: Revenue growth of 30-35%

i. Revenue growth of 30-35%

Growth of 30-35% will be organic. Inorganic growth if any will add to the organic growth.

We expect to continue our growth momentum in FY25, plan to deliver a planned revenue growth of between 30% and 35%.

We are not really planning any of the 30% to 35% growth coming from any new acquisitions into the enterprise. If new acquisitions happen, we will see what impact it has on model.

ii. Maintain PAT margins at 15-16%

Will keep EBITDA and PAT margins at similar levels EBITDA between 20% and 22% and PAT between 15% and 16%. So, those are the planned numbers for FY25.

9. PAT growth of 40% & Revenue growth of 35% in FY24 at a PE of 38

10. So Wait and Watch

If I hold the stock then one may continue holding on to AURIONPRO.

For the period FY22-24, AURIONPRO has grown at a PAT CAGR of 38% & Revenue CAGR of 33% which is in line with the guidance of 30-35% growth for FY25. Additionally, AURIONPRO has delivered growth at the top end of its revenue growth guidance which provides confidence in the ability of the management to deliver in FY25.

FY24 performance: Our full year performance came in at the high end of our growth guidance of 35% marking another milestone in our journey to build out significant global products and platforms player. It’s the third consecutive year that we grew the business in excess of 30%

Three consecutive years of 30%+ revenue growth in AURIONPRO is supported by the quarterly performance too. AURIONPRO has delivered sequential PAT growth on a QoQ basis since Q1-21 i.e. 12 consecutive quarters of QoQ PAT growth.

The guidance of delivering 30-35% revenue growth while maintaining guidance is a good enough reason to continue with AURIONPRO

11. Or, join the ride

If I am looking to enter AURIONPRO then

AURIONPRO has delivered PAT growth of 40% & Revenue growth of 35% in FY24 at a PE of 38 which makes it fully price in the short-term.

AURIONPRO is guiding for FY25 revenue growth 30-35% while maintaining margins.This 30-35% expected growth with create opportunity in the stock over FY25.

AURIONPRO delivered Rs 131 cr of free cash flow in FY24 against a market cap of Rs 6,052 cr. As of FY24 end it is available on a free cash flow yield of 2.2% which is nothing exceptional from a valuation perspective.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer