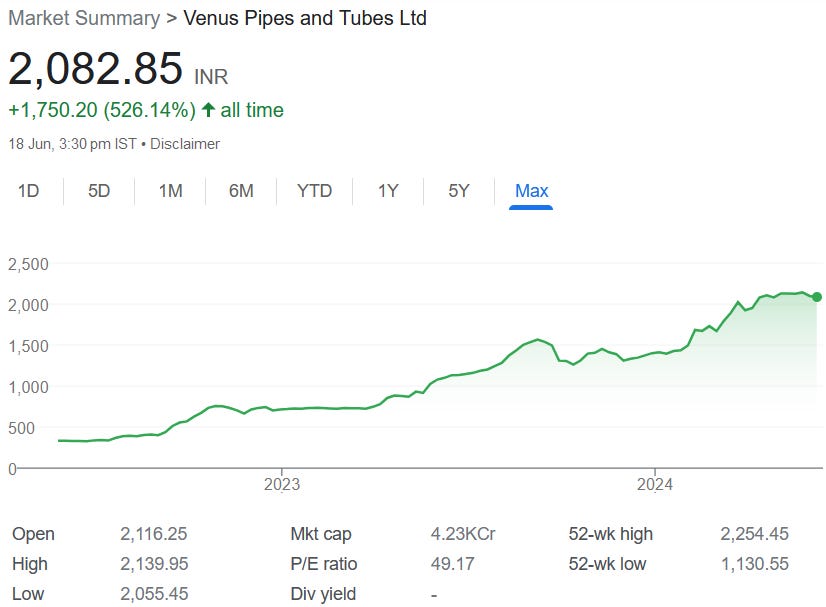

Venus Pipes & Tubes: PAT growth of 94% & Revenue up 54% in FY24 at a PE of 49

Volume CAGR of 30%+ for FY24-26. Guidance for EBITDA margin expansion by VENUSPIPES in FY25. Capex operationalized to support FY25 volumes. New Capex to support growth beyond FY26

1. Manufacturer of stainless-steel pipes and tubes

venuspipes.com | NSE: VENUSPIPES

Revenue Split

Product split changing with an increasing contribution of seamless pipes.

2. FY20-24: PAT CAGR of 114% & Revenue CAGR of 46%

3. Strong 9M-24: PAT up 99% and Revenue up 54% YoY

4. Strong Q4-24: PAT up 87% and Revenue up 27% YoY

PAT up 7% and Revenue up 8% QoQ

5. Strong FY24: PAT up 94% and Revenue up 45% YoY

6. Solid return ratios

7. Outlook: Volume CAGR of 30%+ till FY26

i. FY24-26: Volume growth CAGR of 30%+

ii. FY25: EBITDA margin improvement.

VENUSPIPES is guiding for margin improvement in FY25

there would be also slight improvement in the margin also going forward on the side of seamless and on the side of the welded. So, you can see have this margins will further improve going forward also.

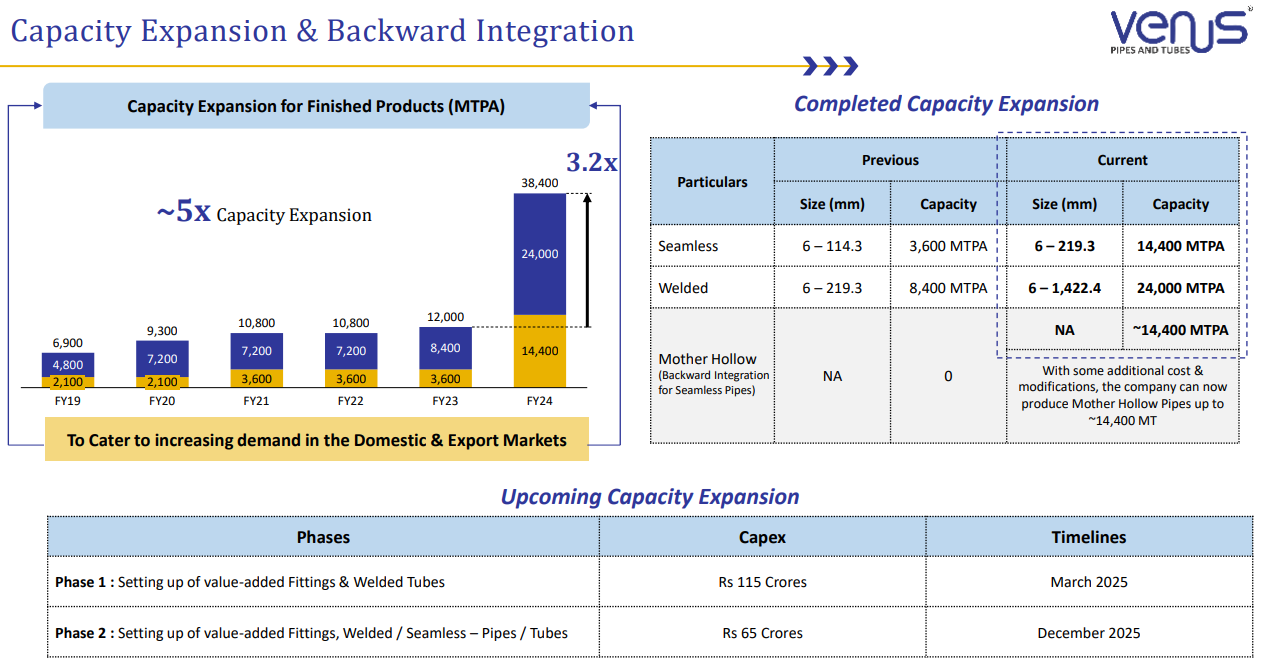

iii. Capex in place for FY25; New capex to support FY26.

8. PAT growth of 94% and Revenue up 45% in FY24 at a PE of 49

9. So Wait and Watch

If I hold the stock then one may continue holding on to VENUSPIPES

Coverage of VENUSPIPES was initiated after Q1-24 results. The investment thesis has not changed after a strong FY24. The management has delivered FY24 growth as per guidance and FY24 capex completed as per plan

Yes, see, the guidance, I think, we have to do that only as compared to FY'23. It was in the range of 40% to 50% only. And I think we stick to that.

We increased our capacity by 3.2x in the last financial year and simultaneously we have also been able to ramp up the utilization

Outlook is positive given guidance of 30% volume CAGR for FY24-26

We enter FY25 and we look at an optimistic future characterized by the ongoing expansion of our product range and client base.

10. Join the ride

If I am looking to enter VENUSPIPES then

VENUSPIPES has delivered PAT growth of 94% and revenue growth of 45% in FY24 at a PE of 50 which makes the valuations fully priced.

Outlook for 30%+ volume CAGR for FY24-26 with bottom-line growing faster than the top-line on account of EBITDA margin expansion at a PE of 49 which makes the valuations acceptable over the longer term.

The performance for FY24 looks well discounted in the price. The opportunity in stock is from the performance from FY25 onwards.

A PE of 49 looks rich in the short term hence positions need to be built over time over bad days when the stock is not doing well. Reaction in stock price will be seen if execution for even one quarter is not in line with the guidance given.

Previous coverage of VENUSPIPES

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer