Venus Pipes & Tubes: PAT growth of 99% & Revenue up 54% in 9M-24 at a PE of 41

Solid performance in 9M-24. Challenge is for the increased capacities and increasing utilization to drive the revenues and margins going forward in step with current valuations.

1. Manufacturer of stainless-steel pipes and tubes

venuspipes.com | NSE: VENUSPIPES

Revenue Split

Product split changing with an increasing contribution of seamless pipes.

2. PAT CAGR= 86%, Revenue CAGR= 47%, for FY19-23

YoY sequential growth over five years from FY19-23

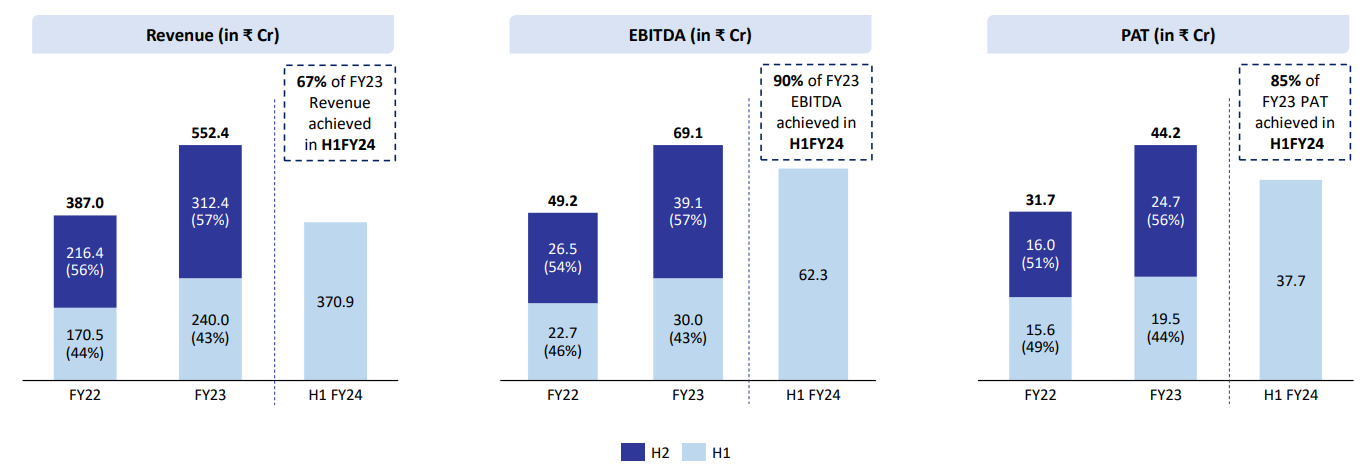

3. Strong H1-24: PAT up 93% and Revenue up 55% YoY

4. Strong Q3-24: PAT up 107% and Revenue up 52% YoY

PAT up 15% and Revenue up 8% YoY

Expansion in PAT margins both YoY and QoQ

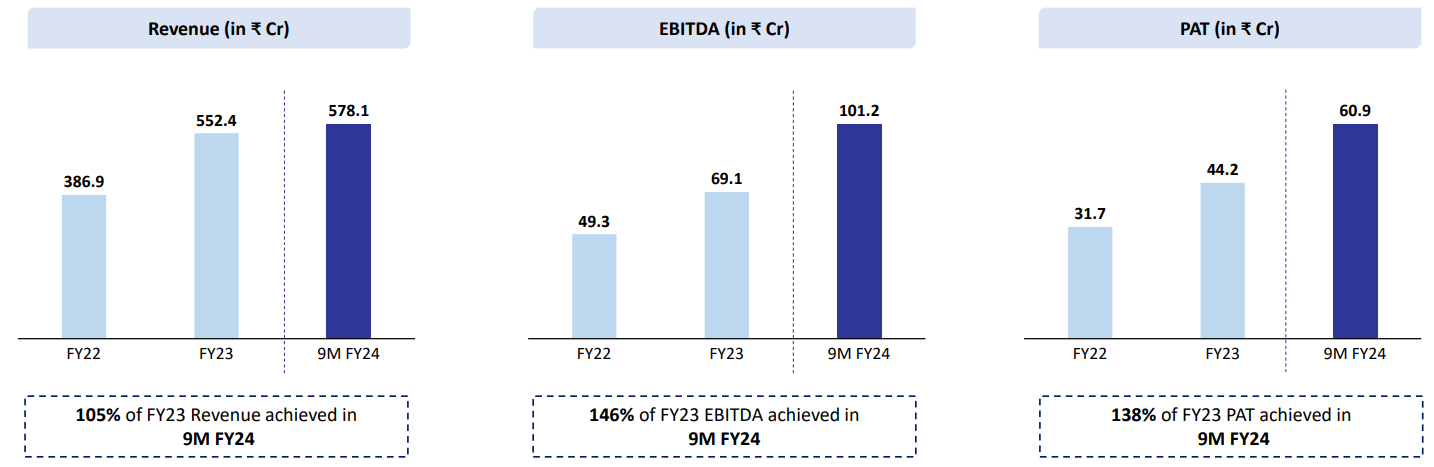

5. Strong 9M-24: PAT up 99% and Revenue up 54% YoY

Expansion in PAT margins

6. Solid return ratios

7. Strong outlook: Revenue CAGR of 35% till FY25

i. FY24: Revenue growth of 40-50%

Yes, see, the guidance, I think, we have to do that only as compared to FY'23. It was in the range of 40% to 50% only. And I think we stick to that.

ii. FY25: Revenue growth of 30-40%

See, FY'25, should be again a good year because many of the capacity would be utilized to a good extent. I believe the range bound of 30% to 40% from FY'24 if I compare.

iii. Order book: Revenue visibility for Q4-24

We have an order book of INR230 crores and the export is around 20% of that

Generally, it should be basically 90 to 110 days.

iv. Cash flow improvement from H2-24

Definitely a second-half will also see a much better operating cash flow as compared to what we have achieved in the first year but I think FY2025 would be a very good year, cash flow from operation should be there in good quantum.

8. PAT growth of 99% and Revenue up 54% in 9M-24 at a PE of 41

9. So Wait and Watch

If I hold the stock then one may continue holding on to VENUSPIPES

Coverage of VENUSPIPES was initiated after Q1-24 results. The investment thesis has not changed after a strong Q3-24. The delivery of a strong 9M-24 and the increased confidence in the management to deliver a stronger FY24

Outlook is positive

With all our capacities operational in May 2023 & July 2023 along with backward integration of seamless pipes, we anticipate not only sustaining but enhancing this positive trajectory

Improving demand environment globally & across India, we are optimistic of growth momentum to sustain going forward

Increased capacities and increasing utilization will drive the revenues and margins going forward

10. Join the ride

If I am looking to enter VENUSPIPES then

VENUSPIPES has delivered PAT growth of 99% and revenue growth of 54% in 9M-24 at a PE of 41 which makes the valuations acceptable.

Valuations are priced to perfection. PE of 41 for 40-50% top-line growth in FY24 followed by 30-40% growth in FY25 with bottom-line growing faster than the top-line

The performance for FY24 looks well discounted in the price. The opportunity in stock is from the performance and growth outlook from FY25 onwards.

A PE of 41 looks rich in the short term hence positions need to be built over time over bad days when the stock is not doing well.

Previous coverage of VENUSPIPES

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action.