Supriya Lifescience Q1 FY26 Results: Promising a Strong H2 After a Weak Q1

Confirms 20% growth guidance for FY26, hitting ₹1,000 Cr revenue by FY27. Maintenance impact in Q1-26 has made execution critical to deliver FY26 guidance

Share your best AI hacks for stock analysis.

Top hacks will be shared back with everyone — you get to learn from the best too.

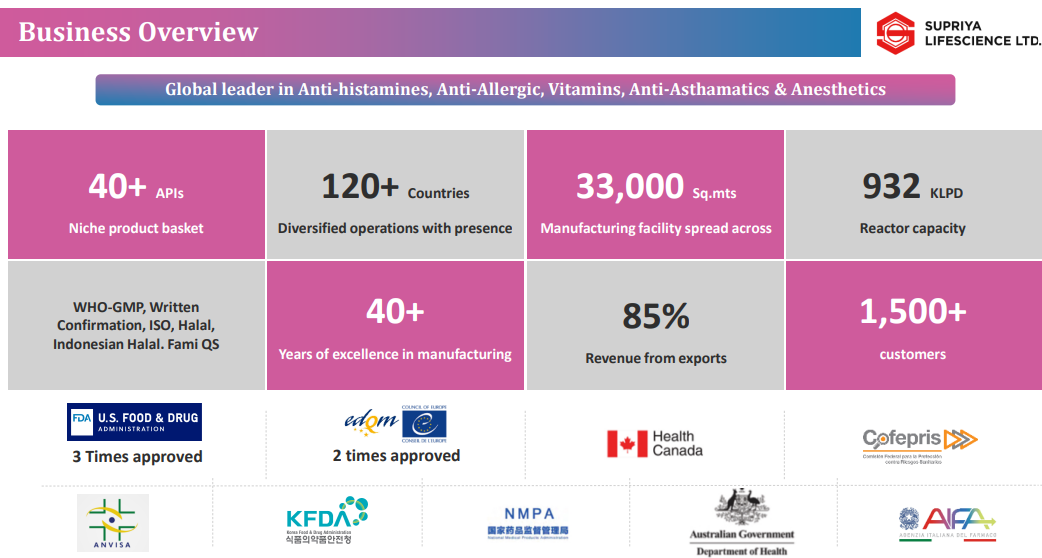

1. API Manufacturer

supriyalifescience.com | NSE : SUPRIYA

Current Facilities

Lote Parshuram (Maharashtra): Core API site with 5 blocks (932 KLPD), including new Module E (335 KLPD, 2024). Backward-integrated, export-regulated, houses R&D, QC, and ETP.

Ambernath (Thane): Finished Dosage Form facility (5,000 sqm) for tablets, capsules, liquids, injectables. Validation ongoing; commercial launch Q4 FY26.

Proposed Facilities

Patalganga (80,000 sqm): Planned API + formulations hub, construction post-FY26.

Additional Land: 12,500 sqm (adjacent to Lote) + 24,600 sqm (20 km away) earmarked for expansion and backward integration.

Would you like me to cut it down even further into a 2-line “at a glance” version for a slide header?

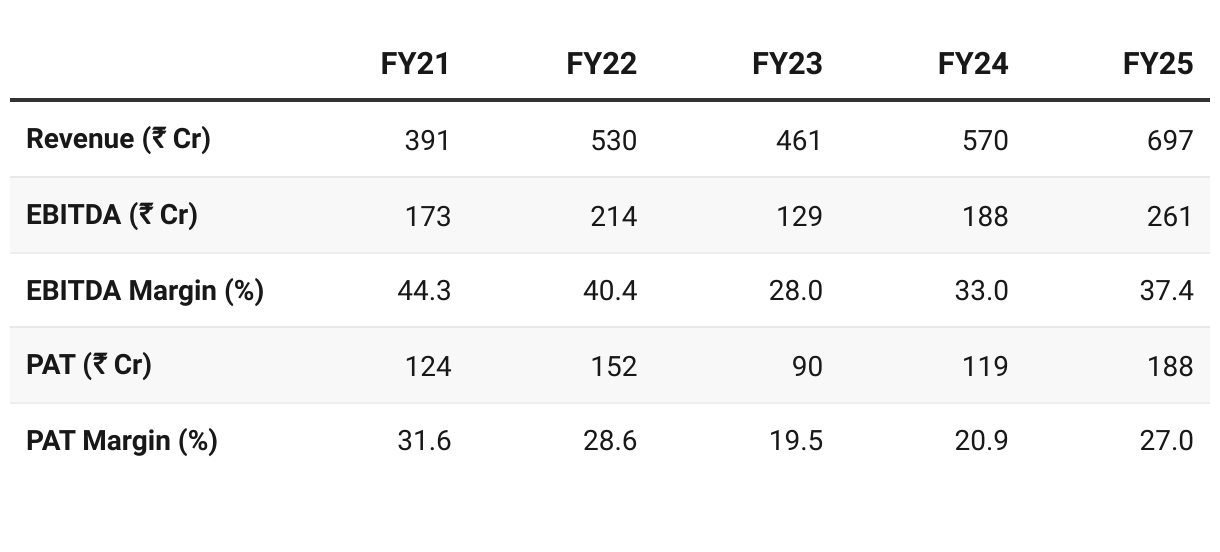

2. FY21–25: PAT CAGR of 11% & Revenue CAGR of 15%

Regulated Market Shift: Focus moved from semi-regulated to regulated geographies (Europe up from 31% to 51%), boosting margin stability and pricing power.

Product Diversification: Expanded from antihistamines to anesthetics, anti-anxiety, and anti-diabetics, enabling entry into high-volume, high-value markets.

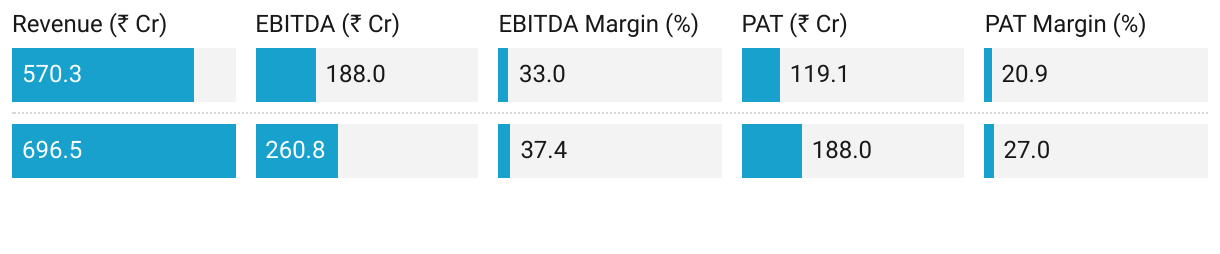

3. Strong FY25: PAT up 58% & Revenue up 22% YoY

Revenue Growth: Scale-up in anesthetics and anti-diabetics, and higher LATAM & Europe sales.

EBITDA Margin Expansion: Benefits of backward integration and regulated market pricing power.

Cost Drivers: Launch of the new high-capacity Module E plant helped produce more efficiently and at larger scale.

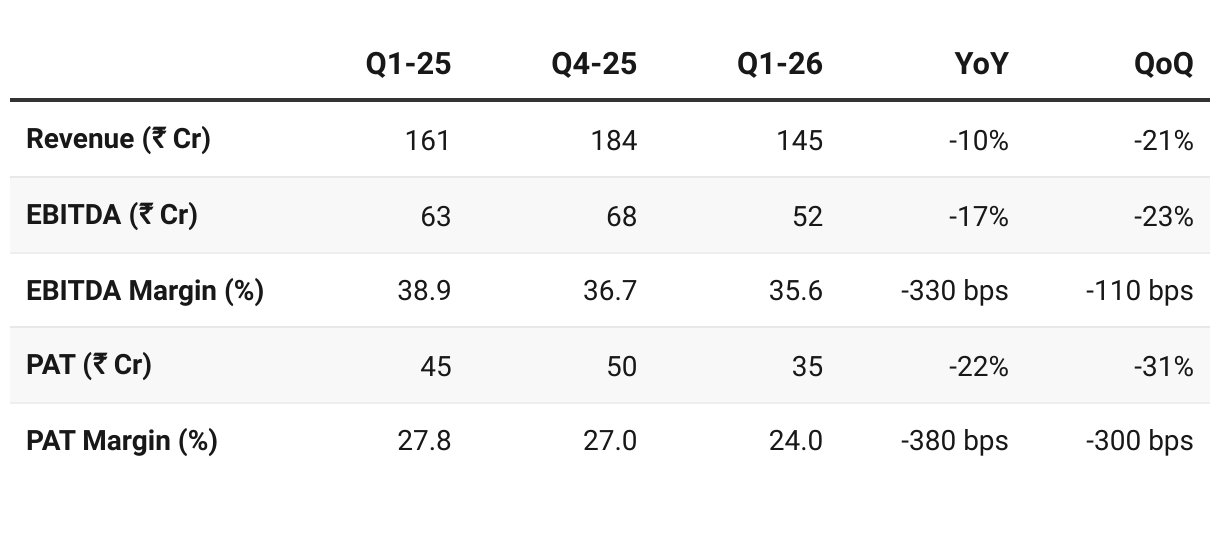

4. Q1 FY26: PAT down 22% & Revenue down 10% YoY

The drop was primarily due to a delay in the production facility campaign, following repair and maintenance work at our Lote facility.

Exports: 85% of revenue (up from 77–80% historically). Europe’s share rose to 41% (vs 36% in Q1 FY25).

Backward Integration: Strengthened to 81% of revenue (vs 69% YoY) → better cost control & supply security.

Therapy Mix: Anesthetics grew further, now 53% of revenue (vs 45% last year). Antihistamines/Vitamins stable.

Capacity utilization: 76% reported, but on an expanded denominator (post-Module E commissioning), actual utilization of new capacity is still ramping up.

Future capacity: Land acquired at Patalganga (80,000 sqm) for next growth phase (API + formulations).

Q1 FY26 was weak due to plant maintenance, but demand remains intact (no demand-side issues). Export traction (esp. Europe), stronger backward integration, and CDMO pipeline provide medium-term visibility. With H2 expected to recover, Supriya remains on track for 20% CAGR and ₹1,000 Cr revenue by FY27, though execution on new launches and CMO contracts is key.

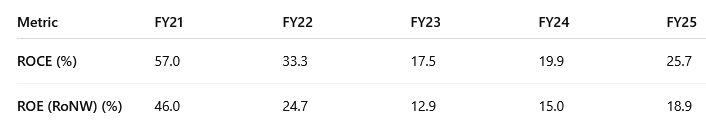

5. Business Metrics: Return Ratios Rebound with Profitability and Efficiency

FY24–FY25 Recovery: Returns rose as new capacity kicked in, regulated markets scaled, & margins improved

6. Outlook: Confident of ~20% Growth in FY26

6.1 FY26 Guidance – Supriya Lifescience

We remain confident of delivering ~20% annual revenue growth with EBITDA margins in the range of 33% to 35%.

We expect the second half of the year to outperform the first as the delays in production and sales from H1 are recovered in H2.

In quarter 2, you will see some part of that sales getting recovered.

There is absolutely no issue on the demand side. It has only got to do with the maintenance activities and the loss of production days, which has sort of translated into the lower revenue.

Our goal of reaching INR 1,000 crores in revenue by FY '27 is supported by a strong pipeline, 3 to 4 product launches planned for FY '26 and rising demand across key therapeutic areas such as anesthetics, antidiabetics, antianxiety, vitamins and ADHD treatments.

Regarding the U.S. tariff situation, while this market accounts for a small share of our revenue, we continue to track developments and assess any potential implications. Our primary focus remains on expanding in other high-potential regulated markets.

Beyond FY '27, the 2 most important growth drivers for us are going to be:

Introduction of new products in the portfolio.

We are actively introducing about 3 to 4 new products every year.

We are also introducing newer therapies in our product portfolio to make it more robust.

Once these products start gaining traction in semi-regulated and regulated markets, the revenue from these products will really amplify the sales.

The second thing for us is going to be in the CMO, CDMO space, both in terms of advanced intermediate API and also the finished formulation site, which we are setting up in Ambernath.

FY26

Revenue growth ~20% YoY; Q1 weak but recovery from H2.

EBITDA margin 33–35%

CAPEX ₹65–80 Cr (mainly maintenance, debottlenecking).

H2 drivers: Module E ramp-up, DSM contract, Ambernath FDF (commercial Q4).

FY27

Revenue target ~₹1,000 Cr

Growth from 3–4 product launches (ADHD, cardio, anesthetics), DSM scale-up, Contrast Media.

Beyond FY27

New products/therapies (anti-diabetics, ADHD, anesthetics, cardio).

CDMO/CMO scale-up (DSM, Whey Protein, Contrast Media, EU deals).

Ambernath FDF facility (tablets, liquids, injectables).

Patalganga expansion (API + formulations).

6.2 Q1 FY26 vs FY26 Guidance — Supriya Lifescience

Asking Run-rate to meet FY26 guidance is challenging

Soft Start vs FY26 Guidance:

Q1 FY26 revenue was ₹145 Cr, well below the ₹210 Cr/quarter run-rate needed for 20% growth.

With only partial recovery expected in Q2, the ask rate for H2 jumps to ~₹250 Cr/quarter — far above Supriya’s historic peak of ₹186 Cr (Q3 FY25), making the guidance extremely challenging.

Strong Margins:

EBITDA margin was 35.6% (above the guided band of 33–35%)

H2-Centric Recovery Needed: Management reiterated confidence that lost volumes from Q1 will be recovered in H2, aided by Module E ramp-up, DSM contract volumes, and Ambernath FDF facility contributions

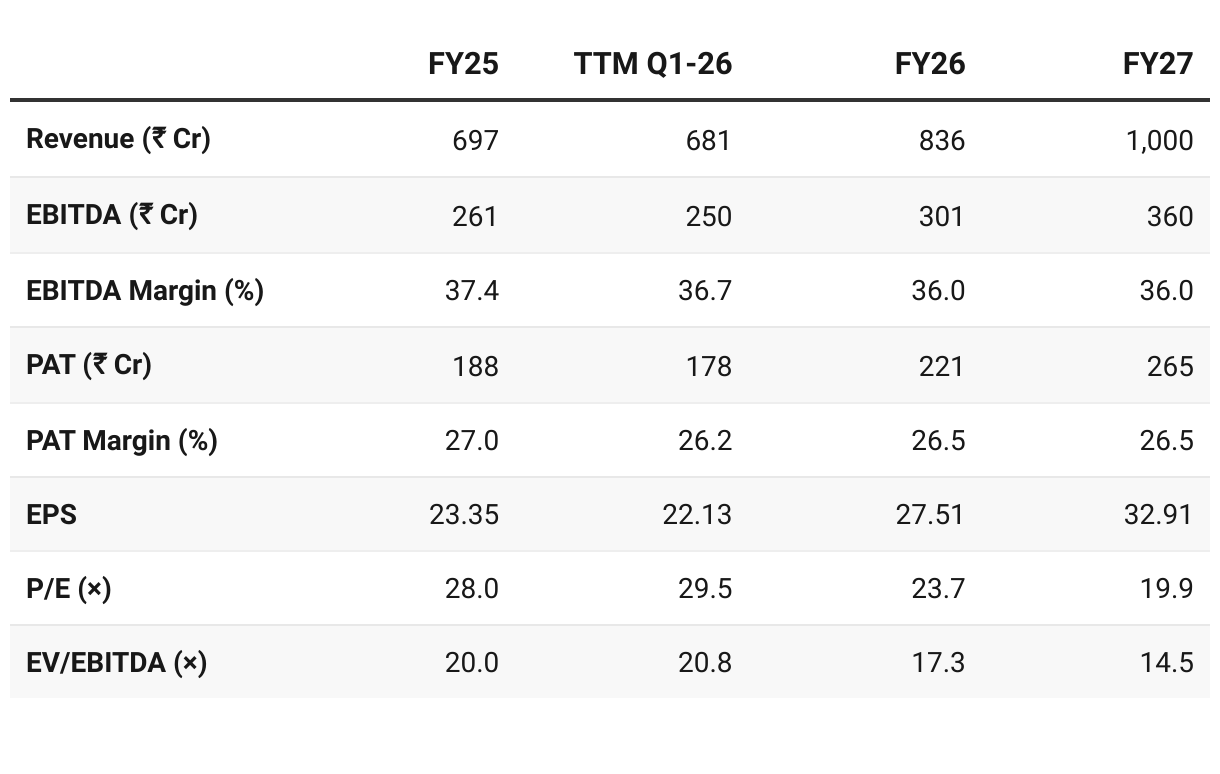

7. Valuation Analysis

7.1 Valuation Snapshot — Supriya Lifescience

CMP ₹653.2; Mcap ₹5,286.86 Cr

Rich on Trailing, Reasonable on Forward:

Valuations look stretched on TTM multiples (P/E ~29.5×, EV/EBITDA ~20.8×), but moderate on FY27 with P/E ~20× and EV/EBITDA ~14.5× as earnings compound.Valuation Hinges on Growth Delivery:

Execution as per guidance is critical given that demand is intact.Attractive Valuations Beyond FY27:

With growth driven by new products, entry into new categories, and scale-up in CDMO, Supriya is well placed to sustain ~20% growth in FY28. If this momentum continues, valuations could ease to mid-teens on P/E and ~10× EV/EBITDA, making the stock look attractive from a long-term perspective.

Supriya trades at premium multiples on trailing basis, but forward valuations look reasonable (FY27 P/E ~20×) if growth guidance is delivered. Sustained 20%+ growth, margin stability, and CDMO/CDO ramp-up could drive a valuation re-rating.

Risk: The “ask rate” for FY26 is aggressive; any slip in H2 execution could delay earnings compounding and cap near-term upside.

7.2 Opportunities at Current Valuation

Growth Drivers Post-FY27

New Products: Management plans 3–4 launches annually, across anesthetics, ADHD, cardiovascular, anti-diabetic, vitamins. These are larger TAM molecules (e.g., anesthetic ~$300M, ADHD ~$90M API market).

CDMO/CMO Scaling:

DSM contract → ₹60 Cr peak annual revenue (by FY27–28).

Whey Protein → ₹40–100 Cr revenue potential in 4–5 years.

Contrast Media → 20–25% market share ambition over 3–4 years.

Ambernath FDF facility: Will add formulations (tablets, liquids, injectables) from FY27 onwards, diversifying revenue beyond APIs.

Patalganga expansion: Provides runway for next capacity cycle (API + formulations).

Supriya’s long-term rerating hinges on proving it can move from being an API-led exporter to a broader CDMO + formulations growth story. If 20% growth continues post-FY27, forward valuations look attractive, with room for wealth creation.

7.3 Risks at Current Valuation — Supriya Lifescience

Execution Challenge in FY26: To hit FY26 guidance, Supriya must deliver well above its historic peak — a steep run-rate.

Regulatory & Ramp-Up Risks: New products (ADHD, Contrast Media, Anesthetics) require 9–12 months for CEP/DMF approvals; delays could defer revenue contribution.

Therapy & Geography Concentration: High reliance on anesthetics (~50% revenue) and Europe/LatAm markets increases exposure to demand shifts or regulatory tightening.

CDMO Scale-Up Uncertainty: While DSM/Whey Protein contracts offer potential, they are new categories with execution, adoption, and market-acceptance risks.

Execution in H2 FY26, regulatory approvals (CEP/DMF), CDMO contract scale-up, and capacity commissioning at Ambernath/Patalganga.

Share your best AI hacks for stock analysis.

Top hacks will be shared back with everyone — you get to learn from the best too.

Previous coverage on SUPRIYA

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer