Som Distilleries & Breweries: 21% PAT growth & 23% revenue growth in 9M-25 at a PE of 24

Guiding for Revenue CAGR of 25% for FY24-27 while maintaining margins in the 12-13% range. Promoter stake increasing for the last 10 quarters. Attractive valuations on a free cash flow yield

1. Alcoholic Beverages (Beer + Blending & Bottling of IMFL)

somindia.com | NSE: SDBL

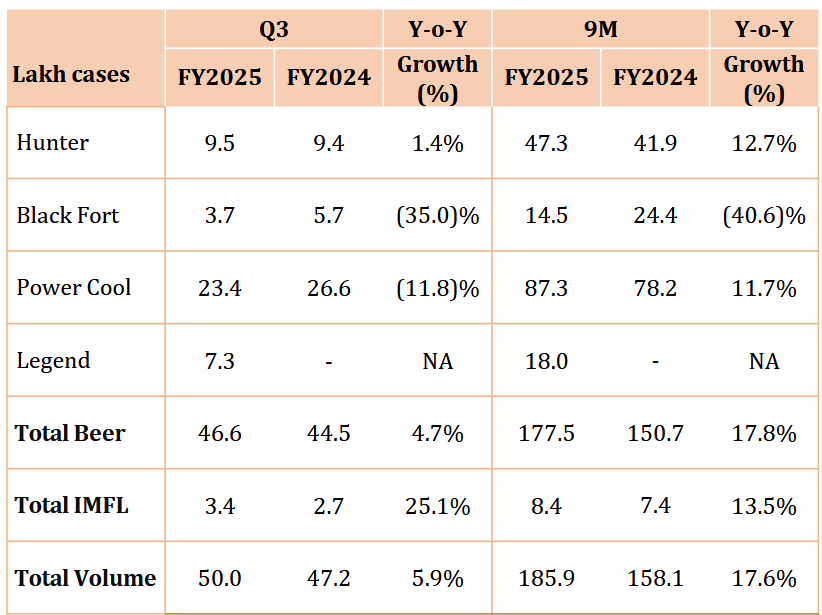

Beer accounted for 95% of total volumes and 89% of the revenue during Q3 FY2025

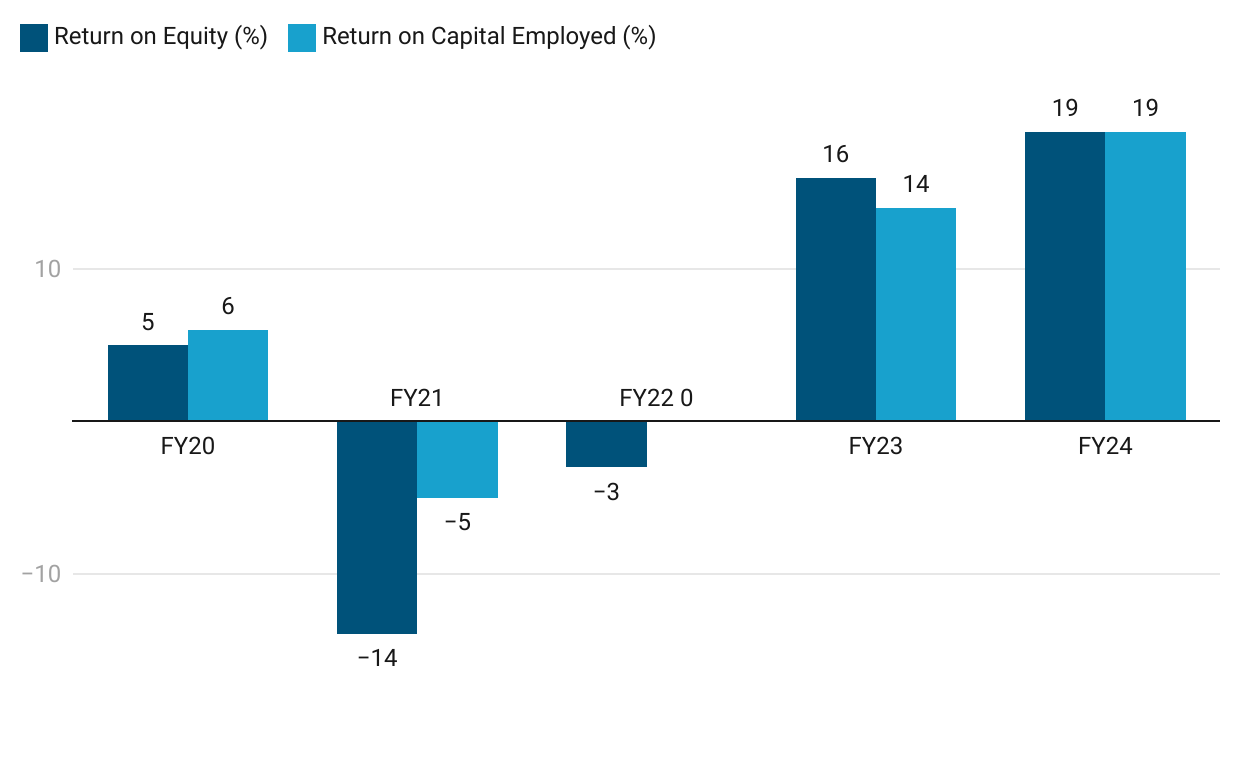

2. FY20-24: PAT CAGR of 55% & Revenue CAGR of 29%

3. Strong FY24 : PAT up 42% & Revenue up 59% YoY

4. Q3-25 : PAT up 7% & Revenue up 14% YoY

5. 9M-25 : PAT up 21% & Revenue up 23% YoY

6. Strong & improving return ratios in FY24

7. Outlook: Revenue CAGR of 25% for FY24-27

i. FY25: Revenue growth of 17-24%

Revenue of Rs 1,500-1,600 cr in FY25 implies a 17-24%

We should be able to achieve a top line of between Rs. 1,500 crores to Rs. 1,600 crores, net sales for this year,

ii. FY24-27: Revenue CAGR of about 25%

Against an internal target of 25-30% growth, SDBL is pretty sure that it will achieve at least 22-25% revenue CAGR for FY24-27

We are looking at a growth in the range of about 25% to 30% year-on-year for the next two to three years that's I think is our internal target.

And on a sustainable level, I think, for the next 3 years I am pretty sure that we'll be able to maintain a growth rate in the range of 22% - 25%.

iii. EBITDA Margins to be stable at 12-13%

This year we have delivered more EBITDA margin as compared to last year. So, I think we should be able to maintain these kind of margins going forward

Our target for the EBITDA should be in the range of about 12% to 13%.

8. PAT growth of 21% & revenue growth of 23% in 9M-25 at a PE of 24

9. Hold?

If one holds the stock then one may continue holding on to SDBL

Based on 9M-25 performance, SDBL appears to be on track to deliver Rs 1,500-1,600 cr revenue.

The performance in 9M-25 is providing confidence that SDBL is on track to deliver Rs 2000 cr of revenue by FY27.

The internal target of 25-30% revenue CAGR for FY24-27 creates a strong outlook for SDBL

The underlying business of SDBL is strong and delivering strong volume growth

Capacity expansion in Odisha plant is providing visibility into growth in FY26

We will be doing capacity expansion for our Odisha plant which should happen by early next year. And hopefully, we should be able to complete it by April of next year.

And we are also eyeing certain acquisition opportunities in states where we want to enter, or we might even look at a Greenfield but may be for next year.

SDBL promoters are increasing their holdings for the last 10 quarters, indicating their bullishness on the business.

Things to watch out for

SDBL is consciously moving up the value chain, which supports margin expansion. New brands like Woodpecker (twist-cap) and Legend need to deliver

Geographic expansion by entering UP, Northeast, and other markets with stable excise policies to diversify revenue away from heavy dependence on MP & Karnataka and deliver growth

Alcohol is a state subject and any state-wise Excise uncertainty can impact margins and demand quickly.

10. Buy?

If one is looking to enter SDBL then

SDBL has delivered 9M-25 with PAT growth of 21% & revenue growth of 23% at a PE of 24 which makes the valuations reasonable in the short term.

SDBL is guiding for a revenue of Rs 1,500-1,600 cr in FY25 i.e. 17-24% growth at a PE of 24 which makes the valuations reasonable from a FY24 perspective.

The internal target of revenue CAGR of 25-30% for FY24-27 of which SDBL is pretty sure to achieve a growth rate in the range of 22-25% at a PE of 24 makes the valuations attractive from a longer term perspective.

SDBL has generated free cash flow of Rs 82.9 cr as of Q2-25 end and is available at a current market cap of Rs 2,582 cr which implies it is at a free cash flow yield of 3.2% (not annualized) which makes the valuation quite attractive.

Previous coverage on SDBL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Concise and crisp as usual.. May add CG issues too