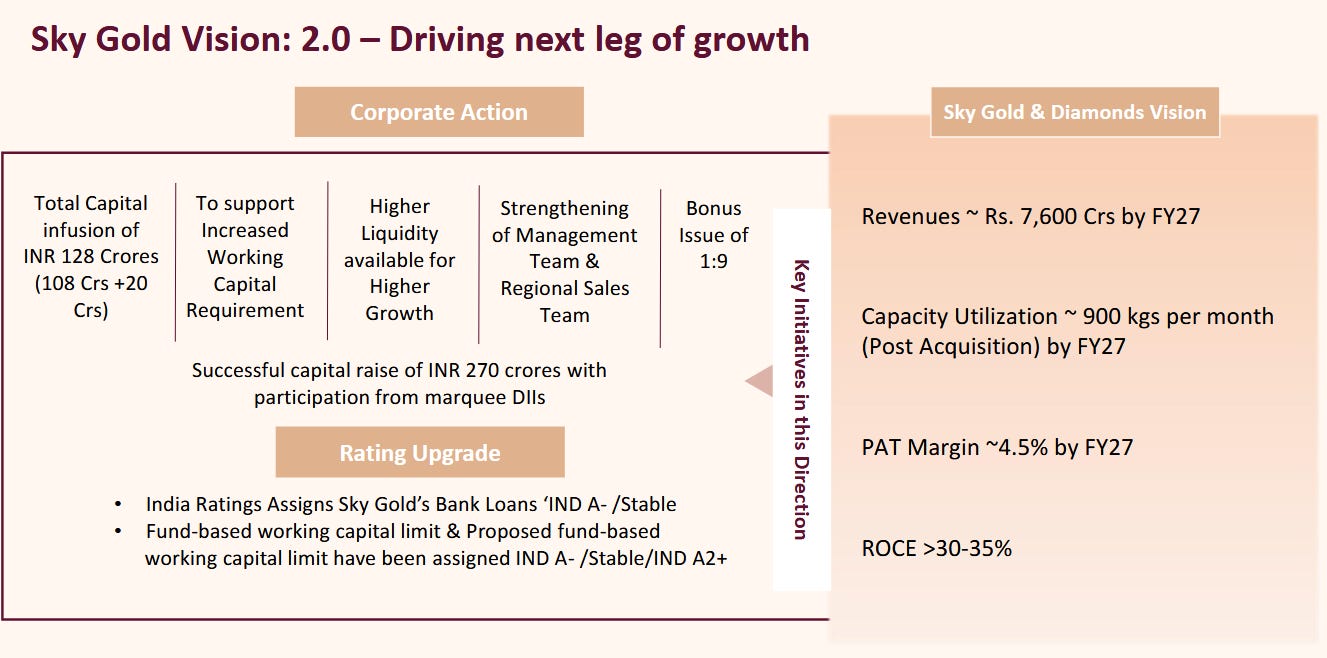

Sky Gold FY25 Results: PAT Up 228%, Targeting PAT CAGR of 61% for FY25-27

Revenue CAGR of 46% for FY25-27 on the back of 52% growth in FY26 with expanding margins. Re-rating likely if EBITDA margins expand & execution is as per guidance

1. Manufacturing of Casting Gold Jewelry

skygold.co.in | NSE: SKYGOLD

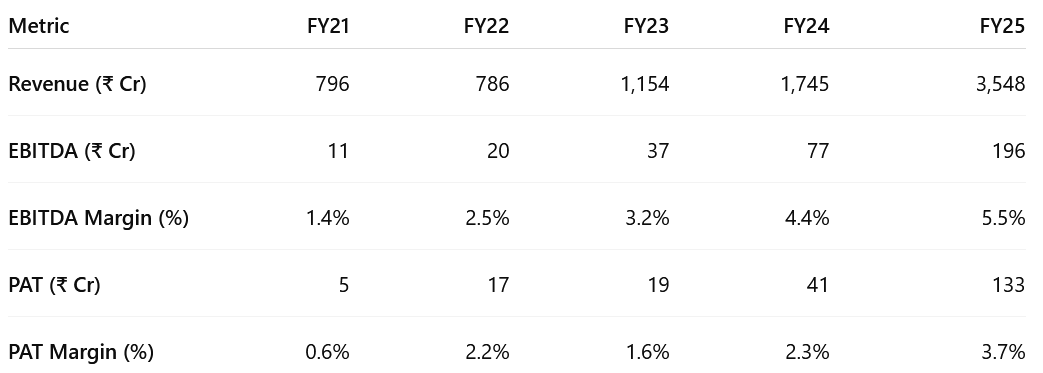

2. FY21–25: PAT CAGR of 129% & Revenue CAGR of 45%

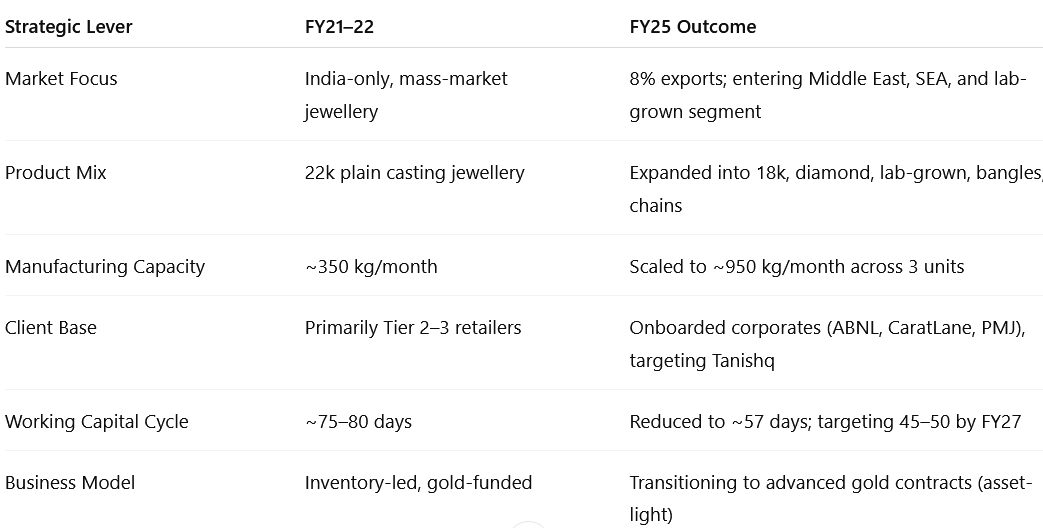

2.1 What Changed Between FY21–25

Export Expansion: Entered UAE, Singapore, and Malaysia. Exports hit 8% of revenue in FY25; targeting 15%+.

Product Mix Shift: Added 18k rose/white gold, diamond, and lab-grown jewellery to core 22k offerings—targeting younger, value-driven buyers.

Capacity Growth: Scaled monthly output from ~350 kg to 950 kg across three facilities.

Corporate Wins: Revenue from institutional clients rose from 65% to 80%+ with ABNL, CaratLane, Pothys onboarded.

Working Capital Gains: ERP + bullion-supplied model cut cycle by 25%. Targeting 45–50 days by FY27 via gold metal loans and client mix shift.

Model Upgrade: Transitioned from gold-funded to client-supplied bullion, boosting capital efficiency and EBITDA scalability.

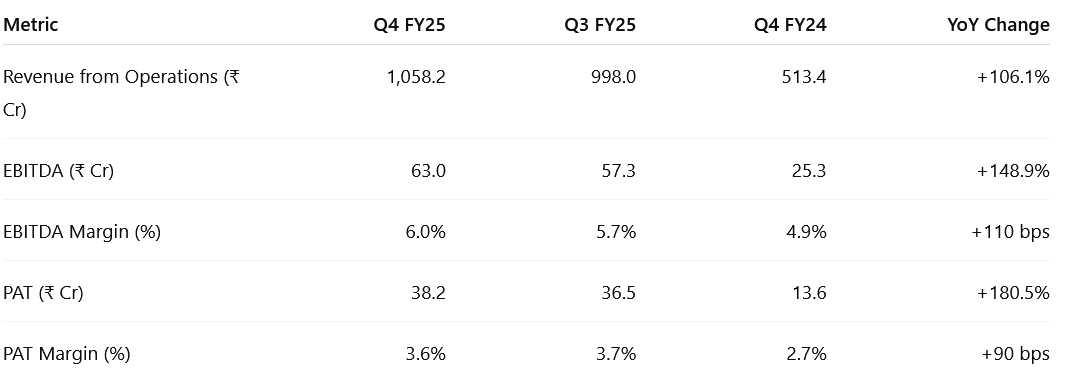

3. Q4 FY25: PAT up 180% & Revenue up 106% YoY

PAT up 4% & Revenue up 6% QoQ

Corporate-Led Growth: Driven by volume ramp from Aditya Birla, CaratLane, and Pothys.

Higher-Margin Mix: Increased contribution from 18k, diamond, and lab-grown jewellery.

Exports Scaling: Middle East orders supported 12% export growth QoQ.

Operating Leverage: Gross margin improved 90 bps YoY; PAT nearly tripled.

Exit Momentum: Q4 sets strong base for FY26 with added capacity and higher-margin mix.

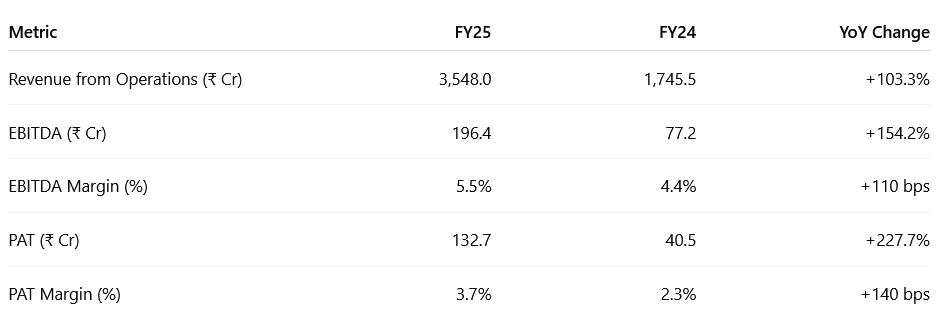

4. Strong FY25: PAT up 228% & Revenue up 103% YoY

Key drivers for PAT margin expansion are advanced gold, gold metal loans, and our high margin diamond business, along with operating leverages from scale

Broad-Based Growth: Driven by volume, client additions, and capacity scale-up.

Export Contribution: Share rose to 8% of revenue, with strong recurring traction.

Product Expansion: 18k, diamond, and lab-grown added margin-accretive growth.

Capital Efficiency: ERP, gold metal loans, and client-funded models improved cycle.

FY26 Outlook: Visibility supported by higher run-rate and strong client order book.

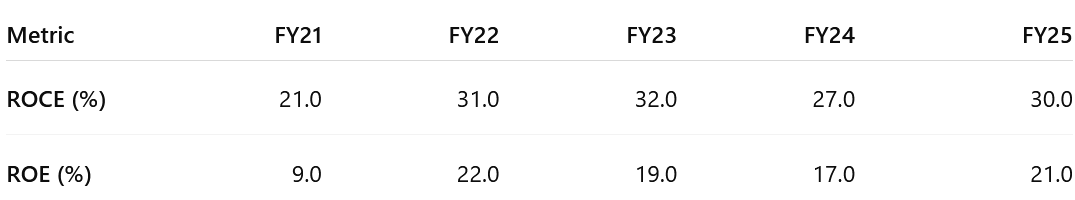

5. Business metrics: Strong return ratios

Return Ratios dipped in FY24 despite rising profits due to a 2.5× increase in equity (fund infusion).

Return Ratios recovered in FY25 as earnings growth outpaced capital expansion.

6. Outlook: PAT CAGR of 61% for FY25-27

6.1 FY25 Expectations vs. Performance – Sky Gold

✅ HITS (Met or Exceeded Expectations)

Revenue Growth: 103% YoY surge —driven by volume ramp-up, corporate orders, and margin-accretive products.

PAT Growth: 228% jump, supported by margin expansion, scale efficiencies, and operational leverage.

EBITDA Margin: Delivered 5.5% —driven by higher-margin product mix and exports.

New Product Launches: Successfully launched 18k, natural, and lab-grown lines with Limelight and Wondr clients.

Export Contribution: Reached 8% of revenue as planned—UAE, Singapore, and Malaysia led the scale-up.

Capex Execution: Deployed ₹150–170 Cr across three verticals (facilities, ERP, working capital), fully in line with guidance.

Client Wins: Added ABNL, CaratLane, and Pothys as large client onboarding goal.

❌MISSES (Below or Deferred vs. Guidance)

Working Capital Days: Ended at 57 days vs. 45–50 target; impacted by inventory ramp and onboarding cycles. Expected to improve with GML share rising in FY26.

Revenue of ₹3,300 crore for FY25, which includes ₹2,700 crore from core operations and ₹600 crore from recently acquired subsidiaries.

The contribution from subsidiaries was limited in Q2, but is expected to be on a full quarter basis from Q3 onwards.

Gross Margin: Sky Gold aims to achieve a gross margin of 8% through an optimised product mix and exports.

EBITDA Margin: The company plans to maintain a long-term EBITDA margin of 5-5.5%.

PAT Margin: Sky Gold expects to improve its PAT margin to 3.5% by reducing interest costs through increased utilization of gold metal loans (GML).

The company expects to reach monthly production volumes of 375-400 kg by the end of FY25.

Sky Gold also projects reaching 550-600 kg per month by FY26.

6.2 Guidance – Sky Gold

Revenue Growth: FY26= 52% | FY25-27= 46% CAGR

So we have given the guidance of Rs. 5,400 crores for FY26 and Rs. 7,600 crores for FY27

Margin: FY25-27= 61% PAT CAGR

So we are at current 3.7% PAT and we are expecting to go to 4.5% conservatively by FY ’27 March. EBITDA, we are now 5.7% approximately, 5.67%, and we will go up to 6.2%, 6.3% of EBITDA, conservative 6.2%

Product MiX:

Currently, diamonds contribute about 1% to our revenue and we anticipate this increasing to 4% by FY ‘27.

Export Contribution:

We foresee significant contributions from Dubai and Malaysia, aiming for exports to represent. 20% of our volume by FY ’27

Working Capital:

Aiming to reduce working capital days to 50–52 by FY26-end, driven by:Shift to advanced gold contracts (client-supplied bullion)

Higher GML usage (>60%)

Improved collection cycles from new ERP rollout

Upside to current guidance:

After June quarter acquisition will be over and we will add the guidance of this in this.

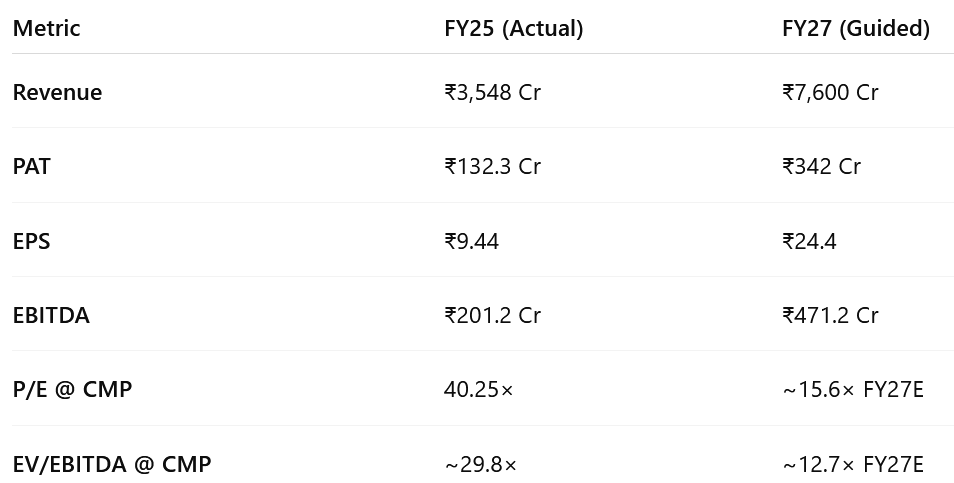

7. Valuation Analysis

7.1 Valuation Snapshot — Sky Gold

Even assuming no re-rating (i.e., CMP stays constant), EPS and EBITDA growth alone compresses valuation multiples sharply, suggesting strong upside if:

Guidance is delivered,

Export & diamond share scales,

FY26 acquisition adds further delta.

7.2 What’s in the Price?

Valuation Reflects Strength: P/E (40.25×) and EV/EBITDA (29.8×) price in FY25’s 5.7% EBITDA margin and 30% ROCE.

FY27 Targets Embedded: Market factors in ₹7,600 Cr revenue and 4.5% PAT margin by FY27.

GML Benefits Partially Priced: Working capital gains from >60% GML usage appear considered.

Client Execution Assumed: Continued volume from ABNL, CaratLane, and Pothys seems factored in.

Capital Efficiency Valued: Strong ROCE and WC reduction (~57 days) support premium multiples.

7.3 What’s Not in the Price?

Acquisition Upside: June quarter acquisition (~₹500–700 Cr) isn’t in FY26 guidance.

Global Retail Orders: High-potential onboarding could rerate volume and margin base.

Export Expansion: 20% volume target by FY27 likely under-modeled (currently ~8%).

Diamond Growth: Ramp-up from 1% to 4% revenue by FY27 not fully priced.

Working Capital Compression: Drop to 50–52 days (from 57) may unlock FCFF upside.

D2C Brand Pilot: FY26 boutique launch optionality not reflected in valuations.

7.4 Risks and What to Monitor – Sky Gold

🔻 Key Risks

Execution Risk: Volume scale-up depends on consistent order flow and timely onboarding of new institutional clients

Input Cost Volatility: Gold price swings, especially in non-GML contracts, can affect margin stability if hedging isn't precise.

Export Risk: Growing exposure to Middle East and Southeast Asia (~8% revenue) brings FX and geo-political uncertainty.

Working Capital Drag: Expansion in SKUs and geographies may stretch receivables and delay gold metal loan conversions.

Client Concentration: High share of revenue still comes from 5–6 key accounts; slower-than-expected ramp-up from new clients could impact growth visibility.

📌 What to Monitor

GML Uptake: Tracking conversion rate to >60% gold metal loan usage is key to unlocking margin and WC efficiency.

EBITDA Margins: Ability to maintain or expand beyond 5.5–6.2% guided range as scale and product mix evolve.

Export Momentum: Execution of export orders, especially in UAE, Malaysia, and upcoming geographies.

Capex Productivity: Effective ROI from ₹80–100 Cr FY26 capex, especially on new verticals (e.g., lab-grown).

Receivable Cycles: ERP-driven collection improvement and adherence to 50–52 WC day target by FY26.

Post-Acquisition Integration: Timely consolidation and synergy realization from June quarter acquisition.

8. Implications for Investors

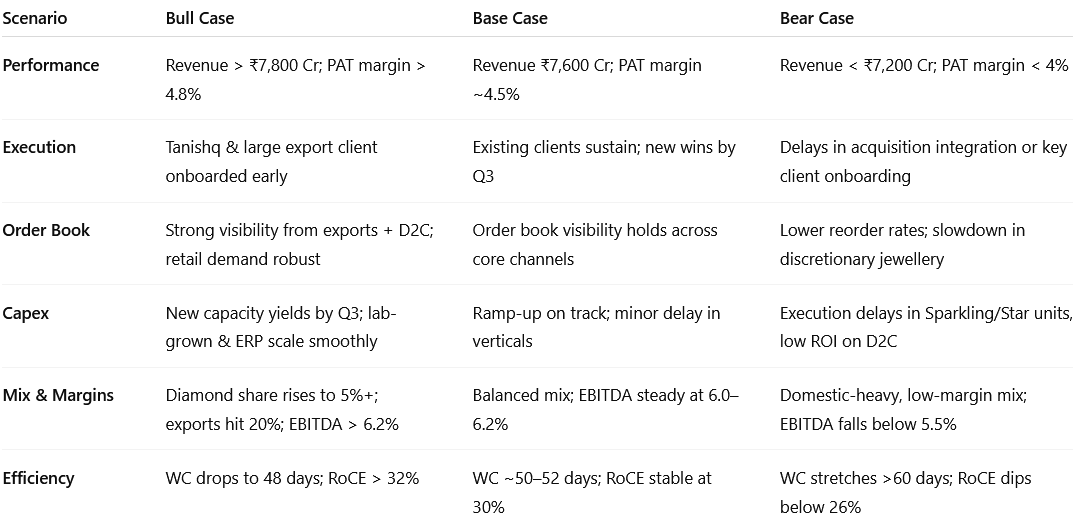

8.1 Bull, Base & Bear Case Scenarios – Sky Gold

8.2 Overall Margin of Safety: Moderate with Re-Rating Potential

Sky Gold offers a moderate margin of safety, underpinned by high RoCE, strong earnings visibility, and improving efficiency—but much of the FY26 growth is partially priced in. Valuation expansion hinges on margin delivery, working capital gains, and successful integration of new verticals.

🔍 What the Market Has Priced In

FY26–27 Visibility: ₹7,600 Cr revenue and 4.5% PAT margin by FY27 appear embedded in valuations.

Base-Case Price at ₹380–400: Implies 15–16× FY27E P/E and ~12.7× EV/EBITDA.

EBITDA Expansion: 6.2% margin guided, factored in via mix shift and scale efficiency.

GML Usage Benefits: Partial adoption (>60%) seems considered in working capital efficiency assumptions.

No Upside for D2C or M&A Synergy: Price does not yet reflect post-acquisition contribution or boutique pilot launch.

🚀 Upside Optionality (Not Fully Priced In)

Acquisition Impact: June quarter acquisition (~₹500–700 Cr revenue) can lift FY26 guidance.

New Client Wins: Large Middle East retail addition would materially boost confidence in order flow.

Export Re-rating: Export mix to 20% by FY27 (from 8% now) offers meaningful upside to margin and scale.

Diamond Scale-Up: Share moving from 1% to 4% can uplift blended margins.

Working Capital Gains: Compression from 57 to ~50 days may improve FCF yield and capital efficiency.

P/E Re-Rating with PAT Growth: ₹342 Cr PAT can justify compression from 40× to 30–32× trailing, with upside on absolute earnings.

🧱 Downside Protection Factors

Earnings Growth: 60% PAT CAGR (FY25–27) offsets execution volatility.

High RoCE: 30%+ supports valuation stability, even in margin-normalized scenarios.

Limited Dilution Risk: Low debt + strong cash flow enable internal funding of expansion.

Client Stickiness: Long-standing relationships with ABNL, CaratLane, and Pothys create revenue continuity.

Product/Geographic Diversification: Entry into lab-grown, diamond, and exports lowers concentration risk.

At ₹380, Sky Gold trades at ~15.6× FY27E P/E and ~12.7× EV/EBITDA, implying partial optimism is priced in—but re-rating potential remains if margin expansion and execution play out as guided.

Previous coverage of SKYGOLD

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer