Supriya Lifescience: PAT growth of 57% & Revenue growth of 22% in Q1-25 at PE of 31

FY25 revenue growth at 20%+ with 30%+ EBITDA margin. Doubling revenue to Rs 1,000 cr during FY24-27 at a CAGR of 21%. . Maintaining EBITDA margin of 28-30% over the long term

1. API Manufacturer

supriyalifescience.com | NSE : SUPRIYA

Supriya Lifescience Ltd., a cGMP-compliant business in API manufacturing and a focus on products from a variety of therapeutic segments, including anti-histamine, anti-allergic, vitamin, anaesthetic, and anti-asthmatic.

2. FY20-24: PAT CAGR of 13% & Revenue CAGR of 16%

3. Weak FY23: PAT down 41% and Revenue down 13% YoY

4. Strong FY24: PAT up 33% & Revenue up 24% YoY

5. Strong Q1-25: PAT up 57% & Revenue up 22% YoY

PAT up 23% & Revenue up 1.5% QoQ

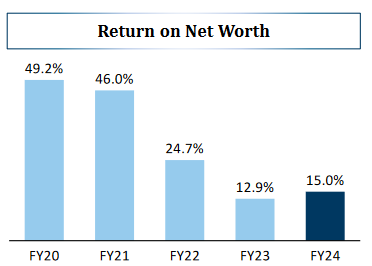

6. Business metrics: Stabilizing return ratios

7. Outlook: Revenue growth of 20%+ in FY25

i. FY25: Revenue growth of 20%+

In terms of revenue growth, we have always maintained that year on year, you can expect upwards of 20% growth from our side. And that is still the number that we would like to maintain for the next three years.

ii. FY25: Expectations for 30%+ EBITDA margin

Management is indicating to a 30%+ EBITDA margin in FY25, higher than FY4. The revised guidance in EBITDA margin would be made looking at 2-25 results

We are very confident that 28% to 30% we will be able to maintain. The company definitely has potential to achieve higher than 30% because a lot of the new projects the same opportunities come at a more premium margin that is what we benchmark ourselves against.

iii. FY24-27: 21% revenue CAGR

Guiding for revenue of Rs 1,000 cr by FY27 from Rs 570 cr in FY24, implies a revenue CAGR of 21% which is in the range of 20%+ guided by management in FY25 and looks reasonable.

I would say, that the INR1000 crores with the margins we are committing, we will be able to achieve that.

iv. FY27: CMO CDMO to be 18-20% of revenue with better than 28-30% margins

We have large CMO, CDMO opportunities in our hand. Those will also scale up in the next three years.

In the INR1,000 crores we anticipate about 18% to 20% coming in from CMO, CDMO. It is in fact a better margin proposition than what you are guiding at 28% to 30%

9. PAT growth of 57% & Revenue growth of 22% in Q1-25 at a PE of 31

10. So Wait and Watch

If I hold the stock then one may continue holding on to SUPRIYA

Coverage of SUPRIYA was initiated after Q1-24 results. The investment thesis has not changed after a good FY24 and equally strong Q1-25. After a delivering 20%+ revenue growth there is confidence in the management to deliver as per the 20%+ growth guidance for FY25.

SUPRIYA is in the middle of a strong run. It has delivered increasing PAT on a sequential QoQ basis for the last 3 quarters.

SUPRIYA is working on a roadmap of a revenue of Rs 1,000 cr by FY27

Capacity enhancement for further backward integration for existing products, new product rollouts and CMO/CDMO opportunities

In the INR1,000 crores we anticipate about 18% to 20% coming in from CMO, CDMO.

11. Or, join the ride

If I am looking to enter SUPRIYA then

SUPRIYA has delivered PAT growth of 57% & Revenue growth of 22% in Q1-25 at a PE of 31 which makes valuations fairly priced in the short term..

Outlook for revenue growth of 20% in FY25 while maintaining EBITDA margins at with 30%+ EBITDA margin at a PE of 31 makes the valuations reasonable from a medium term perspective.

From a longer term perspective, the growth guidance of the management to deliver a top-line of Rs 1,000 cr by FY27 and grow at CAGR of 21% for FY24-27 creates opportunity in the stock over the longer term.

Previous coverage on SUPRIYA

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer