Supriya Lifescience FY25 Results: PAT up 58%, FY26 Targets 20% Growth with ₹1,000 Cr Revenue by FY27

With new capacity online, Supriya targets ₹1,000 Cr revenue by FY27. High-margin APIs, CDMO growth, and rising ROE support upside despite elevated P/E.

1. API Manufacturer

supriyalifescience.com | NSE : SUPRIYA

2. FY21–25: PAT CAGR of 11% & Revenue CAGR of 15%

Revenue: Strong expansion in regulated markets (Europe, LATAM) and growth across antihistamines, anesthetics, and new therapies.

EBITDA: Margins dipped post-FY22 due to input costs and mix shift but rebounded in FY25 on better realization from backward-integrated APIs and mature products.

2.1 What Changed Between FY21–25

Regulated Market Shift: Focus moved from semi-regulated to regulated geographies (Europe up from 31% to 51%), boosting margin stability and pricing power.

Product Diversification: Expanded from antihistamines to anesthetics, anti-anxiety, and anti-diabetics, enabling entry into high-volume, high-value markets.

Capacity Doubling: Manufacturing scaled from 550 to 1,020 KLPD via Module E and Ambernath FDF facilities—supporting long-term growth and CDMO ramp-up.

Backward Integration: Enabled cost control, margin resilience, and import substitution. Backward-integrated products now contribute over 70% of revenue.

Working Capital Efficiency: Inventory days reduced significantly (from 223 to 167), aided by faster customer cycles and improved planning.

Emerging CDMO Engine: Transitioning from pure-play APIs to integrated solutions. CDMO to contribute ~20% of revenue by FY27.

3. Q4 FY25: PAT up 38% & Revenue up 16% YoY

Margin Drivers: Gains stemmed from higher regulated market share (Europe, LATAM), continued scaling of anesthetics, and improved utilization from Module E.

Geographic Momentum: LATAM surged to 21% of revenue in Q4 vs 8% YoY, validating Supriya’s strategy to aggressively tap regulated emerging markets.

Strong Exit Run Rate: Q4 performance sets a strong base for FY26, with additional revenue from CDMO expected to kick in by H2.

4. Strong FY25: PAT up 58% & Revenue up 22% YoY

Strong Revenue Growth: Scale-up in anesthetics and anti-diabetics, and higher LATAM & Europe sales.

EBITDA Margin Expansion: Benefits of backward integration and regulated market pricing power.

Cost Drivers: Launch of the new high-capacity Module E plant helped produce more efficiently and at larger scale.

This improved cost savings and profit margins, which balanced out the higher depreciation costs from recent investments.

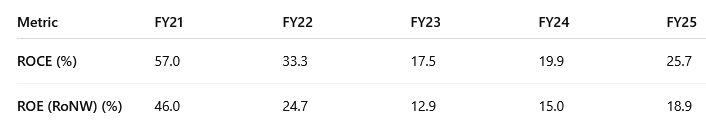

5. Business Metrics: Return Ratios Rebound with Profitability and Efficiency

FY21–FY23 Decline:

ROCE dropped due to IPO-led equity dilution, margin compression from product mix and cost inflation, and capex (Module E, Ambernath) yet to yield returns.

ROE fell, also impacted by higher depreciation and tax on earnings.

FY24–FY25 Recovery:

ROCE rose as new capacity kicked in, regulated markets scaled, & margins improved

ROE rose, reflecting stronger profitability on fully deployed equity.

6. Outlook: Revenue growth of 20%+ in FY25

6.1 FY25 Expectations vs. Performance – Supriya Lifescience

HITS (Met or Exceeded Guidance)

Revenue Growth: Delivered 22%, exceeding 20%+ target despite modest volume growth

PAT Growth: 58% YoY surge, supported by margin expansion and interest income.

EBITDA Margin: Delivered 37.4% vs guidance of 34–36% due to regulated market mix and backward integration benefits.

Geographic Diversification: LATAM revenue doubled to 22%; Europe remains strong; Southeast Asia also grew

Capex Discipline: ₹162 Cr invested as planned; expansion via Module E and Ambernath formulation unit completed.

New Product Pipeline: Q4 launch in anesthetics; 3 more targeted in FY26 across contrast media, ADHD, and CV segments.

MISSES (Below or Deferred vs. Guidance)

Working Capital Days: Rose to 158 days vs 125–130 target, due to batch size increases and receivables buildup. Recovery expected in H1 FY26.

CDMO Revenue: DSM supplies began but FY25 contribution was minimal. Ramp-up expected in FY26–27 as commercial volumes scale and new contracts close.

6.2 FY26 Guidance – Supriya Lifescience

Revenue Growth:

Targeting 20% YoY growth, implying revenue of ₹830–₹850 Cr, led by scale-up in regulated markets and new product launches.EBITDA Margin:

Expected to be in the range of 33–35%, slightly lower than FY25 due to initial semi-regulated sales from new products and formulation site.

FY26 guidance builds on the trajectory of 20% growth seen in FY24 and FY25.

Reduction in EBITDA margin guidance, compared to FY25 is a disappointment

Reflects either a genuine expectation of margin normalization due to product mix and early-stage launches, or a conservative stance by management at the start of the year.

New Product Launches:

Launch of 3 new APIs across contrast media, ADHD, and cardiovascular segments (cumulative API market > $900 Mn); all backward integrated.CDMO Revenue:

CDMO segment to begin contributing meaningfully; DSM contract to deliver ₹30–35 Cr, with 2 additional contracts moving into commercial stage.Formulation Ramp-Up:

Ambernath facility to start commercial supplies by Q3 FY26 in non-regulated markets; minor revenue contribution expected in FY26.Capex:

FY26 capex expected to be ₹75–80 Cr, focused on maintenance, Ambernath site stabilization, and R&D investments.Working Capital:

Days expected to remain in the 150–160 range. Inventory likely stable; effort to reduce receivables through tighter collection cycles.Geography Mix:

Growth to be led by Europe and LATAM. North America remains <7% but expected to rise post product approvals in FY27–28.Regulatory Filings:

3–4 new USDMFs and CEPs to be filed, supporting medium-term revenue scale-up.

6.3 Long-Term Outlook – Supriya Lifescience

Revenue Ambition: ₹1,000 Cr by FY27 (13–14% CAGR from ₹697 Cr in FY25)

Driven by regulated market expansion (Europe, LATAM, SE Asia) and product scaling

Product Strategy :3–4 new APIs/year, focused on:

Anesthetics (launched Q4 FY25)

Contrast media (~$500 Mn market)

ADHD, cardiovascular APIs

All products fully backward integrated

Competing with China-dominant suppliers, leveraging regulatory + cost edge

CDMO Scale-Up; DSM contract: ₹30–35 Cr in FY26, scaling to ₹60–70 Cr

5 CDMO projects: 3 commercial, 2 under negotiation

Targeting ₹200 Cr CDMO revenue by FY27; formulations could add upside

Formulations & Ambernath: Ambernath to contribute meaningfully from FY27

₹130 Cr invested; ₹450–500 Cr potential

3 validated lines: oral solids, liquid anesthetics, inhalation

FY26 revenue limited to non-reg markets; full scale post approvals

Margins & Leverage: Long-term margins to remain strong with:

72% revenue from backward integrated products

Better product mix and asset utilization (Module E, Ambernath)

Geographic Mix: Exports = 85% in FY25 (vs 79% in FY24)

LATAM: 11% → 22%; Europe: remains core

North America: <5% now, expected to reach ~10% by FY28

Supriya is evolving into a vertically integrated, global CDMO + formulation player with scalable pipeline, deep regulatory and supply chain capabilities with sustained growth visibility beyond FY27

7. Valuation Analysis – Supriya Lifescience

7.1 Valuation Snapshot – Supriya Lifescience

Premium Multiples Reflect Strong Fundamentals

Supriya trades at 32.2× P/E and 22.9× EV/EBITDA—rich, but justified by its 37.4% EBITDA margin, 25.7% ROCE, dominant backward-integrated API base (72% of revenue), and emerging CDMO/formulation businesses.

Valuation Compression Likely by FY27

With revenue guided to ₹1,000 Cr and PAT to ₹240 Cr, P/E compresses to ~19.5×. CDMO monetization (DSM + 4 projects) and Ambernath’s scale-up (minor FY26, meaningful FY27) improve EV/EBITDA to ~13× via operating leverage and limited capex.

Strong Returns Justify P/B

ROE/ROCE at 18.9%/25.7% to improve further as asset turnover and scale rise. P/B (6.07×) compresses to ~3.2× as book value builds through earnings retention.

Sales-Based Valuation Still Full

Market Cap/Sales at 8.68× in FY25 drops to 6.05× by FY27—still high, reflecting confidence in execution, especially on CDMO and formulations.

Despite rich multiples, Supriya offers visibility on earnings and margin scale-up. It remains a rerating-through-execution story, backed by a high-quality business mix and defined growth roadmap.

7.2 What’s in the Price?

High Margins & Return Profile:

Current P/E of 32.2× and P/B of 6.07× already discount Supriya’s strong EBITDA margin (37.4%) and superior ROCE (25.7%).FY27 Revenue Target:

The market is pricing in Supriya achieving its ₹1,000 Cr revenue target by FY27 with PAT compounding at ~20–25%.Execution on CDMO Ramp-Up:

Partial contribution from DSM and other commercial-stage CDMO projects appears to be embedded in valuations.Formulation Optionality (Ambernath):

Minor contribution from Ambernath has been considered in price, but meaningful upside is still treated as optional.Sustained Capital Efficiency:

ROE/ROCE strength and high cash flow conversion are assumed to persist—reflected in elevated P/B and EV/EBITDA multiples.

7.3 What’s Not in the Price? (Potential Upside Triggers)

Full CDMO Monetization:

Only DSM is partially priced in; 2–3 other CDMO contracts (under negotiation or validation) could materially boost revenue and margin visibility.Formulation Scale-Up:

Ambernath facility has ₹450–500 Cr full-revenue potential. FY27 guidance factors in only ~₹50–100 Cr contribution—leaving scope for meaningful re-rating post-regulatory approvals.New Product Launches:

3–4 backward-integrated, high-entry-barrier APIs launching in FY26–27 (contrast media, ADHD, cardiovascular) are not fully reflected in Street estimates.North America Growth:

US contributes <5% today; share could rise to ~10% by FY28+ as newer filings gain approvals.Inhalation & Specialty Dosage Expansion:

Long-term opportunities in niche formats from Ambernath (inhalation, injectables) not yet captured in near-term valuation.Working Capital Optimization:

FY25 WC days rose to 158; reduction back to 125–130 days can drive improved FCF and return ratios.

8. Implications for Investors: What to Watch

8.1 Bull, Base & Bear Case Scenarios – Supriya Lifescience

Bull Case: All engines fire — strong CDMO scale-up, margin expansion, Ambernath ramps, and valuation re-rating

Revenue Growth:

25% CAGR through FY27, driven by full CDMO monetization (DSM + 3 contracts), new APIs (contrast media, ADHD), and Ambernath contributing ₹250–300 Cr.EBITDA Margin:

Sustains at 35–36%+ as new launches and formulations scale; high realization from backward-integrated APIs.PAT Growth:

PAT grows to ₹300–325 Cr by FY27; ROE exceeds 20%. P/E compresses to 16–18× on higher earnings base.Working Capital Efficiency:

WC days reduce to 130 or below as receivables normalize and scale drives operating leverage.Capital Allocation:

Strong FCF supports growth capex or shareholder payouts; net debt remains nil.

Base Case: Execution meets expectations; earnings compound steadily with margin stability and partial CDMO contribution

Revenue Growth:

20% CAGR to ₹1,000 Cr by FY27, driven by CDMO (DSM + 1–2 projects), regulated APIs, and partial Ambernath scale-up (₹100 Cr).EBITDA Margin:

Moderates to 33–34%, aligned with FY26 guidance; higher contribution from semi-regulated markets in new launches.PAT Growth:

PAT grows to ₹240 Cr by FY27; ROE stays in 18–19% range. Steady return profile supports 14–15× P/E.Working Capital:

Stabilizes around 145–150 days. Inventory managed, receivables improve modestly.

Bear Case: CDMO ramp-up delayed, Ambernath stuck in validation, and margin compression from semi-regulated exposure

Revenue Growth:

<15% CAGR; Ambernath and CDMO fail to scale meaningfully. Revenue reaches only ₹900 Cr by FY27.EBITDA Margin:

Slips to 30–32% due to higher share of lower-margin geographies and delayed operating leverage.PAT Growth:

PAT grows only to ₹190–200 Cr; ROE drops below 16%. Earnings visibility weakens.Working Capital Strain:

WC days remain elevated (~160+); higher batch sizes and slower collections impact cash flow.

8.2 Key Risks & What to Monitor – Supriya Lifescience

A. Execution Risk – CDMO & Formulations Ramp-Up

Supriya's CDMO and Ambernath formulation segments are early-stage. Delays in validations, regulatory approvals, or commercial scale-up could push back revenue timelines.

Monitor: DSM contract volume ramp, status of 2–3 CDMO deals in pipeline, Ambernath regulatory progress and batch validation updates (especially Q2–Q4 FY26).

B. Margin Risk – Product Mix & New Launches

FY26 EBITDA margin guidance (33–35%) is lower than FY25 (37.4%), reflecting expected mix shift toward semi-regulated and low ASP markets during initial scale-up.

Monitor: Quarterly gross and EBITDA margins, contribution from high-margin APIs vs. new launches, price trends in LATAM/Asia, and scale-up pace of backward-integrated products.

C. Working Capital Risk

WC cycle worsened in FY25 (158 days vs 124 days in FY24), led by inventory build-up and slower collections. Delays in customer billing, especially in new markets, may keep WC intensity elevated.

Monitor: Quarterly receivables, inventory trends, batch size transitions in Module E, and any credit extensions to emerging-market clients.

D. Regulatory Approval Risk

Several new products (ADHD, contrast media) and the Ambernath site depend on multi-jurisdiction filings. Any delay in CEPs, USDMFs, or site inspections could impact growth.

Monitor: Product-specific filing status, CEP/USDMF updates, Ambernath plant inspection timelines, and progress on EU/US regulatory milestones.

E. Valuation Sensitivity

At ~32× FY25 P/E, Supriya trades at rich multiples. Any slippage in PAT growth, CDMO monetization, or formulation contribution could compress valuations.

Monitor: Quarterly earnings growth, CDMO order visibility, Ambernath contribution ramp, and consistency of PAT CAGR toward FY27 ₹240 Cr target.

F. Concentration Risk – Customers & Geographies

Top 10 clients contribute ~50% of revenue (many are large distributors). Europe and LATAM dominate geographic mix. Delays or loss of key accounts could impact scale.

Monitor: Client concentration updates, diversification progress in North America and Southeast Asia, and share of direct customers vs. distributors.

9. Margin of Safety for a Supriya Investor

A. Valuation Reflects Execution Strength, But Not Full Earnings Power

At 32.2× P/E and 22.9× EV/EBITDA, Supriya trades at elevated but earnings-anchored multiples, supported by margin leadership, strong returns. However, the valuation does not fully price in FY27 PAT compounding or CDMO/formulation upside.

Current assumptions priced in:

Revenue CAGR of 20% to ₹1,000 Cr by FY27 (guided)

EBITDA margins stabilize at 33–35% (vs 37.4% in FY25)

CDMO contribution limited to DSM contract

Formulation revenues from Ambernath factored only marginally

Valuation leaves scope for re-rating if:

PAT scales from ₹188 Cr (FY25) to ₹240–250 Cr by FY27

CDMO/formulation segments deliver more than conservative ramp

Working capital normalizes and return ratios remain above 18–20%

B. Execution Levers Are in Place

Supriya has built deep strategic levers for non-linear earnings growth:

CDMO Pipeline: 5 active projects; DSM in scale-up, 2 others in validation, 2 under negotiation

Ambernath Formulations: ₹130 Cr capex done; 3 lines commissioned; commercial production expected in FY26

New APIs: 3–4 launches in FY26 across contrast media, ADHD, and cardiovascular areas (global market size: ~$1 Bn)

Regulatory Clearances: CEP/USDMFs filed or in progress to unlock volume in regulated markets

These assets are validated, high-barrier and integrated—enabling sticky client relationships and superior realizations.

C. Downside Protection Despite Execution Risk

Even if ramp-ups are delayed, Supriya offers structural margin of safety:

Cash-Generating Core: FY25 base EBITDA of ₹261 Cr with 37.4% margin; backward-integrated APIs with global leadership

Minimal Capex Needs: No equity raise required; cash on books (₹761 Mn); capex intensity tapering

Zero Net Debt: Net cash position maintained, supports flexibility

Low Fixed Cost Operating Model: High-margin APIs cushion CDMO scale-up risk

Diversified End Markets: Europe, LATAM, SE Asia account for 85% exports; US optional

These levers limit valuation risk and offer compounding durability, even if FY26 execution is staggered.

9.1 Overall Margin of Safety: Moderate to High

Supriya Lifescience offers a moderate-to-high margin of safety for long-term investors, backed by high return ratios, earnings visibility, global diversification, and optionality from CDMO and formulations.

Current Valuation Reflects Only:

FY26 revenue visibility (~₹835 Cr) with partial CDMO contribution and no meaningful Ambernath scale-up

Base-case PAT CAGR of ~20%, and moderated EBITDA margins (33–35%) vs FY25 peak (37.4%)

Conservative realization from new product launches still in regulatory cycles

Upside Optionality From:

CDMO Ramp-Up: DSM monetization underway; 2–3 more contracts in pipeline could meaningfully boost earnings by FY27

Formulation Contribution: Ambernath has ₹450–500 Cr full-scale potential, but FY27 guidance includes only ₹100 Cr—leaving re-rating headroom

Working Capital Release: WC days rose to 158 in FY25; normalization to ~130 could unlock cash flows and lift return metrics

P/E Compression with PAT Growth: PAT compounding to ₹240 Cr by FY27 can compress P/E from 32× to ~19–20×

Regulatory Approvals: New APIs (ADHD, contrast media) can open up new revenue pools post-approval cycles

This makes Supriya a high-quality compounder over a 2–3 year horizon. Its execution visibility, clean balance sheet, and margin-accretive product mix create a favorable risk-reward setup for long-term value creation.

Previous coverage on SUPRIYA

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer