Tanla Platforms: Earnings expected to grow faster than revenue

Tanla changing from an Enterprise communications to a Platforms business with higher growth and higher margins

Company Overview

Tanla Platforms Limited is a multinational cloud communications company based in Hyderabad. The two business segments of Tanla are:

Enterprise Communications (90% of revenue): Helps enterprises engage with their end customers across communication channels.

Communications Platform as a Service (CPaaS) market share: 30-35%

SMS market share for National long distance (NLD): 40% to 45%+

WhatsApp market share 10-15%

Digital Platforms: consists of Trubloq (DLT platform) and Wisely (collection of six platforms). Trubloq contributes ~50% of platform revenues. Wisely products are moving from development to monetisation phase. Wisely currently contributes 30% to platform revenues while the remaining 5 Wisely platforms contribute the rest.

Tanla announced the acquisition of ValueFirst in June 2023 to add to its Enterprise business. On a base of by FY23, the acquisition is expected to add Rs 645 cr (19%) to Tanla top line

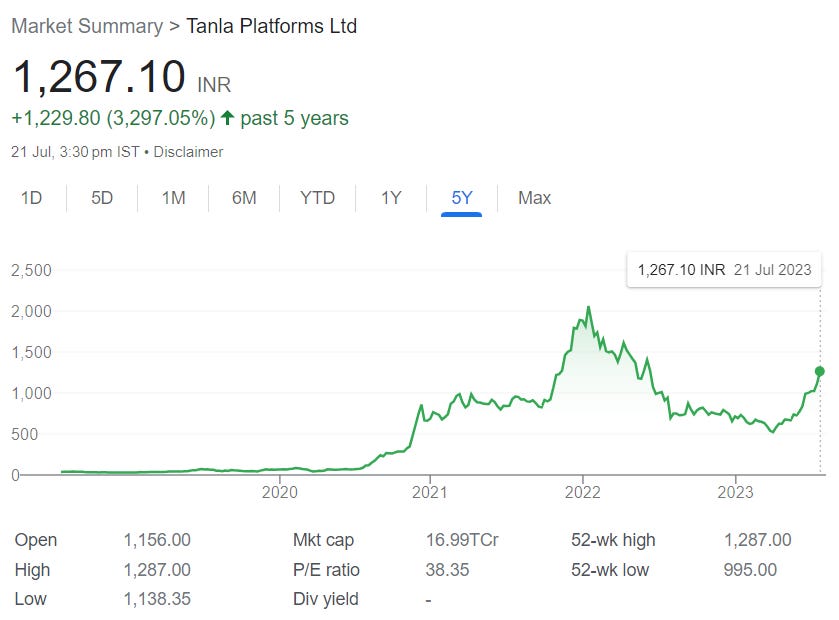

Share Details

NSE:TANLA( tanla.com)

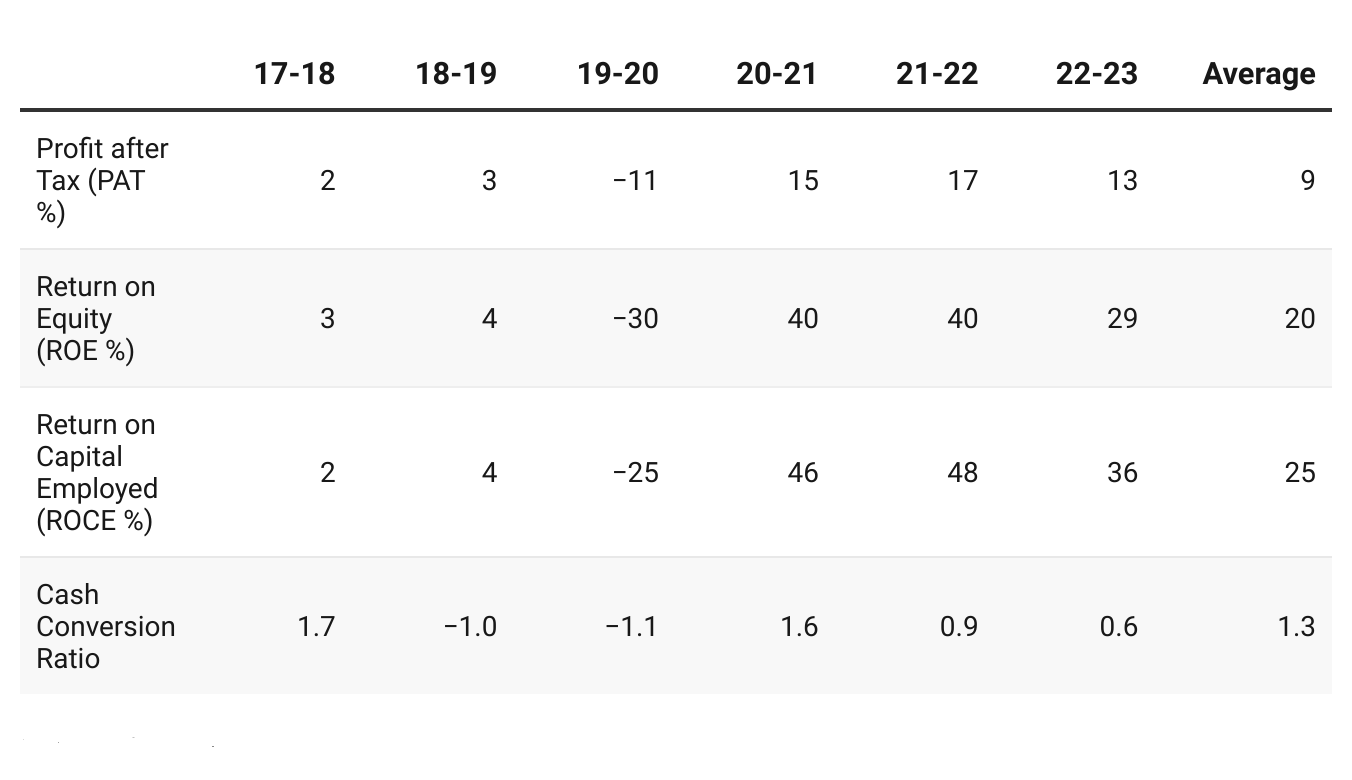

Quality: Returns on capital employed in cash

The return ratios are solid and cash conversion is good.

Growth

Bottom line is growing faster than the top line. Anomaly in FY19-20 growth is on account of acquisition of Karix in Aug-18. If remove the impact of inorganic growth then top line and bottom-line growth would not look as exceptional.

Growth Momentum

The revenue growth momentum is solid and indicative of 20% top-line growth after removing the impact of the Karix acquisition and ignoring FY22-23 as one off bad year.

Q1-24 Update

Revenue up 14% YoY

PAT up 35% YoY

ROCE = 38% vs 36% in FY23

ROE = 33% vs 35% in FY23

Cash conversion ratio: 1.23

Outlook

Platform business is expected to operate at rule of 60 which means that the sum of revenue growth and EBITDA margin will be 60 or more

We are currently operating at close to rule of 100. Aim to converge at Rule of 60 even at a scale

Gross profit in the Platform business are growing 20% plus over last 12 quarters

This poor performance in FY23 is over

We have seen our enterprise margins come back to 20% levels. We think the worst is behind us and we are looking at growth in FY '24.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. The story of the Platforms business, contributing to 35%+ of gross margin (10% of revenue) and growing at 20%+ for the last 12 quarters should keep playing out as it is the key organic growth driver for Tanla

If I don't currently own the stock, I may want to enter it.

Efficiently run company, return ratios and cash generation is solid

Q1-24 results are positive, confirming growth is back on track.

The 20%+ growth in Platforms and contributing currently to 35% of gross margin will change the complexion of Tanla to more of a Platforms business and less of an Enterprise communication business. Growth and margins would be higher in the Platforms business

The issue is that we have the stock currently at a PE of 38+. If there is faith in the growth outlook for the Platforms business then one can look to wait patiently and enter it on bad days and slowly build positions.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades