Supriya Lifescience: PAT growth of 67% & Revenue growth of 24% in 9M-25 at PE of 31

Revenue growth of 20% with 35% EBITDA growth at a 34-36% EBITDA margin in FY25. Doubling revenue to Rs 1,000 cr during FY24-27 at a CAGR of 21%. . Maintaining EBITDA margin of 28-30%

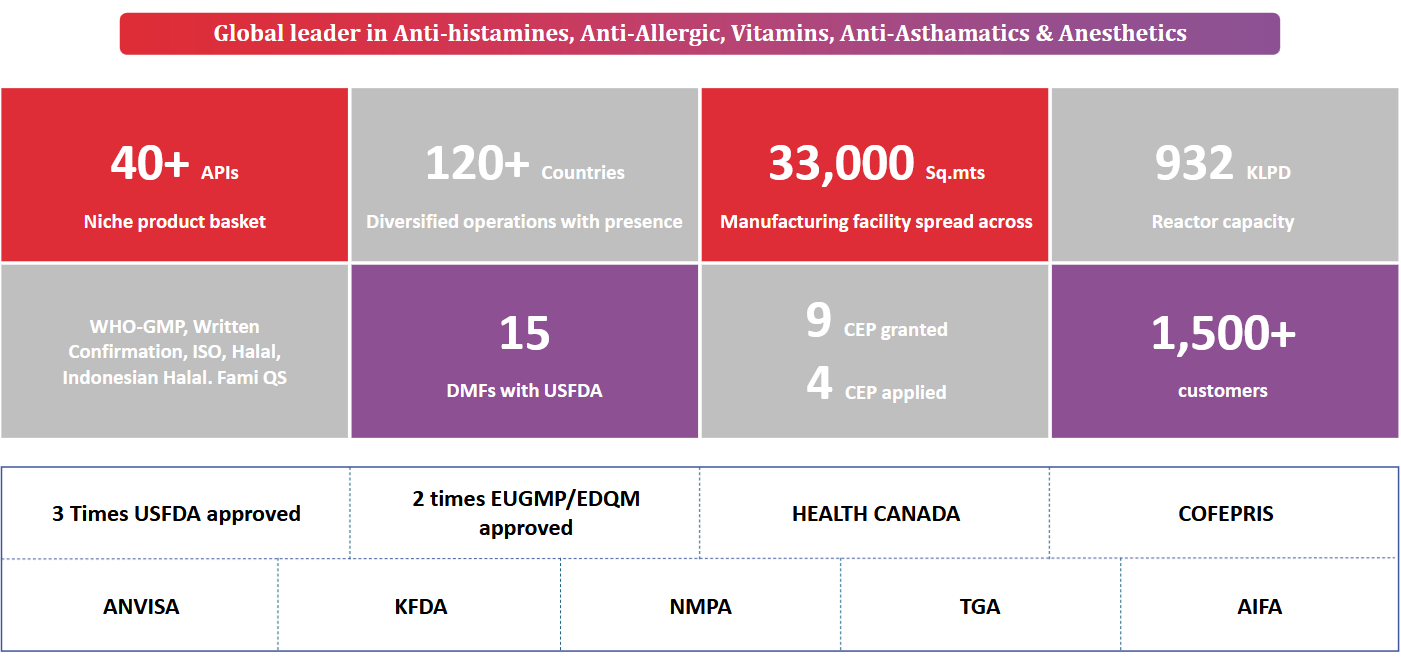

1. API Manufacturer

supriyalifescience.com | NSE : SUPRIYA

2. FY20-24: PAT CAGR of 13% & Revenue CAGR of 16%

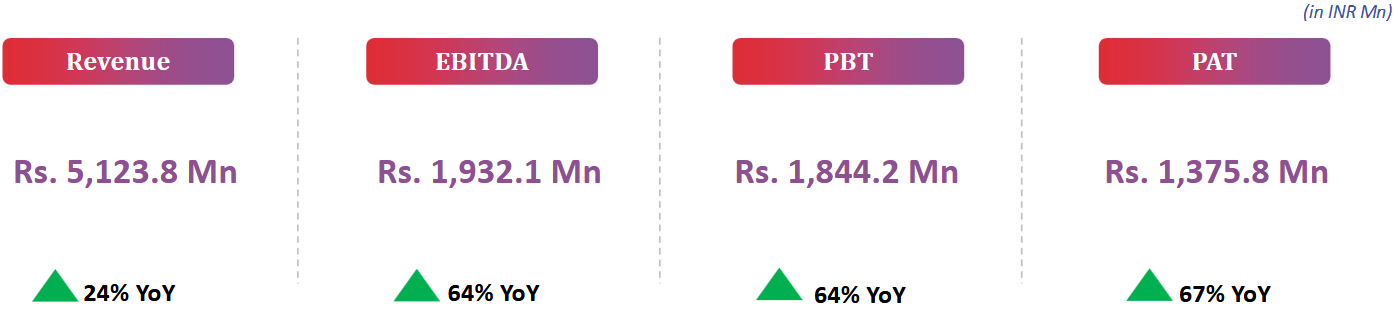

3. Strong FY24: PAT up 33% & Revenue up 24% YoY

4. Strong Q3-25: PAT up 56% & Revenue up 33% YoY

PAT up 1% & Revenue up 12% QoQ

5. Strong 9M-25: PAT up 67% & Revenue up 24% YoY

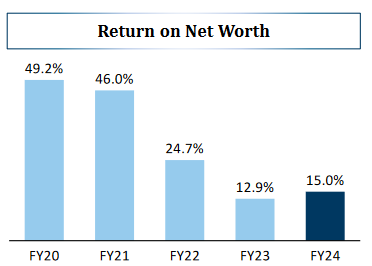

6. Business metrics: Stabilizing return ratios

7. Outlook: Revenue growth of 20%+ in FY25

Product and Market Strategy

Supriya Lifescience is focused on high-margin niche products with limited competition.

The company is expanding its portfolio with new molecules in therapeutic segments, including anti-stimulants, anesthetics, anti-anxiety, and anti-diabetic.

They plan to launch at least four new products annually, aiming to stay at the forefront of API manufacturing innovation.

LATAM region contributed 21% of the revenue this quarter, compared to 8% in the same quarter last year.

They are also seeing strong traction in North America and Africa for key products.

The company is capitalizing on the China +1 policy by launching products to reduce dependence on China.

Specific Projects and Opportunities

Whey Protein Project: The company has received the FSSAI license and expects revenue contribution from this project in FY26.

Contrast Media: Supriya Lifescience is developing two to three products in contrast media, with the first product launch expected in Q2 of the next financial year.

They are using a fully backward integrated business model, bypassing the use of iodine.

DSM Project: The company is supplying the first commercial quantity to DSM in Q4, with a strong forecast for the next financial year.

Backward Integration

The company focuses on backward integration across all products, aiming for a fully backward integrated basket.

Backward integration contributes to around 77% of their total revenue.

They aim to control raw material costs through in-house manufacturing.

Market Outlook

Europe and LATAM are expected to remain the larger markets in the near future, but the North American market is expected to grow.

The company sees growth potential in vitamins, anti-asthmatics and anesthetic products.

New product launches will drive future revenue growth.

Pricing pressures in the API market are not significantly impacting Supriya Lifescience due to its backward integrated model.

Key Takeaways

Supriya Lifescience is experiencing strong growth and expansion across its operations.

The company is focused on high-margin products, backward integration, and regulatory compliance.

They are expanding their product portfolio, entering new therapeutic areas, and leveraging their manufacturing capabilities for CMO/CDMO opportunities.

The management is confident in achieving its long-term financial goals.

i. FY25: Revenue growth of 20%

Management is confident in achieving a revenue growth guidance of 20%.

ii. FY25: Strong margin expansion with 34-36%+ EBITDA margin

Assuming SUPRIYA meets its FY25 revenue guidance of 20% growth and achieving at least 34% EBITDA margin. This translates into 35+ growth in EBITDA for FY25.

The company aims to maintain a 34-36% EBITDA margin for the full financial year.

iii. FY24-27: 21% revenue CAGR

Guiding for revenue of Rs 1,000 cr by FY27 from Rs 570 cr in FY24, implies a revenue CAGR of 21% which is in the range of 20% guided by management in FY25 and looks reasonable.

The long-term goal of doubling revenue to 1,000 crore by FY27 remains on track.

iv. FY27: CMO CDMO to be 18-20% of revenue with better than 28-30% margins

The company expects CMO to contribute approximately 20% of the total revenue by FY27.

They are actively pursuing opportunities in advanced intermediates and API contract manufacturing.

Several CMO/CDMO opportunities are in the negotiation or contract signing stage.

They are focusing on liquid inhalation for their Amber facility.

The company is working on two or three CMO opportunities similar to the DSM project, with individual contributions of around 25-30 crores.

In the INR1,000 crores we anticipate about 18% to 20% coming in from CMO, CDMO. It is in fact a better margin proposition than what you are guiding at 28% to 30%

9. PAT growth of 67% & Revenue growth of 24% in 9M-25 at a PE of 31

10. Hold?

If I hold the stock then one may continue holding on to SUPRIYA

Coverage of SUPRIYA was initiated after Q1-24 results. The investment thesis has not changed after a good FY24 and equally strong 9M-25. After a delivering 20%+ revenue growth there is confidence in the management to deliver as per the 20% growth guidance for FY25.

SUPRIYA is in the middle of a strong run. It has delivered increasing PAT on a sequential QoQ basis for the last 5 quarters starting Q3-24.

SUPRIYA is working on a roadmap of a revenue of Rs 1,000 cr by FY27

Capacity enhancement for further backward integration for existing products, new product rollouts and CMO/CDMO opportunities

In the INR1,000 crores we anticipate about 18% to 20% coming in from CMO, CDMO.

11. Or, join the ride

If I am looking to enter SUPRIYA then

SUPRIYA has delivered PAT growth of 67% & Revenue growth of 24% in 9M-25 at a PE of 33 which makes valuations fairly priced in the short term..

Outlook for 35% EBITDA growth & 20% revenue growth in FY25 at a PE of 33 makes the valuations reasonable from a medium term perspective.

From a longer term perspective, the growth guidance of the management to deliver a top-line of Rs 1,000 cr by FY27 and grow at CAGR of 21% for FY24-27 creates opportunity in the stock over the longer term.

Previous coverage on SUPRIYA

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer