Som Distilleries & Breweries: 42% PAT growth & 59% revenue growth in FY24 at a PE of 30

SDBL is guiding for a revenue of Rs 2,000 cr by FY26, this implies a revenue CAGR of 25% for FY24-26. Promoters are increasing stake in SDBL for the last 9 consecutive quarters.

1. Leading Alcoholic Beverage Manufacturer in India

somindia.com | NSE: SDBL

Production of Beer and Blending & Bottling of IMFL

Product portfolio consists of beer, rum, brandy, vodka and whisky

Three key millionaire brands (sales more than 1 mn cases per annum) – Hunter, Black Fort and Power Cool

New products introduced with seasonal themes to increase consumer traction and engagement –flavors of RTD drinks

Beer accounted for 96% of total volumes and 93% of the revenue during Q4 FY2024

2. FY20-24: PAT CAGR of 55% & Revenue CAGR of 29%

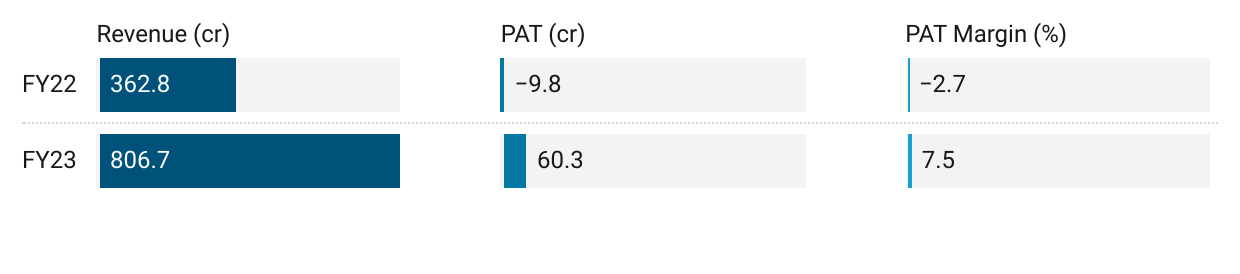

3. FY23: Return to profits after revenue growth of 122%

4. Strong 9M-24 : PAT up 50% & Revenue up 62% YoY

5. Q4-24 : PAT up 19% & Revenue up 52% YoY

6. Strong FY24 : PAT up 42% & Revenue up 59% YoY

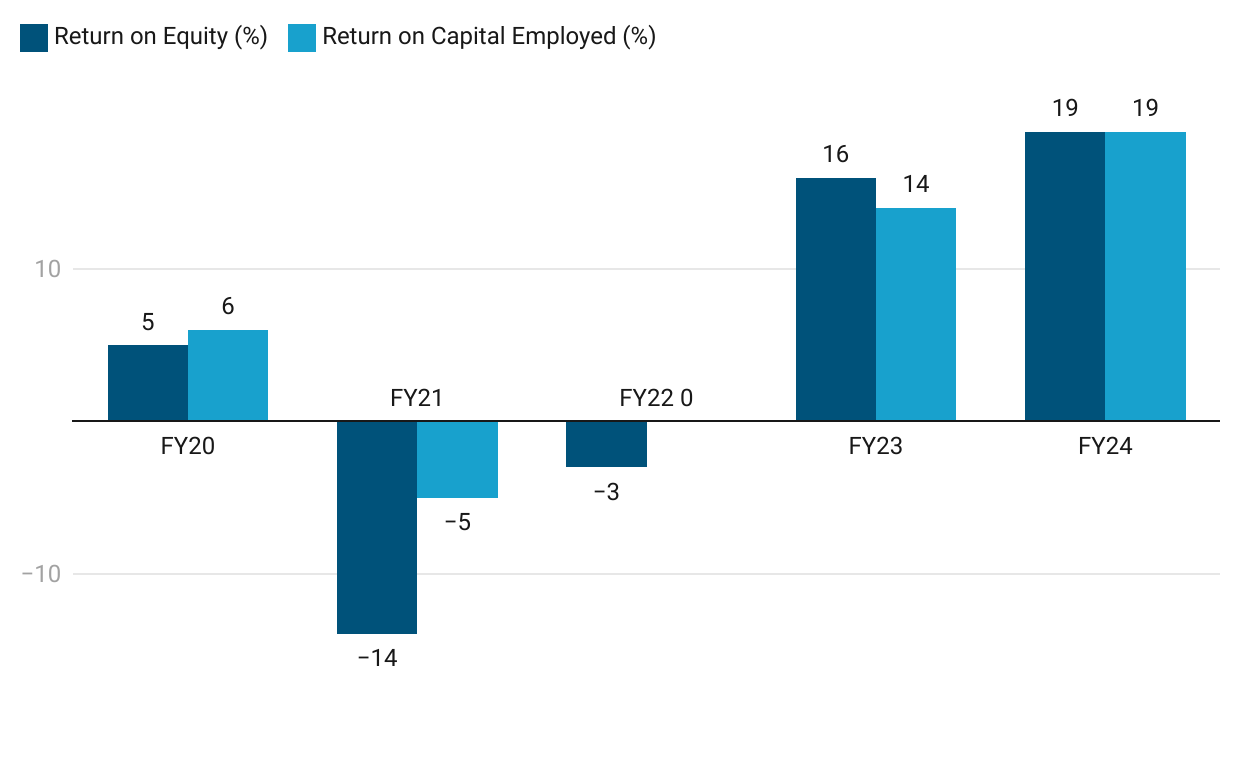

7. Strong & improving return ratios in FY24

8. Outlook: Revenue CAGR of 25% for FY24-26

i. FY26: Revenue of Rs 2000cr, revenue CAGR of 25%

9. PAT growth of 42% & revenue growth of 59% in FY24 at a PE of 30

10. So Wait and Watch

If one holds the stock then one may continue holding on to SDBL

Coverage of SDBL was initiated after Q2-24 results. The investment thesis has not changed after a strong FY24 delivering the highest revenue and PAT

The performance FY24 is providing confidence that SDBL is on track to deliver Rs 2000 cr of revenue by FY26.

SDBL is in the middle of a strong run and has grown is PAT quarter on quarter for the last 3 quarters of FY24

The underlying business of SDBL is strong and delivering growth across all brands & categories

Capacity expansion in Karnataka plant is providing visibility into growth in FY25

We are thrilled to share with the stock exchanges our unparalleled success in beer sales within Karnataka during March. Achieving our highest-ever sales in a month since entering Karnataka is a remarkable feat.

SDBL promoters are increasing their holdings for the last 9 quarters, indicating their bullishness on the business.

11. Or, join the ride

If one is looking to enter SDBL then

SDBL has delivered a strong FY24 with PAT growth of 42% & revenue growth of 59% at a PE of 30 which makes the valuations reasonable in short term.

The outlook of revenue CAGR of 25% for FY24-26 as SDBL is guiding for a revenue of Rs 2,000 cr by FY26 at a PE of 30 makes the valuations attractive from a longer term perspective.

Previous coverage on SDBL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer