Welspun Living: PAT growth of 242% & Revenue growth of 20% in FY24 at a PE of 22

WELSPUNLIV has given a guidance of 20%+ revenue CAGR till FY26 with an EBITDA of 15%.

1. Global Home Textiles Leader

welspunindia.com | NSE: WELSPUNLIV

Welspun Living Ltd (WLL), part of $3.6 bn Welspun Group, is a global leader in the Home Textiles landscape. With a strong global distribution network and worldclass vertically-integrated manufacturing facilities located in India, Welspun is strategic partners with top global retailers.

Company has achieved the highest ever quarterly and yearly revenue of ₹ 26,167 in Q4 FY 24 & ₹ 98,251 in FY 24 grew 19.2% and 19.6% respectively

2. FY20-24: PAT CAGR of 8% & Revenue CAGR of 9%

3. Strong 9M-24: PAT up 629% & Revenue up 20% YoY

Strong margin expansion

4. Q4-24: PAT up 16% & Revenue up 19% YoY

5. Strong FY24: PAT up 242% & Revenue up 20% YoY

6. Business metrics: Strong & improving return ratios

7. Strong outlook: Revenue growth of 24%

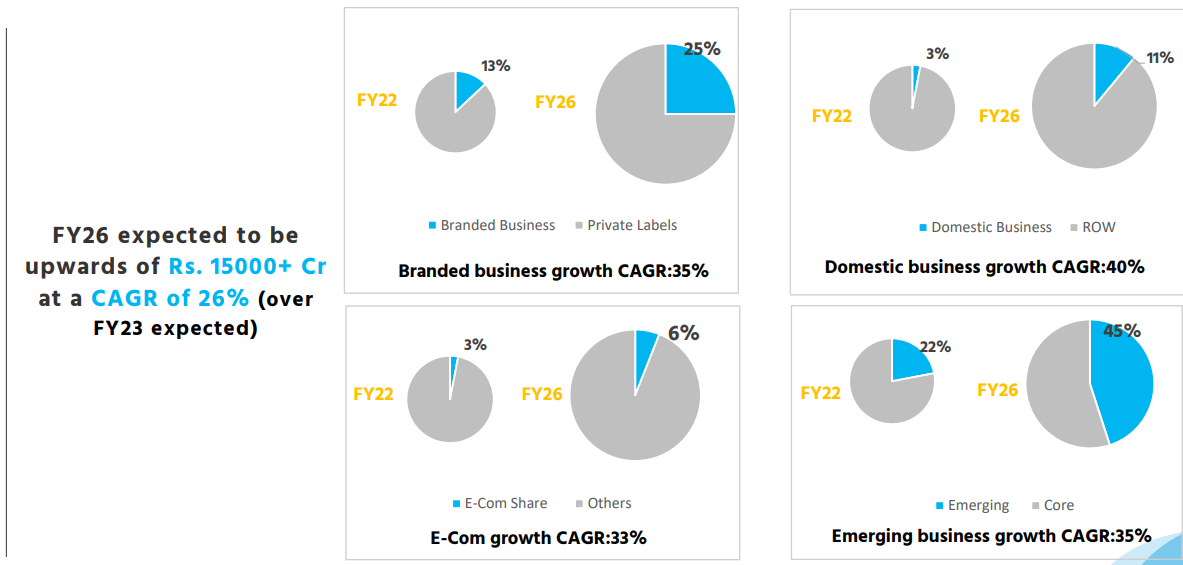

i. FY23-26: Revenue CAGR of 24%

FY24 revenue of Rs 9,825 cr growing to Rs 15,000 cr by FY26 implies a revenue CAGR of 24%. Revenue growth of 20% in FY23 is in line with the asking rate of 20% revenue growth.

8. PAT growth of 242% & Revenue growth of 20% in FY24 at a PE of 22

9. So Wait and Watch

If I hold the stock then one may continue holding on to WELSPUNLIV

WELSPUNLIV has delivered a strong performance in FY24, showing a smart recovery from a weak FY23

Company achieving a considerable growth of 20% in FY24, recording its highest ever yearly revenues and sustainable profitability,

Domestic Consumer Business in FY24 - highest every yearly revenue

Flooring Business also recorded the highest ever yearly revenue in FY 24.

WELSPUNLIV has delivered revenue growth of 20% in FY24 vs a guidance of 15%. Additionally, EBITDA margins have come at 15.4% in line with the guidance of 15% EBITDA margin.

The roadmap of Rs 15,000 cr revenue by FY26 provides a reason to continue with WELSPUNLIV. FY24 performance provides confidence that the target can be achieved.

10. Join the ride

If I am looking to enter WELSPUNLIV then

WELSPUNLIV has delivered PAT growth of 242% and revenue growth of 20% in FY24 at a PE of 22 which makes the valuations quite acceptable over the short term.

With an outlook for 20%+ top-line growth till FY26 a PE of 22 can be sustained by WELSPUNLIV over the longer term

Previous coverage of WELSPUNLIV

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer