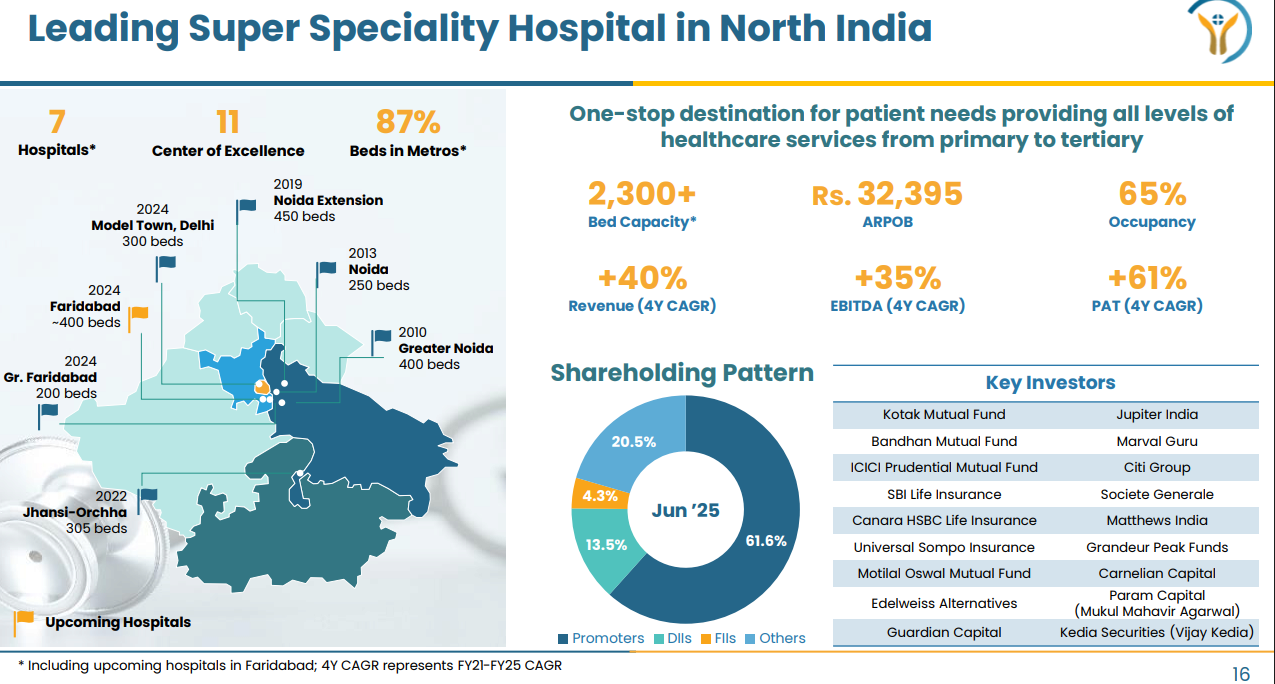

Yatharth Hospital Q2 FY26 Results: PAT up 33%, On-track FY26 Guidance

Guides for 30%+ revenue CAGR till FY27 with stable margins. Strong earnings in H1 FY26 support guidance. Yatharth available at reasonable forward valuations

1. Super specialty hospital chain

yatharthhospitals.com | NSE: YATHARTH

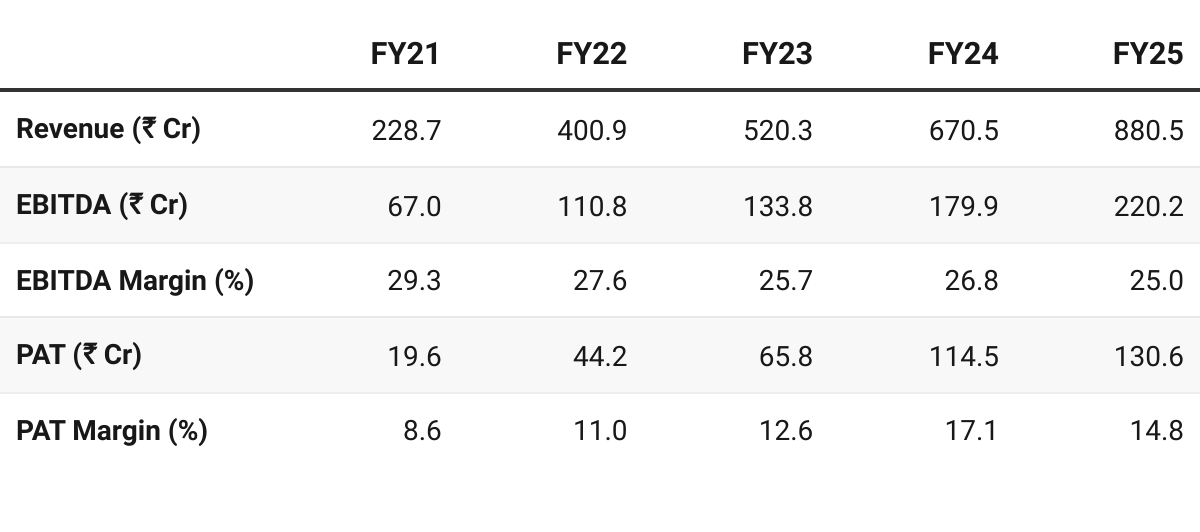

2. FY21–25: PAT CAGR 61% & Revenue CAGR 40%

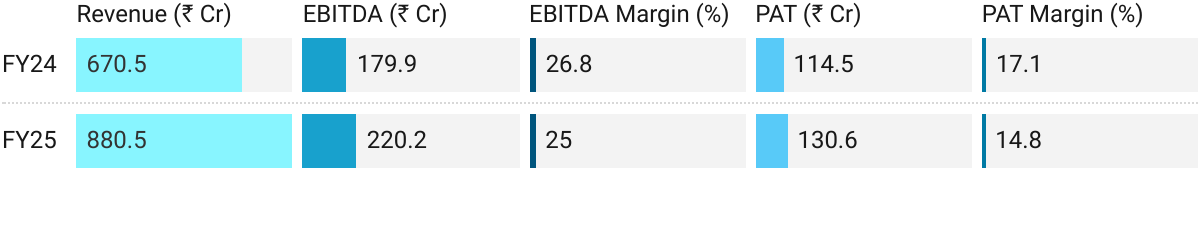

3. FY25: PAT up 14% & Revenue up 31% YoY

Growth led by higher occupancy (61%) and ARPOB gains (+8%).

Oncology and robotics drove case mix upgradation.

Margins diluted by losses at new units and depreciation spike.

Strong recovery in OCF positions Yatharth for next phase of capex and scale.

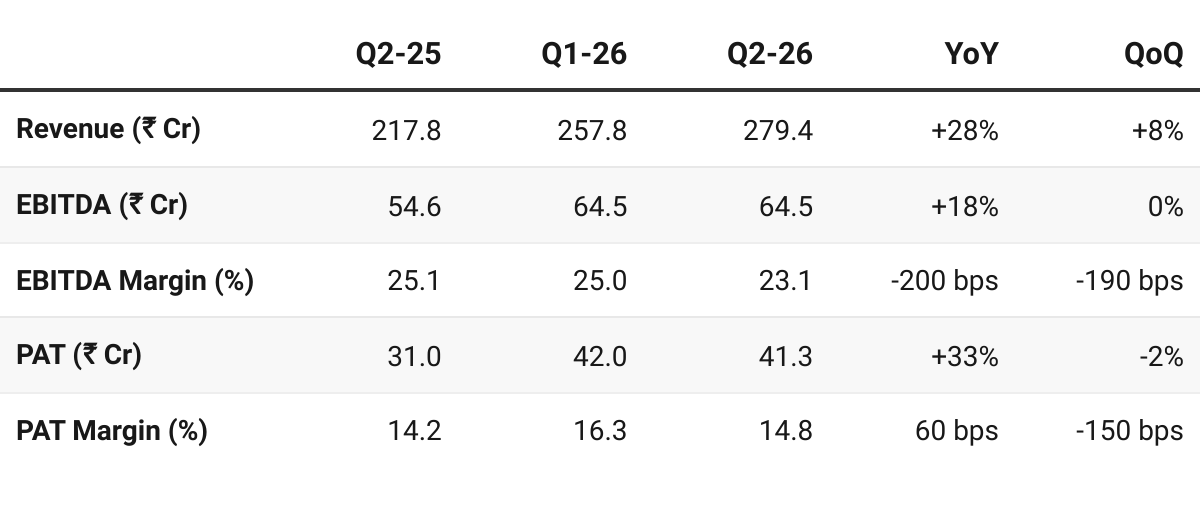

4. Q2-26: PAT up 33% & Revenue up 28% YoY

PAT down 2% & Revenue up 8% QoQ

Q2 FY26 was one of the strongest quarters in Yatharth’s history.

Strong growth from new hospitals (Faridabad + Delhi)

110% YoY growth

Caused 3.3% EBITDA drag, as expected, since they are in early ramp-up.

Mature hospitals sustaining double‐digit growth

19% YoY growth

Adjusted EBITDA (excluding new hospital drag) = 26.7%

PAT Margin: 14.8%, 55 bps improvement YoY

Higher scale

Improved payer mix

Lower finance cost + Higher other income

Occupancy: 66% (vs ~60% last year)

Despite adding 700 new beds

ARPOB (Average Revenue Per Occupied Bed)

Mature hospitals ARPOB: +9% YoY

New hospitals ARPOB: +19% YoY

New hospitals operational

Model Town, Delhi (300 beds)

Faridabad Sector-20 (400 beds)

Both witnessing strong footfalls since launch.

New acquisition

Shantived Hospital, Agra (150 → 250 beds)

Integration from Q4 FY26

EBITDA positive from Day 1

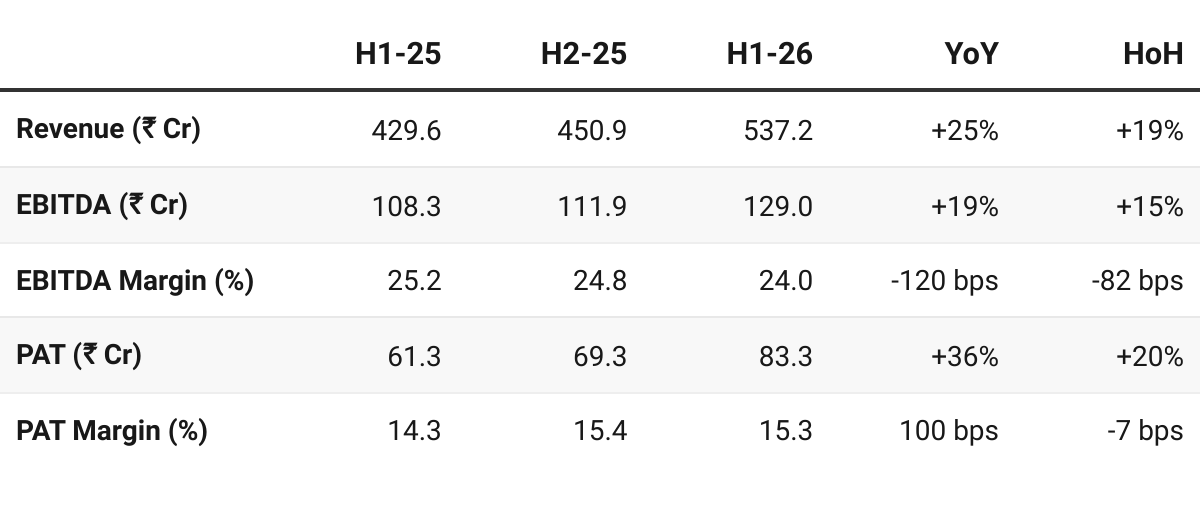

5. H1-26: PAT up 36% & Revenue up 25% YoY

PAT up 20% & Revenue up 19% HoH

5. Business Metrics: Weakening Ratios — Impacted by Acquisitions

FY25 return ratios dipped due to front-loaded capex, equity dilution, and margin compression from new hospital ramp-ups.

Management expects normalization as new units breakeven and ARPOB/margins improve.

7. Outlook: 30% Revenue CAGR FY25-27; 24 % EBITDA margin

7.1 Outlook for FY26 — Yatharth Hospital

FY26

Revenue: I think we are being actually a bit conservative when we’re seeing 30% revenue growth. We feel that this number should be easily overachieved

Margins: I think what we closed the H1 margin for, I think somewhere around that would be a realistic number for the whole of the end year also, maybe 0.5% up and down here.

For next 3 years, we do expect 8% to 10% ARPOB growth clearly.

FY27:

Our guidance remains the same, as we have always maintained that last few years the company has grown close to around 30%. I think in the upcoming years also, including this year, we remain on track for that.

Delhi and Faridabad breakeven expected in 15–17 months

ARPOB and occupancy expected to rise steadily

Large inorganic opportunity pipeline (300–400 beds) in FY27

Significant headroom for acquisitions and expansion

7.2 H1 FY26 Performance vs FY26 Guidance

Overall Positive: Revenue, margins In-line, capacity expansion on schedule, Out-Performance on PAT

Revenue Growth: 30%+ growth guidance vs +25% YoY achievement

On track — H1 typically lower, Q3/Q4 will include Delhi + Faridabad ramp

EBITDA Margin: ~24% ±50bps target vs 24.0% achievement. In-line

ARPOB Growth: 8–10% per year vs +6% YoY actual

Slightly below full-year target (new hospitals dilute early)

PAT Growth: +36% YoY. Strong out-performance over revenue and EBITDA growth

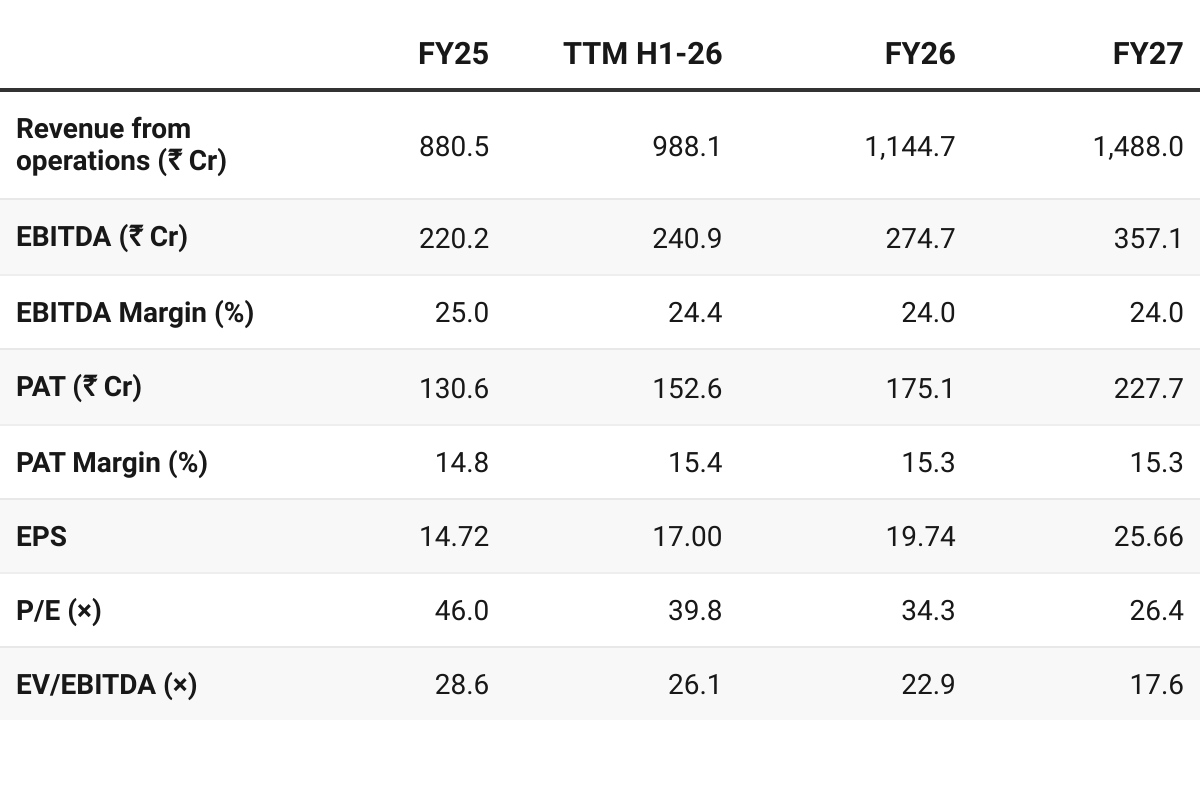

8. Valuation Analysis

8.1 Valuation Snapshot — Yatharth Hospital

Current Market Price= ₹676.9; Market Cap = ₹6,522.3 Cr

Fully-priced from an FY26 perspective.

Attractively priced from an FY27 perspective – possibility of re-rating of multiples

Opportunity emerges beyond FY28 as addition of beds is completed and operations start stabilizing with integration of Agra hospital.

7.2 Opportunity at Current Valuation

Valuations: At FY26 P/E of ~34×, EV/EBIDTA of ~23× the valuations seem to be discounting FY26 performance and FY26 guidance

Potential for re-rating of multiples based on FY27 execution as break-even of Delhi and Faridabad hospitals is not yet discounted

Significant opportunity emerges in FY28 as acquisitions start delivering

Opportunity of increased occupancy in the new hospitals

Impact of acquisition of Agra hospital not yet fulled discounted.

Large inorganic opportunity pipeline (300–400 beds) in FY27 is not discounted in the price as its full impact will be visible in FY28

7.3 Risk at Current Valuation

While valuations offer an opportunity but margin of safety in the valuations is limited. Any slip-up in execution would impact multiples

Delhi Model Town and Faridabad-20 are critical to FY27–28 earnings. Slower-than-expected occupancy ramp up and delays in break-even would impact both the top-line and profitability of overall operations

Government/CGHS is 37% of payer mix. Delays in claim settlement or any future rollback of rates would impact the profitability of the business

Previous coverage of YATHARTH

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer