Yatharth Hospital: PAT growth of 32% & revenue growth of 32% in H1-25 at a PE of 36

Guidance of 34-42% revenue growth in FY25. Growth to be driven by increase in number of bed and average revenue per occupied bed. EBITDA margins to be sustained during this growth

1. Super specialty hospital chain

yatharthhospitals.com | NSE: YATHARTH

2. FY22-24: PAT CAGR of 61% & Revenue CAGR of 29%

3. FY24: PAT up 74% & Revenue up 29% YoY

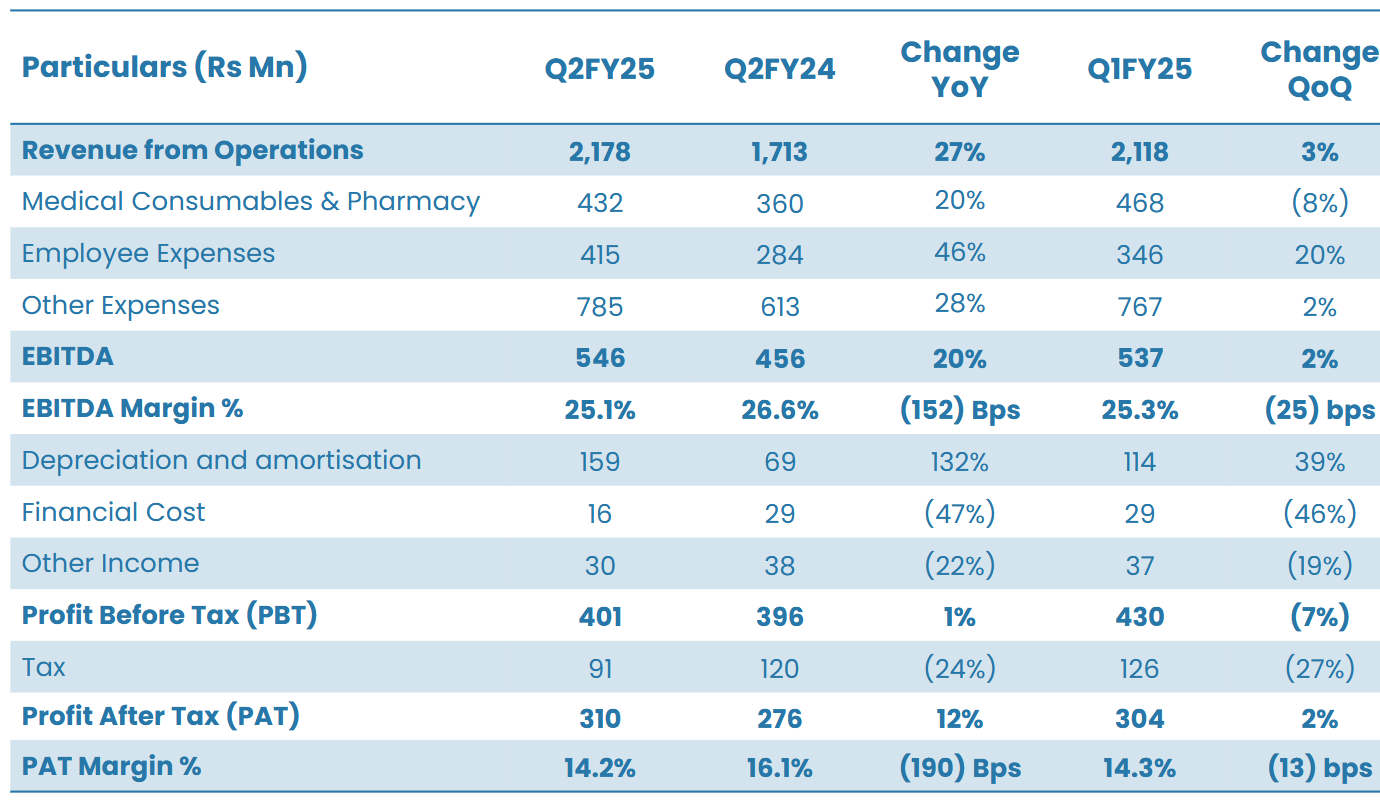

4. Q2-25: PAT up 12% & Revenue up 27% YoY

PAT up 2% & Revenue up 3% QoQ

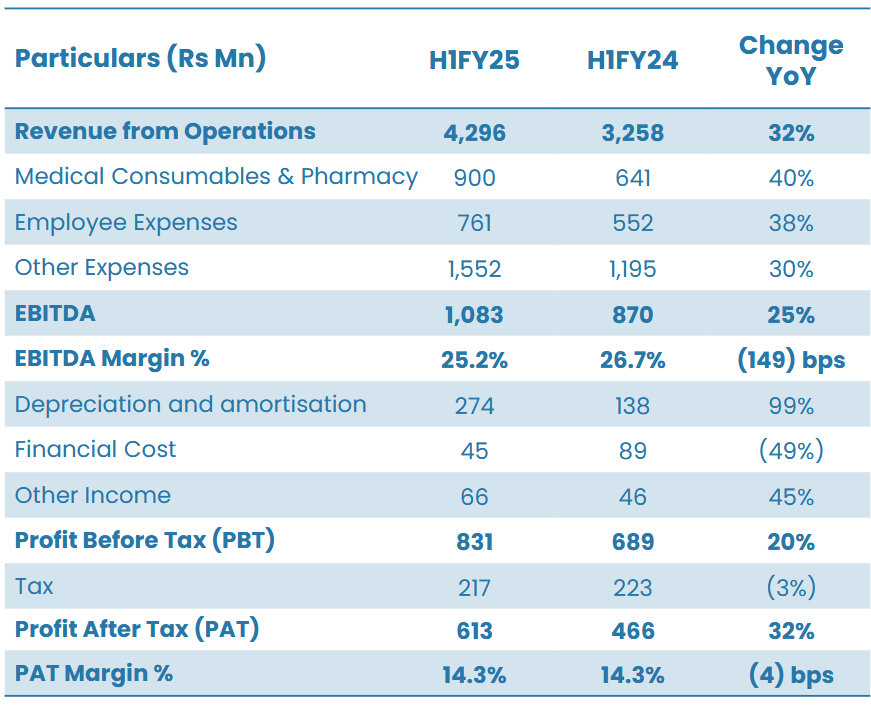

5. H1-25: PAT up 32% & Revenue up 32% YoY

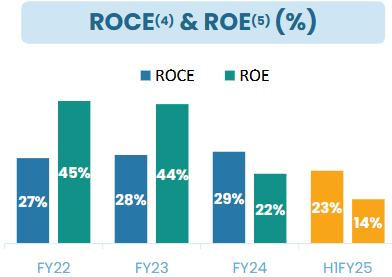

6. Business metrics: Strong return ratios

7. Outlook: FY25 Revenue growth of 34-42%

i. FY25 Revenue growth of 34-42%

Assuming 32% revenue growth of H1-25 going into FY25 leads to a FY25 revenue of Rs 884 cr. Going by the management commentary that Q3 and Q4 would be good growth quarters, we are assuming FY25 revenue to be in the Rs 900-950 cr range which implies a 34-42% revenue growth in FY25

On reaching Rs 1000 cr revenue in FY25: I think what we said is we will be closer to that mark. It's not that we said that we will surpass or touch that mark. So, I think we still maintain that we will be very close to that mark, and I think the company is on track with that

we do expect Q3 and Q4 to be good growth quarters, typically Q4 should be even higher than the previous quarters and because of certain new therapeutic areas maturing, certain new doctors coming up. So, I think we do expect quarter-on-quarter growth going forward and we will be very close to that mark.

ii. Sustainable EBITDA margin of 25-26%

If you talk about quarter-on-quarter we have been close to 26% and this is what we will maintain somewhere between 25% to 26%. That will be the target going forward also.

The EBITDA margins should be sustainable because of the increase in the margins in our matured hospitals even though that will compensate from the drag down for the newer hospitals.

8. PAT growth of 32% & Revenue growth of 32% in H1-25 at a PE of 36

9. Hold?

If I hold the stock then one may continue holding on to YATHARTH.

Based on H1-25 performance one can look forward to a strong FY25 providing a reason to continue with YATHARTH. The guidance of reaching close to Rs 1000 cr revenue is indicating to a strong FY25

H2-25 is expected to be strong for YATHARTH

we do expect Q3 and Q4 to be good growth quarters, typically Q4 should be even higher than the previous quarters and because of certain new therapeutic areas maturing, certain new doctors coming up.

YATHARTH is preforming strongly against competition on revenue growth and margins.

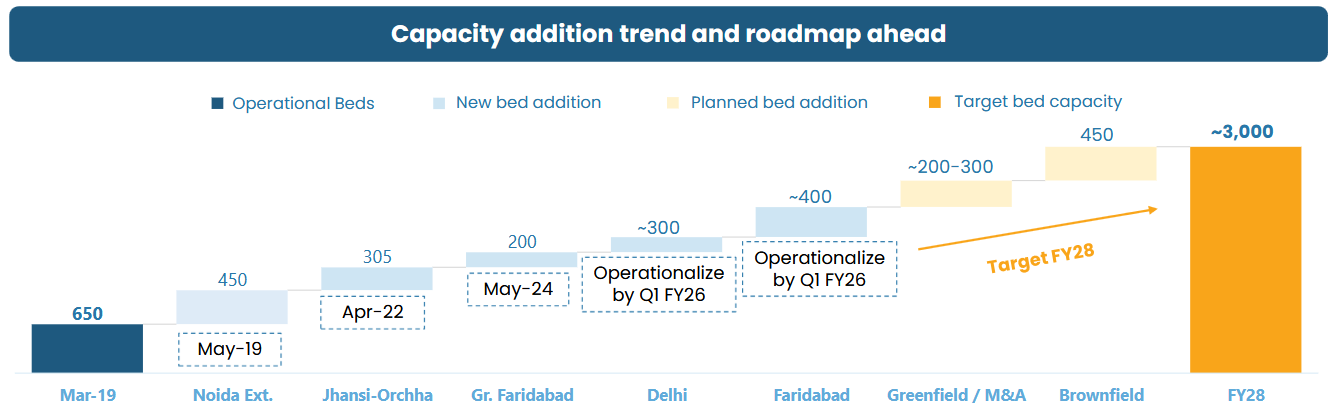

YATHARTH is also looking good from a longer term growth perspective as it is guiding to increase number of beds from 2300 to 3000 by FY28.

On track to expand bed capacity to ~3,000 by FY28

In addition to the increase in beds, YATHARTH is indicating towards increasing average revenue per occupied bed (ARPOB) which will also drive growth.

Another big reason, we feel, for growth for the next two to three years is going to come from our average revenue per occupied bed (ARPOB). Our ARPOB has increased around 10% year on year (YoY) and quarter on quarter (QoQ) also we do expect good growth

10. Buy?

If I am looking to enter YATHARTH then

YATHARTH has delivered PAT growth of 32% & Revenue growth of 32% in H1-25 at a PE of 36 which makes valuations acceptable in the short term.

YATHARTH has is guiding for revenue growth of 34-42% in FY25 with & Revenue growth of 32% in H1-25 at a PE of 36 which makes valuations acceptable from a FY25 perspective

YATHARTH will operationalize 700 beds in Q1-26 which will drive growth in FY26. Addition of another 650-700 by FY28 provides a roadmap for top-line growth

YATHARTH has launched a QIP to fund the acquisition of hospitals as it looks to increase in number of beds. One needs to watch out if this is a one off. A pattern of equity dilution will impact the EPS growth

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

I think the TTM PE is around 40. TTM EPS after the QIP is 13.38 (with 9.64cr shares) but all websites seem to be calculating it with the share count from before the QIP.

Hi Avi ... Yes you are right. We are also using the Q2-25 published data on which to base the analysis. With Q3-25 results the shares will change and we will also change our EPS calculations. We see the risk associated with QIP. "YATHARTH has launched a QIP to fund the acquisition of hospitals as it looks to increase in number of beds. One needs to watch out if this is a one off. A pattern of equity dilution will impact the EPS growth"