Ujjivan Small Finance Bank: PAT up 31% & NII up 28% YoY in H1-24, guiding 25% growth till FY26 at PE of 8 & price to book of 2.3

UJJIVANSFB maintains its immediate and long-term guidance given even after an ordinary Q2. UJJIVANSFB is on strong footing to deliver a 25% growth with a sustained ROE of 20% plus.

1. A Small Finance Bank

ujjivansfb.in | NSE: UJJIVANSFB

As per order received from the Hon’ble NCLT, shareholder’s EGM is being convened on 3rd Nov’23 by the Bank as well as Ujjivan Financial Services. Once the merger is approved by the shareholders of both the companies, we will proceed with the remaining procedural and regulatory aspects.

We expect the merger to be completed in Q4FY24.

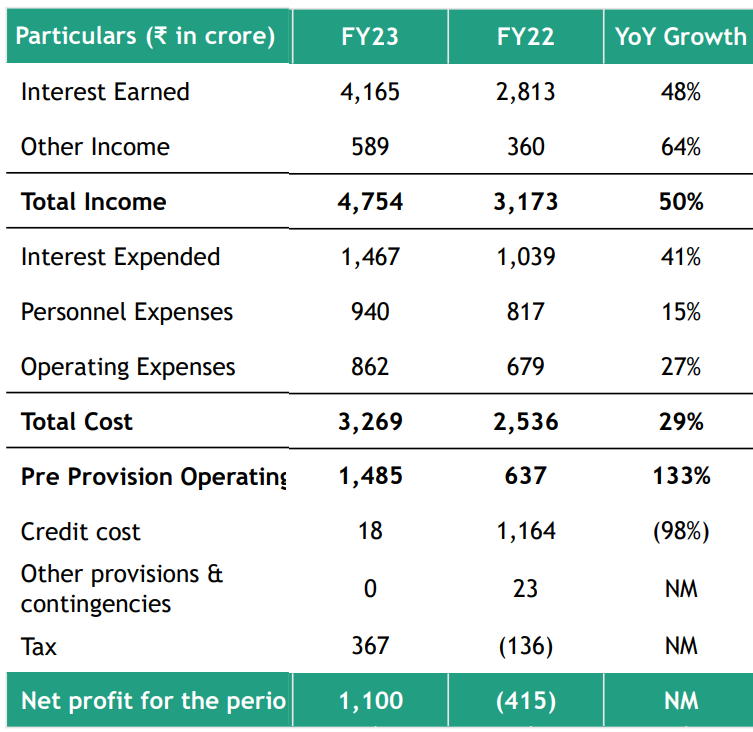

2. Strong FY23: Total income up 117% YoY

Back in the green in FY23 after making losses in FY22

Net Interest Income (NII) = Interest Earned - Interest Expended = up 52%

Net Interest Margin (NIM) driving PAT in FY23

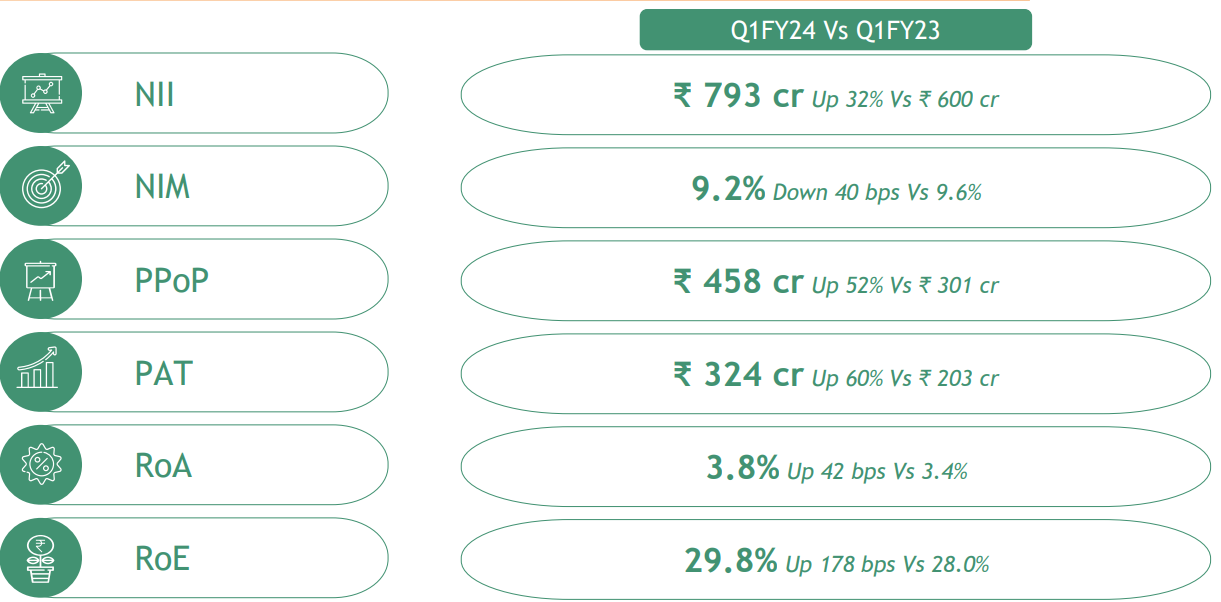

3. Strong Q1-24: PAT up 60% & NII up 32% YoY

FY24 has started on a very strong note as we hit another highest ever profit figure.

Our disbursement has been strong, despite Q1 being seasonally weakest quarter, taking our loan book past ₹25,000 crore mark.

We remain confident of our sub-100 bps credit cost for FY24.

4. An ordinary Q2-24: PAT up 11% and NII up 24% YoY

5. Strong H1-24: PAT up 31% & NII up 28% YoY

Net interest margins (NIM) down to 9% in H1-24 from 9.7% H1-23 needs to be watched.

6. Return ratios: Weaker in H1-24, due to falling NIM

7. Outlook: Guiding for 25%+ growth till FY26

i. Strong guidance for growth

We continue to stick to our guidance on loan and deposit book growth. Further we are also confident to maintain credit cost below 100 bps.

ii. Confident of maintaining NIM’s

We expect that NIM should be better than the Q2 NIMs. First half, we are already at 9%. So achieving 9% for the full year, we do not really see that as a major challenge.

iii. Merger of promoter & UJJIVANSFB to add 10% to book value

Book value per share at Rs 23.4 as of H1-24 end to increase by Rs 2.4 (10%) on account of merger with promoter

On the book value side, that should add to the book by around INR2.4 or a little more than that.

8. PAT up 31% in H1-24 and guiding 25%+ growth till FY26 at PE of 8 & price to book of 2.3

9. So Wait and Watch

If I hold the stock then one may continue holding on to UJJIVANSFB

Coverage of UJJIVAN was initiated after Q4-23 results. The investment thesis has not changed after a strong Q1-24 and an ordinary Q2-24.

H1-24 looks strong even though the performance was weak in Q2-24.

The management has confirmed that the NIM of 9% will hold in FY24. NIM’s will improve over the coming quarters.

The outlook for FY25 is also strong given that the FY25 guidance remains unchanged after Q2-24.

10. Or, join the ride

If I am looking to enter the stock then

PAT up 31% & NII up 28% YoY in H1-24 while guiding 25%+ growth till FY26 at PE of 8 and price to book of 2.3 makes the valuation reasonable

The addition to the book value on account of the merger with the promoter adds a little valuation comfort to the price to book of 2.3. Book value expected to increase by 10% brings the forward book value closer to 2.

Previous coverage of UJJIVANSFB

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades