South Indian Bank Q1 FY26 Results: PAT up 10%, Attractive Valuations

Retail is driving asset-side growth; focus on quality over pace. Profitability intact despite NII pressure. Book is clean. Valuations offer re-rating potential

Confused about analyzing bank stocks? Most investors get confused about NIM’s and CASA. Here’s how to actually do it right.

1. Private Sector Bank

southindianbank.com | NSE: SOUTHBANK

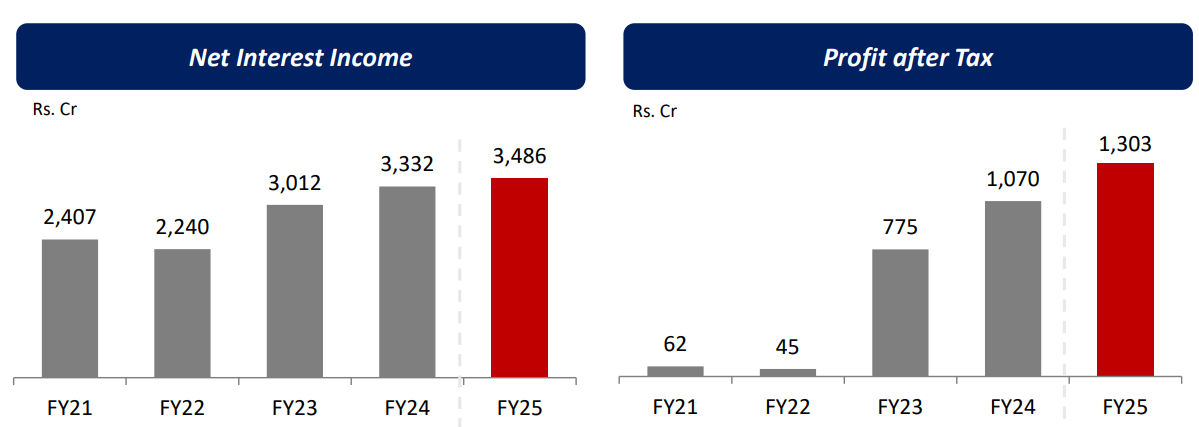

2. FY21-25: PAT CAGR of 114% & Net Interest Income CAGR of 10%

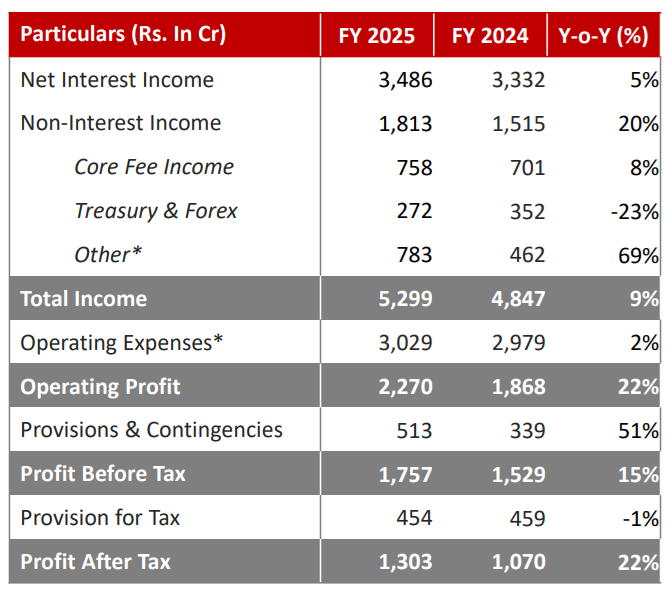

3. FY25: PAT up 22% & Net Interest Income up 5% YoY

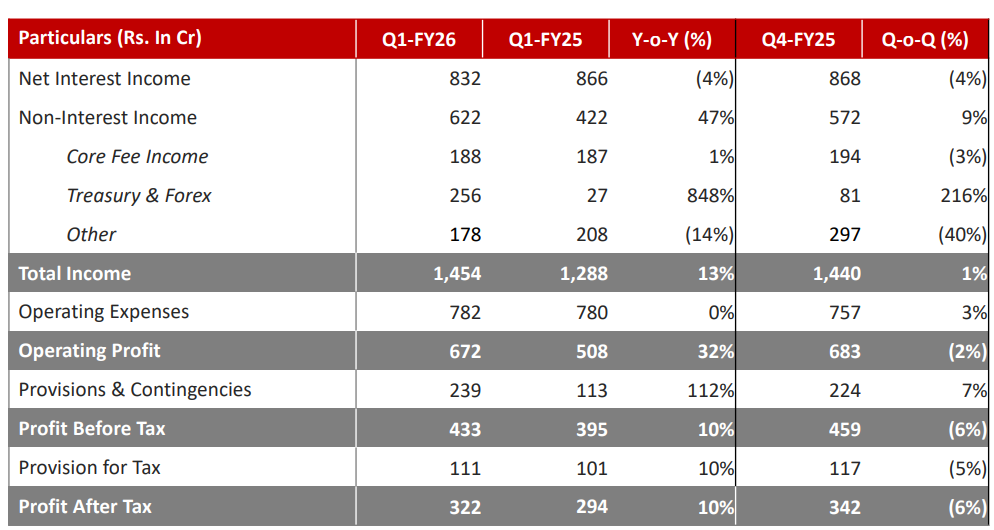

4. Q1-26: PAT up 10% & Net Interest Income down 4% YoY

Profitability & Core Operations: Core profitability intact despite NII pressure

Net Profit rose 10% YoY despite a 4% decline in NII.

Supported by non-interest income and low slippage

NIM: 3.03% — down from 3.26% YoY due to repo-linked rate reset

Cost of funds didn’t decline in sync

Non-Interest Income: +47% YoY, boosted by ₹256 Cr treasury gains

Operating Profit up 32% YoY, driven by tight cost control and strong treasury gains (₹256 Cr).

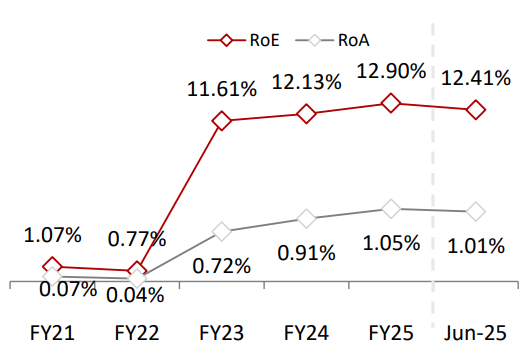

Return on Assets (RoA): Stable YoY; supported by treasury income

ROE: Slightly down due to stable PAT and growing base

Cost-to-Income Ratio: Flat YoY; expenses well-managed

Growth: Retail is driving asset-side growth; focus is on quality over pace

Advances: +8% YoY — Strong momentum in retail

Home loans +66%, Auto +27%, Gold +7%

Deposits: +9% YoY — Strong traction in current account and NR deposits

Branch Productivity (SVA): +60% YoY

Big jump in productivity, especially outside Kerala

Asset Quality: Book is clean and well-covered

Gross NPA: 3.15% (vs. 4.5%) — Sharp improvement due to legacy resolution

Net NPA: 0.68% (vs. 1.44%) — Among best in peer group

PCR (incl. write-offs): 88.82% — Conservative stance maintained

Slippage Ratio: 0.20% — Very low fresh stress addition

Credit Costs: High in Q1 — Front-loaded using treasury income; expected to taper

Capital Adequacy: Capital buffer sufficient for targeted growth; no raise required

CRAR: 19.48% — Tier 1 Capital: 18.25%

Liquidity & Funding: Granular, retail-led liabilities support growth flexibility

CASA Ratio: 32.06% — Flat YoY; CA (Current Accounts) up 21%

Loan-to-Deposit Ratio (LDR): ~79% (implied) — Balanced, allows for steady credit expansion

NR Deposits: >30% of total — Stable, low-cost source

Operational Efficiency & Strategic Direction: Turnaround is digital-first, high-yield oriented, and execution-focused

Digital Infrastructure— 12+ platforms rolled out (e.g., GST Power, EduPower, Lab Power)

MSME Strategy: Geographies split between South (ex-Kerala) and Rest of India

61% of MSME book now outside Kerala

Loan Book Shift: Gradual move away from short-duration corporate loans

Focus: Retail, MSME, LAP, Gold

Execution Levers:

No new branches; sweating existing network

Hub-and-spoke underwriting model launched in key states

Summary Assessment

Profitability: Resilient

Growth: Quality-led, not volume-chasing

Asset Quality: Strongest in years

Capital: Fully adequate

Liquidity: Stable and sticky

Strategy: Executing well, aligned with ROA target

Q1 FY26 confirms structural improvement. Retail and MSME momentum is building. Margin pain remains near-term — but trajectory is right.

5. Business metrics: Improving Return ratios

6. Guidance & Strategic Outlook

Credit Growth

FY26 credit growth target: North of 12%

MSME loan book expected to grow at 15–18% in FY26.

Significant push into secured, better-yielding segments like:

Gold loans (expected to scale further)

MSME loans

LAP (Loan Against Property)

Affordable housing (early-stage efforts underway)

Deposit Growth

Expected to match or exceed credit growth.

~30% of deposits come from NRI segment, predominantly low-cost CASA.

Bank confident of continuing strong deposit mobilization without aggressive pricing.

Return on Assets:

Expecting FY26 ROA to be same as FY25 at 1.01%, increasing to 1.15% by FY27.

FY26: ROA in the 100 basis points neighborhood.

FY27: As the environment becomes a little bit more benign i.e. our cost of funding reduces in line with the repo rate cuts that have taken place the the return on assets will improve in the coming year and we think that at that point in time we'll be closer to about 115 basis points or thereabouts

Margins and NIMs

NIMs may remain under pressure in the near term due to external benchmark cuts (100 bps passed through).

Expect NIM bottoming out in Q2 FY26, with recovery beginning Q3 onwards, assuming:

No further repo rate cuts

Normalization in asset pricing pressure

Incremental growth from high-yield segments

Credit Costs & Asset Quality

Credit cost to trend lower in remaining quarters of FY26.

Q1 had elevated provisioning, funded by ₹256 Cr treasury income.

Slippages to remain <1% (20 bps in Q1, annualized ~80 bps).

Net NPA at 0.68%, no incremental aggressive provisioning expected unless unexpected events arise.

Branch Network

No near-term branch expansion.

Focus is on sweating existing branches, improving branch productivity (already up 60% YoY).

Expansion in future likely to be limited to Peninsular India, Maharashtra, Gujarat, NCR.

Operating Leverage & Cost Efficiency

Operating expenses largely flat; hiring will now increase but tied to productivity.

Aim is to maintain positive operating leverage in FY26:

Q1: Revenue up 13%, Opex flat ⇒ Operating Profit up 32%.

Medium-Term Aspirations (3-Year Horizon)

ROA Target: 1.4–1.5% by FY28 (vs 1.01% in Q1 FY26).

Will be driven by:

Higher share of MSME/retail loans

Improving yields

Cost stability and digital process efficiency

Portfolio Transformation:

Gradual exit from short-tenure, low-yield corporate book.

Rebalance into granular, higher-yield, secured retail/MSME mix.

Execution Enablers

New digital lending platforms (e.g., GST Power, LAB Power) now deployed pan-India.

Enhanced hub-and-spoke distribution model in key growth states: Karnataka, Maharashtra, Gujarat, Tamil Nadu.

Improved underwriting capacity via field-based acquisition and processing teams.

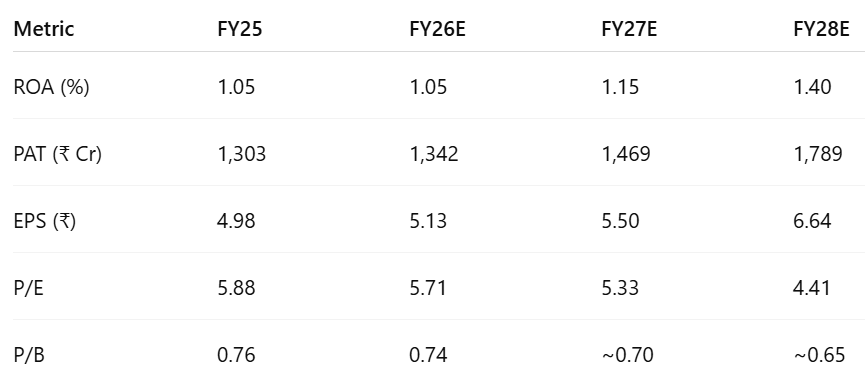

7. Valuation Analysis

7.1 Valuation Snapshot — South India Bank

Assumptions

ROA projections are aligned with management’s forward guidance.

Asset Base is conservatively held constant at ₹1,27,770 Cr (Q1 FY26 level) through FY28 for simplicity, even though actual growth is expected. This results in a more conservative PAT estimate across forecast years.

For P/B Valuation:

Book value increases annually based on fully retained earnings; no dividend payouts are assumed.

No fresh equity issuance or dilution is factored in.

Book value excludes the impact of any asset revaluations or extraordinary adjustments.

P/E Ratio Trends (FY25 P/E = 5.88 → FY28 P/E = 4.41)

Despite growing EPS (₹4.98 → ₹6.64), the stock trades at declining P/E multiples.

Either the market isn’t pricing in growth.

Or rerating hasn’t yet occurred due to historical baggage or perceived execution risk.

P/B Ratio Trends (FY25 P/B = 0.76 → FY26 TTM = 0.74)

PAT accretion implies BVPS ≥ ₹44–46 by FY28, so implied P/B ~0.65 by FY28

Stock trades at a discount to book — market may doubt long-term RoE or franchise strength.

Typically, banks with RoE >12% sustain P/B >1.0.

Profitability + Valuation

Fundamentals Improving:

Steady ROA growth (1.05% → 1.4%)

Healthy EPS and BVPS expansion

PAT CAGR of ~11.2% (FY25–FY28)

Valuation Still Undemanding:

P/E < 6× for a RoA > 1% bank implies lack of confidence in sustainability of growth

P/B < 1.0 even by FY28 implies market isn't pricing franchise value yet

Re-rating Possible if:

South Indian Bank sustains ROA > 1.25% and RoE > 13%

MSME and high-yield retail loan traction improves

Lower credit cost and stable NIMs continue

7.2 Opportunity at Current Valuation

Consistent Profitability, But Re-rating Lagging

Track record matters: SIB has delivered consistent profitability with:

ROA > 1% for the last 6 quarters

FY25 PAT of ₹1,303 Cr; TTM PAT (Q1FY26) at ₹1,331 Cr

FY28 PAT guided to rise ~37% vs FY25, backed by stable execution and internal systems overhaul.

ROA-led PAT growth model (not credit-led):

Asset base assumed stable at ₹1,27,770 Cr, but PAT improves through yield and mix gains.

ROA guidance: 1.05% (FY26E) → 1.15% (FY27E) → 1.4% (FY28E)

Valuation Inexpensive Despite Track Record

Despite improving profitability and ROA > 1%, South Indian Bank trades at:

5.7x FY26E P/E

0.74x TTM P/BV

Earnings yield ~17%+ – undervalued vs cost of capital or PSU/old private peers

At these levels, the market does not fully price:

Operating leverage from productivity gains

Mix shift towards higher-yield secured retail loans

Stable asset quality and capital adequacy (CAR: 19.48%, Tier-1: 18.25%)

Optionality Without Structural Rebuild

Clean-up is behind: asset quality solid (Net NPA 0.68%), provisioning healthy (PCR >88%)

Growth levers in place: tech stack, digital MSME journeys, product/process-led distribution

High CASA share from NR base (30%+ NR deposits) ensures cost of funds advantage

Upside could come from:

Momentum in MSME/gold loans

ROA approaching 1.4% by FY28

Modest re-rating in P/BV (0.7× → 1.0x) as earnings compound

7.3 Risk at Current Valuation

Execution Risk in Composition of Growth

PAT growth is modeled on ROA improvement, not balance sheet expansion:

Asset growth assumption is conservative (static at ₹1.27L Cr)

Slower credit growth could still meet PAT guidance — but it requires:

Yield improvement via mix shift (gold/MSME/LAP)

Cost control and fee income support

MSME and retail scale-up still in early innings, despite strong Q1 trends.

Valuation Isn’t Demanding — But Assumes Steady Execution

At 5.3x–5.7x forward P/E and 0.74x P/BV:

Stock is not pricing in breakout — but assumes no slip-ups either

Any drag in MSME momentum, margin compression, or system slippage could delay ROA lift

Capital Comfort Exists, but Monitoring Required

Capital levels are robust for now (Tier 1 >18%), and no dilution is expected near term

But:

Loan growth or branch scale-up may eventually need capital infusion

Any equity issuance could dilute P/B accretion, unless offset by higher ROA

South Indian Bank offers compounding-led upside with valuation comfort.

While the bank is not in breakout territory yet, it is quietly executing a ROA-driven transformation.

At current valuation, optionalities around multiple re-rating exist — without requiring heroic assumptions.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer