Styrenix Performance Materials: PAT growth of 49% & revenue growth of 19% in H1-25 at a PE of 24

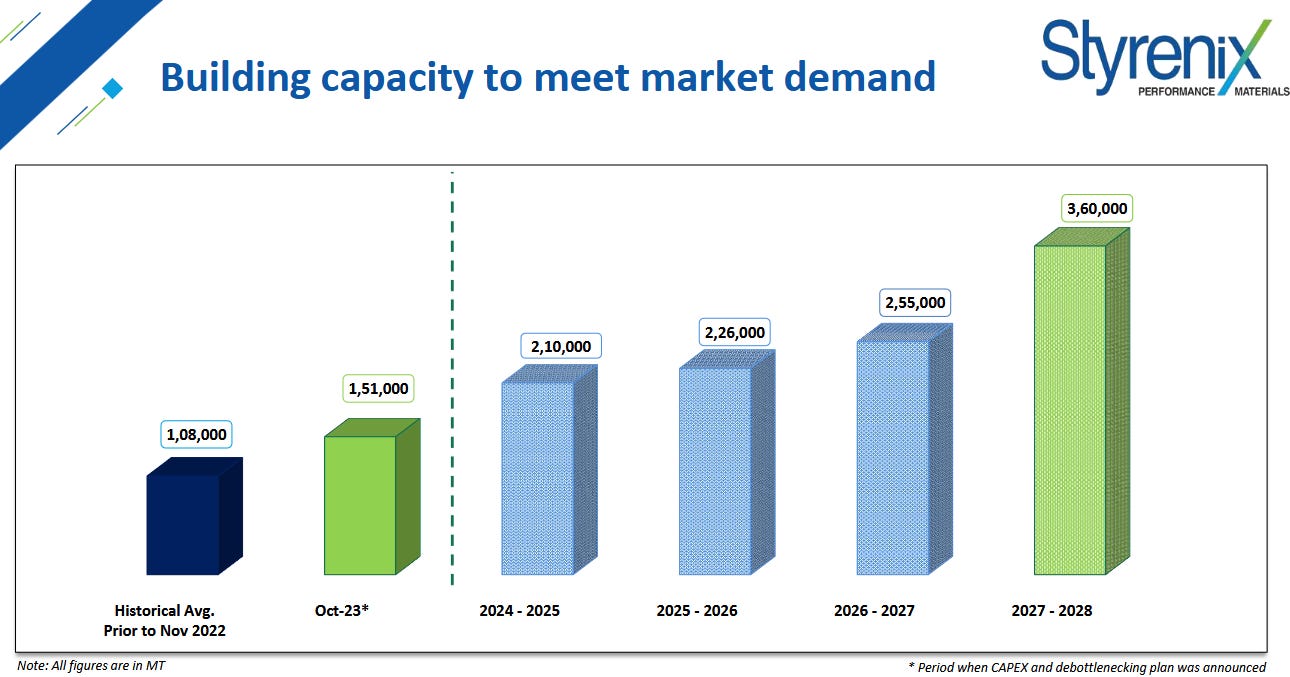

Volume growth guidance of 20% for FY25. FY24-28 capacity to expand at a CAGR of 20%. Past performance does not inspire confidence. Positive outlook based on the capacity expansion planned till FY28

1. Market leader in ABS & SAN in India….Growing in polystyrene and other polymer segments…

styrenix.com | NSE: STYRENIX

2. FY20-24: Weak Performance

3. FY24: PAT down 5% & Revenue down 7% YoY

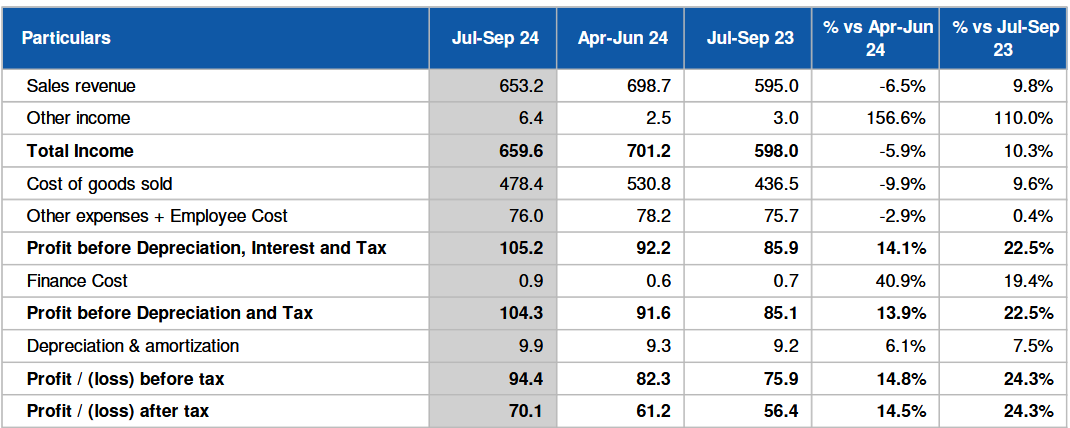

4. Q2-25: PAT up 24% & Revenue up 10% YoY

PAT up 15% & Revenue down 7% QoQ

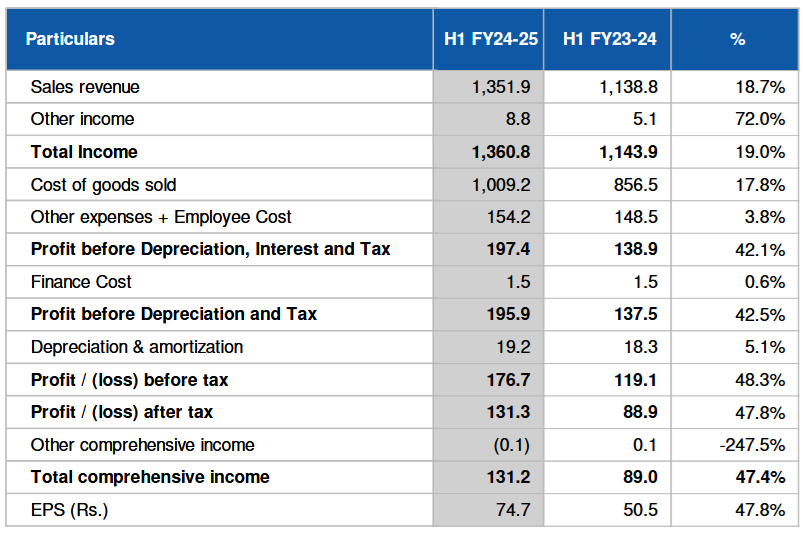

5. H1-25: PAT up 48% & Revenue up 19% YoY

6. Business metrics: ROE strong even when overall performance was weak

7. Outlook: 22% Revenue CAGR for FY24-26

Financial Performance and Growth:

Strong H1 FY25: The company experienced robust demand for its products, marking a significant growth trend.

Sales volume increased by 6.5% to 90.1 KT compared to 84.7 KT in H1 FY24.

Q2 FY25 Performance: Sales volumes decreased by 13.5% compared to Q1 FY25 and 7.3% compared to Q2 FY24 due to a shutdown for debottlenecking at the Dahej plant. However, Q2 FY25 saw better price realization and improved profitability.

Capacity Expansion:

Polystyrene (PS): Debottlenecking at Dahej was completed, increasing capacity from 66 KT to 100 KT. The full benefit of this capacity increase is expected in the next financial year.

Lost sales due to the shutdown were approximately 3,500 to 4,000 tons.

ABS: Debottlenecking of ABS is planned for the second half of the financial year.

HIPS: The company is working with Toyo Engineering for a 150 KTPA expansion at Dahej. An engineering study is underway to determine the exact CAPEX, capacity augmentation, and timeline. They anticipate more than doubling the current HIPS capacity.

Overall Production: The company maintains its guidance of approximately 2 lakh tons of production for FY25.

Product Mix: The company is focused on improving its product mix by adding value-added grades to enhance overall profitability.

New brands, STYROLOY (blends of PC ABS, Nylon ABS, etc.) and ASALAC (weatherable ASA), have been launched. While current sales are still low, they are experiencing rapid adoption and expect significant growth in the next financial year.

There is a push to increase the percentage of OEM sales, particularly in polystyrene, where they are aiming for 30% or higher.

International Expansion: A subsidiary has been established in the UAE to serve as a base for international activities as the company expands its capacities.

Key Factors Affecting Profitability:

Raw Material Prices: Styrene, butadiene, and acrylonitrile are the key raw materials. Prices of styrene and acrylonitrile have largely remained stable, while butadiene prices increased year-on-year.

The company has been able to pass on raw material price increases to customers.

Freight Costs: International freight costs had a temporary impact in July, which normalized in August and September.

Product Optimization: Better price realizations were achieved through optimization of product formulations and pricing.

Guidance and Outlook:

Management has stated that it is best to look at the company's annual performance, as quarter-on-quarter changes can be misleading due to market fluctuations.

The company is focused on cost rationalization, improved operating leverage through increased capacity, and a better product mix.

They anticipate that the Indian market will be able to comfortably absorb the additional capacities being added both by them and competitors, and this would largely come from a reduction in imports.

The company aims to meet the demands of domestic customers before venturing internationally.

While crude oil prices do impact some base chemicals, the correlation between crude oil and styrene monomer is not always elastic, therefore its impact is not direct. Contracts with customers are often based on transparently published commodity pricing.

Other Points

A large part of the GP change in Q2 was due to better price realization, which resulted from higher pricing due to freight issues and product optimization.

The full-year benefit of the switch to renewable fuel sources in the Dahej plant is expected in the next financial year.

The company is on track with its expansion plans.

The company is seeing good demand from the auto sector, including in EVs, despite some slowdown in certain segments.

8. PAT growth of 48% & Revenue growth of 19% in H1-25 at a PE of 24

9. Hold?

If I hold the stock then one may continue holding on to STYRENIX.

Based on H1-25 performance one can look forward to a strong FY25 providing a reason to continue with STYRENIX. However one should keep a lookout for the performance in Q3-25

We expect Q3 to be average based on historical industry trends.

STYRENIX is on track to deliver on its guidance of 2 lakh MT of production

2 lakh is what we have given on production. And I think, like I said, our sales volume would follow that and would probably, we will be in line with whatever we have said in terms of growth for this year.

STYRENIX is in the middle of a strong run and has delivered 4 consecutive quarters of PAT growth starting Q3-24. One can hold on as long as the underlying business momentum is strong even though Q3-25 is expected to be an average quarter

The longer term outlook is strong given the capacity expansions in place. One should start seeing the impact of the de-bottlenecking from FY26

10. Buy?

If I am looking to enter STYRENIX then

STYRENIX has delivered PAT growth of 48% & Revenue growth of 19% in H1-25 at a PE of 24 which makes valuations reasonable in the short term.

STYRENIX did a sales volume of 1,65,189 MT and is guiding for 2,00,000 MT production (sales volume would follow that) in FY25. This would be 20% volume growth in FY25 which at a PE of 24 makes valuations look reasonable from a FY25 perspective.

STYRENIX is guiding to grow capacities at CAGR of 20% for FY24-28 which should reflect in the business performance and at PE of 24 makes the valuations reasonable from a longer term perspective.

STYRENIX has not delivered great business performance and hence the execution in FY25 and forward needs to be watch on a quarter to quarter basis.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer