Styrenix Performance Materials: PAT growth of 45% & revenue growth of 26% in 9M-25 at a PE of 22

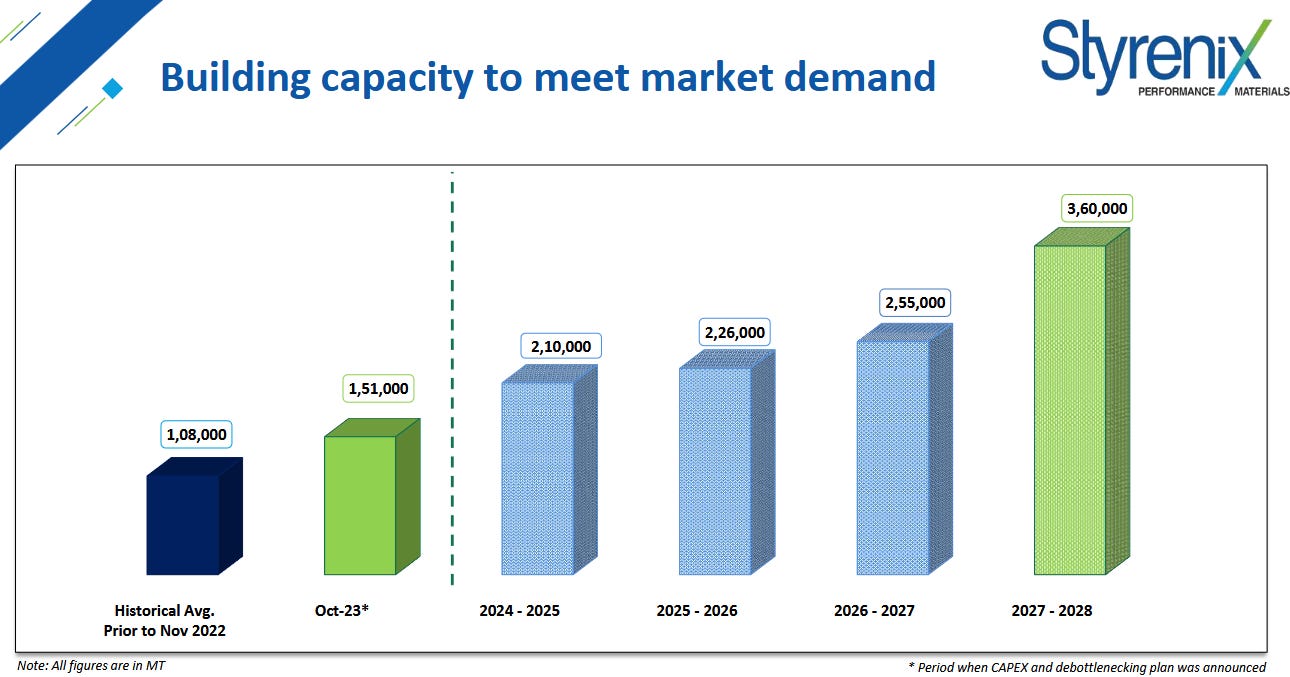

Volume growth guidance of 15-20% till FY28. FY24-28 capacity to expand at a CAGR of 20%. Positive outlook based on the capacity expansion planned till FY28

1. Market leader in ABS & SAN in India….Growing in polystyrene and other polymer segments…

styrenix.com | NSE: STYRENIX

2. FY20-24: Weak Performance

3. FY24: PAT down 5% & Revenue down 7% YoY

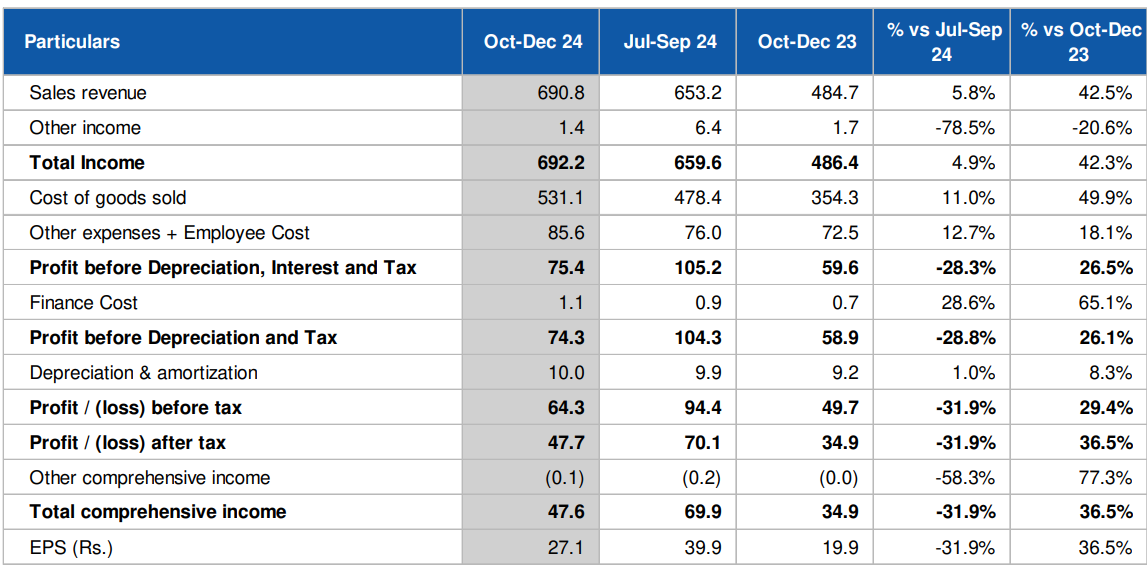

4. Q2-25: PAT up 37% & Revenue up 43% YoY

5. 9M-25: PAT up 45% & Revenue up 26% YoY

6. Business metrics: ROE strong even when overall performance was weak

7. Outlook: Volume growth guidance of 15-20%

A "robust demand for our products for nine months of FY ‘25, marking a significant growth trend."

Margins in Q3 lower QoQ due to the absence of extraordinary gains seen in Q2 related to supply chain disruptions.

On a YoY basis, spreads are considered "quite healthy" and have improved.

Higher contribution of polystyrene sales (which historically has slightly lower margins) to the overall volume mix in Q3 also played a role.

2. Acquisition of Ineos Styrolution (Thailand) Co., Limited

Acquisition provides access to new technologies not currently available in India

It adds significant capacity. Thai plant has significant unutilised capacity. This provides "headroom to grow."

Access to established markets and OEM qualifications in key regions like China, Vietnam, Indonesia, Thailand, Japan, and Korea in sectors such as automotive, industry, and household appliances.

Cost of acquisition ($22 million) is considered "highly attractive" and expected to be a "very rewarding acquisition for the company and its shareholders."

3. Expansion Plans (India)

Maintains its volume growth guidance of 15% to 20% for the India business, driven by increased capacities from debottlenecking and expansions.

8. PAT growth of 45% & Revenue growth of 26% in 9M-25 at a PE of 24

9. Hold?

If I hold the stock then one may continue holding on to STYRENIX.

Based on 9M-25 performance one can look forward to a strong FY25 even though Q4 is expected to be average.

Market outlook for Jan to Mar looks to be average industry growth

So, in Q4, again, the full volumes of ABS would also be available to us from our rubber plant

We will see even higher throughputs in Q4 in polystyrene.

STYRENIX is on track to deliver on its guidance of 15-20% volume growth

YTD FY’25 Performance (December 2024): Sales volume increased by 14.3% YoY (137 KT vs. 120 KT).

The longer term outlook is strong given the capacity expansions in place. One should start seeing the impact of the de-bottlenecking from FY26

STYRENIX anticipates continued growth overall beyond FY25

Revenue growth in India operations driven by volume increases from debottlenecking & capacity expansions.

Thailand business presents significant potential for revenue growth through increased capacity utilisation, expansion in existing markets, and leveraging product and market synergies with the India business.

10. Buy?

If I am looking to enter STYRENIX then

STYRENIX has delivered PAT growth of 45% & Revenue growth of 26% in 9M-25 at a PE of 22 which makes valuations reasonable in the short term.

STYRENIX is guiding for 15-20% volume growth over the longer term which at a PE of 22 which makes valuations reasonable in the short term.

STYRENIX is guiding to grow capacities at CAGR of 20% for FY24-28 which should reflect in the business performance and at PE of 22 makes the valuations reasonable from a longer term perspective.

One needs to keep in mind the following risks factors which could impact the STYRENIX

Thailand turnaround delayed beyond FY27, utilization remains ~60–65%.

ABS expansion (50 KT) faces ramp-up delays or under-utilization.

India demand grows slower (5–6% CAGR), affecting ABS off-take.

Commodity pricing pressure on ABS/PS due to imports, competitive intensity.

Raw material (styrene, rubber) cost volatility, squeezing spreads.

Margins remain suppressed due to higher PS share and underutilized ABS capacity.

Previous Coverage of STYRENIX

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer