South Indian Bank Q3 FY26 Results: PAT up 9%, Attractive Valuations

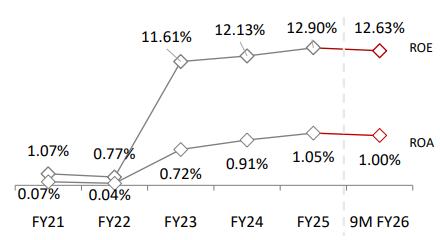

Potential for re-rating of valuation multiples on the back of expanding RoA as NIM's have bottomed out with loan book mix shift towards higher-yield secured retail loans

Confused about analyzing bank stocks? Most investors get confused about NIM’s and CASA. Here’s how to actually do it right.

1. Private Sector Bank

southindianbank.com | NSE: SOUTHBANK

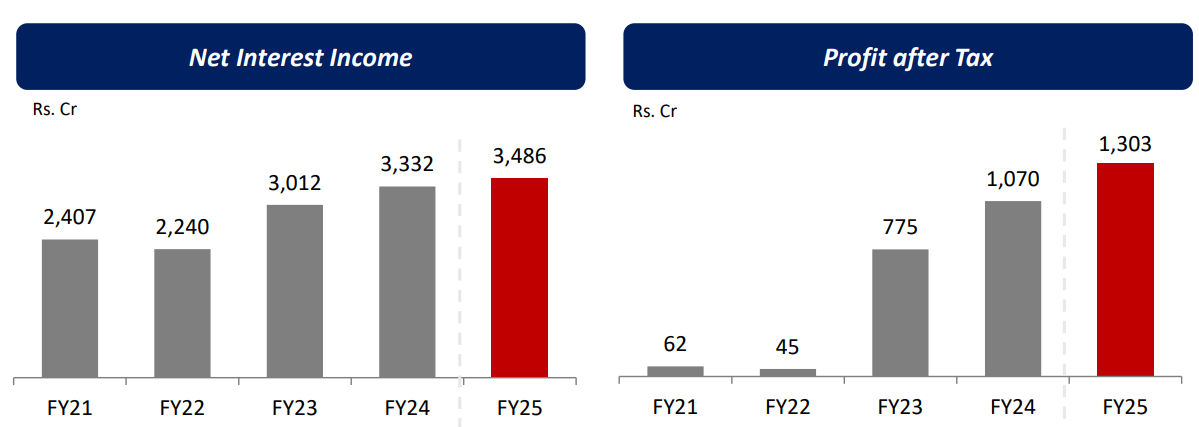

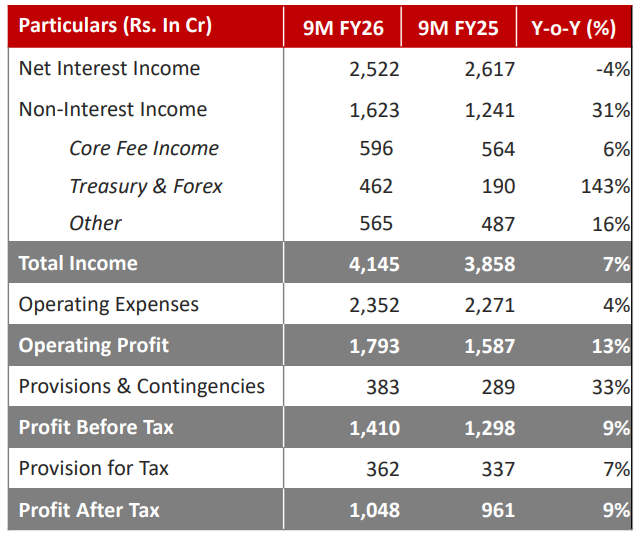

2. FY21-25: PAT CAGR of 114% & Net Interest Income CAGR of 10%

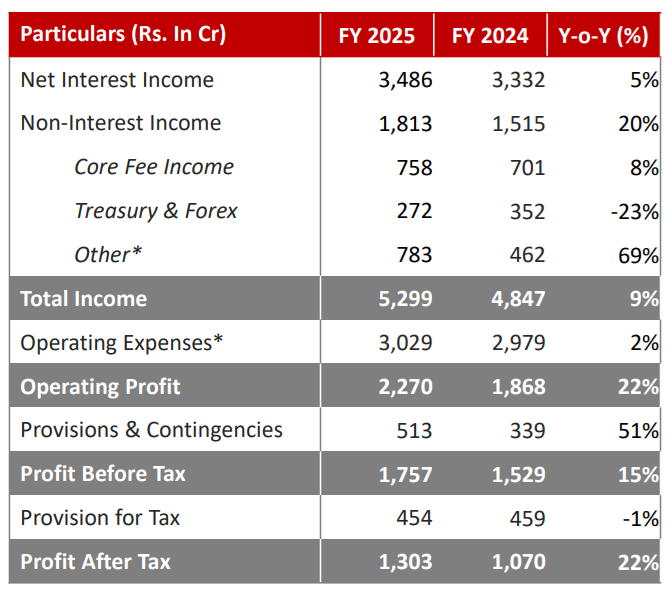

3. FY25: PAT up 22% & Net Interest Income up 5% YoY

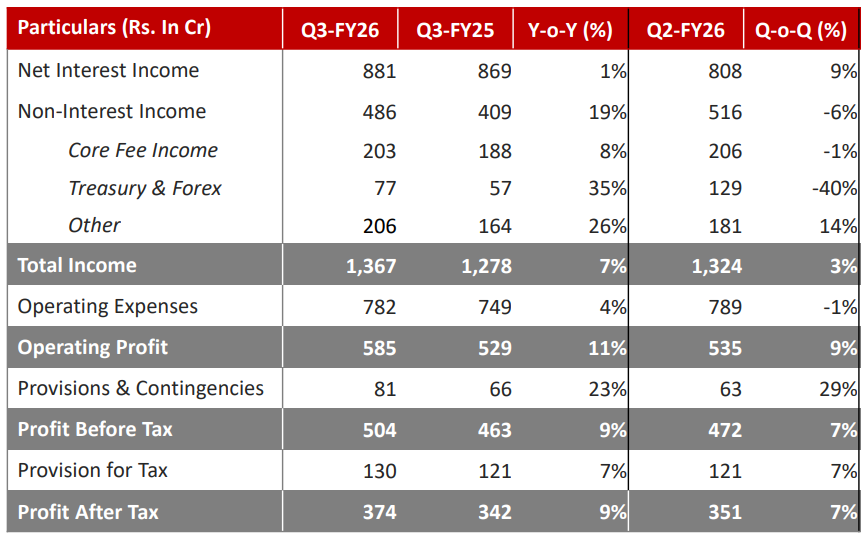

4. Q3-26: PAT up 9% & Net Interest Income up 1% YoY

PAT up 7% & Net Interest Income up 9% QoQ

5. 9M-26: PAT up 9% & Net Interest Income down 4% YoY

6. Business metrics: Improving Return ratios

7. Outlook — 12% loan growth

7.1 Management Guidance

Loan Growth and Asset Mix

Credit Growth: Maintained guidance for loan growth at over 12%. M

Q4 being a busy season — likelihood of increased demand,

Possibility of achieving better than the 12% target.

Higher growth rate indicated for FY27 — higher than the current 12% but lesser than 20% — one could consider a conservative 15% growth (number to be watched in Q4 26 as management gives guidance for FY27

But we go into the next year our growth will increase from here but we don't want to you know take it to 20% and so on and so forth because that's going to be counterproductive from a P&L standpoint.

Reduction the Corporate book: Targeting ~33% of advances vs. the current 40%

Specific Segments:

Grow Retail, MSME, and Gold loan segments faster than Corporate segment.

Aim to double the monthly disbursals in the MSME Business Group

Profitability (NIMs and ROA)

Net Interest Margins (NIM):

Believe NIMs have stabilised and plateaued at current levels.

Slight downward pressure due to a 25 basis point repo rate cut — expected to be counterbalanced by the repricing of approximately 20% of the deposit book during the quarter.

If the book pivots successfully towards higher-yielding assets, NIMs are expected to climb.

Return on Assets (ROA):

Expects to operate in the range of 1.00% to 1.15% in the near term.

Expectation is to end the next 12-month period with ROA of 1.15-1.20%

Aspirational goal to reach an ROA of 1.4-1.5% over a three-year horizon.

Acknowledge this is a "tough ask," — believe it is achievable as internal dynamics change and the portfolio mix shifts toward higher-yielding assets

Asset Quality and Credit Costs

Credit Costs: Near-term credit costs would be approximately 7 to 8 basis points, which is roughly half the slippage rate.

Slippages: Slippage ratio for the quarter was 16 basis points.

Expects recoveries exceeding new NPA slippages to continue over the next 12 months.

Liabilities and Branch Expansion

Deposits:

Align liability growth with asset growth, targeting approximately 12%.

Will not aggressively raise rates to chase liability growth

Preferring to maintain tight checks on deposit costs,.

Branch Network:

After two years of pause — plans to add 10-12 branches in the near term.

Expansion will focus on core areas such as Tamil Nadu, Andhra Pradesh, Telangana, and Karnataka.

Gold Loans — ~22% of the total book

Has not currently imposed a cap on the gold loan portfolio,

Monitoring risks closely.

7.2 9M FY26 Performance vs FY26 Guidance

Loan Growth — On-track:

Gross advances growth of 11.3% YoY in-range of the 12% target.

Segment Details:

Aimed for 20%+ growth in Retail & MSME to offset slow corporate growth

Retail advances grew 23% YoY

Gold loans grew 26% YoY.

MSME disbursements grew 45% YoY

Retail disbursements grew 60% YoY,.

Deposit Growth — Targeted growth “north of 10%”

Performance (Exceeded): Total deposits grew by 12% YoY

CASA balances grew by 15% YoY, significantly higher than the overall deposit growth, helping manage costs.

Profitability (ROA and NIM)

Return on Assets (ROA): — ROA in the “1.00% ballpark” for FY26

ROA for 9M FY26 stood exactly at 1.00%.

Trend is positive, with Q3 FY26 ROA coming in higher at 1.07%.

Net Interest Margin (NIM):

NIMs to bottom out in Q2 & stabilize or improve in Q3

NIM improved to 2.86% in Q3 FY26 from 2.80% in Q2, aligning with the guidance that margins had bottomed out.

Asset Quality

Expected slippages to remain controlled and for recoveries to exceed new NPA additions

In Q2, they guided that full-year slippages would likely be double the half-year figure (approx. INR 380 crores) with no material degradation.

Performance (Exceeded):

Slippage ratio of 16 bps in Q3 FY26, significantly lower than the 33 bps in Q3 FY25.

NPA Ratios: GNPA improved to 2.67% (from 4.30% YoY) and NNPA improved to 0.45% (from 1.25% YoY).

SOUTHBANK noted that recoveries continue to exceed new NPA slippages.

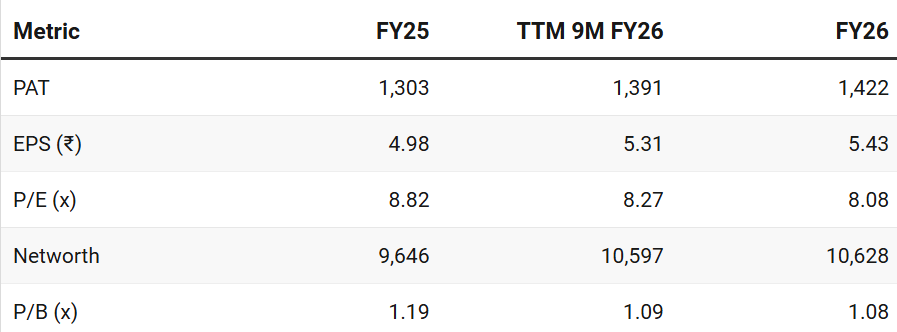

8. Valuation Analysis

8.1 Valuation Snapshot — South India Bank

Current Market Price = 43.91; Market cap = ₹1,521.3 Cr

ROA expansion from 1% to 1.15%+ in FY27

Credit growth higher than the 12% achieved in FY26

bottoming out of NIM

Reduction in the corporate book

Implies that SOUTHBANK is available at less than 1x P/B for FY27

Potential of P/B re-rating to 1.25-1.5x P/B

8.2 Opportunity at Current Valuation

Valuations are not demanding at current pace of growth

Current multiples indicate — lack of confidence in sustainability of growth and quality of growth

Future opportunities not discounted in SOUTHBANK on account of

ROA expansion from 1% to 1.15-1.2% in FY27 and longer term-goal of 1.4-1.5% would drive strong growth in net-worth

Indications of higher than 12% growth in FY27 while management is clear that currently they cannot chase 20% kind of growth

NIM’s bottoming out and improving

Mix shift towards higher-yield secured retail loans — Texture of overall book changing as corporate book reduces and proportion of retail and MSME increases.

8.3 Risk at Current Valuation

Valuation Isn’t Demanding — But Assumes Steady Execution

At less than 1x P/BV for FY27:

Stock is not pricing in breakout — but assumes no slip-ups either

Any drag in MSME momentum, margin compression, or system slippage could delay ROA lift

Previous Coverage of SOUTHBANK

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer