Welspun Corp: EBITDA growth 332% & revenue growth of 126% in 9M-24 at a PE of 13

WELCORP performance on track to beat FY24 guidance. Available at very reasonable valuations. One needs to watch out for the revenue visibility given order book is sufficient for the next 6 months

1. One of the largest manufacturers of large diameter pipes globally

welspuncorp.com | NSE : WELCORP

Top 3 global Line Pipe manufacturer

The company also manufactures BIS-certified Steel Billets, TMT (Thermo Mechanically Treated) Rebars, Ductile Iron (DI) Pipes, Stainless Steel Pipes, and Tubes & Bars.

The company recently acquired Sintex-BAPL, a market leader in water tanks and other plastic products, to expand its building materials portfolio.

It has also acquired specified assets of ABG Shipyard with a potential to enter Defence and commercial shipbuilding, green steel, ship breaking, and ship repair.

2. FY13-23: An Average business

Nothing bad, nothing spectacular to talk about

Went nowhere in the last decade

Consistent Performance over the last 10 years: EBITDA in the range of INR 800 – 1200 crores per annum from Line Pipes Business

3. Weak FY23: PAT down 53% & Revenue up 50% YoY

4. Strong H1-24: Revenue up 147% YoY & back in profit

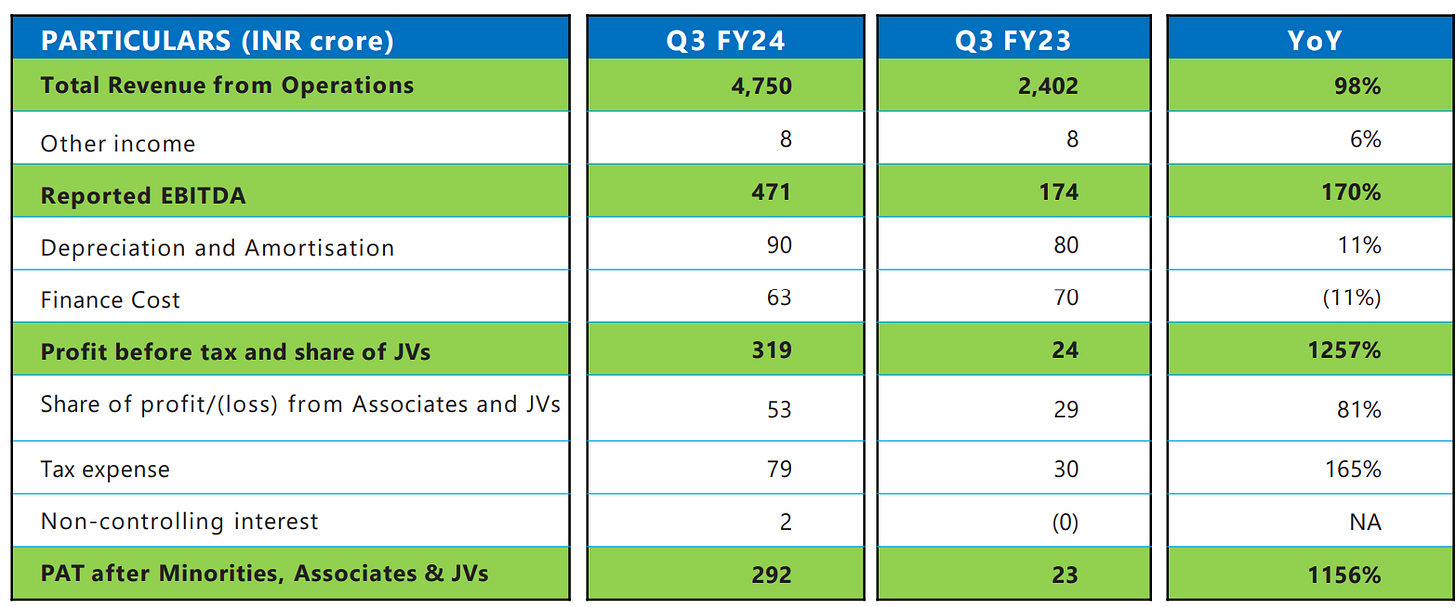

5. Mixed Q3-24: PAT up 1156% & Revenue up 107% YoY

PAT down 24% and Revenue up 17% QoQ

6. Strong 9M-24: EBITDA up 332% & Revenue up 126% YoY

7. Business metrics: Return ratios improving in 9M-24

Net debt stood at about INR500 crores at the end of December compared with INR1,800 crores at the end of last year, same period driven by our very strong free cash flows from the businesses. ROCE stood at 15.7%. This is for a 9-month period compared with the last year's ROCE for March '23 at 7.9%.

On track to delivering FY24 ROCE guidance of 16%

8. Outlook: 50% revenue growth & 90% EBITDA growth in FY24

i. Progress in 9M-24 ahead of guidance

EPS Guidance for 26.8 for FY24 has been beaten with 9M-24 EPS at 32.2

We are well on track not only to achieve them, but to actually surpass them.

9. EBITDA growth of 332% & revenue growth of 126% in 9M-24 at a PE of 13

10. So Wait and Watch

If I hold the stock then one may continue holding on to WELCORP

Coverage of WELCORP was initiated after Q1-24 results. The investment thesis has not changed after a strong 9M-24. The only changes are the delivery of a strong Q3-24 and the increased confidence in the management after beating FY24 guidance

On the back of a strong 9M-24, one can wait for the FY25 guidance to come in.

One needs to keep a watch on the order book as the revenue visibility is for the next 6 months only.

Order book for the line pipes in India and U.S. stands at a robust 575,000 tons valued at more than INR7,000 crores.

this anyway gives us visibility easily for the next 6 months or so

11. Or, join the ride

If I am looking to enter WELCORP then

AGI has delivered a return to profitability with EBITDA growth of 332% & revenue growth of 126% in 9M-24 at a PE of 13 which makes valuations quite reasonable .

WELCORP is guiding for 90% EBITDA growth & 50% revenue growth in FY24 at a PE of 13 which makes the valuations reasonable.

WELCORP generated Rs 950 cr of free cash flow in H1-24 at a current market cap of Rs 14,256 cr. It is available at free cash flow yield of 6.7% (not annualized) which makes the valuations quite attractive.

WELCORP is at a market cap of Rs 14,256 cr which is less than the Rs 15000+ cr of revenue expected in FY24

Previous coverage of WELCORP

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer