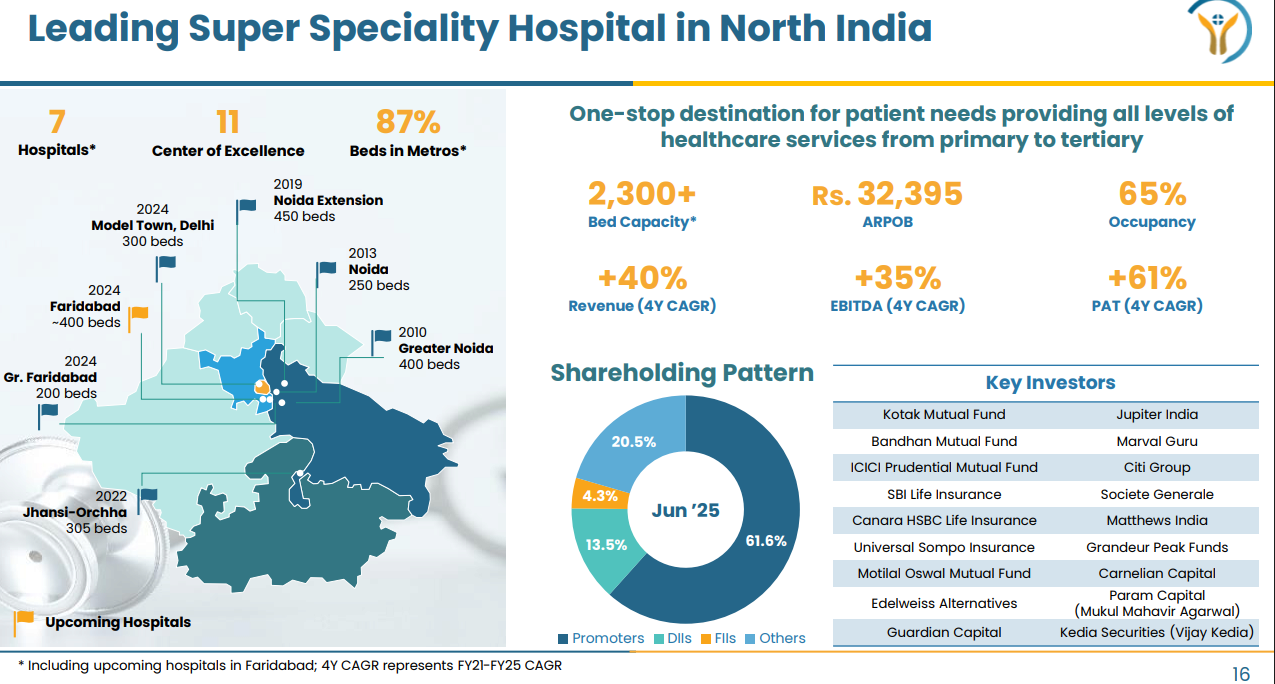

Yatharth Hospital Q1 FY26 Results: PAT up 14%, On-track to 2X Bed Capacity by FY28

Revenue CAGR of 30% for FY25-F27. Growth driven by bed ramp-up, specialty mix improvement, higher occupancy. Rich multiples; derating potential if execution falters

1. Super specialty hospital chain

yatharthhospitals.com | NSE: YATHARTH

2. FY21–25: PAT CAGR 60% & Revenue CAGR 38%

Revenue nearly 4x growth in 5 years; FY25 revenue at ₹880+ Cr.

PAT CAGR ~60%; strong operating leverage until FY24.

EBITDA margins stayed healthy despite new unit drag in FY25.

Cash flows rebounded sharply in FY25 (₹1,496 Cr) after FY24 working capital drag.

FY25 OCF conversion highest at 68%, showing improved collection efficiency.

3. FY25: PAT Up 14% & Revenue Up 31%

Growth led by higher occupancy (61%) and ARPOB gains (+8%).

Oncology and robotics drove case mix upgradation.

Margins diluted by losses at new units and depreciation spike.

Strong recovery in OCF positions Yatharth for next phase of capex and scale.

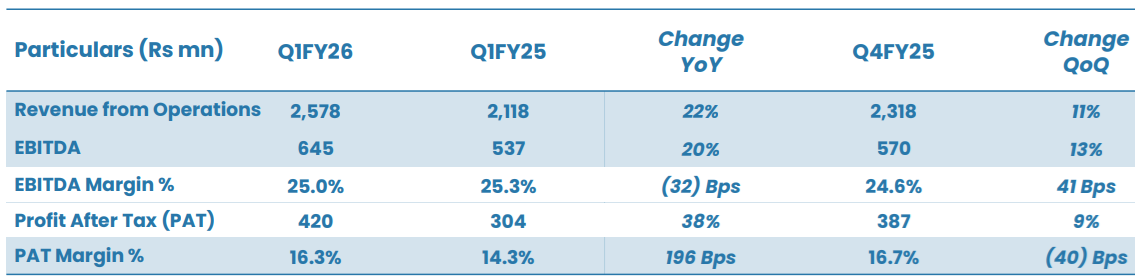

4. Q1-26: PAT Up 38% & Revenue Up 22% YoY

Q1-26: PAT Up 9% & Revenue Up 11% QoQ

Revenue Growth

Q1 Revenue: +22% YoY (vs. ~30% full-year growth guidance).

Growth driven by:

Greater Faridabad (breakeven in ~13 months since launch).

Jhansi–Orchha scale-up.

Steady gains at Noida Extension and Greater Noida via case mix and ARPOB lift.

Shortfall vs. the annual pace was expected, as the two large capacity additions (Delhi & Faridabad) are only contributing from Q2 FY26.

Profitability & Margins

EBITDA: +22% YoY; EBITDA margin: 25.0% (Q4 FY25: 24.6%).

Margin in line with guidance (~24% ± 1%), benefiting from:

Higher occupancy at mature sites (65% vs 61% YoY).

Specialty mix enrichment (oncology, ortho, cardiac).

The expected start-up drag from new hospitals will show in Q2–Q4, but management still sees full-year margins around 24%.

ARPOB & Case Mix

Group ARPOB: ₹32,395 (+6% YoY), within guidance for 8–10% full-year growth.

Mature sites: Noida Extension: ₹39,830 & Greater Noida: ₹38,419.

Stronger mix from oncology, transplants, and high-end procedures continues to drive ARPOB.

Occupancy

Q1 Occupancy: 65% (vs 61% YoY).

Noida / Noida Extension saw stable occupancy but higher IPD volumes.

Jhansi at ~70% utilization, volume-led growth.

Group occupancy is expected to rise further even with 700 new beds being added.

Cash Flow & Balance Sheet

Net cash position remains strong (~₹300+ cr).

Capex in Q1 largely related to completing Delhi & Faridabad; brownfield expansion to start later in the year.

Receivables: debtor days ~117–118 (in line with H1 guidance).

Operational Highlights

Greater Faridabad turned net-profit positive within 13 months, validating management’s ramp-up playbook.

Increased international patient traction; specialty mix shift continues toward high-value areas.

Talent pipeline strengthened via onboarding of key specialists and DNB program expansion.

Q1 FY26 was a steady, in-line quarter on profitability and operating metrics, with the full revenue acceleration deferred to Q2 onwards as new capacity goes live. Execution at Greater Faridabad provides confidence in the ramp-up timeline for Delhi and Faridabad, keeping full-year guidance intact.

5. Business metrics: Temporary dip in ratios

FY25 return ratios dipped due to front-loaded capex, equity dilution, and margin compression from new hospital ramp-ups.

Management expects normalization as new units breakeven and ARPOB/margins improve.

6. Outlook: 30% Revenue CAGR FY25-27; 24 % EBITDA margin

6.1 Outlook for FY26 — Yatharth Hospital

1,605 beds as of FY25 end, excluding upcoming hospitals in Delhi & Faridabad to scale 2X up to ~3,000 by FY28

Overall Growth and Strategic Priorities

Revenue growth for FY26 and FY27 to be ~30%, consistent with growth in previous years.

Growth to accelerate from Q2 FY26 onwards with new hospitals in New Delhi and Faridabad.

New Hospitals (New Delhi & Faridabad)

New Delhi facility inaugurated in mid-July 2025,

Faridabad facility scheduled for inauguration in late August 2025.

Revenue from these two hospitals will start flowing from Q2 FY26 onwards, specifically from August for Delhi and late August for Faridabad.

The Average Revenue Per Operating Bed (ARPOB) for the New Delhi hospital is expected to be better than the current flagship hospitals like Noida and Noida Extension, specifically in line with Noida Extension's ARPOB of ₹39,830.

The ARPOB for the new Faridabad hospital is also expected to be more than the group average (which was ₹32,395 in Q1 FY26). It is specifically expected to be around ₹38,000 for both new hospitals.

The big impact on ARPOB from these new hospitals is expected to be seen from Q3 FY26 onwards.

Both hospitals are expected to reach profit positive within approximately 15 months of operation, following the successful example of the Greater Faridabad facility.

After the first year of operation (from Q2 FY26), both new hospitals are expected to achieve an occupancy of around 30% to 35%.

The government business contribution in these new hospitals is expected to be no more than 20-24%.

The operationalisation of these two hospitals will lead to a "certain drag" on the EBITDA margin compared to FY25, but the full-year EBITDA margin for FY26 is expected to be around 24%, with a possible percentage point up or down, comparable to Q4 FY25 levels.

Existing Hospitals and Occupancy

Jhansi hospital's ARPOB is expected to remain a volume-driven growth, staying in the range of ₹15,000 to ₹17,000.

Occupancy is expected to optimally utilise at 70-75%.

For Greater Noida and Noida Extension, while occupancy has been similar, the Inpatient Department (IPD) numbers have increased, and the focus is on sanitising the payer mix by reducing dependency on government business.

Optimal occupancy for Noida and Noida Extension facilities (which are over 400 beds) would be 75-80%.

Will see increased occupancy in these two hospitals in the coming quarters and years due to the addition of star doctors, new treatments like transplant programmes and radiation oncology, and increased international patients.

Overall, occupancy is expected to grow from all super specialities, with the highest share increase in cardiology, oncology, and neurosurgeries.

Even with the addition of 700 new beds, the group-level occupancy should increase due to anticipated increases in existing hospitals.

Existing hospitals at a group level are expected to achieve an occupancy of close to 75% in a couple of years.

Financial Metrics and Outlook

ARPOB Growth: Expects an 8% to 10% increase in ARPOB for FY26 and FY27.

EBITDA Margins: Full-year FY26 EBITDA margin is estimated to be around 24% (plus or minus one percent).

Trade Receivables: For H1, debtor days are expected to be around 117-118 days, with the full year following a similar trend. They anticipate a further reduction in receivables as government business decreases to 25% of the mix over the next few years.

Expansion Plans (Capex and Beds)

Plans to add approximately 1,200 more beds in the next three years (beyond the 700 new beds currently operationalising), which will bring the capex per bed down to around ₹1 crore.

Actively evaluating acquisition opportunities (greenfield land or stressed assets) and aim to close at least one acquisition in FY26.

For a greenfield project, they are looking to add around 300-350 beds, with a total capex outlay including land of approximately ₹300 crores.

3,000-bed capacity target for FY28 is likely to be met sooner. Beyond that, the company aims to continue scaling up at a similar pace in North India, not driven by specific bed targets but by good market opportunities.

Brownfield expansion for Greater Noida (200 beds) is about to start construction, and Noida Extension (250 beds) is in the final map stages. Both are expected to be operational within approximately two years.

Expansion strategy will focus on bigger cities, particularly NCR and state capitals, where there is high paying potential.

Capex funding will be through the existing strong net cash position (upwards of ₹300 crores), the option to explore debt (currently zero debt), and good internal accruals.

Payer Mix and Services

Reducing its dependency on government business, which has decreased from around 40% to 35% in Q1 FY26.

Remaining revenue is equally divided between cash and private insurance, with private insurance having slightly higher volumes but cash having a bit more revenue.

International patient contribution is expected to reach double-digit numbers (close to 10%) in a couple of years. This increase in international patients is not expected to negatively impact profitability or EBITDA margins, as significant expenses for doctors and equipment are already in place; only volume needs to grow.

Oncology business, currently contributing about 10% to the group's revenue, is expected to grow to around 15% in the next couple of years, as upcoming hospitals will also have radiation oncology facilities.

The future trend of the case mix will see an increase in oncology, other transplants, and high-end procedures. While the share of internal medicine may decline as a percentage, its absolute numbers will not decrease, as it serves as a crucial feeder for super-specialities, ideally contributing 15-17%.

Aims to improve all "cognate" specialties, including cardiac, ortho, and neurosciences.

Speciality charges as a percentage of overall revenue are expected to be about 5% higher than the last five-year average of 40-45%.

The company expects to beat inflation in all NCR region hospitals by adjusting pricing twice a year.

Corporate Governance

Regarding the income tax investigation, the audit for EKS (a large subsidiary) is largely complete with a minor demand expected to be settled soon. The matter for the rest of the company is expected to be resolved by the end of the calendar year, with any required payments being a "very small amount" that the company is well-capable of handling.

6.2 Q1 FY26 Performance vs. FY26 Guidance

Revenue growth: Below full-year pace (22% vs ~30%), but expected to accelerate from Q2.

Margins: On track; Q1 slightly above guidance midpoint.

Occupancy: Ahead of last year, consistent with targets.

ARPOB: Tracking well toward 8–10% YoY growth.

Capex & launches: Delhi operational from mid-July, Faridabad launch on track for late August.

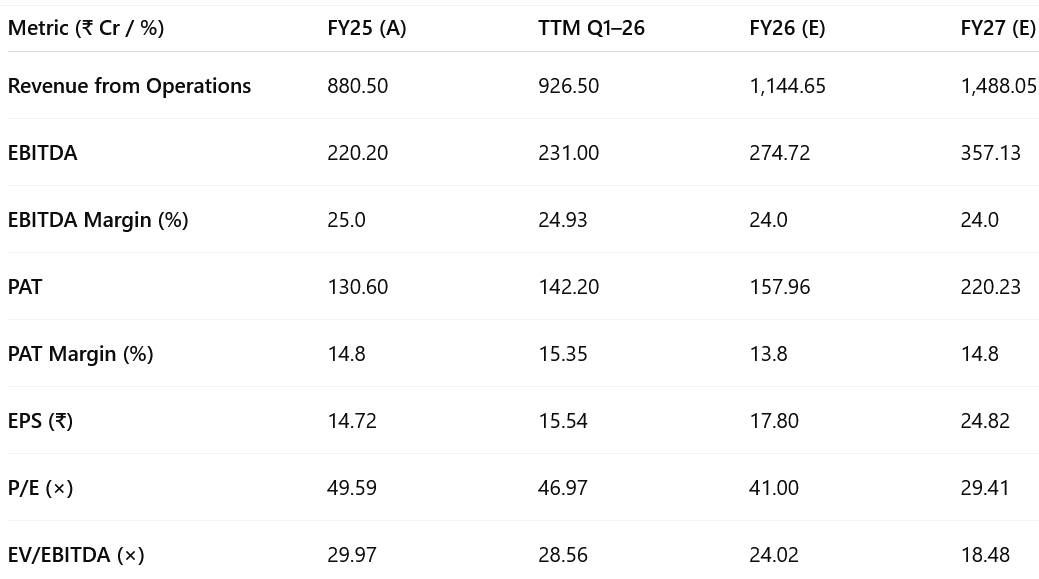

7. Valuation Analysis

7.1 Valuation Snapshot — Yatharth Hospital

Key Takeaways:

Premium valuation: ~41× FY26E P/E and ~24× EV/EBITDA — market pricing in strong growth visibility and execution record.

Significantly higher than the listed Indian hospital peer average

Why the premium?

High growth visibility (~30% CAGR FY25–27E revenue & PAT).

Superior return metrics: stable ~24% EBITDA margin despite large capacity additions.

Balance sheet strength: net cash >₹440 Cr enables capex without leverage.

Track record: fast breakeven at Greater Faridabad (~13 months), proving execution capability.

Earnings multiple remains rich; derating potential exists if execution falters.

Growth runway: Revenue & PAT CAGR ~30% over FY25–27E driven by Delhi & Faridabad ramp-up, plus brownfield expansion.

Margins: EBITDA margin stable at ~24% despite start-up drag from new hospitals.

PEG (Price/Earnings to Growth) FY26E–27E: ~1.37× (P/E 41 ÷ earnings CAGR ~30%), reasonable for high-growth healthcare.

Premium is partially justified given growth visibility and capital efficiency, but any operational miss could trigger a sharp multiple contraction.

7.2 Opportunity at Current Valuation

Growth Visibility

30%+ revenue CAGR expected over FY25–27E, driven by:

Ramp-up of Delhi (300 beds) and Faridabad (400 beds) from Q2 FY26.

Brownfield expansions at Greater Noida (+200 beds) and Noida Extension (+250 beds) within ~2 years.

Continued ARPOB uplift from case mix shift toward oncology, transplants, neurosurgery, and cardiac care.

Margin Resilience

EBITDA margin guided at ~24% ±1% despite start-up drag from new hospitals — among the highest in listed hospital peers.

Execution Track Record

Greater Faridabad turned net-profit positive in ~13 months, validating ramp-up capability for new assets.

Occupancy gains across mature hospitals even as bed base expands (+700 beds in FY26).

Balance Sheet Strength

Net cash position >₹440 Cr allows aggressive capex and M&A without leverage risk.

Capex per bed targeted at ~₹1 Cr, supporting strong ROCE and faster breakevens.

Valuation Support

EV/EBITDA expected to fall from 28.56× (TTM) to 18.48× (FY27E) as earnings compound faster than EV — leaving scope for re-rating if execution beats expectations.

Opportunity Rating: MODERATE–HIGH

Premium justified by visibility, margins, and strong cash backing. Sustained execution on ramp-up and specialty mix improvement can support a rating re-rate as EV/EBITDA compresses into high teens.

7.3 Risk at Current Valuation

High Starting Multiple

Trading at 41× FY26E P/E and 24× FY26E EV/EBITDA vs. sector average of 18–20× EV/EBITDA — leaves limited room for error.

Execution Dependence

FY26–27 growth heavily reliant on new hospitals; any delay in occupancy ramp or ARPOB expansion could materially impact earnings.

Margin Sensitivity

While margins are guided at ~24%, higher initial government business share or slower specialty mix shift could compress EBITDA.

Regulatory & Pricing Risk

Changes in healthcare pricing regulations or government scheme reimbursements could impact ARPOB growth and profitability.

Concentration Risk

Heavy focus on NCR and North India; regional demand shocks or increased competition could slow growth momentum.

Working Capital Drag

High debtor days (~117–118) remain a structural feature; slower-than-expected reduction in government business share could stretch receivables.

Risk Rating: MODERATE

Valuations are rich, leaving limited margin for error. However, strong balance sheet and diversified specialty mix provide downside cushion if occupancy ramp is slower than guided.

Previous coverage of YATHARTH

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Very nice review. Many points well covered. Most importantly CFO/EBIDTA is improving and yes currently stock has valuation. I have invested on your last quarter review so thanks for this.

Request you to share review on Garware Hitech films. Currently stock is under due to tariff.

Thanks

Amazing !