Zaggle Prepaid Ocean Services: PAT up 714% & Revenue up 113% in Q1-25 at a PE of 75

Guidance of 45-55% organic growth with adjusted EBITDA margin of 11-13% in FY25. 50% growth guidance for the next 3 years. Expecting an acquisition in Q3-25 to add to the organic growth.

1. Why is ZAGGLE interesting

zaggle.in | NSE: ZAGGLE

ZAGGLE sees strong tailwinds and 50% organic revenue CAGR for the next 2-3 years with margin expansion. Inorganic growth on top of the organic growth expected from Q3-24. Rich valuations in the short term, do not fully capture the opportunity over the longer term. 2. SaaS-based fintech platform

3. FY20-24: PAT CAGR of 9% & Revenue CAGR of 52%

4. FY24: PAT up 92% & Revenue up 40%

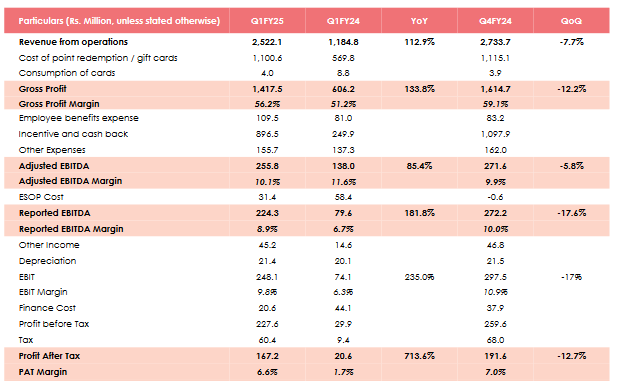

5. Strong Q1-25: PAT up 714% & Revenue up 113% YoY

6. Strong outlook: Organic growth of 45-50%

See Tremendous Tailwinds And 50% Growth For Next 2 To 3 Years: Zaggle Prepaid Ocean Services

i. Organic Revenue growth of 45-55%

FY25: our guidance for the Fiscal Year as 45% to 55% revenue growth over the previous fiscal year.

I am tempted to say that FY25 will be higher than our old guidance, but do not want to revise it now, but will definitely revisit after the Q2 Results.

FY24-26: We remain very confident of doubling our FY24 revenues,

which were Rs. 775 crores, to double in the next two years.

ii. Improvement in margins

FY25: We expect our adjusted EBITDA to hold steady around current levels.

Every effort is being made to increase the adjusted EBITDA to expand to 15%-16% by FY27-28.

iii. Inorganic growth over and above the organic growth guidance

We continue to explore inorganic opportunities with companies in the spend management space. We are in active discussions with a few players across synergistic domains like payments, B2B SaaS, NBFCs, etc.

We are looking to try and close something in the second half, preferably Q3.

Any inorganic growth would be over and above this

7. PAT growth of 714% & Revenue growth of 113% in Q1-25 at a PE of 75

8. So Wait and Watch

If I hold the stock then one may continue holding on to ZAGGLE

Based on Q1-25 performance, ZAGGLE is on track to deliver as per the FY25 guidance of 45-55% revenue growth and 11-13% adjusted EBITDA margin.

Reduced interest costs to drive PAT margin expansion in FY25

Following the recent IPO, the company has successfully repaid INR470 million in borrowings, which is expected to result in reduced finance costs starting from H2. In the future, we will realize significant interest cost savings, resulting in a meaningful shift towards the profitability.

ESOP costs have been a drag on the bottom-line and are expected to reduce going forward which will drive PAT margin expansion in FY25 and FY26

ESOP costs: FY '24, it is going to be roughly about INR19 crores and the going forward, which is '25 and '26, it will be minuscule about INR4 crores or so is, what is our guidance

Have headroom for growth for next 3-4 years without needing money.

So, sir, we have raised about INR490 crores from the IPO and it is sufficient for our next three years to four years of growth. It would -- if unless and until we go ahead and do an inorganic acquisition, where we might require some external funding. We do not see any signs of needing money in the next two to three to maybe let's say three to four years.

Business momentum is strong and expected to continue into the rest of the year

ZAGGLE management is confident of growth

I think we do not see any specific head winds for our business. We see more and more confidence growing with corporate customers and banks to work with us as a profitable listed entity.

9. Join the ride

If I am looking to enter ZAGGLE then

ZAGGLE has delivered PAT growth of 714% and revenue growth of 113% in Q1-25 at a PE of 75 which makes the valuations quite rich over the short term.

With an FY24-26 outlook for 45-55% top-line growth with organic growth by Q3-24 and higher bottom-line growth on account of falling ESOP costs & interest costs a PE of 75 can be sustained over the longer term given that ZAGGLE management claims that the growth estimates are conservative

At a 75 PE, the margin of safety in ZAGGLE is quite low to sustain even a single weak quarter.

Previous coverage of ZAGGLE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer