TD Power Systems Q1 FY26 Results: PAT Up 40%, Ahead of FY26 Guidance

Strong growth till FY27 with stable margins. Supported by industry tailwinds, order inflows and exports. Tariff risks remain, valuations demand strong execution

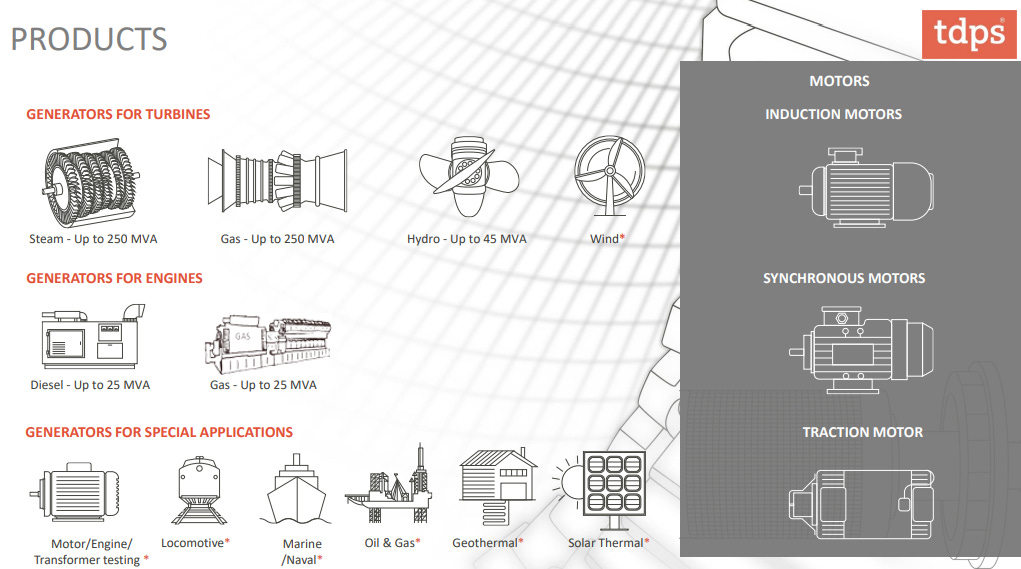

1. Motors & Generators Manufacturer

tdps.co.in | NSE: TDPOWERSYS

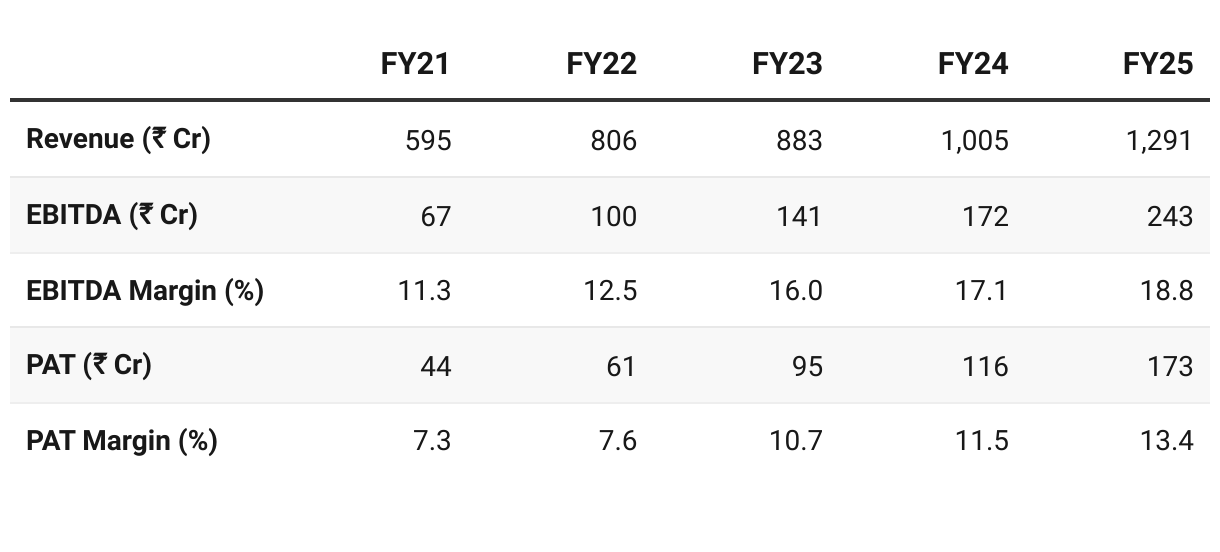

2. FY21-25: PAT CAGR 41% & Revenue CAGR 21%

Scale of Operations Doubled: Global market expansion, product diversification (motors, hydro, geothermal), and revival in domestic demand.

Margin Expansion: Increased export share, better product mix, leaner operations, and selective participation in higher-margin projects (e.g., data centers, geothermal, traction motors)

Exports Became the Growth Engine: Focus on clean energy, grid stabilization, and AI-linked infrastructure in export markets transformed the business

Product Portfolio Expansion: From Steam turbine generators to Gas & geothermal generators, Motors (synchronous, induction), Traction motors (NPCIL, export markets), Grid stabilization & data centers

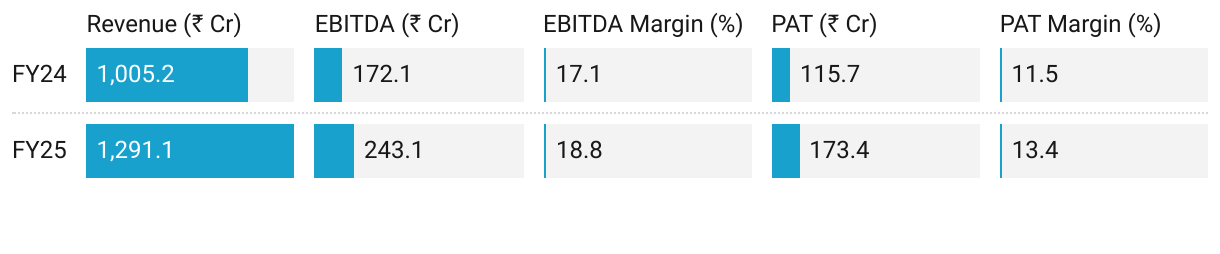

3. FY-25: PAT up 50% and Revenue up 28% YoY

Growth broad-based across all four quarters, with revenue rising QoQ despite Q3 softness in the domestic market

Motors & Traction Businesses Evolved from Incubation to Delivery

New verticals are scalable, margin-accretive, and lay the foundation for ₹500–1,000 Cr incremental revenue over 3–4 years.

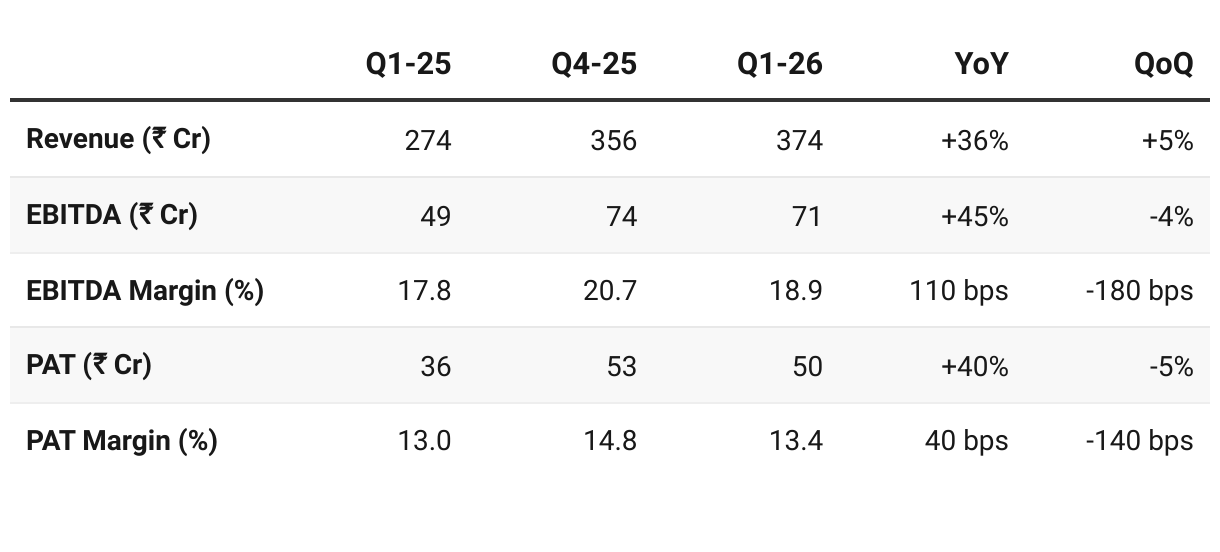

4. Q1-26: PAT up 40% and Revenue up 36% YoY

PAT down 5% and Revenue up 5% QoQ

Export-driven order inflows (66% share), strong demand from AI/data center markets, and diversification into hydro refurbishment & railways underpin growth visibility.

The key risk factor is US tariff impact, but the Turkey plant provides a mitigation strategy.

Business Segments & Markets

Steam Turbine Generators: Steady demand (10–12% growth, domestic + exports).

Gas Turbine & Gas Engine Generators:

US tariffs (extra 25–50%) → shifting some production to Turkey to retain cost competitiveness.

Demand strong from data centers & AI server farms in US & Europe.

Hydro: Strong order inflow; large refurbishment projects expected.

Motors: On track for ₹150 Cr revenue in FY26; targeting ₹200+ Cr in FY27.

Railways: Orders from US, Europe, Russia, and India (Alstom). Uptick expected in FY27.

Aftermarket & Spares: ~6–7% of sales; big hydro refurbishment order; global tenders being targeted.

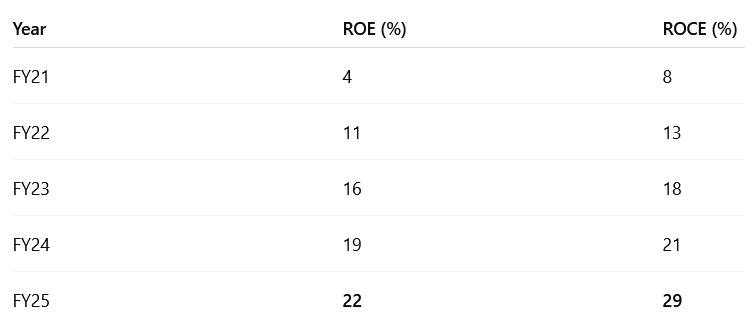

5. Business Metrics: Strong & improving return ratios

ROCE > ROE = Capital-Light Model — self-funded and not reliant on leverage to generate returns.

6. Outlook: Solid Growth Guidance till FY27

6.1 FY26 Guidance — TD Power Systems

Currently, we have given a guidance of INR 15 billion consol for this year and INR 18 billion consol for next year.

Looking at the way that the orders are flowing in and the forecast given by our OEMs, we will exceed these guidances.

Margins will be maintained at the current levels plus/minus 0.5%.

FY26

Revenue Guidance (Consolidated): ~₹1,500 Cr

Backed by executable order book of ~₹1,468 Cr.

Upside potential, formal upgrade likely in Q2 FY26 call.

EBITDA Margins: Sustainable at ~18% (±50 bps).

Third Plant: Progressive commissioning in Q2–Q3; raises revenue potential to ₹2,000 Cr initially, scalable to ₹2,300–2,400 Cr without major new capex.

FY27

Revenue Guidance: ~₹1,800 Cr consolidated.

Drivers:

Order flow from US & Europe (data centers, AI server farms, grid stability).

Railways: Supplying to US, Europe, Russia & India — significant uptick expected in FY27.

Motors: Revenue expected to cross ₹200 Cr in FY27 (vs ~₹150 Cr in FY26).

Hydro: Execution of large refurbishment orders in pipeline.

Medium- to Long-Term (FY28 onwards)

Large Generator Business:

UK Design Centre developing own 50–150 MW generator designs.

Commercialization expected FY28 onwards; targets global market beyond licensed products.

Hydro Refurbishment: Positioned for multi-year large-value orders.

Data Center & AI Demand: US and Europe remain strongest; India opportunity likely medium-term once larger AI/data center projects come up.

Capacity Utilization: Existing facilities (including third plant) optimized to ₹2,300–2,400 Cr turnover → no major capacity capex for next 2 years.

Tariff Mitigation: Turkey subsidiary to handle ~4–5% of sales (direct US exposure) if high tariffs persist, ensuring cost arbitrage vs Europe/Japan (~20% gap maintained).

FY26: ₹1,500 Cr revenue, ~18% margin; upside possible.

FY27: ₹1,800 Cr+, strong export-led growth.

FY28+: Entry into large 50–150 MW generator market (UK design center), hydro refurbishments, and scaling railways & motors segments.

Long-term strategy: Diversified portfolio (steam, gas, hydro, motors, railways, aftermarket) + global market presence = consistent 20%+ growth trajectory with stable margins.

6.2 Q1 FY26 Performance vs FY26 Guidance

Revenue — strong start, ~25% of FY26 guidance already achieved in Q1.

Margins: Delivered 18.7% vs guided ~18% — execution ahead of plan.

Order Inflow: ₹392 Cr (+32% YoY) — healthy momentum; 66% export-driven.

Order Book: ₹1,468 Cr — nearly covers FY26 revenue guidance of ~₹1,500 Cr.

Tariff Risks: US tariffs may impact 4–5% of sales, mitigated by Turkey plant; execution will be closely watched in H2.

Q1 FY26 performance is comfortably ahead of trajectory vs guidance. Revenue visibility and margin stability provide confidence for an upgrade in FY26 guidance by Q2 if order inflows sustain.

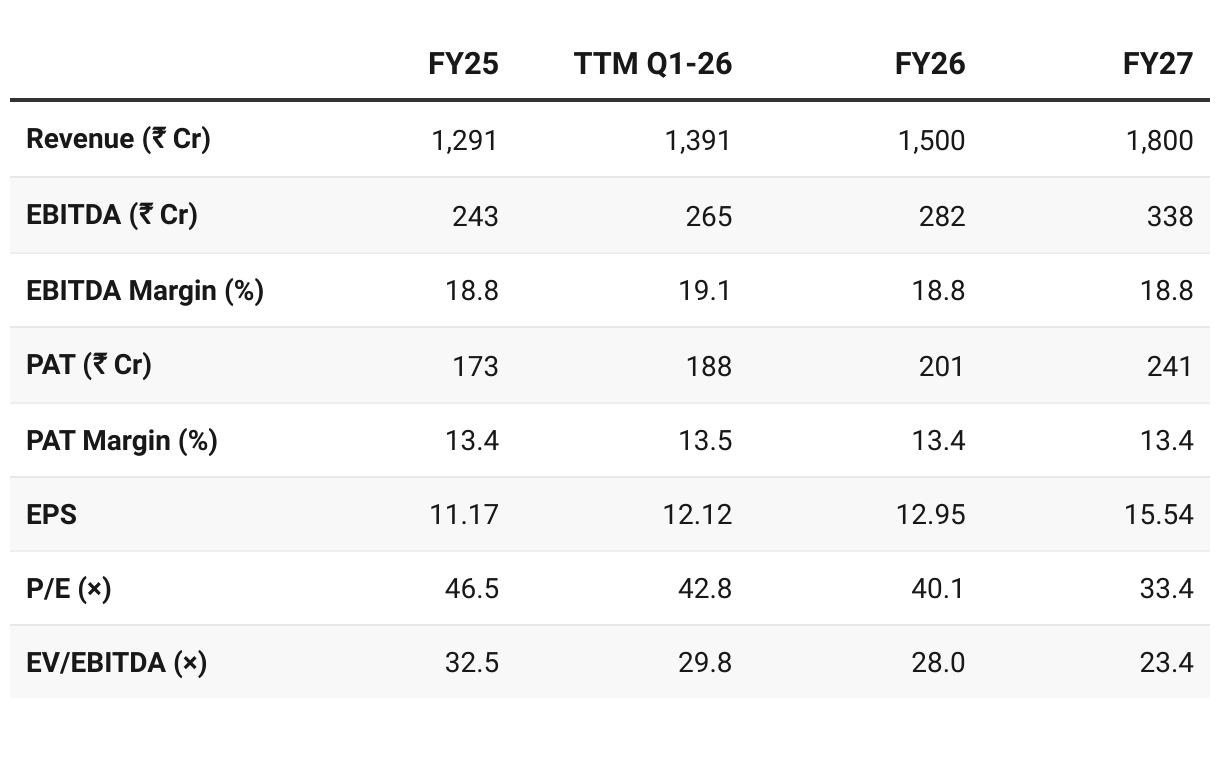

7. Valuation Analysis

7.1 Valuation Snapshot

CMP ₹519; Mcap ₹8089.53 Cr

P/E (33×): Premium; justifiable if 20% growth + margins sustain as it reaches the ₹2,300–2,400 Cr turnover post capex

EV/EBITDA (23×): Market pricing in durable growth; comparable to high-quality capital goods leaders.

PEG: ~1.6–1.8 → expensive,

Rerating beyond FY27 depends on export demand, guidance upgrades, and smooth tariff mitigation.

A premium growth story with long-term appeal, but near-term valuation comfort is limited.

7.2 Opportunity at Current Valuation

Guidance Upgrade Likely: Guidance upgrade expected in Q2 — not baked into the valuations

Capacity Leverage Without Heavy Capex:

Revenue potential of ₹2,300–2,400 Cr, if achieved in FY28 on the back of guidance upgrades for FY26 and FY27 could create an opportunity

Export Momentum Strong:

Structural tailwinds driving exports, led by AI/data centers, grid stability, and renewables in US/EU markets could continue into FY28 and beyond

Hydro refurbishments and railway orders add diversification to export-led growth.

Large Generator Business (FY28+):

UK Design Centre developing 50–150 MW machines — entry into a much larger global market beyond current product range.

Positions TD Power for long-term structural growth with higher-value offerings.

Strong order visibility, export tailwinds, and scalable capacity provide a pathway for upgraded guidance in FY26 and sustained growth into FY27–28, with long-term optionality from the large generator business.

7.3 Risk at Current Valuation

Premium Multiples Already Built-In:

FY27E, valuations remain steep at 33× P/E and 23× EV/EBITDA, leaving little room for disappointment.

Tariff & Geopolitical Exposure:

US tariff hikes (25–50%) add execution complexity.

Turkey is a near-term workaround, but reliance on it introduces geopolitical and operational risks.

Execution Dependencies:

Scaling to ₹2,300–2,400 Cr without major capex requires flawless plant ramp-up and efficiency gains.

New verticals — railways, hydro refurbishments — are lumpy and could strain execution bandwidth.

Large Generator Business (FY28+):

While high-potential, commercialization is still 2–3 years away.

Technology development and market acceptance risks remain.

Current multiples leave no margin for error. Any slip in execution, tariff headwinds, or delays in scaling new businesses could trigger a valuation de-rating despite long-term growth potential.

Previous Coverage of TDPOWERSYS

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Thanks for your valuable information and excellent analysis 👍