Transformers & Rectifiers India FY25 Results: PAT up 357%, Revenue up 56%

TARIL guides 73% revenue growth in FY26. Strong order book, capex & backward integration support 50%+ CAGR. Long-term opportunity, fully priced in the short term

1. Transformer & Reactor manufacturer

transformerindia.com | NSE: TARIL

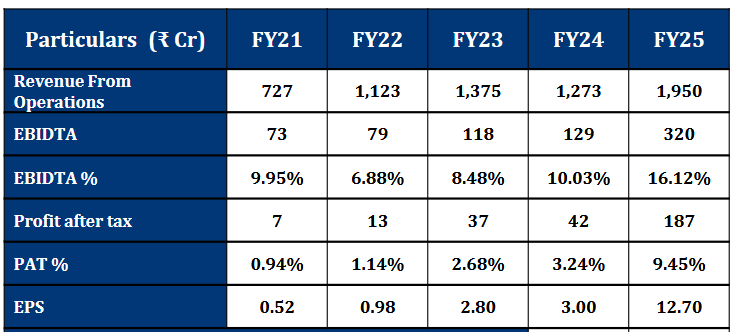

2. FY21-25: PAT CAGR of 127% & Revenue CAGR of 28%

3. FY24: PAT up 11% & Revenue down 7%

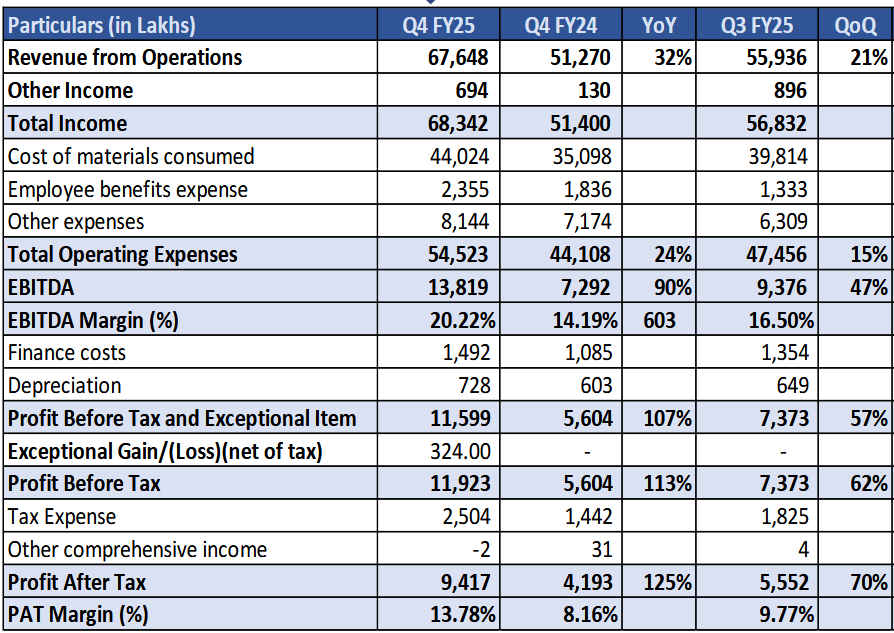

4. Strong Q4-25: PAT up 125% & Revenue up 32% YoY

PAT up 70% & Revenue up 21% QoQ

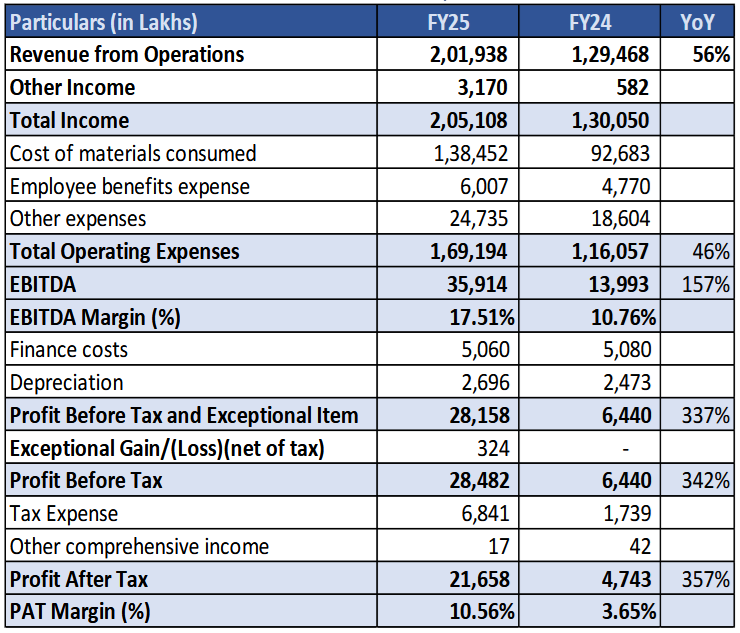

5. Strong FY25: PAT up 357% & Revenue up 56% YoY

6. Business metrics: Return ratios are not exceptional

FY25 ROCE =22.76%

7. Outlook: Strong Revenue growth & margin expansion supported by order book

i. FY26: Revenue growth of 73%

Growing to Rs 3,500 cr in FY26 from an expected revenue of Rs 2,019. cr implies a 73% growth in in FY26 and revenue CAGR of 64% for Fy24-25

ii. FY25-27: Revenue CAGR of 52-60%

Stand alone revenue growing from Rs 1950 cr in FY25 to Rs 4500-5000 cr by FY27 implies a FY25-27 revenue CAGR of 52-60%.

next 3 years we are well posed to reach Rs. 4500 crores to Rs. 5000 crores numbers on a standalone basis

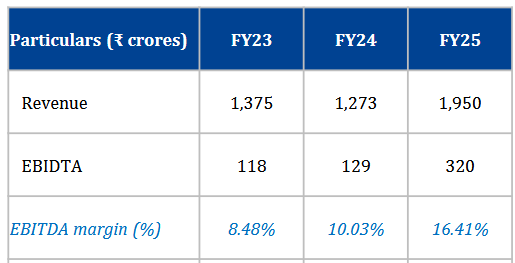

iii. FY25-27: EBITDA CAGR of 50-63%

EBITDA margin expansion from 16.4% to 16-17% in FY27 implies an FY24-27 EBITDA CAGR of 50-63%

EBITDA levels or somewhere 16% to 17% levels.

Targeting a 17% plus EBITDA margin by FY27.

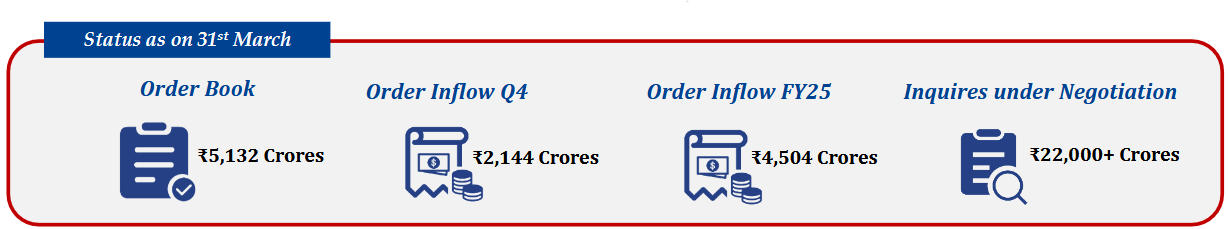

iv. Order book: 1.5X FY26 expected Revenue

v. $1 million revenue by FY28

Will the ambition of $1 bn is noted, our focus is on performance till FY27

Phase 1 of the Journey towards US$ 1 Billion Revenue in next 3 Financial Years, achieved in FY24-25 by achieving the target numbers.

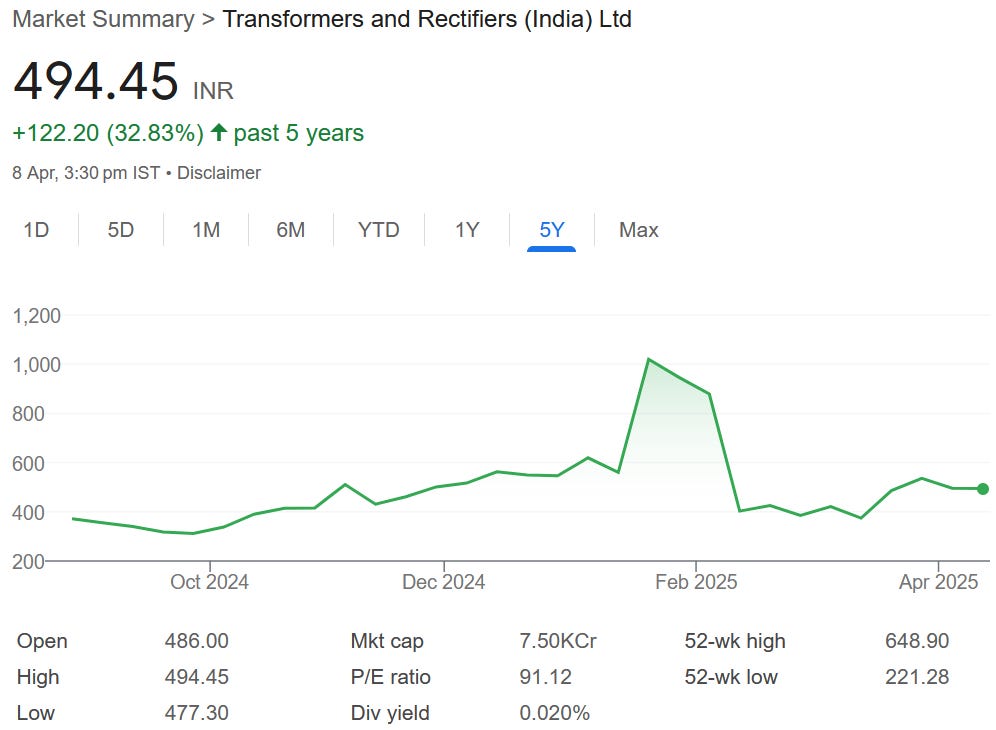

8. PAT growth of 357% & Revenue growth of 56% in FY25 at a PE of 69

9. Hold?

If I hold the stock then one may continue holding on to TARIL

TARIL achieved its FY25 guidance of Rs 2,000 cr while beating the EBITDA margin guidance.

Rs. 2000 crores is quite achievable and we are working on that

And EBITDA margin will remain somewhere between 12.5% to 13% levels

Revenue outlook for FY26,FY27 & FY28 is very strong, supported by a strong order book for FY26. It is a strong reason to continue in the stock

TARIL is pursuing backward integration to secure critical component supplies, and support the guidance for margin expansion. Expected to generate significant cost savings and potentially open new revenue streams.

Implementation of 4 new backward integration facilities started

Target to be 100% backward integrated organization by Q1 FY 26-27

Capacity is coming online to support the growth outlook

First Phase of new capacity addition of 15,000 MVA will start for commercial production from May 2025.

The company will expand its Extra High Voltage (EHV) transformer

capacity by an additional 22,000 MVA.

Commercial production from the expanded capacity is expected to begin in February 2026.With this addition, the total production capacity will exceed 75,000 MVA

The Indian power transmission and distribution (T&D) sector is experiencing robust demand driven by government initiatives, grid expansion, and renewable energy investments.

Expect tailwinds to continue and good improvement going forward

10. Buy?

If I am looking to enter TARIL then

TARIL has delivered PAT growth of 357% and revenue growth of 56% in FY-25 at a PE of 69 which makes the valuations fully priced in the short term.

TARIL is guiding for revenue growth of 73% while maintaining margins in FY26 at a PE of 69 which makes the valuations fully priced from a FY26 perspective.

The guidance of EBITDA CAGR of 50-63% & Revenue CAGR of 52-60% by TARIL for FY25-27 with improving margins at a PE of 69 creates opportunity from a longer term perspective.

The $1 billion revenue guidance presents a long-term opportunity in the stock, but the key risk is whether industry tailwinds will remain strong through FY28.

TARIL is not cheap, but not irrational either. It’s a classic high-growth, high-expectation stock where valuation will compress only if execution falters. Otherwise, it has the potential to become a re-rated, structurally stronger player in the Indian power equipment space.

Previous Coverage of TARIL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer