Vishnu Prakash R Punglia: PAT growth of 35% & revenue growth of 26% in FY24 at a PE of 18

Revenue growth of 15-20% in FY25. EBITDA margin sustained at FY24 levels of 13-14%. Strong revenue visibility. Order book 2.7X FY25 expected revenue to to be executed within 2-3 years

1. Engineering, procurement & construction (“EPC”) company, design & construction of infrastructure projects

vprp.co.in | NSE: VPRPL

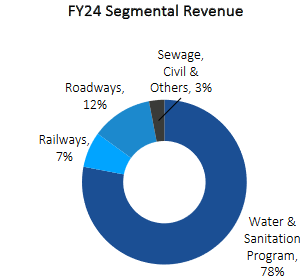

Business operations are broadly divided into four categories i.e.

Water Supply Projects (“WSP”)

Railway Projects

Road Projects

Irrigation Network Projects.

Key customers are Central & State Government, Autonomous Bodies & Private Bodies

2. FY21-24: PAT CAGR of 73% & Revenue CAGR of 43%

3. 9M-24: PAT 9% Revenue up 15% YoY

4. Strong Q4-24: PAT up 68% & Revenue up 44% YoY

PAT up 286% & Revenue up 171% QoQ

5. Strong FY24: PAT 35% & Revenue up 26% YoY

6. Business metrics: Strong return ratios

7. Outlook: 15-20% revenue growth in FY25

i. FY25: Revenue growth of 15-20%

Can’t tell about the numbers, but yes, growth will be 15% to 20%

ii. FY25: EBITDA margin of FY24 to be sustained in FY25

will keep the current margins sustainable. It will be the same 13% to 14% margin will be there.

iii. Strong revenue visibility: Order book 2.7X FY25 expected revenue

The current orderbook stands at ~Rs.4,717 crores spread across all the business segments to be executed over the next 24-36 months.

8. PAT growth of 35% & Revenue growth of 26% in FY24 at a PE of 18

9. So Wait and Watch

If I hold the stock then one may continue holding on to VPRPL.

VPRPL has delivered a strong FY24 continuing the trajectory of FY21-23. It has increased the confidence in the management to deliver a stronger FY25 based on the guidance for FY25.

the bid pipeline is robust and we are hopeful of some opportunities to materialize over the next few months.

The order book is providing long term visibility into the prospects of VPRPL. One continue with VPRPL as long as the order book is in place to provide longer term visibility along with a strong execution of the order book.

10. Or, join the ride

If I am looking to enter VPRPL then

VPRPL has delivered PAT growth of 35% & Revenue growth of 26% in FY24 at a PE of 18 which makes valuations quite reasonable.

FY25 guidance for 15-20% revenue growth by VPRPL with EBITDA margin being sustained at a PE of 18 makes valuations look reasonable from a FY25 perspective.

The strong order book provides a roadmap for growth for FY24-26 which provide opportunity in the stock over the longer term

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Good analysis