Som Distilleries & Breweries: PAT up 21%, Targets 20%+ Growth with Stable Margins

Targets growth in beer, IMFL & premium brands with expansion into new states. supported by new capacities At ~24× FY26 P/E, valuations price in strong execution.

1. Alcoholic Beverages (Beer + Blending & Bottling of IMFL)

somindia.com | NSE: SDBL

Beer accounted for 95% of total volumes and 89% of the revenue during Q4 FY2025

2. FY23-25: PAT CAGR of 32% & Revenue CAGR of 34%

Revenue CAGR of 50.4% highlights a strong post-COVID rebound and sustained expansion.

Profitability flipped from losses to consistent margins — CAGR not meaningful due to negative base in FY21.

Margin stability in FY23–FY25 shows solid operating leverage and mix improvement.

3. Q4-25: PAT up 19% & Revenue down 12% YoY

PAT down 15% & Revenue down 13% QoQ

Steep increase in excise duty in Karnataka, one of Som's largest beer markets (~30%+ of volume) — made their products more expensive, reducing demand

Som protected its profitability thru:

Strong IMFL growth (25%+ in Q4) helped offset some beer weakness

Better product mix: more sales from premium SKUs like Legend & Woodpecker

Recovery likely in Q1 FY26 as Karnataka excise rolls back

4. FY25 : PAT up 21% & Revenue up 13% YoY

5. Business Metrics: Improving return ratios

Som Distilleries has transformed from a moderate-efficiency company to a capital-efficient growth story between FY23 and FY25. If FY26–27 earnings and asset turns hold up, it could justify a valuation re-rating.

6. Outlook: 20-22% Revenue Growth with stable margins

6.1 FY25 Expectations vs Performance — Som Distilleries

✅ Hits: What Went Right

Strong Profit Growth

Net Profit grew 21% YoY

EBITDA increased 16% YoY with margin expansion to 12.5% from 12.1%.

Managed to expand gross margin despite regulatory hurdles.

New Brand Success

Legend Beer: Launched from scratch and scaled to 19.2 lakh cases, becoming a “millionaire brand” in its first year.

Woodpecker (premium twist-cap beer): Well received, especially in Karnataka; strengthened premium portfolio.

IMFL Growth

IMFL volumes up 14% YoY (11.4 lakh cases), with 22% YoY growth in Q4 alone.

IMFL realization rose from ₹914 to ₹991 per case, showing strong premiumization.

Geographic Expansion

Began supplying to Tamil Nadu from the Karnataka plant.

Achieved #2 position in Jharkhand with 22% market share; strong growth also reported in MP and Odisha.

Capacity Expansion and Capex Execution

Odisha plant expansion from 60 to 90 lakh cases completed.

Began construction of ₹600 crore greenfield brewery in UP; ₹40 crore already spent.

Operational Efficiencies

Capacity utilization held at ~70% despite expansions.

Finance cost reduced to 0.76% of revenue (vs 0.92% last year); net debt fell by ₹13 crore.

❌ Misses: What Fell Short

Revenue Shortfall

Revenue missing guidance of ₹1,550–1,600 Cr.

Q4 revenue was hit by a 12% decline YoY, mostly due to Karnataka.

Beer Volume Miss

Beer volume grew only 10% YoY vs implied guidance of ~18%.

Q4 beer volumes dropped 10% YoY, heavily impacted by Karnataka excise shocks.

Underperformance of Key Brand

Power Cool, the second most sold brand, saw only 1.4% growth YoY and –22.5% volume drop in Q4 due to pricing pressure from excise duty.

Realization Drop in Beer

Beer realization dropped from ₹552 to ₹545 per case, due to a weaker brand/pack mix despite price hikes in some states.

EBITDA Margin Compression in Q4

Q4 EBITDA margin fell vs Q3, partly due to lower volumes and excise impact.

6.2: FY26 Guidance — Som Distilleries

Revenue & Volume Growth: We should expect, I think, conservative level at least 20%, 22% growth

Margins: I think we expect that the margin, we should be able to maintain at the same level as last year.

Excise impact in Karnataka is reversing: Partial rollback as of May 2025

UP Plant Phase 1 will begin contributing by H2 FY26

Tamil Nadu entry is expected to contribute significant volumes by FY26-end

Legend beer scaled to 19.2 lakh cases in FY25 and expected to grow further in FY26

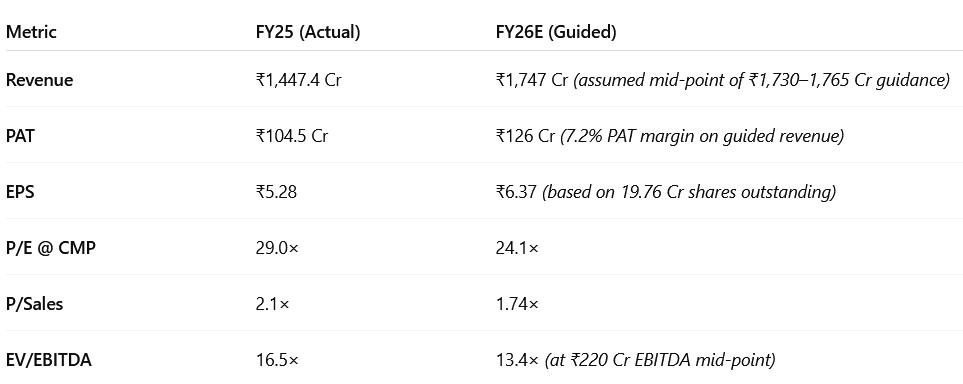

7. Valuation Analysis — Som Distilleries

7.1 Valuation Snapshot

TTM Basis: Slightly expensive (29× P/E) but backed by improving financials

Forward Basis: Reasonable (24× P/E, 13× EV/EBITDA) for 20%+ growth

Overall: Fairly valued with upward bias if FY26 guidance holds and regulatory headwinds ease

7.2 What’s in the Price?

The current valuation (~29× P/E TTM, ~24× forward P/E) reflects high confidence in execution over FY26–27.

FY26 PAT of ₹125–127 Cr and 20% YoY growth are priced in

Sustained 20–22% PAT CAGR through FY27 implies a forward P/E of ~24×, already close to long-term industry median

Implied valuation assumes:

Karnataka volumes recover

Tamil Nadu, UP ramp-up executes on time

Premium brands (Legend, Woodpecker) gain market share

📉 Full earnings monetization by FY27, with no room for execution miss — any under-delivery on volumes, margins, or pricing may trigger sharp de-rating.

7.3 What’s Not in the Price?

Several upside triggers remain underappreciated:

New Market Upside: TN, Bihar, Odisha may scale faster than modeled

Premium Mix Shift: Further ramp in Legend, Woodpecker, and IMFL SKUs could raise realization and margins

Export Potential: Early medical and MENA/Tanzania trials could create a new vertical (currently zero in valuation)

Asset-light Growth Options: No contribution priced in from asset-light distribution or franchise partnerships

Valuation Re-rating: Could re-rate to 28–30× forward P/E if ROCE > 24% with no dilution by FY27

7.4 Risks and What to Monitor

📉 The market is pricing in clean execution — any delay may hurt valuation.

Execution Risk: Karnataka excise, distributor issues, or TN launch delays could derail FY26 volumes

Input Volatility: Glass, ENA, freight cost pressures could compress margins

Regulatory Risk: Alcobev is state-regulated — pricing, taxes, and approvals vary widely

Product Concentration: Beer still dominates mix — any pullback in volume or price pressure (e.g., Power Cool) can impact headline growth

Capex Absorption: FY26–27 capex must be absorbed without ROCE drag or working capital stretch

No Equity Dilution Priced In: Market assumes self-funded growth — any QIP or M&A could compress return metrics temporarily

What to Monitor

🧠 Summary:

The current valuation leaves little room for execution error, but also rewards any outperformance significantly. Margin stability, brand scaling, and regional execution will determine if Som remains a premium-rated alcobev stock or normalizes to industry medians.

8. Implications for Investors

8.1 Bull, Base & Bear Scenarios — Som Distilleries

Bull Case (Probability = Moderate)

Premium brands (Legend, Woodpecker) scale faster than expected

FY27 revenue exceeds ₹2,100 Cr

PAT margin expands to 8.5%

No excise disruptions; UP and TN deliver faster

Base Case (High)

FY27 revenue reaches ₹2,000 Cr

PAT margin stable at 7.2% - 20–22% earnings CAGR sustained

Volume recovery in Karnataka and full UP ramp-up

Bear Case (Moderate)

Execution delays in UP/TN scale-up or prolonged excise impacts

FY27 revenue caps at ₹1,800 Cr

PAT margin contracts to 6.0–6.5%

Slower premiumization or margin pressure from input cost spikes

8.2 Is There Any Margin of Safety?

✅ Where There Is Margin of Safety

Business Quality & Model

Well-diversified alcohol portfolio across beer and IMFL, with strong distribution in Tier 2/3 markets.

Premium brands (Legend, Woodpecker) gaining traction, improving blended realizations and margins.

FY25 EBITDA margin stable at 12.5%, with high gross margin resilience despite Karnataka excise hit.

Capital Structure

Net debt reduced to ₹151 Cr, with net debt/EBITDA improving to 0.63× (from 1.06× in FY24).

Gross debt-equity dropped to 0.26×, giving ample headroom for future expansion without dilution.

Capex is being internally funded — no QIP or equity raise expected, enhancing capital return potential.

Execution Levers Not Yet Priced In

Faster ramp-up in Tamil Nadu, Odisha, and Bihar could add ₹100–150 Cr in unmodeled upside.

If PAT margin expands to 8%+ (vs 7.2% FY25), FY27 PAT could exceed ₹160 Cr without capex jump.

Potential margin-led P/E compression from 24× to ~18× implies you’re buying into FY27–28 earnings early.

If these levers play out, current valuation could lock in 2–3 years of earnings growth at a fair multiple.

❌ Where There Isn’t Margin of Safety

Valuation is Still Full

FY25 P/E of 29×, forward P/E of ~24× — reflects high expectations of execution and volume recovery.

EV/EBITDA of 16.5× vs industry average of 12–13× signals little upside room without earnings beat.

Execution Risks Persist

FY25 Q4 revenue fell 11.7% due to Karnataka excise — proof of regulatory sensitivity.

Geographic expansion (TN, Odisha) may take 4–6 quarters to mature — any delay would defer earnings.

Beer still dominates volume (~90% mix) — input inflation (ENA, packaging) can compress margins.

❗ No Cushion for Disappointment

If FY26 PAT or revenue misses guidance, stock may quickly derate to 18–20× P/E.

Market assumes self-funded growth and no equity dilution — any deviation may affect credibility.

Margin of safety lies more in the business than in the stock price.

You're paying for forward growth, Som’s FY27 earnings are being secured at a reasonable multiple — provided execution holds.

Previous coverage on SDBL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Very well written as usual. Thanks for the insight. Have a big position in som