Welspun Living: PAT up 629% & Revenue up 20% in 9M-24 at a PE of 20

WELSPUNLIV has given a guidance of 20%+ revenue CAGR till FY26 with an EBITDA of 15%.

1. Global Home Textiles Leader

welspunindia.com | NSE: WELSPUNLIV

reaching highest Q3 revenues, growing at 29% and highest ever revenues in Domestic and Flooring businesses leading to increased market share in all areas of our operations

2. FY20-23: Growth momentum derailed in FY23

3. H1-24: PAT up 1054% & Revenue up 16%

Strong margin expansion

4. Strong Q3-24: PAT up 317% & Revenue up 29% YoY

5. Strong 9M-24: PAT up 629% & Revenue up 20% YoY

Strong margin expansion

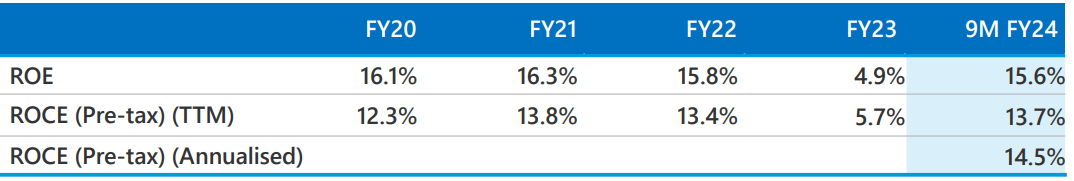

6. Business metrics: Strong & improving return ratios

7. Strong outlook: Revenue growth of 23%

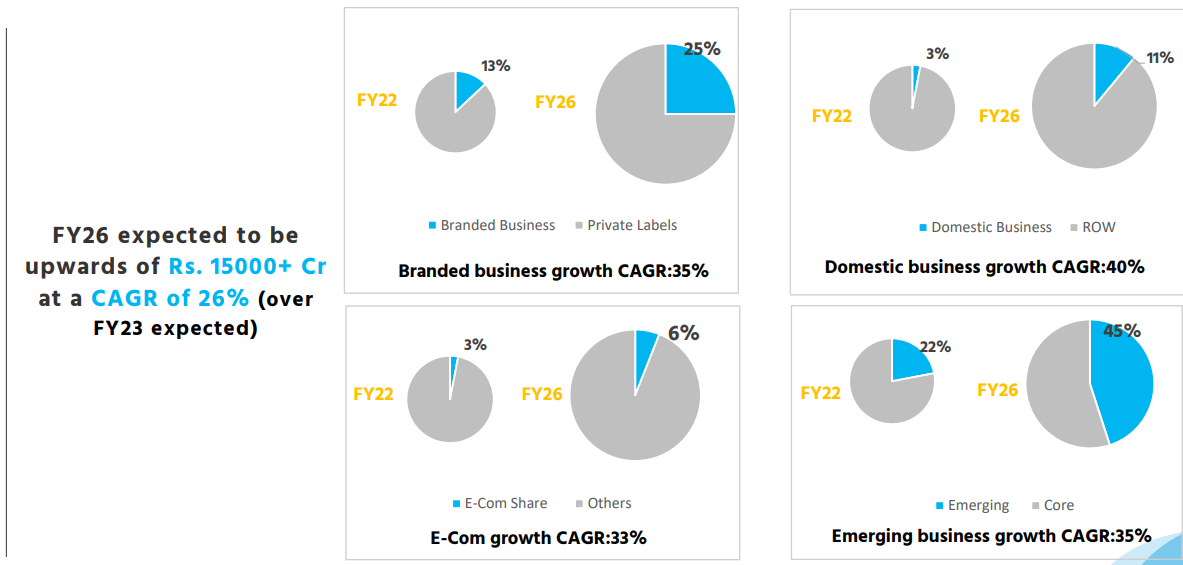

i. FY23-26: Revenue CAGR of 23%+

FY23 revenue of Rs 8,093.76 cr growing to Rs 15,000 cr by FY26 implies a revenue CAGR of 23%

ii. FY24: 15% revenue growth

9M-24 revenue growth of 20% leading to 15% revenue growth in FY24 implies that WELSPUNLIV management is being conservative.

achieving revenue growth around 15% in FY 2024.

iii. FY24: 15% EBITDA Margin

15% EBITDA

8. PAT growth of 629% & Revenue growth of 20% in 9M-24 at a PE of 20

9. So Wait and Watch

If I hold the stock then one may continue holding on to WELSPUNLIV

Based on 9M-24 performance, WELSPUNLIV looks on track to deliver the strongest operating PAT & revenue in FY24 and reach peak revenue & profitability of FY22

The roadmap of Rs 15,000 cr revenue by FY26 provides a reason to continue with WELSPUNLIV

10. Join the ride

If I am looking to enter WELSPUNLIV then

WELSPUNLIV has delivered PAT growth of 629% and revenue growth of 20% in 9M-24 at a PE of 20 which makes the valuations quite acceptable over the short term.

With an outlook for 20%+ top-line growth till FY26 a PE of 20 can be sustained by WELSPUNLIV over the longer term

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer