Supriya Lifescience: PAT growth of 33% & Revenue growth of 24% in FY24 at PE of 24

Doubling revenue to Rs 1,000 cr by FY27 at a CAGR of 21%. FY25 revenue growth to be at 20%+. Maintaining EBITDA margin of 28-30% till FY27

1. API Manufacturer

supriyalifescience.com | NSE : SUPRIYA

Supriya Lifescience Ltd., a cGMP-compliant business in API manufacturing and a focus on products from a variety of therapeutic segments, including anti-histamine, anti-allergic, vitamin, anaesthetic, and anti-asthmatic.

2. FY20-24: PAT CAGR of 13% & Revenue CAGR of 16%

3. Weak FY23: PAT down 41% and Revenue down 13% YoY

4. Strong 9M-24: PAT up 59% & Revenue up 29% YoY

5. Weak Q3-24: PAT down 5% & Revenue up 11% YoY

PAT up 22% & Revenue up 13% QoQ

6. Strong FY24: PAT up 33% & Revenue up 24% YoY

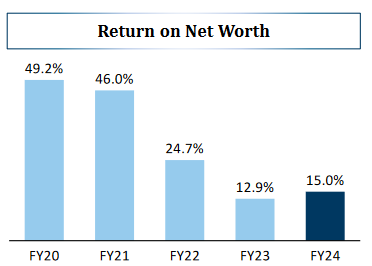

7. Business metrics: Stabilizing return ratios

8. Outlook: Revenue growth of 20%+ in FY25

i. FY25: Revenue growth of 20%+

In terms of revenue growth, we have always maintained that year on year, you can expect upwards of 20% growth from our side. And that is still the number that we would like to maintain for the next three years.

ii. FY25: 28-30% EBITDA margin

We are very confident that 28% to 30% we will be able to maintain. The company definitely has potential to achieve higher than 30% because a lot of the new projects the same opportunities come at a more premium margin that is what we benchmark ourselves against.

iii. FY24-27: 21% revenue CAGR

Guiding for revenue of Rs 1,000 cr by FY27 from Rs 570 cr in FY24, implies a revenue CAGR of 21% which is in the range of 20%+ guided by management in FY25 and looks reasonable.

I would say, that the INR1000 crores with the margins we are committing, we will be able to achieve that.

iv. FY27: CMO CDMO to be 18-20% of revenue with better than 28-30% margins

We have large CMO, CDMO opportunities in our hand. Those will also scale up in the next three years.

In the INR1,000 crores we anticipate about 18% to 20% coming in from CMO, CDMO. It is in fact a better margin proposition than what you are guiding at 28% to 30%

9. PAT growth of 33% & Revenue growth of 24% in FY24 at a PE of 24

10. So Wait and Watch

If I hold the stock then one may continue holding on to SUPRIYA

Coverage of SUPRIYA was initiated after Q1-24 results. The investment thesis has not changed after a good FY24. After a delivering 20%+ revenue growth there is confidence in the management to deliver as per the 20%+ growth guidance for FY25.

SUPRIYA is working on a roadmap of a revenue of Rs 1,000 cr by FY27

Capacity enhancement for further backward integration for existing products, new product rollouts and CMO/CDMO opportunities

In the INR1,000 crores we anticipate about 18% to 20% coming in from CMO, CDMO.

11. Or, join the ride

If I am looking to enter SUPRIYA then

SUPRIYA has delivered PAT growth of 33% & Revenue growth of 24% in FY24 at a PE of 24 which makes valuations fairly priced in the short term..

Outlook for revenue growth of 20% in FY25 while maintaining EBITDA margins at 28-30% at a PE of 24 makes the valuations reasonable from a medium term perspective.

From a longer term perspective, the growth guidance of the management to deliver a top-line of Rs 1,000 cr by FY27 and grow at CAGR of 21% for FY24-27 creates opportunity in the stock over the longer term.

Previous coverage on SUPRIYA

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer