Tanla Platforms: 32% PAT growth & 16% revenue growth in H1-24 to be followed by a stronger H2 for a PE of 28

TANLA is delivering strong YoY growth in H1-24 after a very weak FY23. H2-24 is expected to be much stronger than H1-24 given the price hikes taken by TNALA.

1. Cloud communications company

tanla.com | NSE: TANLA

2. FY18-23: Revenue CAGR of 38% & PAT CAGR of 88%

Growth slowed down in FY23

3. Strong Q1-24: PAT up 29% & Revenue up 14% YoY

4. Stronger Q2-24: PAT up 35% & Revenue up 19% YoY

4 out of last 5 quarters have grown sequentially qoq

Q2-24 stronger than Q1

5. Overall H1-24 looking strong: PAT up 32% & Revenue up 16%

Revenue increased by 16% year-over-year to ₹19,197 million

Profit after tax increased by 32% year-over-year to ₹2,780 million. Profit after tax margin at 14.5%

Earnings per share increased by 33% year-over-year to ₹ 20.67

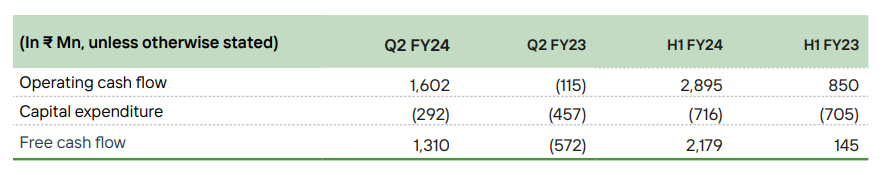

Cash & Cash Equivalents at ₹5,450 million and free cash flow of ₹2,179 million

6. Return ratios are good

7. Outlook: Expecting a strong Q3

i. Expecting a 40% PAT growth in Q3

TANLA delivered 35% PAT growth in Q2 with growth in Q3 expected to be more pronounced, one could estimate a PAT growth closer to 40%

9. So Wait and Watch

If I hold the stock then one may continue holding on to TANLA given the momentum from FY23 has continued on into H1-24 end. Additionally, the momentum is expected to be stronger in Q3-24

The execution is in place given the 16% growth in top-line and 32% growth in PAT for H1-24.

TANLA has grown its EPS on QoQ basis sequentially for the last 5 quarters and qoq growth is expected to continue into Q3-24

10. Or, join the ride

If I am looking to enter the stock then

TANLA has delivered a very strong H1-24 after a weak FY23. The strong growth is expected to continue into Q3-24 given the price hikes. TNALA is available at a PE of less than 28 which makes the valuations reasonable.

TANLA has delivered Rs 218 cr and is available for a market cap of Rs 14,318 cr which implies that its available at free cash flow yield of 3% ( annualized) which makes the valuation reasonable

Given the strong outlook for Q3-24, one can estimate a 35% PAT growth for FY24, given that in H1-24 a 32% growth has already been delivered. This makes TNALA look reasonable at it is available on a FY24 forward PE of 25.

The real upside in TANLA would come in based on the outlook for FY25

Previous coverage of TANLA

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades