Som Distilleries & Breweries: 12% PAT growth & 33% revenue growth in Q1-25 at a PE of 25

Guiding for Revenue CAGR of 25% for FY24-27 while maintaining EBITDA margins in the 12-13% range. FY25 revenue growth of 17-24%. Promoter stake increasing for the last 10 consecutive quarters

1. Why is SDBL interesting

somindia.com | NSE: SDBL

SDBL is targeting an annual growth rate of 25% to 30% over the next two to three years. The company is confident in sustaining this growth trajectory based on its strong brand portfolio, market position, and expansion plans. For the promised growth, SDBL is available at reasonable valuations 2. Leading Alcoholic Beverage Manufacturer in India

Production of Beer and Blending & Bottling of IMFL

Beer accounted for 97% of total volumes and 93% of the revenue during Q1 FY2025

Product portfolio consists of beer, rum, brandy, vodka and whisky

Three key millionaire brands (sales more than 1 mn cases per annum) – Hunter, Black Fort and Power Cool

After the completion of expansion in April 2024, beer capacity has increased from 30.2 million cases to 35.2 million cases

3. FY20-24: PAT CAGR of 55% & Revenue CAGR of 29%

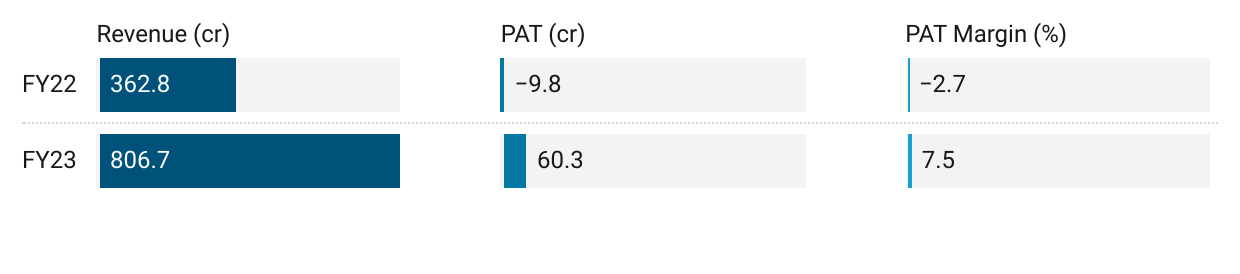

4. FY23: Return to profits after revenue growth of 122%

5. Strong FY24 : PAT up 42% & Revenue up 59% YoY

6. Q1-25 : PAT up 12% & Revenue up 33% YoY

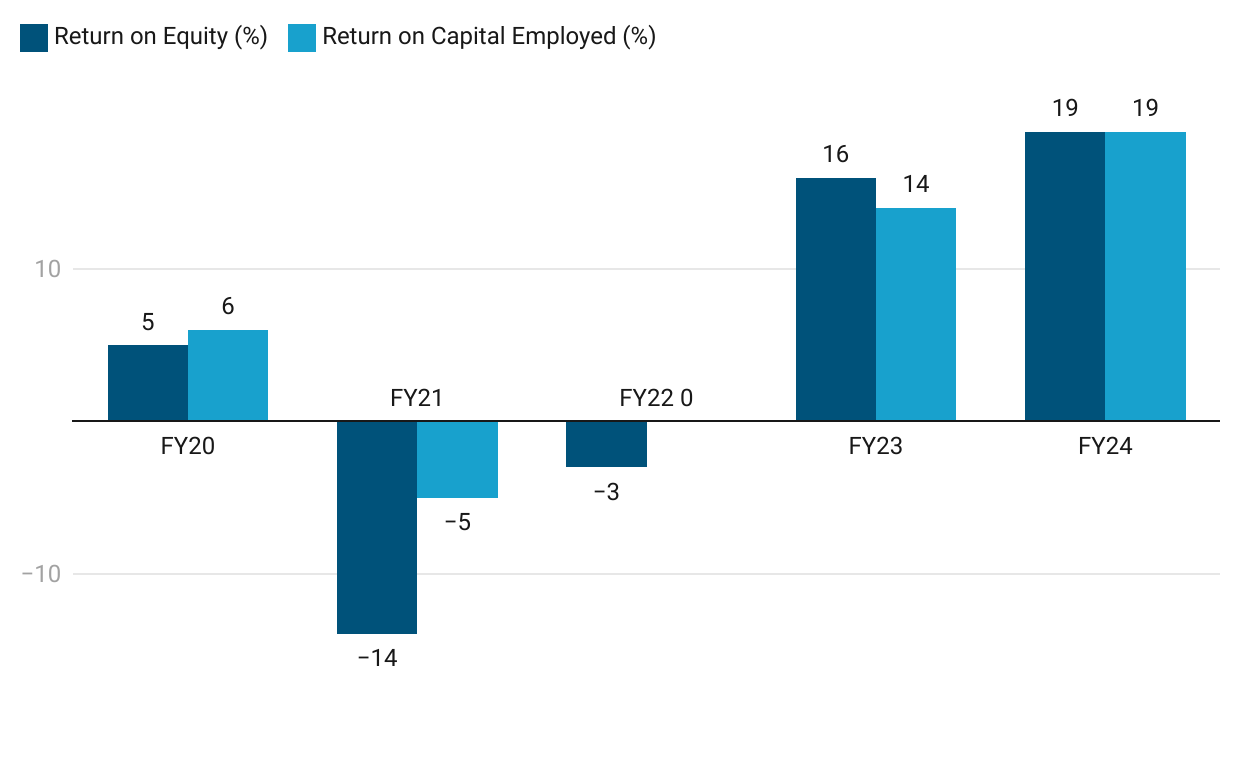

7. Strong & improving return ratios in FY24

8. Outlook: Revenue CAGR of 25% for FY24-27

i. FY25: Revenue growth of 17-24%

Revenue of Rs 1,500-1,600 cr in FY25 implies a 17-24%

We should be able to achieve a top line of between Rs. 1,500 crores to Rs. 1,600 crores, net sales for this year,

Our target for the EBITDA should be in the range of about 12% to 13%.

ii. FY24-27: Revenue CAGR of about 25%

Against an internal target of 25-30% growth, SDBL is pretty sure that it will achieve at least 22-25% revenue CAGR for FY24-27

We are looking at a growth in the range of about 25% to 30% year-on-year for the next two to three years that's I think is our internal target.

And on a sustainable level, I think, for the next 3 years I am pretty sure that we'll be able to maintain a growth rate in the range of 22% - 25%.

9. PAT growth of 12% & revenue growth of 33% in Q1-25 at a PE of 25

10. Do I stay?

If one holds the stock then one may continue holding on to SDBL

Based on Q1-25 performance, SDBL management appears confident to achieve FY25 guidance.

The bottom-line growth lagging top-line growth in Q1-25, leading to reduction in PAT margin needs to be observed closely in SDBL. It could be a cause of concern if the trend continues into the remaining part of FY25.

The performance FY24 is providing confidence that SDBL is on track to deliver Rs 2000 cr of revenue by FY26.

The internal target of 25-30% revenue CAGR for FY24-27 creates a strong outlook for SDBL

The underlying business of SDBL is strong and delivering strong volume growth

Capacity expansion in Odisha plant is providing visibility into growth in FY26

We will be doing capacity expansion for our Odisha plant which should happen by early next year. And hopefully, we should be able to complete it by April of next year.

And we are also eyeing certain acquisition opportunities in states where we want to enter, or we might even look at a Greenfield but may be for next year.

SDBL promoters are increasing their holdings for the last 10 quarters, indicating their bullishness on the business.

11. Do I enter?

If one is looking to enter SDBL then

SDBL has delivered Q1-25 with PAT growth of 12% & revenue growth of 33% at a PE of 25 which makes the valuations reasonable in the short term.

The internal target of revenue CAGR of 25-30% for FY24-27 of which SDBL is pretty sure to achieve a growth rate in the range of 22-25% at a PE of 25 makes the valuations attractive from a longer term perspective.

Previous coverage on SDBL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer