Zaggle Prepaid Q4 FY25 Results: PAT Doubles, FY26 Guidance for 80% Growth & Margin Expansion

Strong earnings growth, improving margins, platform synergies, and a capital-light model position Zaggle as a scalable SaaS player for FY26 despite premium valuations

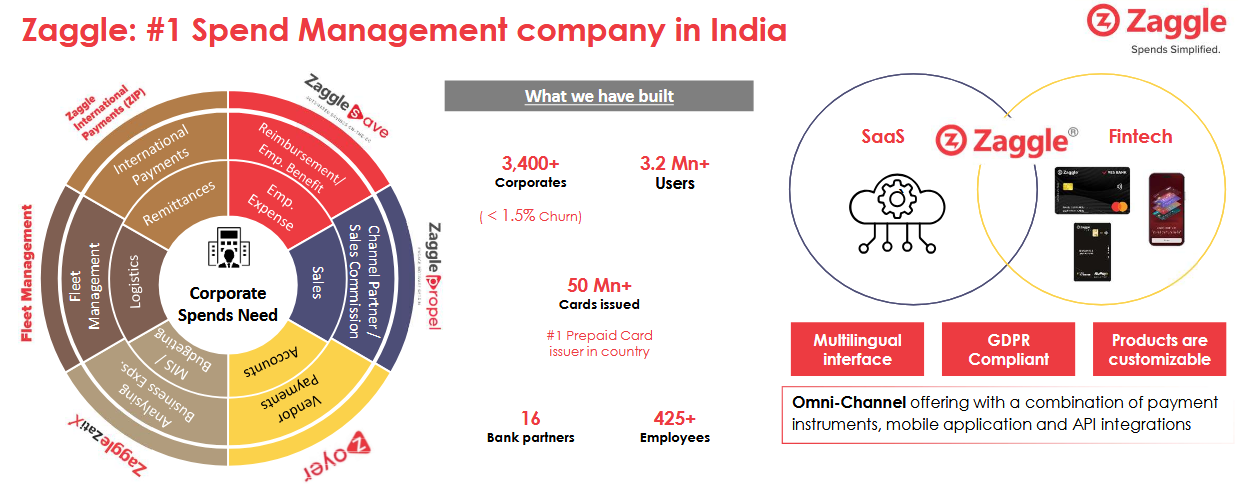

1. SaaS-based Spend Management company

zaggle.in | NSE: ZAGGLE

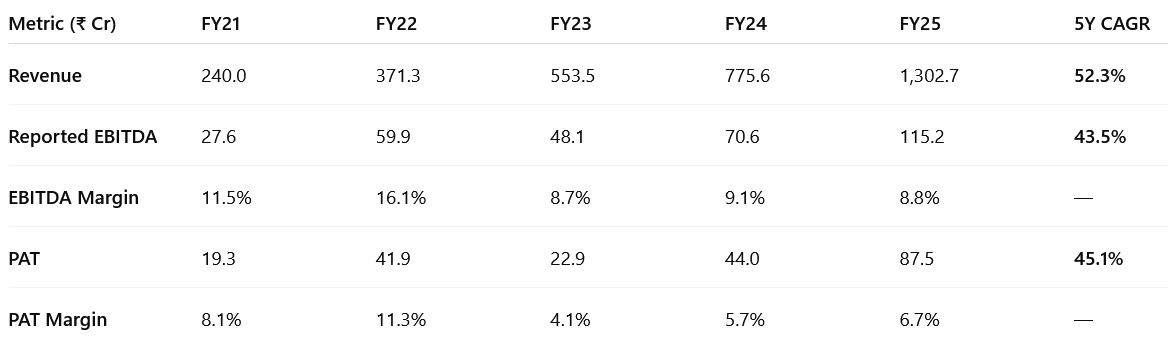

2. FY21-25: PAT CAGR of 45% & Revenue CAGR of 52%

Margin Resilience Despite Scaling: Reported EBITDA margins remained steady (~9%) even with increased ESOP costs and product development investments — a sign of disciplined scaling.

PAT Nearly 5× in 4 Years: Profits compounded at a 45.1% CAGR, underscoring the strength of Zaggle’s SaaS + Fintech hybrid monetization model.

Shift Toward Quality Growth: From FY23 to FY25, PAT margin rose from 4.1% to 6.7%, signaling an improving ability to translate scale into sustainable profitability.

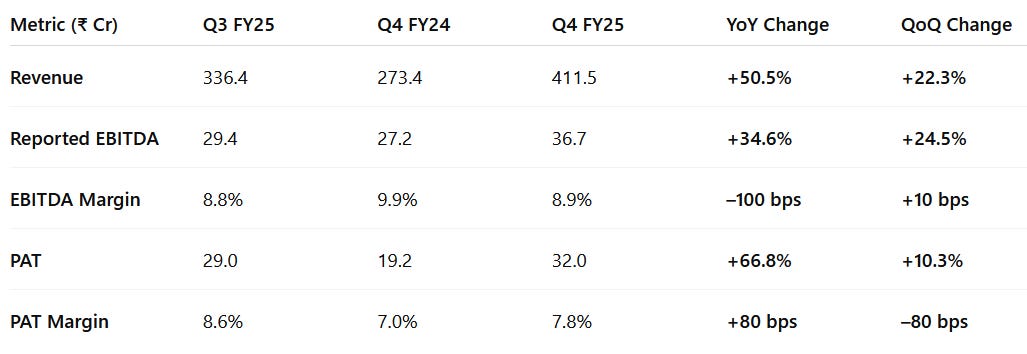

3. Q4-25: PAT up 67% & Revenue up 51% YoY

PAT up 10% & Revenue up 22% QoQ

Strong topline momentum: Revenue grew 22.3% QoQ and 50.5% YoY, driven by seasonality tailwinds (Q4 is historically strong), and deeper client penetration across platforms.

Profit growth outpaced revenue: PAT surged 66.8% YoY and 10.3% QoQ, supported by improved operating leverage and lower ESOP-related drag.

EBITDA growth lags topline slightly: While EBITDA grew 24.5% QoQ, margins remained stable at 8.9% due to continued investments in platform and sales scale-up.

Margins holding steady: Despite scale investments and higher seasonality-led expenses, PAT margins improved YoY to 7.8%, showcasing earnings quality.

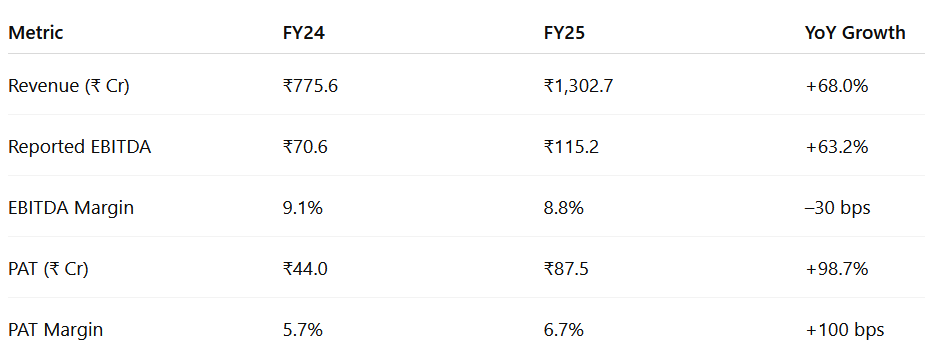

4. FY25: PAT up 99% & Revenue up 68% YoY

Topline crossed ₹1,300 Cr: Revenue grew 68% YoY, led by strong traction across Zaggle Save, Zoyer, and Propel platforms — beating internal guidance.

Profit growth outpaced revenue: PAT nearly doubled (+98.7%), reflecting improved monetization, cost control, and growing operating leverage.

Margins held firm despite investments: While EBITDA margin dipped slightly (–30 bps), PAT margin improved by 100 bps — a sign of earnings quality.

Earnings per share up 73%: EPS rose from ₹4.03 to ₹6.96, validating the scalability of Zaggle’s high-margin, asset-light business model.

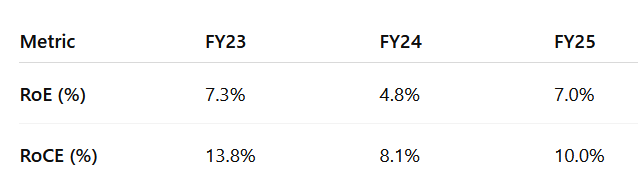

5. Return Ratios: Improving but below-average returns

RoE dipped in FY24 due to post-IPO equity dilution, but rebounded in FY25 as PAT nearly doubled.

RoCE improved to 10.0% in FY25 — signaling efficient capital deployment and growing operating leverage.

6. Strong outlook: Consolidated growth of ~80%

See Tremendous Tailwinds And 50% Growth For Next 2 To 3 Years: Zaggle Prepaid Ocean Services

6.1 Strategic Priorities for FY26:

Aggressive Revenue Growth:

Targeting standalone revenue growth between 35% to 40%.

If all planned acquisitions are completed before September, overall consolidated growth could potentially be around 80%.

Improved Profitability:

Upping standalone Adjusted EBITDA margin guidance to 10% to 11% (from 9-10% guided for FY25).

This is a step towards the long-term objective of achieving an EBITDA margin of 12% to 15% over the next three to four years, with FY26 being a deciding year for this goal.

Growing profitably is a key focus alongside growth.

Enhanced Cash Flow & Capital Efficiency:

Focus on improving cash flow generation compared to the previous year.

Aims to be capital efficient and improve the conversion of EBITDA to Operating Cash Flow (OCF).

Efforts are being made to further reduce Days Sales Outstanding (DSO), which improved to 60 days at the end of FY25.

Strategic Inorganic Growth:

Inorganic growth continues to be a key pillar of the growth strategy.

Capital raised, including from the QIP, will be primarily utilized for investment activity and acquisitions.

The company is in advanced stages of looking at multiple potential acquisitions.

Acquisitions aim to build a comprehensive bouquet of spend management solutions and enhance capabilities in areas like tax, UPI, and payment solutions.

Majority of the targeted acquisitions are expected to be margin accretive.

AI-Powered Innovation:

Aiming to fundamentally transform spend management by becoming an AI-powered SAS company.

Transitioning from static rule-based systems to a dynamic, intelligent context-based platform.

Implementing AI workflows across their offerings (EMS, Zoyer, Propel).

Developing a Zagel co-pilot as an AI assistant for finance teams.

Leveraging advanced conversational AI for customer engagement.

Platform & Ecosystem Expansion:

Focus remains on delivering a comprehensive offering in the spend management space.

Expanding reach to new clients and increasing wallet share amongst existing ones.

Leveraging strategic collaborations (e.g., Gift City, Thomas Cook, Redington/Google).

Achieving TPAP approval from NPCI allows them to facilitate UPI payments directly through their app and platform, impacting over 3 million users and is a significant step in creating an integrated fintech ecosystem.

International Reach:

Partnership with Mesh Payments unlocks access to global go-to-market opportunities and provides a boost to international expansion plans.

Exploring opportunities in international markets and building capabilities for global enterprises.

Operational Focus:

Scaling responsibly.

Enhancing customer engagement and increasing automation.

Expected ESOP expenses for FY26 are approximately INR 90-100 Mn.

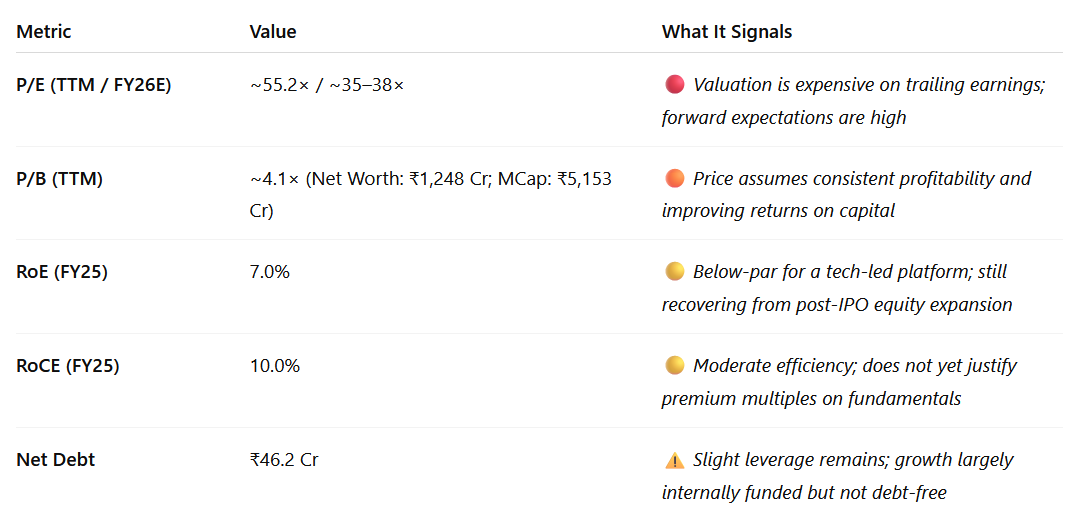

7. Valuation Analysis

7.1 Valuation Snapshot

7.2 What’s Priced In Today

At 55× trailing P/E and a forward P/E of ~35–38×, the stock price reflects:

50%+ revenue growth expectations, driven by both organic scale and recent acquisitions.

Sustained topline momentum for the next 2–3 years, backed by strong industry tailwinds and product expansion.

Improved EBITDA margins, guided at 10–11% for FY26, with a path toward 12–15% over the medium term.

Successful monetization of bundled spend solutions (Zoyer, Save, Propel), especially through BFSI partnerships.

Scaling without heavy capital intensity, allowing for margin expansion and earnings compounding.

Investors are clearly betting on a multi-year high-growth phase — with operating leverage, client retention, and monetization firing in sync.

7.3 What’s Not Fully Priced In

Despite optimism, there are several drivers that could surprise to the upside:

Analytics & AI spend intelligence modules — high-margin, SaaS-led layers just getting commercialized.

Fleet and international spend platforms (Zatix & ZIP) — potential game-changers for enterprise and logistics segments.

Deeper monetization of acquisitions (TaxSpanner, Mobileware) — not yet visible in P&L, but strategically aligned with core.

Expansion into mid-market & global clients — significant whitespace beyond current enterprise base.

EBITDA margin targets of 12–15% — if achieved, could sharply lift PAT and reduce valuation multiple in forward years.

The market values Zaggle like a growth platform — but not yet as a compounder. If margin and return ratios scale in tandem, re-rating potential is still open.

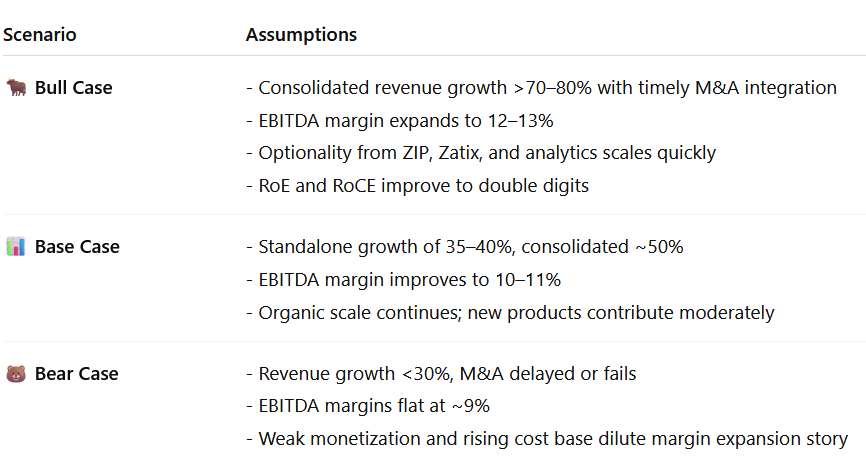

8. Implications for Investors: What to Watch

8.1 Bull, Base & Bear Case Scenarios

8.2 Why Investors May Want to Stay Invested or Add

Strong revenue visibility: Management is guiding 35–40% organic growth and up to 80% consolidated — with tailwinds expected to persist for 2–3 years.

Improving profitability: Clear margin expansion roadmap toward 12–15% EBITDA over the medium term.

Multiple monetization levers: Zoyer, Zatix, ZIP, TaxSpanner, and Mobileware integrations open up cross-sell and VAS income potential.

High client stickiness & retention: Less than 1.5% churn, low CAC, and bundled product suite drive platform longevity.

Scalable, asset-light model: Operating leverage likely to improve returns as topline compounds faster than fixed cost base.

8.3 Risks to Monitor

Execution risk in new products: Zatix, ZIP, and analytics suite are early-stage and not proven at scale yet.

Acquisition integration: Timely closure and revenue realization from M&A is critical to achieve consolidated growth targets.

Valuation risk: At ~55× TTM P/E and 4.1× P/B, much of the next phase of growth is already priced in.

Margin slippage: Delay in EBITDA expansion could compress earnings visibility and trigger sentiment reset.

Regulatory exposure: Changes in prepaid, corporate cards, or tax APIs may impact key revenue streams.

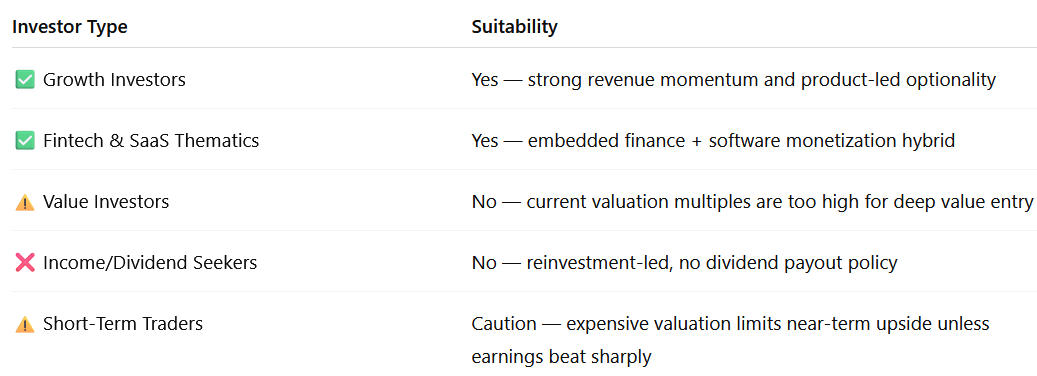

8.4 Investor Suitability

Previous coverage of ZAGGLE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer