Zaggle Prepaid Q1 FY26 Results: PAT up 55%, On-track FY26 Gudiance

Revenue guidance of 35-40% growth with possibility of inorganic growth. If ZAGGLE delivers on long-term margin expansion, valuations would provide opportunity.

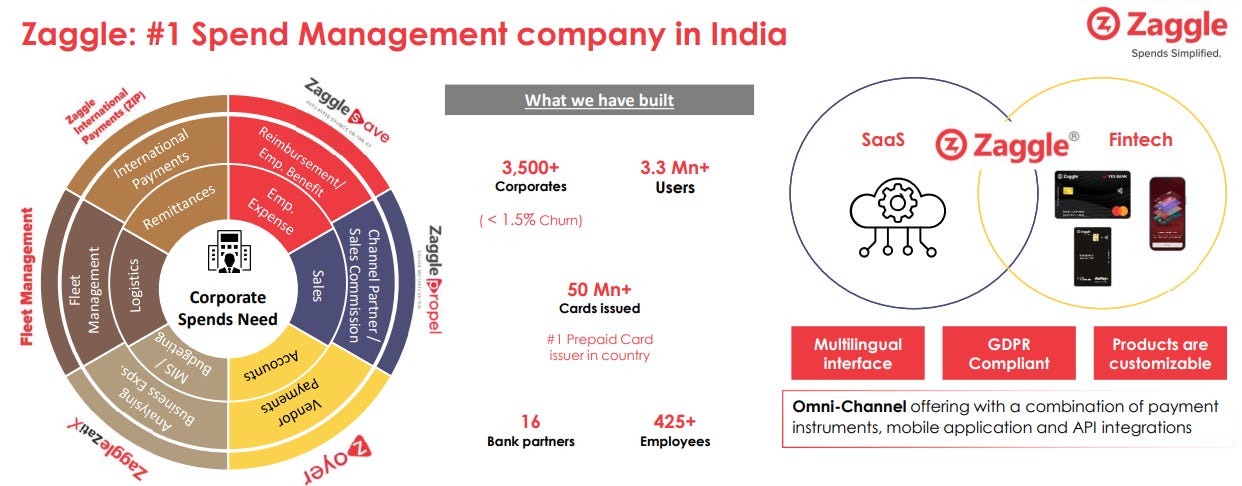

1. SaaS-based Spend Management company

zaggle.in | NSE: ZAGGLE

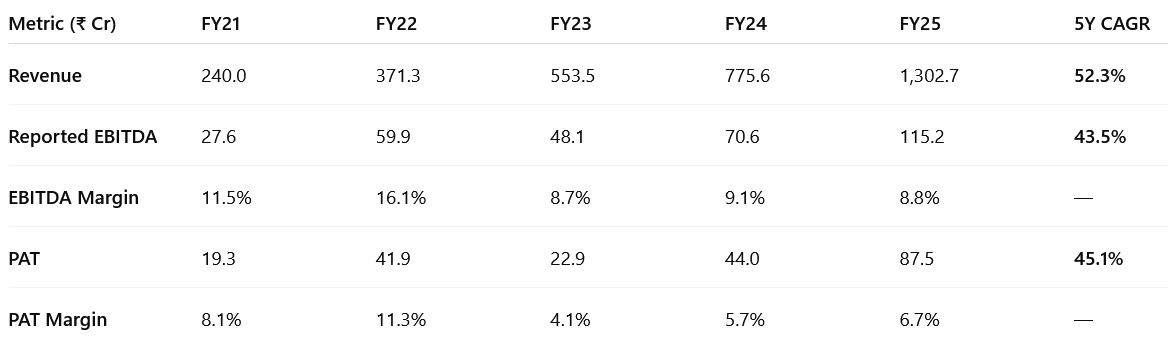

2. FY21-25: PAT CAGR of 45% & Revenue CAGR of 52%

Margin Resilience Despite Scaling: Reported EBITDA margins remained steady (~9%) even with increased ESOP costs and product development investments — a sign of disciplined scaling.

PAT Nearly 5× in 4 Years: Profits compounded at a 45.1% CAGR, underscoring the strength of Zaggle’s SaaS + Fintech hybrid monetization model.

Shift Toward Quality Growth: From FY23 to FY25, PAT margin rose from 4.1% to 6.7%, signaling an improving ability to translate scale into sustainable profitability.

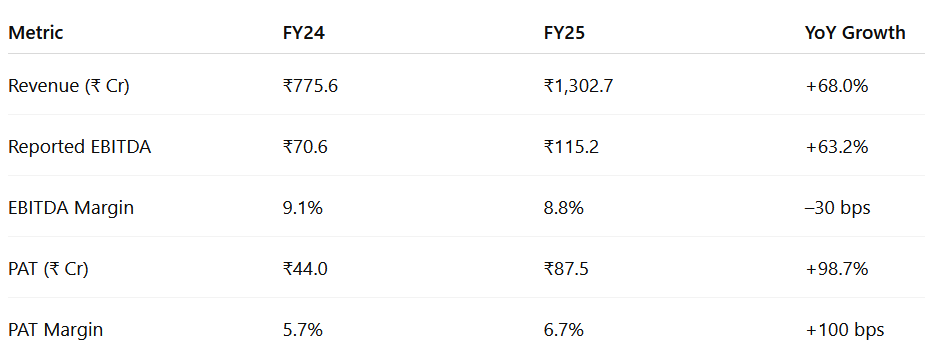

3. FY25: PAT up 99% & Revenue up 68% YoY

Topline crossed ₹1,300 Cr: Revenue grew 68% YoY, led by strong traction across Zaggle Save, Zoyer, and Propel platforms — beating internal guidance.

Profit growth outpaced revenue: PAT nearly doubled (+98.7%), reflecting improved monetization, cost control, and growing operating leverage.

Margins held firm despite investments: While EBITDA margin dipped slightly (–30 bps), PAT margin improved by 100 bps — a sign of earnings quality.

Earnings per share up 73%: EPS rose from ₹4.03 to ₹6.96, validating the scalability of Zaggle’s high-margin, asset-light business model.

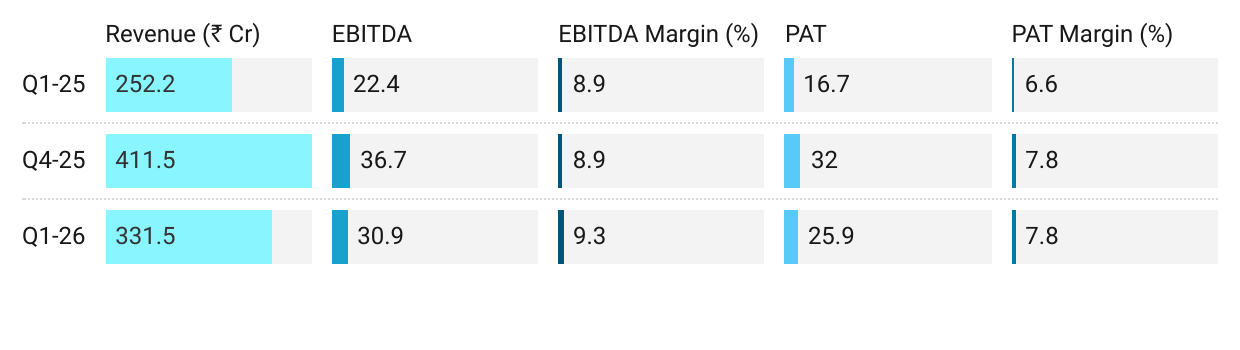

4. Q1-26: PAT up 55% & Revenue up 31% YoY

Revenue from Operations: – highest ever Q1 despite seasonality.

Propel Platform: main growth driver, with strong 50%+ growth from channel incentives and rewards.

Program Fees: growth muted (15%), impacted by seasonality and lower travel spends (geopolitical factors). Management expects recovery from Q2.

SaaS Fees: steady 20% growth, building sticky recurring revenues.

Customers & users steadily rising, with churn <1.5% → sticky business model.

AI-driven automation & M&A pipeline central to growth story → synergy savings and capability expansion.

Execution discipline visible: improved cost efficiency, higher cash PAT, sustained positive outlook.

Inorganic Growth & Investments

Mobileware (38% stake): Q1 PBT ₹2 Cr, already surpassed FY25 full-year. Integration with payments ecosystem.

TaxSpanner: to benefit from extended filing deadline → boost in Q2 FY26.

Proposed acquisitions:

EPR Soft – merchant servicing, payment processing.

DICE – AI-driven spend management suite.

GreenEdge – loyalty & rewards enhancement.

Rio.Money – entry into consumer credit card space.

Integration synergies targeted: ₹25 Cr savings in FY26, expanding further in FY27.

M&A integration risk: Workforce likely doubling; management itself noted “acquisitions are easy, integrations are tough.”

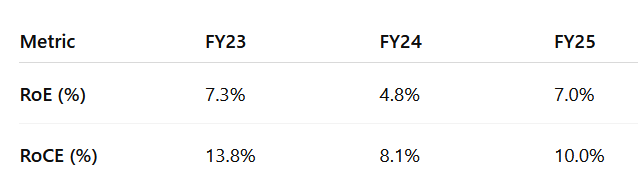

5. Return Ratios: Improving but below-average returns

RoE dipped in FY24 due to post-IPO equity dilution, but rebounded in FY25 as PAT nearly doubled.

RoCE improved to 10.0% in FY25 — signaling efficient capital deployment and growing operating leverage.

See Tremendous Tailwinds And 50% Growth For Next 2 To 3 Years: Zaggle Prepaid Ocean Services

6. Outlook: Growth of 35-40% in FY26

6.1 Guidance for FY26

We currently project our standalone, and I repeat the word standalone, FY '26 revenue growth to range between 35% to 40%.

Last year, FY '25, our guidance on standalone EBITDA margin was between 9% to 10%, and we are happy to announce that we are upping our guidance to 10% to 11% in the coming year, in FY '26.

Hopefully our entire goal of achieving 12% to 15% EBITDA margin over the next three, four years, this year would be a deciding year for that goal to be achieved.

Revenue Growth (Standalone)

35–40% — likely to revise upwards post Q2

More bullish tone compared to Q4-25

Consolidated Growth (w/ M&A)

Q4-25: Up to ~80% growth if acquisitions close by Sep’25

Q1-26: Growth not quantified, but multiple acquisitions progressing; integration savings highlighted

Absence of 80% mention Q1-26 implies — ZAGGLE is slightly toned down, more cautious in quantification of organic growth

EBITDA Margin FY26: 10–11% — Unchanged

Long-Term Margin Goal: EBITDA 12–15% in 3–4 years — Unchanged

M&A / Inorganic

Q4-25: Aggressive hunt; expected to close large deals soon

Q1-26: Shift from “hunt” → “integration + synergy realisation”

Cash Flow

Q4-25: OCF positive in FY25; focus on better EBITDA–OCF conversion

Q1-26: Reiterated. Cash PAT up 58% YoY in Q1 — Stronger proof of execution

Tone:

Q4-25: Conservative → focus on balance between growth & margins

Q1-26: More confident → may raise growth guidance post Q2 — Outlook upgraded in tone

6.2 Q1 FY26 vs FY26 Guidance — Zaggle Prepaid

Q1-26 Run-rate in-line to meet FY26 guidance

Revenue Growth

Q1 FY26: ₹331 Cr (+31% YoY), best-ever Q1.

Guidance: 35–40% growth for FY26.

Assessment: Strong Q1 start, but program fee growth (+15%) lagged. Management confident of recovery; may upgrade guidance post-Q2 if momentum sustains.

Profitability

Q1 FY26: PAT ₹26 Cr (+55% YoY); margin 7.8%.

Guidance: 100 bps margin expansion

Assessment: Ahead of trajectory; efficiency gains (incentives, expenses) already visible.

M&A & Integration

Q1 FY26: Multiple deals in progress; synergy savings of ~₹25 Cr expected in FY26.

Guidance: Growth to be accelerated through acquisitions; integration flagged as key challenge.

Assessment: Positive upside if integration succeeds; risk if delays or disruptions occur.

Cash Flow Conversion

Q1 FY26: Positive OCF guidance.

Guidance: Continue positive OCF momentum post-FY25.

Assessment: Remains a watchpoint; needs proof of consistency.

Global Expansion

Q1 FY26: Focus on MENA & US; progress cautious amid macro/geopolitical risks.

Guidance: Overseas markets remain long-term growth driver.

Assessment: Neutral near-term; execution and timing still unclear.

7. Valuation Analysis

7.1 Valuation Snapshot — Zaggle Prepaid Ocean Services

CMP ₹408.25; Mcap ₹5480.92 Cr

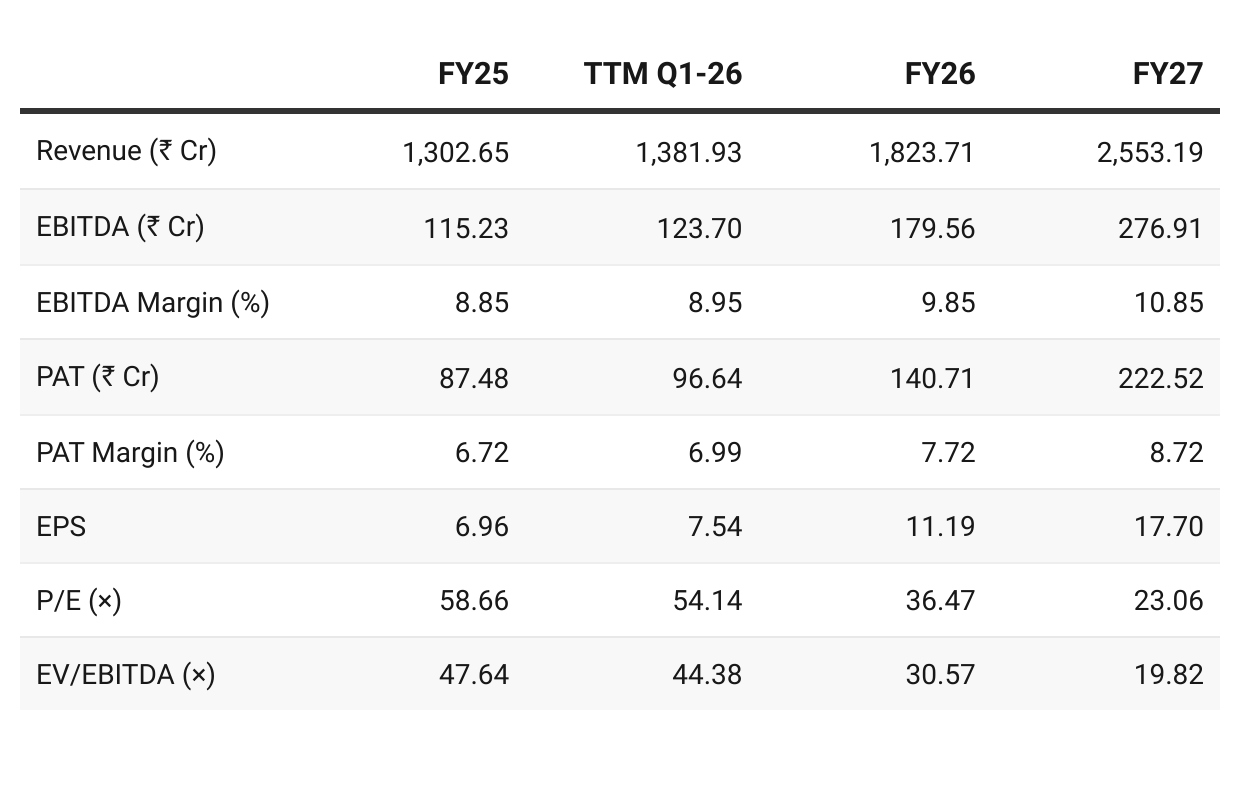

Growth & Margins: Revenue CAGR of ~40% expected over FY25–27, driven by organic growth; M&A contributions not included in base case. EBITDA margins projected to improve ~100 bps annually, reaching 10.9% by FY27E. Management’s long-term ambition is 12–15% margins within 3–4 years.

Valuation Compression:

P/E moderates from ~59× FY25 → ~23× FY27E.

EV/EBITDA falls from ~48× FY25 → ~20× FY27E, with potential to normalize further to ~15–16× if 12–15% margins are achieved.

Sustained growth and cash generation are prerequisites for rerating.

Bottom Line: Zaggle is positioned as a high-growth fintech SaaS platform with structural margin expansion potential. If execution delivers on the 12–15% margin goal, valuations could converge with global peers while earnings compound — unlocking meaningful upside.

7.2 Opportunity at Current Valuation

Organic Growth Visibility:

Revenue CAGR of ~35–40% over FY25–27, supported by strong client additions, <1.5% churn, and cross-selling across Propel, Save, and Zoyer.

PAT expected to ~2.5× over FY25–27.

Optionality of M&A and Inorganic Growth:

Acquisitions (DICE, GreenEdge, Rio.money) expand product breadth in AI spend management, loyalty, and consumer credit cards.

Additional domestic and overseas (MENA, US) opportunities could further accelerate scale beyond forecasts.

Margin Expansion Potential:

Base case: 8.9% (FY25) → 10.9% (FY27E).

Management target: 12–15% EBITDA margin in 3–4 years.

Drivers include AI-led automation, centralization of operations, synergy savings (~₹25 Cr+ annually), and improved incentive ratios.

Valuation Normalization: As earnings compound and margins improve, premium multiples could compress toward global peer levels, providing rerating potential alongside organic and inorganic growth.

7.3 Risk at Current Valuation

Valuation Premium:

Despite expected compression, FY27E multiples leaving little buffer for execution misses.

Execution & Integration Risks:

Multiple acquisitions in FY26 raise integration complexity; realizing promised synergies and managing overseas expansion (MENA/US) adds operational risk.

Guidance Shift (Needs to be watched):

Q4 FY25 guidance: 80% consolidated growth (including acquisitions).

Q1 FY26 guidance scaled back to 35–40% organic growth only, with M&A contributions left unquantified.

This creates uncertainty on inorganic growth visibility and needs to be monitored closely if deals slip or underperform.

Net View: While growth fundamentals are strong, Zaggle’s investment case rests on flawless execution. Elevated valuations, integration risks, and the step-down in growth guidance demand cautious optimism.

Previous coverage of ZAGGLE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer