Time Technoplast: PAT growth of 34% & Revenue of 16% in H1-24 with guidance of 16-18% revenue growth in FY24 at a PE of 16

Target to increase value-added products from 25% in H1-24 to 35% in 3 years to drive revenue & PAT growth along with margin expansion. Value unlocking of Rs 900 cr to add to opportunity in TIMETECHNO

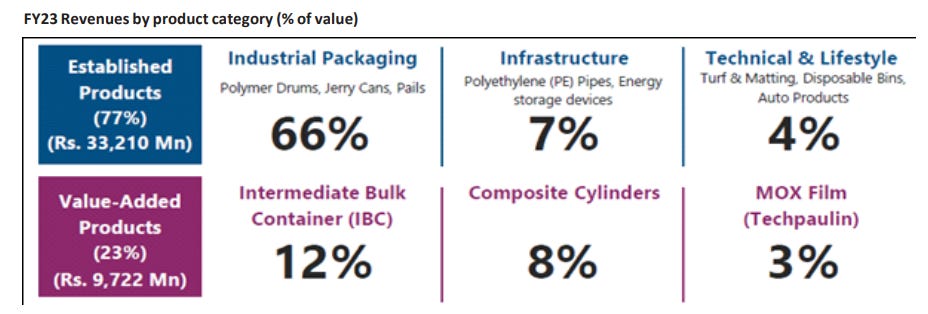

1. Industrial Packaging Company

timetechnoplast.com | NSE : TIMETECHNO

Products

Segments

2. FY18-23: Top-line growth not converted into bottom-line growth

3. FY23: PAT up 17% & Revenue up 18% YoY

4. Strong Q1-24: PAT up 26% and Revenue up 14% YoY

5. Strong Q2-24: PAT up 41% & Revenue up 17% YoY

PAT up 26% and Revenue up 11% QoQ

6. Strong H1-24: PAT up 34% & Revenue up 16% YoY

7. Business metrics: Targeting ROCE improvement

ROCE in the first half is 14.1% as against the last year same period was 11.8%.

Full year ROCE at the end of the year, we are targeting 15.5%

next 3 years overall objective in the company to reach the ROCE around 20%.

8. Outlook: 16-18% top-line growth in FY24

i. 16-18% top-line growth in FY24

Target Rs 5000 cr revenue in FY24 up 16% from Rs 4293 cr in FY23.

Given H1-revenue is 45% of yearly revenue, hence based on H1-24 revenue, FY24 revenue is expected to be Rs 5055 cr up 18% from FY23

If you tell me internally, I've given the whole year target across INR5,000 crores.

first half, we do 45% business, second half, 55%, you can calculate. It's very simple.

ii. Value unlocking of Rs 900 cr, 20%+ of market cap of Rs 4000+ cr

Divestment of overseas JV with a valuation of around Rs 1000 cr. planned in FY24. 80% of stake will be divested, bringing in Rs 800 cr which is 20% of current market cap of Rs 4,000 cr. Additional assets worth Rs 100 cr to be sold.

Roughly, I can say we were estimating for 100% addition is around INR1,000 crores. But as we have mentioned that we are diluting around 80%.

But some additional assets have been identified, and which is in the range of around INR100 crores, and that management is keeping target to sell off and use these proceeds and internal policy is letting it by March 31, 2025, non-performing assets should be zero.

iii. FY25-FY26 top-line growth to be faster than FY24

As proportion of value added increases which is growing faster than the overall growth, FY25 onwards the top-line should grow faster than FY24

current revenue is value-added 25%, we are estimating to reach it 35% in the next 3 years' time because the growth will be faster and the good growth will be the value-added product.

iv. Bottom-line growth to be faster than top-line growth in FY24 on account of margin expansion

Management guiding for an EBITDA margin of 14% as against 13.9% In H1-24 and 13.5% in FY23.

With the proportion of value-added products increasing from 25% to 35% in the next 3 years, the margin expansion trajectory expected to continue till FY26

As the management, we are keeping target of around 14%

9. PAT growth of 34% & Revenue of 16% in H1-24 at a PE of 16

10. So Wait and Watch

If I hold the stock then one may continue holding on to TIMETECHNO

Coverage of TIMETECHNO was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24

Management is confident of a strong FY24

With the strong growth in sales of value-added products, composite cylinder LPG and CNG along with the stable core industrial packaging business, we are highly optimistic of a strong performance for the full year.

TIMETECHNO does not have a consistent track record of delivering bottom line growth. One needs to monitor execution on its guidance to raise value added products from 25% to 35% in the next three years quite closely. Additionally we need to watch for achievement against the EBITDA margin guidance of 14%

11. Or, join the ride

If I am looking to enter TIMETECHNO then

TIMETECHNO is guiding for 16-18% revenue growth with PAT expected to be higher in FY24 at a PE of 16 which makes the valuations reasonable.

Potential for value unlocking based on Rs 900 cr worth of assets to be monetized.

TIMETECHNO generated Rs 96 cr free cash flow in H1-24. It is quoting a market cap of Rs 4073 cr. It is available at free cash flow yield of 2.4% (not annualized) which makes the valuations quite reasonable.

TIMETECHNO had a net worth of Rs 2,366 cr as of H1-24 against a market cap Rs 4073 cr. It is quoting a price to book of 1.7 which makes valuations quite reasonable.

TIMETECHNO is quoting at market cap to sales of less than 1. TIMETECHNO is at a market cap Rs 4073 cr against the expected FY24 revenue of Rs 5000 cr.

Previous coverage of TIMETECHNO

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades