Ujjivan Small Finance Bank: PAT growth of 20% & NII growth of 26% in 9M-24 at a PE of 7

UJJIVANSFB guiding for a solid Q4-24 to end FY24 strongly. It maintains its guidance till FY26. to deliver 25% loan growth with ROE of 22%+. It is available at reasonable valuations of P/B of 1.8

1. A Small Finance Bank

ujjivansfb.in | NSE: UJJIVANSFB

As per order received from the Hon’ble NCLT, shareholder’s EGM is being convened on 3rd Nov’23 by the Bank as well as Ujjivan Financial Services. Once the merger is approved by the shareholders of both the companies, we will proceed with the remaining procedural and regulatory aspects.

We expect the merger to be completed in Q4FY24.

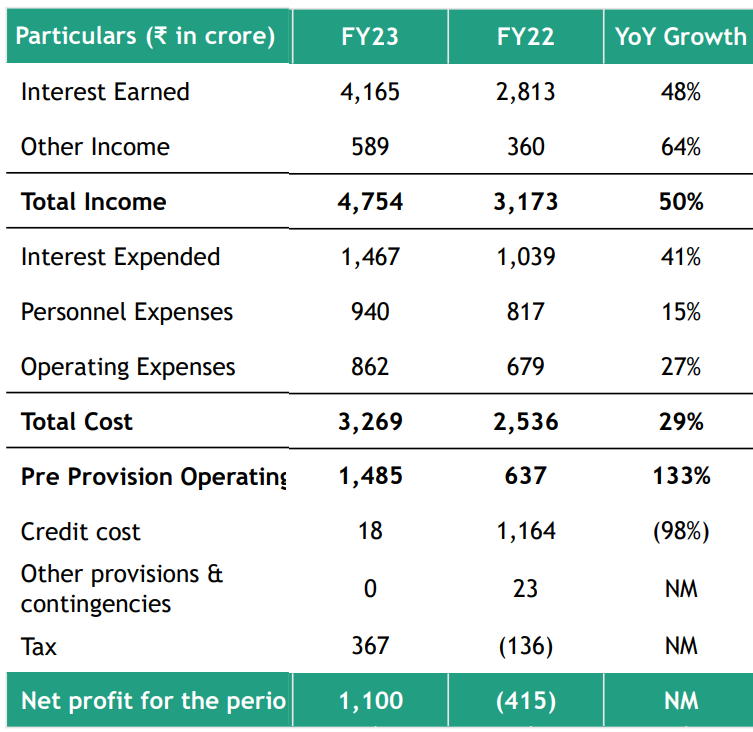

2. Strong FY23: Total income up 117% YoY

Back in the green in FY23 after making losses in FY22

Net Interest Income (NII) = Interest Earned - Interest Expended = up 52%

Net Interest Margin (NIM) driving PAT in FY23

3. Strong H1-24: PAT up 31% & NII up 28% YoY

Net interest margins (NIM) down to 9% in H1-24 from 9.7% H1-23 needs to be watched.

4. Q3-24: PAT up 2% & NII up 23% YoY

5. Strong 9M-24: PAT up 20% & NII up 26% YoY

6. Strong return ratios

7. Outlook: Guiding for 25%+ growth till FY26

i. Strong guidance for growth

We continue to stick to our guidance on loan and deposit book growth. Further we are also confident to maintain credit cost below 100 bps.

ii. Confident of maintaining NIM’s

We expect that NIM should be better than the Q2 NIMs. First half, we are already at 9%. So achieving 9% for the full year, we do not really see that as a major challenge.

8. PAT growth of 20% & NII growth of 26% in 9M-24 at a PE of 7

9. So Wait and Watch

If I hold the stock then one may continue holding on to UJJIVANSFB

Coverage of UJJIVANSFB was initiated after Q4-23 results. The investment thesis has not changed after a strong 9M-24.

The management has confirmed that the NIM of 9% will hold in FY24. NIM’s will improve over the coming quarters.

The outlook for Fy24& FY25 is also strong given that the guidance remains unchanged after Q3-24.

We maintain our short-term and medium-term guidance given earlier this year.

UJJIVANSFB is guiding for a strong Q4-24

I would like to again add that the fourth quarter historically has been our best quarter for the year and should follow this trend during this year as well

10. Or, join the ride

If I am looking to enter UJJIVANSFB then

UJJIVANSFB has delivered PAT growth of 26% & NII growth of 20% in 9M-24 at a PE of 7 which makes valuations quite reasonable for the short term.

Outlook for loan book growth of 25%+ till FY26 at a PE of 7 makes the valuations quite reasonable.

With a share price of Rs 45.6 against a book value per share of Rs 25 as of Q3-24 end implies that UJJIVANSFB is available a price to book of 1.8 which makes the valuations quite reasonable

Previous coverage of UJJIVANSFB

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer