Tanla Platforms: PAT growth of 28% & Revenue growth of 16% in 9M-24 at a PE of 25

TANLA delivered 20%+ YoY growth in gross profit for 14 consecutive quarters. TANLA management guides for 20% CAGR in Platform business. One can look forward towards its re-rating as a SAAS company

1. Communications company or a SAAS company?

tanla.com | NSE: TANLA

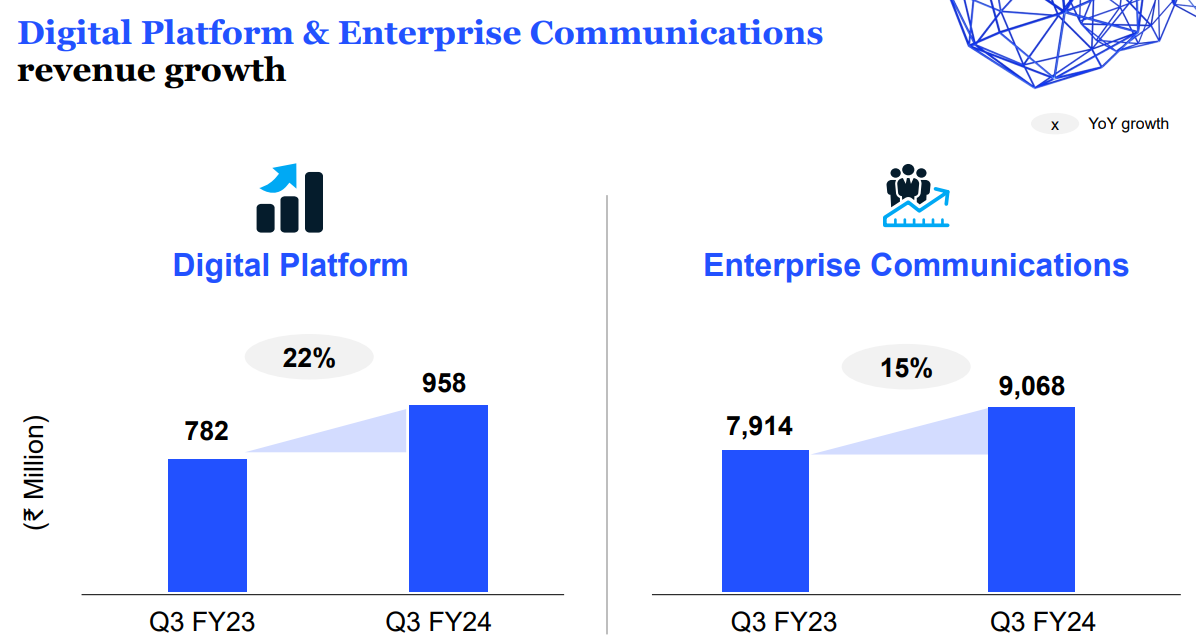

90% of revenues from Enterprise Communications

100% of our platform revenue operates at SaaS business models: per user, per transaction or subscription

41% of EBIT from Digital Platform

2. FY18-23: Revenue CAGR of 38% & PAT CAGR of 88%

Growth slowed down in FY23

3. Strong H1-24 : PAT up 32% & Revenue up 16%

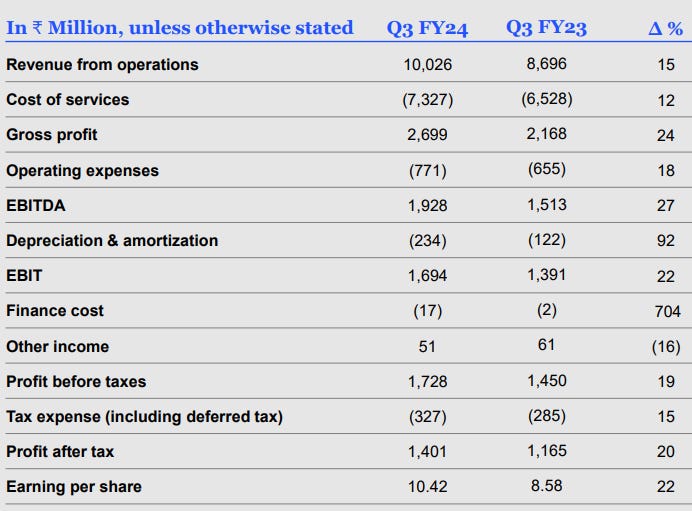

Revenue increased by 16% year-over-year to ₹19,197 million

Profit after tax increased by 32% year-over-year to ₹2,780 million. Profit after tax margin at 14.5%

Earnings per share increased by 33% year-over-year to ₹ 20.67

Cash & Cash Equivalents at ₹5,450 million and free cash flow of ₹2,179 million

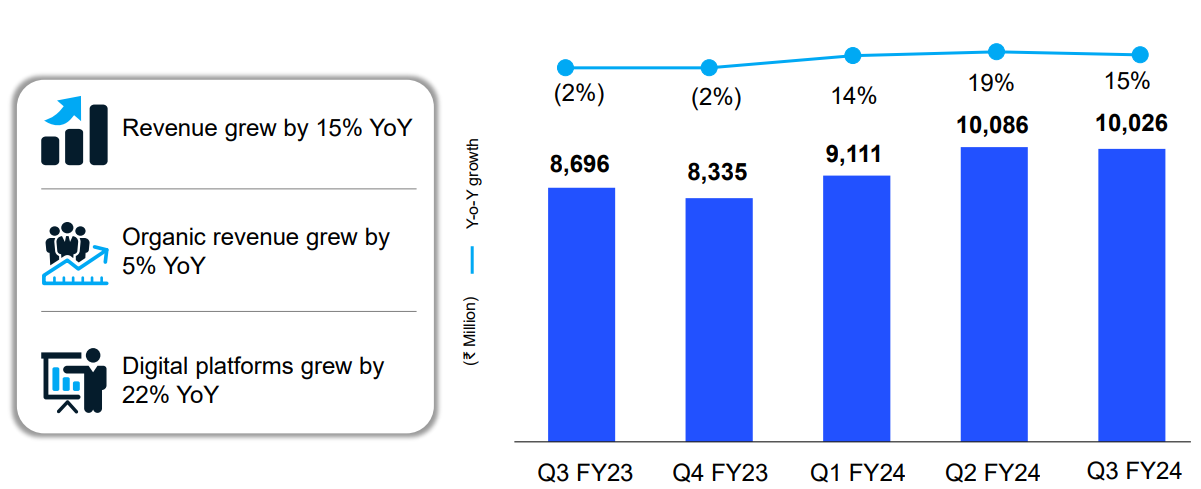

4. Q3-24 : PAT up 22% & Revenue up 15% YoY

5. 9M-24 : PAT up 28% & Revenue up 16%

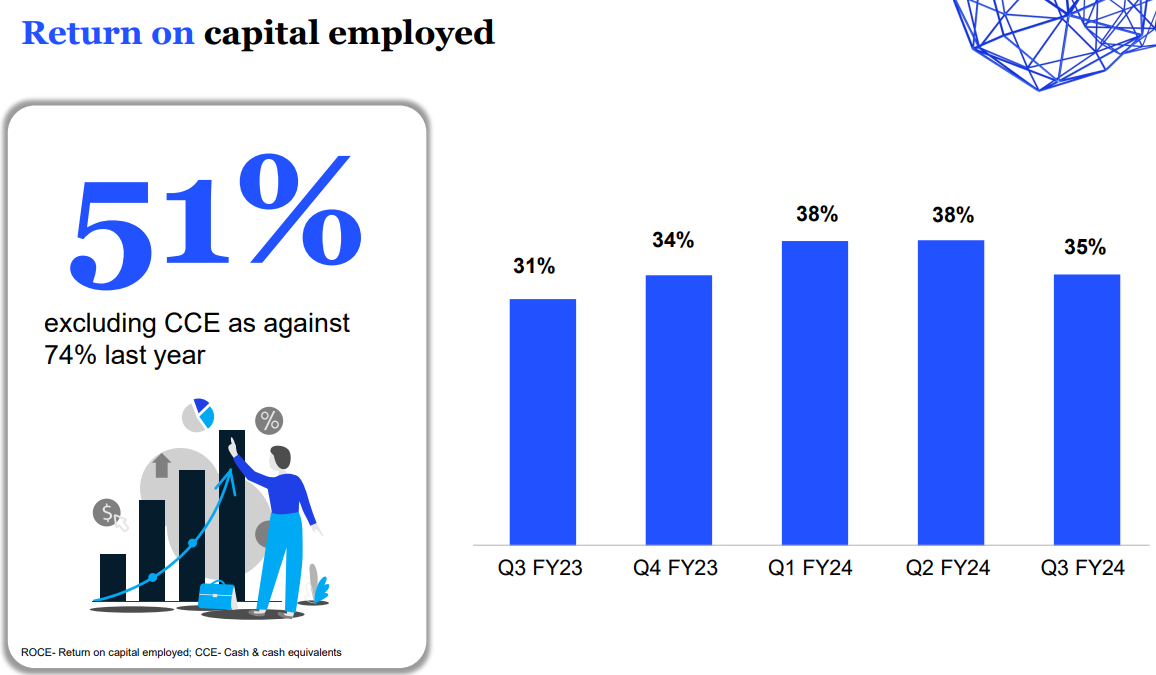

6. Return ratios are good

7. Outlook: Digital Platform at 20%+ CAGR for 3-4 years

TANLA management has guided for 20%+ CAGR for the next 3-4 years for the Digital Platform business in the Q3-24 earnings call.

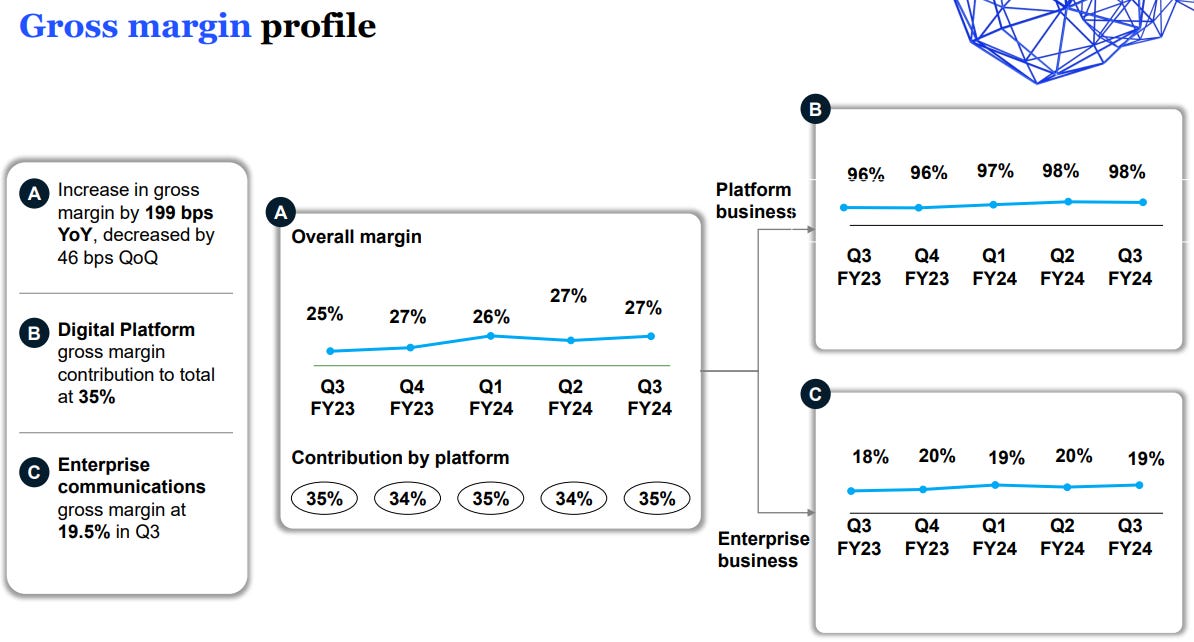

Contribution of the Digital Platform business could move closer to 50% from the current 35% making TANLA more of a SAAS company than an Communication company.

9. PAT growth of 28% & Revenue growth of 16% in 9M-24 at a PE of 25

9. So Wait and Watch

If I hold the stock then one may continue holding on to TANLA.

TANLA of IIFLSEC was initiated after Q2-24 results. The investment thesis has not changed after a reasonable Q3-24. The management is on track to deliver a strong FY24

One needs to keep a close watch on the organic growth. With a 5% organic growth the valuations may not be justified if the trend continues in FY25

Revenue growth led by ValueFirst acquisition

The story in TANLA is the changing business profile from more of an Enterprise Communications business to also a Digital Platform business. As the contribution of Digital Platforms grows, TANLA could be seen as more as a SAAS business and could lead to rerating of valuation metrics and create a bigger upside than the returns seen in the stock in the recent past.

10. Or, join the ride

If I am looking to enter TANLA then

TANLA has delivered a decent 9M-24 with PAT growth of 28% and revenue growth of 16% in 9M-24 at a PE rating of 25 which makes the valuations acceptable in the short-term.

TANLA has a track record of predictability which should continue in Q4-24

In the short-term performance is in the price and opportunities for upside may be limited.

In the medium term, the stock performance would look forward towards the outlook for FY25 which one can have visibility to only after Q4 results

Over the long term, as the contribution of Digital Platform to the overall business increases, TANLA could be seen as a SAAS business lead to re-rating of the business in terms of valuation metrics. However, this is a multi-year transition and would require patience.

Previous coverage of TANLA

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action.