Vishnu Prakash R Punglia: PAT down 10% & revenue down 8% in QQ1-25 at a PE of 26

Conservative guidance of revenue growth of 15-20% in FY25. Possibility of revision in guidance. Bottom line to grow faster than top-line. Rs 5,500 cr of orders to to be executed within 24-27 months

1. Engineering, procurement & construction (“EPC”) company, design & construction of infrastructure projects

vprp.co.in | NSE: VPRPL

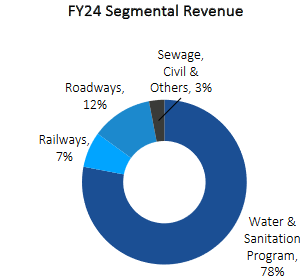

Business operations are broadly divided into four categories i.e.

Water Supply Projects (“WSP”)

Railway Projects

Road Projects

Irrigation Network Projects.

Key customers are Central & State Government, Autonomous Bodies & Private Bodies

2. FY21-24: PAT CAGR of 73% & Revenue CAGR of 43%

3. Strong FY24: PAT 35% & Revenue up 26% YoY

4. Weak Q1-25: PAT down 9.8% & Revenue down 7.8% YoY

5. Business metrics: Strong return ratios

6. Outlook: 15-20% revenue growth in FY25

i. FY25: Revenue growth of 15-20%

A conservative guidance of 15-20% growth with possibility for an upward revision.

15% to 20% on conservative side. Growth, we will only expect to grow more and more. But on a conservative side, I gave you that guidance.

ii. FY25: EBITDA margin expansion

Bottom-line growth expected to be faster than the top-line growth as per the historic trends of FY21-24 where PAT CAGR was 73% & Revenue CAGR was 43%

will keep the current margins sustainable. It will be the same 13% to 14% margin will be there.

iii. Strong revenue visibility: Order book 2.7X FY25 expected revenue

Till June 2024, we have an order book of around Rs.4,915 crores. Even after June the company has received Rs. 510 crores of new orders which will be executed in about 24 to 27 months.

7. PAT down 10% & Revenue down 8% in Q1-25 at a PE of 26

8. So Wait and Watch

If I hold the stock then one may continue holding on to VPRPL.

VPRPL has delivered a a very weak Q1-25 raising questions whether one may continue holding it. However, Q1-25 can be seen as a one off and one does not see the overall business momentum slowing down. The strength of the business momentum can be seen from the fact that between 1-Jul and 14-Aug VPRPL won Rs 500 cr of new orders

This particular quarter was further impacted by the election period, which caused delays in billing and payment processes. These delays, in turn, led to temporary setbacks in work certifications and subsequent payments by the respective departments and clients

Up till June 30 our order book is Rs. 4915 crores. After that we got another Rs. 500 crores.

The order book is providing long term visibility into the prospects of VPRPL. One continue with VPRPL as long as the order book is in place to provide longer term visibility along with a strong execution of the order book (not a continuation of the performance seen in Q1-25).

9. Or, join the ride

If I am looking to enter VPRPL then

VPRPL has delivered a weak Q1-25 with both PAT & Revenue down in Q1-25. However VPRPL management is confirming a conservative revenue growth guidance of 15-20% with possibility of upward revision along with margin expansion in FY25. At a PE of 26 valuations are fully priced in the short term.

With close to Rs 5,000 cr of order book as of Q1-25 end along with Rs 500 cr of new orders in in the 45 days of Q2-25 to be executed in the next 24-27 months provides an opportunity in the stock over the next 2-3 years.

Previous coverage of VPRPL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer