TD Power Systems Q2 FY26 Results: PAT Up 49%, Upward Revision of FY26 Guidance

Guidance of 40% growth in FY26. Industry tailwinds, order inflows and exports drive growth. Tariff risks remain. Expensive valuations demand strong execution

1. Motors & Generators Manufacturer

tdps.co.in | NSE: TDPOWERSYS

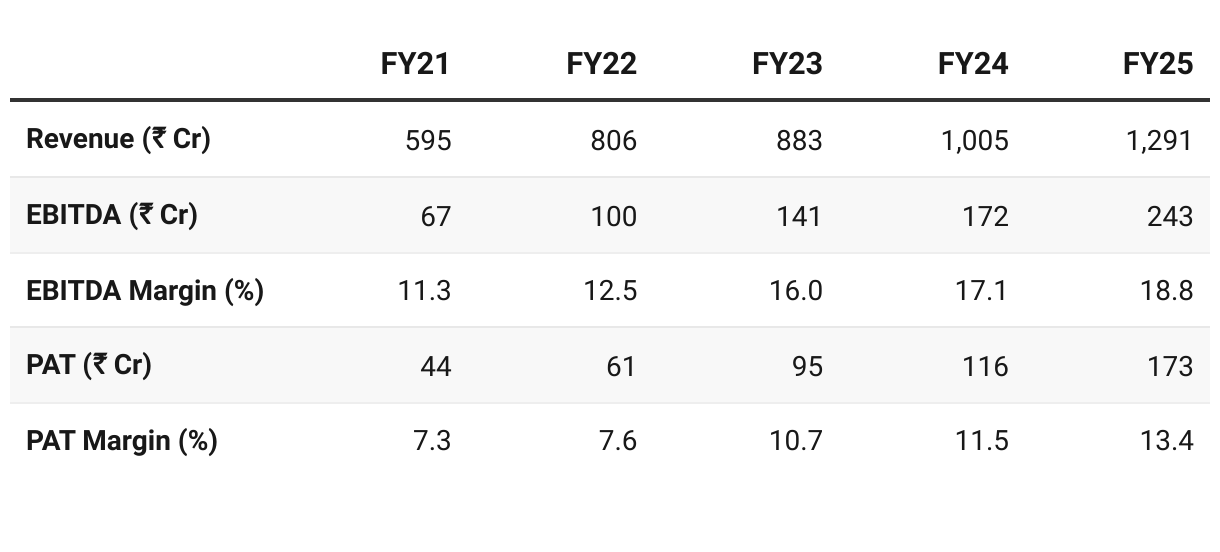

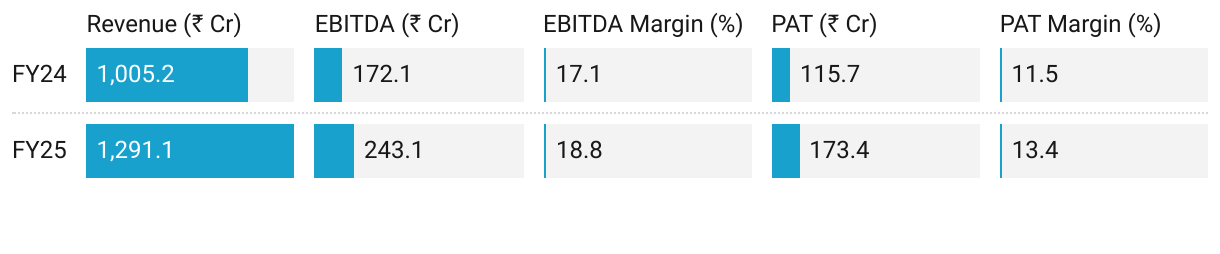

2. FY21-25: PAT CAGR 41% & Revenue CAGR 21%

3. FY-25: PAT up 50% and Revenue up 28% YoY

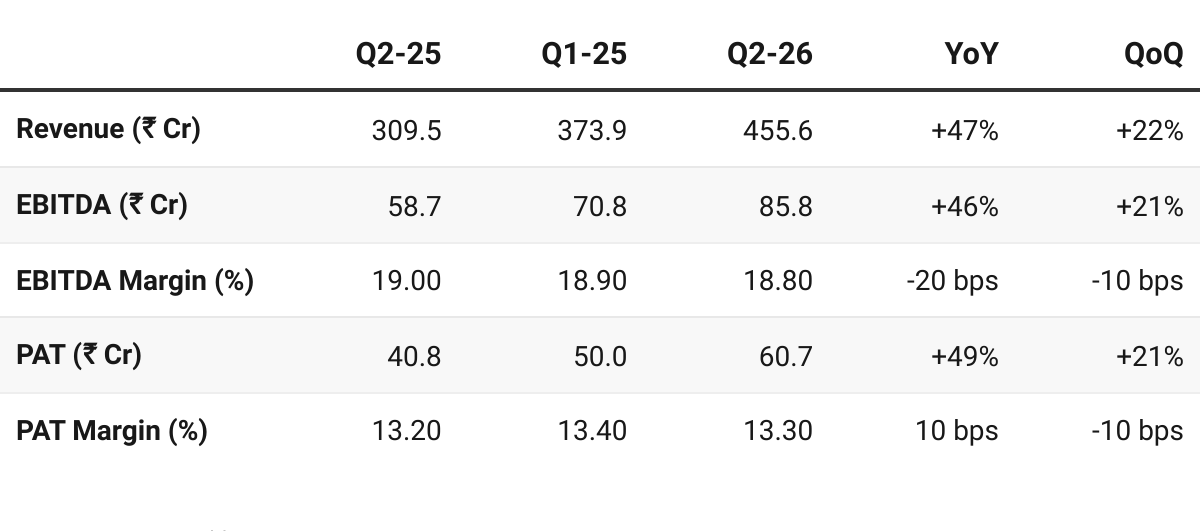

4. Q2-26: PAT up 49% and Revenue up 47% YoY

PAT up 21% and Revenue up 22% QoQ

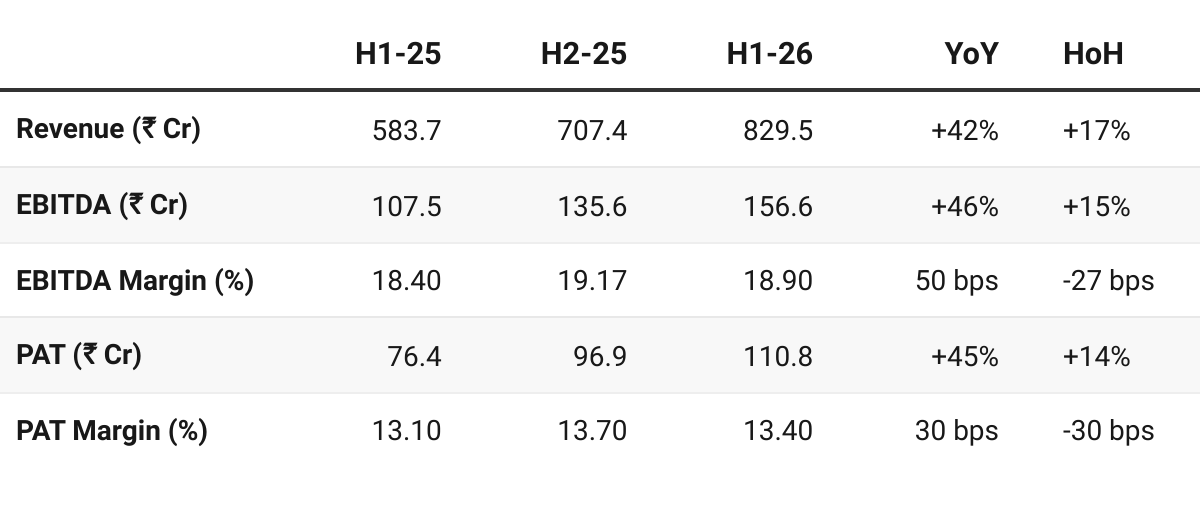

5. H1-26: PAT up 45% and Revenue up 42% YoY

PAT up 14% and Revenue up 17% HoH

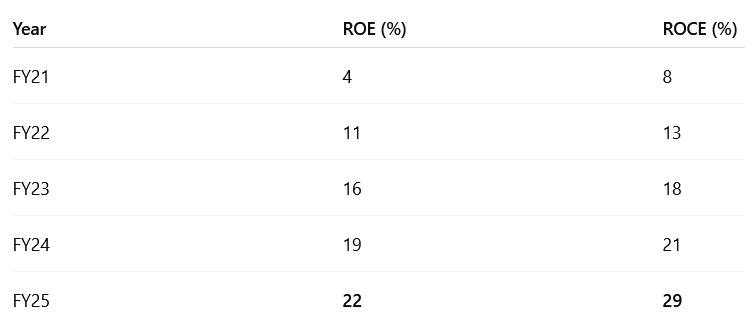

6. Business Metrics: Strong & improving return ratios

ROCE > ROE = Capital-Light Model — self-funded and not reliant on leverage to generate returns.

6. Outlook: 40% Revenue Growth in FY26

6.1 FY26 Guidance — TD Power Systems

The revised top line guidance for FY26 is 18 Billion INR.

FY27: Minimum I said minimum 2,000 crores next year, minimum 20% next year. But I also mentioned that right now order inflow rate is running something like 550 crores per per quarter.

There’s an upside potential on top of this. We will only guide and project what we can do for sure and as and when the upside potential materializes we will announce announce it to the market.

Margins will be maintained at the current levels plus/minus 0.5%.

FY27 guidance of min 20% growth is disappointing after 40% growth in FY26

Even if we assume 40% growth in FY27 — the revenue growth will start getting muted unless new capacity is planned for FY28

Revenue potential from capacity expansion: The third plant will be progressively commissioned, as I said, in Q2 and Q3. Initially, we will have an additional capacity to take us to around INR 2,000 crores, but we are already working on optimization and better manufacturing, lean manufacturing and other things like that. So, we easily see a potential to take this to INR 2,300-2,400 crores. So we will not be making further investment, large investment at least for the next two years, and we want to utilize our assets in a much better way.

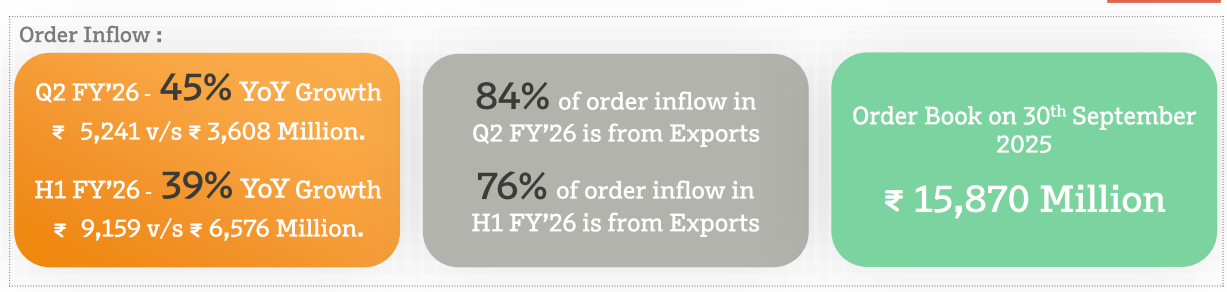

Guidance supported by Order-book

Annual order-inflow of ~₹2,200 Cr to sustain growth projections for FY26 and FY27

We ramped up our order booking to an average of 550 crores per quarter which will sustain into next year.

Mitigation Strategy for US Tariffs (Turkey Option)

The company has a contingency plan to offset potential US tariffs.

Trade Deal Impact: FY27 guidance assumes current tariff conditions.

If an India–US trade deal is finalized by November–December, growth is expected to accelerate.

Turkey Plan: If no deal occurs, production for the US market will be routed through the Turkey facility

Plan already approved by customers — with preparations underway.

Market Dynamics and Segment Outlook

Market conditions remain stable across segments except gas turbine and gas engine, where demand has surged and is now “completely turbocharged.”

Gas Engine / Gas Turbine (Global): US and Europe demand is far above expectations, driven by data center and AI-related investments.

OEMs are planning capacity expansions for FY27–FY28, not just FY26.

India – Steam Turbine: Domestic market growing 10–12%, led by captive power, biomass, and waste heat recovery.

Indian market remains largely steam turbine–focused.

Exports – Steam Turbine: Strong order pipeline with 10–12% growth expected.

Orders coming from multiple geographies, and global demand remains steady.

Hydro Generators: FY27 likely to be one of the strongest years

Led by demand from Nepal and Vietnam.

Motors & Railways: Motor business progressing as planned, targeting ₹500 Cr scale eventually

Revenue share for FY26 guidance is ~₹150 Cr, balance from generators.

Railway segment growth remains on track.

Capacity Expansion

Management reiterated that capacity will not be a constraint — the company plans to book all viable orders to sustain growth.

Third Plant: Fully commissioned by Q3 FY26 (Dec ’25) and operational by mid-Jan ’26. One large shed is already running; the remaining two will be completed by Nov–Dec ’25.

Maximum Potential: Combined capacity of all three plants, with minor incremental spends, is estimated at ₹2,500–2,600 Cr output potential.

Future Investments: No major capex expected until FY28. Existing sites have ~25% spare space and land reserves, allowing expansion beyond ₹3,000 Cr capacity without new buildings.

Large Generator Development

Developing a 50–100 MW large generator

To be offered to customers by Dec ’25 / Jan ’26.

Expect commercial orders from H2 FY26.

This initiative represents a multi-hundred-crore opportunity

Cash Flow and Execution Focus

With production up ~30%, the company is deploying retained earnings toward working capital and inventory buildup to support growth.

During this high-growth phase, free cash flow will remain limited as cash is reinvested into operations.

Immediate priority is execution excellence and maintaining close customer engagement to ensure timely delivery.

6.2 H1 FY26 Performance vs FY26 Guidance

H1 FY26 performance delivered an upgrade in FY26 guidance

Revenue — strong, upward revision of guidance.

Margins: Delivered 18.9% vs guided ~18% — execution ahead of plan.

Order Book: order-inflow covers FY26 and FY27 revenue guidance.

Capacity Expansion — on-track

Tariff Risks: US tariffs may impact, mitigated by Turkey plant; execution will be closely watched in H2.

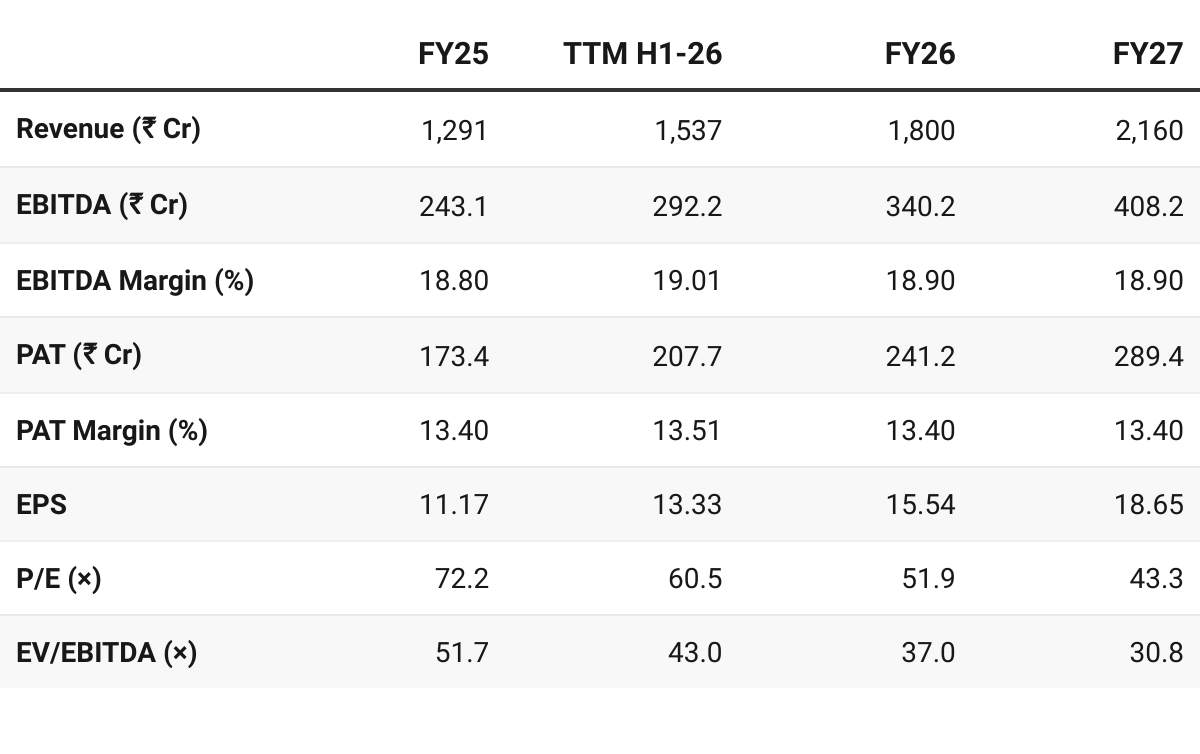

7. Valuation Analysis

7.1 Valuation Snapshot

CMP ₹806.8; Mcap ₹12,728.34 Cr

Very expensive valuations at a FY27E P/E 43× and EV/EBITDA 31× for a company growing at ~20% for the next 2 years

7.2 Opportunity at Current Valuation

Opportunities are limited

The stock price is up ~50% since our previous coverage in Q1-26. The price has run far ahead of its fundamentals.

The demand environment is strong and presents a lot of opportunities for the business but at current valuations:

No opportunity for fresh buying in the stock unless there is some market correction without changes in the business outlook

Opportunity to continue and ride the momentum as long as it lasts for those who already have a position in the stock

The next window of opportunity may open up when the management gives a guidance which is firmer than the minimum 20% growth in FY28

However growth will be constrained by the max revenue potential from the planned capacity expansion

7.3 Risk at Current Valuation

Valuations — The biggest risk

Future Already Discounted — No room for disappointment

At FY27E P/E 43× and EV/EBITDA 31×, the demand environment, capacity expansion and all the optionality from the large generator product is all discounted.

FY27E, valuations remain steep at 43× P/E and 31× EV/EBITDA, leaving little room for disappointment in terms of business execution.

Tariffs:

US tariff hikes add execution complexity.

Turkey is a near-term workaround, but reliance on it introduces geopolitical and operational risks.

Previous Coverage of TDPOWERSYS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

more good stuff

Why promotor selling his stake