WPIL: PAT growth of 47% with flat Revenue in H1-24 at a PE of 19

Order book, 2.6X FY23 revenues providing strong revenue visibility. Industry tailwinds in place, all parts of WPIL are performing. There is potential for inorganic growth on top of the strong outlook

1. Market Leader in Pumps & Pumping Systems

wpil.co.in | BSE: 505872

Designing, Developing, Manufacturing, Erecting, Commissioning and Servicing of Pumps & Pumping Systems.

Pump business is about 60 plus percent of our revenue, 60%-65% of our revenues and the pump business has lots of growth areas. We are present in the entire gamut of pumps, which is roughly from 5 horsepower to 50,000 horsepower and across various segments. So, primarily, today itself, the Jal Jivan mission and the water supply schemes in India are a major area. The oil and gas segment across the world is booming because the crude oil price is very high. Then the industrial business is also doing very well because with the inflation and higher prices, we are seeing good traction there also. So, all segments are doing well and that's why we see good growth for us in both domestic and international markets.

2. FY20-23: Growth picking up in FY23

3. Strong FY23: PAT up 86% & Revenue up 51%

4. Strong Q1-24: PAT up 34% & Revenue up 20% YoY

5. Strong Q2-24: PAT up 63% & Revenue down 14% YoY

PAT up 6% & Revenue up 3% QoQ

6. Strong H1-24: PAT up 47% & with flat Revenue

7. Business metrics: Strong & Improving return ratios

8. Outlook: Order book 2.6X FY23 reveneu

i. Strong order-book: Multi year revenue visibility

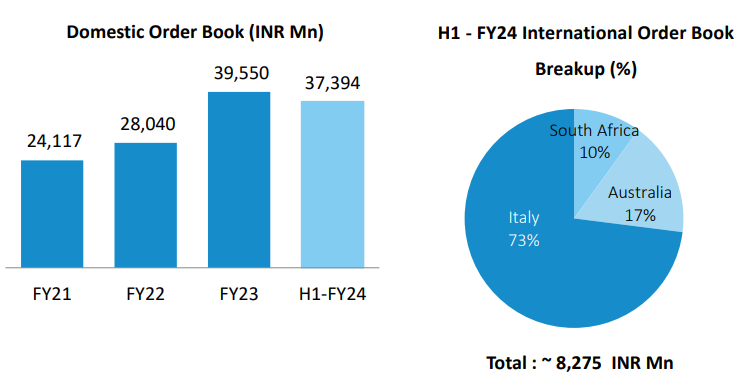

Consolidated Orderbook ~ INR 45,669 Mn

So, the domestic order book is about Rs. 3,800 crore and the project is about Rs. 3,500 crores and the product is roughly 250-300 in that. And in the project, the O&M is about Rs. 600 crores. And the international order book is about Rs. 809 crores.

the orders are generally roughly 24 to 30 months

ii. EBITDA Margin in 15-20% range

We want to focus on EBITDA margins between 15% and 20%. So when we get to 15%, we start focusing on the margins. But when we get to 20%, we are looking at revenue growth.

9. PAT growth of 47% with flat Revenue in H1-24 at a PE of 19

10. So Wait and Watch

If I hold the stock then one may continue holding on to WPIL

Coverage of WPIL was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24. The delivery of a strong H1-24 has increased confidence in the management to deliver a strong FY24

WPIL management is indicating for a H2-24 stronger than H1-24

We expect to improve year end numbers over last year. Also, typically the last half of the year, second half of the year is much more, the sales are much higher in that half, so we expect to keep that trend and exceed last year.

Order book is strong, 2.6X+ FY23 revenue, with indications of stable margin

With industry tailwinds in place, all parts of the business are delivering

Our 3 main areas. One is the domestic product business, the domestic project business and the International product business, all three are well established and mature, with steady and good margins in the range of 15% to 20% EBITDA.

One needs to wait and keep watching for efficient execution of order book and the new orders coming in each quarter.

11. Or else join the ride

If I am looking to enter WPIL then

WPIL has delivered PAT growth of 47% with flat Revenue in H1-24 at a PE of 20 which makes the valuations look reasonable.

Order book is providing strong revenue visibility for 2-2.5 years

Along with the strong order book, potential for inorganic growth

I think with the strong balance sheet now, we are aggressively going to look at inorganic growth areas also. So, I think, basic is the growth in the end markets and also the inorganic opportunities which were presented to ourselves.

Previous coverage on WPIL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action.