Time Technoplast: PAT growth of 42% & Revenue growth of 17% in FY24 at a PE of 20

Revenue CAGR of 15% for FY24-26. Bottom line to grow faster than the top-line as contribution of value added production expected to increase from 26% in FY24 to 35% in the next 3 years.

1. Industrial Packaging Company

timetechnoplast.com | NSE : TIMETECHNO

Products

Business Segments

Business growth to be driven by Composite Cylinders

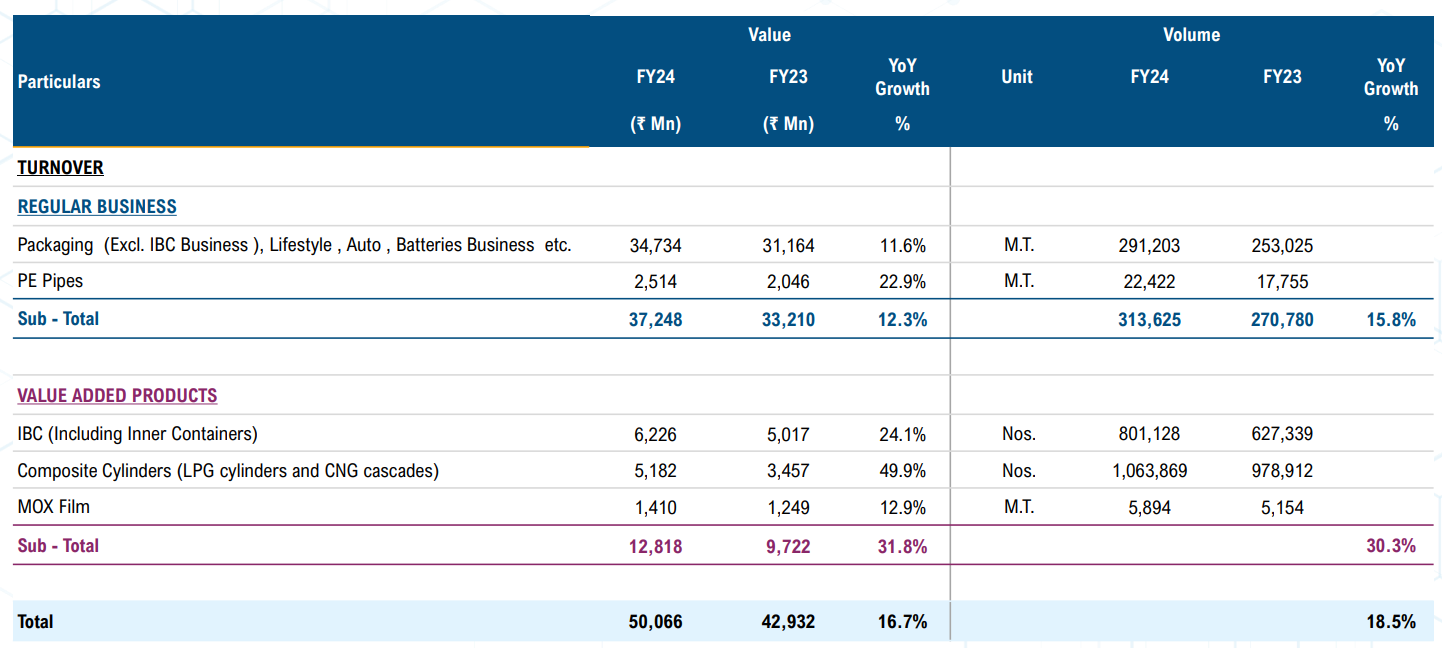

Value added products to be 35% of revenue in next 3 years from 26% in FY24

Value added products expected to grow by 30%+

Regular product to grow at 10-12%

2. FY20-24: PAT CAGR of 16% & Revenue CAGR of 9%

3. FY23: PAT up 17% & Revenue up 18% YoY

4. Strong 9M-24: PAT up 40% & Revenue up 16% YoY

5. Strong Q4-24: PAT up 45% & Revenue up 18% YoY

PAT up 6% and Revenue up 1% QoQ

6. Strong FY24: PAT up 42% & Revenue up 17% YoY

7. Business metrics: Improving return ratios

management intends on achieving an RoCE of ~20% over the next 2 years

8. Outlook: 15% top-line growth in FY24-26

i. 15% top-line growth in FY24-26

Achieved 15% growth target of Rs 5,000 cr revenue in FY24 with guidance for the momentum to continue for the next 2 years.

FY24-26: 15% growth momentum to continue for the next 2 years

ii. Value unlocking: Sale of Middle East business & non core assets

During the year, management has identified Non-Core Assets, estimated realisable value of which is Rs. 1,250.0 Mn (approx.). These are estimated to be liquidated by March 2025. As on March 31, 2024, Assets Held for Sale (Non-Core Assets) amounted to Rs. 903 Mn.

Due Diligence process is ongoing for disinvestment of 50% business in Middle East on Debt & Cash free basis, for a valuation of around USD 25 million.

9. PAT growth of 42% & Revenue of 17% in FY24 at a PE of 20

10. So Wait and Watch

If I hold the stock then one may continue holding on to TIMETECHNO

Coverage of TIMETECHNO was initiated after Q1-24 results. The investment thesis has not changed after a strong FY24. Increased confidence in the management to deliver a FY25 as per guidance given that FY24 targets were achieved.

TIMETECHNO is in them middle of a strong run. It has delivered sequential QoQ growth in its top-line and bottom-line in all the four quarters of FY24.

Margin profile of TIMETECHNO expected to improve and drive PAT growth with increasing contribution of value added products and reduction in interest cost as it reduces its debt.

And given our value-added product has much higher margins as compared to your established product, so it’s share which is currently at 27%, so ideally it per year based on what you are saying per year it should increase by 3%-4% per year for next 2-3 years. Like it can go from 27% right now to 35%-36%.

Substantial EBITDA margin increase which is currently 14% to 16%

Goal of becoming debt-free in 2-3 years.

The proposed value unlocking will create opportunity in TIMETECHNO.

11. Or, join the ride

If I am looking to enter TIMETECHNO then

For a PAT growth of 42% and revenue growth of 17% in FY24, the PE of 20 looks acceptable.

TIMETECHNO is guiding for 15% revenue growth in FY25 with PAT expected to grow faster than the revenue at a PE of 20 which makes the valuations reasonable.

TIMETECHNO generated Rs 225.53 cr free cash flow in FY24. It is quoting a market cap of Rs 6127 cr. It is available at free cash flow yield of 3.7% which makes the valuations reasonable.

TIMETECHNO had a net worth of Rs 2,616.28 cr as of FY24 against a market cap Rs 6127 cr. It is quoting a price to FY24 book of 2.3 which makes valuations quite reasonable.

TIMETECHNO is quoting at 0.8 market cap to FY24 sales. TIMETECHNO is at a market cap Rs 6127 cr against the FY24 revenue of Rs 5,007 cr

TIMETECHNO is trading at the top end of its historical PE. If guidance of 15% growth is not met or the thesis of increased contribution of value added product which will drive bottom line growth higher than the top line is not delivered then it may not sustain current valuations.

Previous coverage of TIMETECHNO

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer