Tanla Platforms: PAT growth of 22% & Revenue growth of 17% in FY24 at a PE of 21

Platform business to grow at 20%+ CAGR. FY25 outlook similar to the performance delivered in FY24. One can look forward towards its re-rating as a SAAS company

1. Digital Platforms & Enterprise Communications

tanla.com | NSE: TANLA

90% of revenues from Enterprise Communications

33% of PAT from Digital Platforms

2. FY19-24: PAT CAGR of 79% & Revenue CAGR of 31%

3. Weak FY23 : PAT down 17% & Revenue up 5%

4. 9M-24 : PAT up 28% & Revenue up 16%

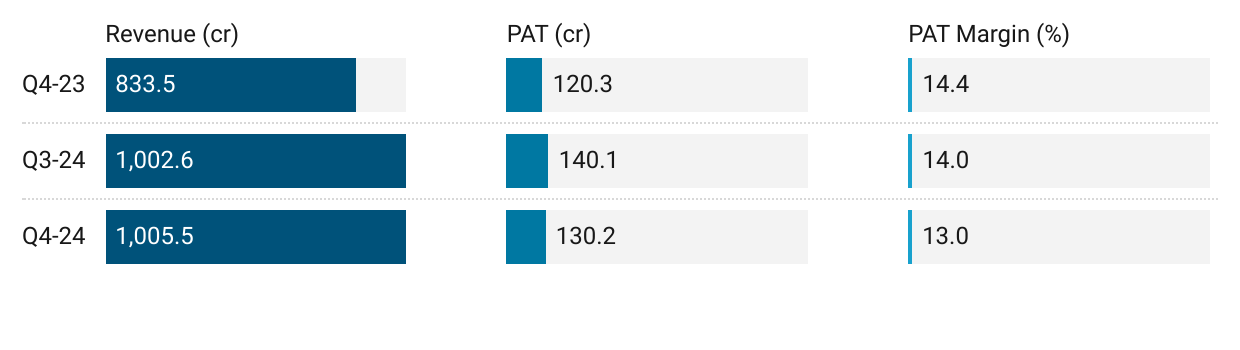

5. Q4-24 : PAT up 8% & Revenue up 21% YoY

Q4-24 growth was muted on account of

we had talked about, exiting one of the firewall deals with Vodafone sometime back. And this quarter showed a portion of that impact.

6. FY24 : PAT up 22% & Revenue up 17% YoY

7. Return ratios are good

8. Outlook: Digital Platform at 20%+ CAGR for 3-4 years

i. Digital Platform growth outlook of 20%+

FY25: we don't really want to give a guidance, but let me put it this way. As we look out from the year ahead, we are quite bullish on the Platform business.

Next 3-4 years: we should be able to grow a minimum 20%. There's no doubt about that.

ii. Enterprise Communication: OTT Channels to drive growth

The company is strategically shifting its focus towards OTT channels, capitalizing on their higher margins as opposed to the SMS business. The company has extended its exclusive partnership with True Caller for two years. Tanla tied up with Whatsapp in the integration of ONDC seller application for small and medium sized business. The company launched a new MaaP (Messaging as a Platform) product for Google Rich Content Service (RCS) and signed a deal with Vodafone Idea (Vi) to deploy the MaaP platform in India, shaping revenue visibility in FY25.

9. PAT growth of 22% & Revenue growth of 17% in FY24 at a PE of 21

10. So Wait and Watch

If I hold the stock then one may continue holding on to TANLA.

TANLA of was initiated after Q2-24 results. The investment thesis has not changed after a reasonable FY-24. Based on the outlook for provided by TANLA, the management is on track to deliver a FY25 similar to FY24

The story in TANLA is the changing business profile from more of an Enterprise Communications business to also a Digital Platform business. As the contribution of Digital Platforms grows, TANLA could be seen as more as a SAAS business and could lead to rerating of valuation metrics and create a bigger upside than the returns seen in the stock in the recent past.

10. Or, join the ride

If I am looking to enter TANLA then

TANLA has delivered a decent FY24 with PAT growth of 22% and revenue growth of 17% in FY24 at a PE rating of 21 which makes the valuations acceptable in the short-term.

TANLA has delivered Rs 431.1 cr on a market cap of Rs 11,576 cr which implies that its available at a free cash flow yield of 3.7% which makes the valuations look in line with performance.

In the short-term performance is in the price and opportunities for upside may be limited.

In the medium term, TANLA is looking to deliver a FY25 similar to FY24 which is pointing towards another year of solid performance but not indicating towards a large opportunity in the stock price.

The opportunity in FY25 could be created if OTT Channels within the Enterprise Communication surprise on the upside.

Over the long term, as the contribution of Digital Platform to the overall business increases, TANLA could be seen as a SAAS business lead to re-rating of the business in terms of valuation metrics. However, this is a multi-year transition and would require patience.

Previous coverage of TANLA

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer