Yatharth Hospital: PAT growth of 21% & revenue growth of 32% in 9M-25 at a PE of 24

Guidance of 30% revenue growth in FY26. FY25 on track for 30% revenue growth. Guiding for 10% average revenue per occupied bed. Near doubling to 3000+ beds. EBITDA to be sustained

1. Super specialty hospital chain

yatharthhospitals.com | NSE: YATHARTH

2. FY22-24: PAT CAGR of 61% & Revenue CAGR of 29%

3. FY24: PAT up 74% & Revenue up 29% YoY

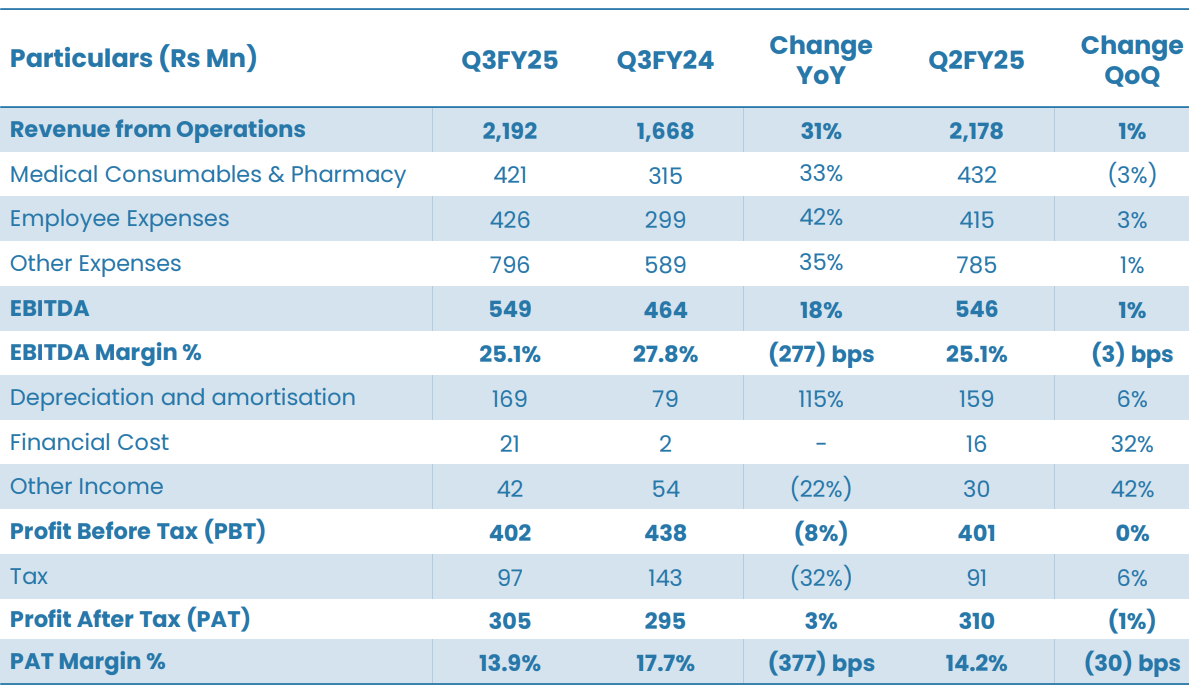

4. Q2-25: PAT up 3% & Revenue up 31% YoY

PAT down 1% & Revenue up 1% QoQ

5. 9M-25: PAT up 21% & Revenue up 32% YoY

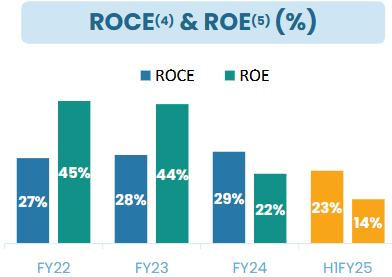

6. Business metrics: Strong return ratios

7. Outlook: FY26 Revenue growth of 30%

Expansion Plans & Acquisitions

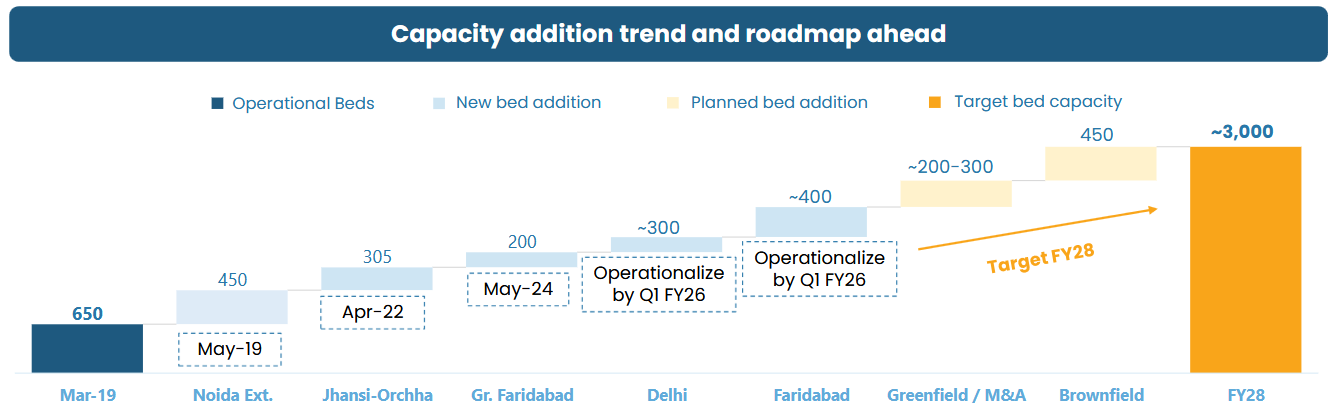

New Delhi and Faridabad Hospitals: Payments completed for two new acquisitions – 300 beds in Delhi and 400 beds in Faridabad. Both hospitals are expected to be operational by Q1 FY26.

Brownfield Expansion: Increasing capacity at Greater Noida and Noida Extension hospitals, making Yatharth one of the largest hospital chains in North India by bed strength.

Target Growth Strategy:

Achieve 3,000+ operational beds by FY28.

Expand high-margin super specialties (oncology, robotic surgeries, transplants).

Increase revenue from self-pay and private insurance to reduce government dependency.

Operational Efficiency & Profitability

Breakeven Timeline: New hospitals expected to break even within 18-24 months and achieve payback within 4-5 years.

Challenges & Risk Management

Income Tax Case: While ₹250 crore was provisionally blocked during an audit, only ₹60 crore remains blocked. Management expects a favorable resolution soon.

EBITDA Impact from Expansion: Margins slightly lower due to new hospitals but expected to recover with higher ARPOB & occupancy rates.

Future Outlook

Revenue Growth Target: Maintain 30%+ YoY revenue growth in FY26.

ARPOB Improvement: 10% YoY growth expected, with new hospitals targeting ₹35,000+ ARPOB.

Market Positioning: Becoming a top-tier hospital chain in North India, focusing on super specialty care and private insurance patients.

i. FY26 Revenue growth of 30%

Revenue growth of 30% in FY26 looks feasible given that FY25 looks on track to deliver 30% growth. 9M-25 growth of 32% with Q4-25 expected to be the strongest quarter of the year

FY26: has always delivered upwards of 30% YoY growth for the last few quarters and we are quite hopeful for sustaining it and increasing it also in the future.

ii. Sustainable EBITDA margin of 25-26%

If you talk about quarter-on-quarter we have been close to 26% and this is what we will maintain somewhere between 25% to 26%. That will be the target going forward also.

EBITDA Margins: Currently at 25.1%, impacted by initial losses from newly operational Greater Faridabad Hospital. The margin is expected to stabilize at 26%-27% once new hospitals break even.

iii. Beds nearly doubling from ~1600 to ~3000 by FY28

Current Bed Capacity (Operational): ~1,600 beds across five hospitals (Greater Noida, Noida, Noida Extension, Jhansi-Orchha, and Greater Faridabad).

Immediate Target Capacity: ~2,300 beds once the upcoming hospitals in Delhi (300 beds) and Faridabad (400 beds) go operational (expected by Q1 FY26).

Longer-Term Goal: To exceed 3,000 beds by FY28 through further expansions and acquisitions.

8. PAT growth of 21% & Revenue growth of 32% in 9M-25 at a PE of 24

9. Hold?

If I hold the stock then one may continue holding on to YATHARTH.

Based on 9M-25 performance of 30% growth and FY26 growth outlook of 30% provides a reason to continue with YATHARTH.

Q$-25 is expected to be strong for YATHARTH

Q4 has been the strongest quarter in company's history and we have every reason to believe that same would be the scenario this financial year.

YATHARTH is preforming strongly against competition on revenue growth and margins.

YATHARTH is also looking good from a longer term growth perspective as it is guiding to increase number of beds from 2300 to 3000 by FY28.

On track to expand bed capacity to ~3,000 by FY28

In addition to the increase in beds, YATHARTH is indicating towards growing average revenue per occupied bed (ARPOB) by 10% for the next few years.

we feel the 10% ARPOB growth that the company has seen YoY for last year should be sustainable for the years to come ahead.

10. Buy?

If I am looking to enter YATHARTH then

YATHARTH has delivered PAT growth of 21% & Revenue growth of 32% in 9M-25 at a PE of 24 which makes valuations fully valued in the short term.

YATHARTH is on track to deliver revenue growth of about 30% in FY25 at a PE of 24 which makes valuations fully valued from a FY25 perspective

YATHARTH guiding for revenue growth of about 30% in FY26 at a PE of 24 which makes valuations reasonable from a FY25 perspective

YATHARTH will operationalize 700 beds in Q1-26 which will drive growth in FY26. Addition of another 650-700 by FY28 provides a roadmap for top-line growth

YATHARTH has launched a QIP to fund the acquisition of hospitals as it looks to increase in number of beds. One needs to watch out if this is a one off. A pattern of equity dilution will impact the EPS growth

Previous coverage of YATHARTH

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer