Sky Gold: PAT up 252% & Revenue up 103% in 9M-25 at a PE of 47

FY25 guidance of 185% growth in PAT & Revenue growth of 89%. Guidance of PAT CAGR of 67% and Revenue CAGR of 53% for FY24-27.

1. Manufacturing of casting Gold Jewelry

skygold.co.in | NSE: SKYGOLD

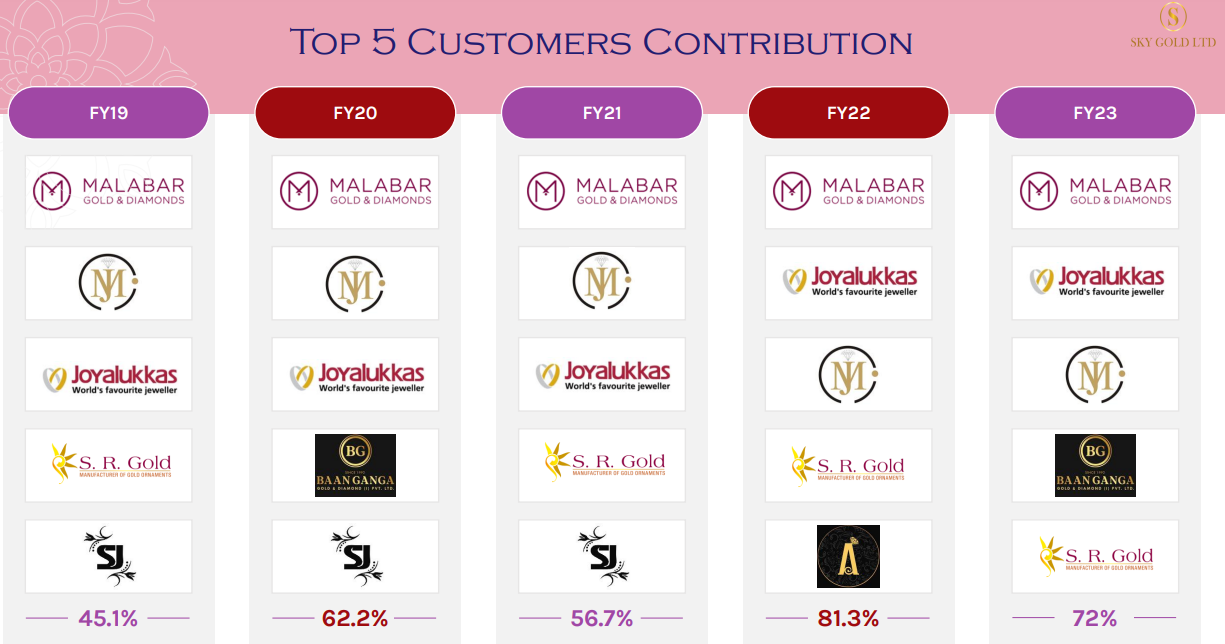

Sky Gold Limited is one of the leading jewellery companies based in Mumbai. The Company specializes in lightweight jewellery of 18 C 22 Carat gold, manufacturing a variety of designs including plain gold jewellery, studded gold jewellery, diamond-studded jewellery, and Turkish jewellery. Operating on a B2B model, Sky Gold collaborates with leading jewellery retailers like Malabar Gold and Diamonds, Joyalukkas, Kalyan Jewellers, GRT Jewellers, and Senco Gold, making its products available in over 2000 showrooms across India.

2. FY20-24: PAT CAGR of 62% & Revenue CAGR of 25%

3. Strong FY24: PAT up 118% & Revenue up 51%

4. Strong Q3-25: PAT up 309% & Revenue up 117% YoY

PAT up 73% & Revenue up 30% QoQ

5. Strong 9M-25: PAT up 252% & Revenue up 103% YoY

6. Business metrics: Strong return ratios

7. Outlook: PAT growth of 185% & Revenue growth of 89% in FY25

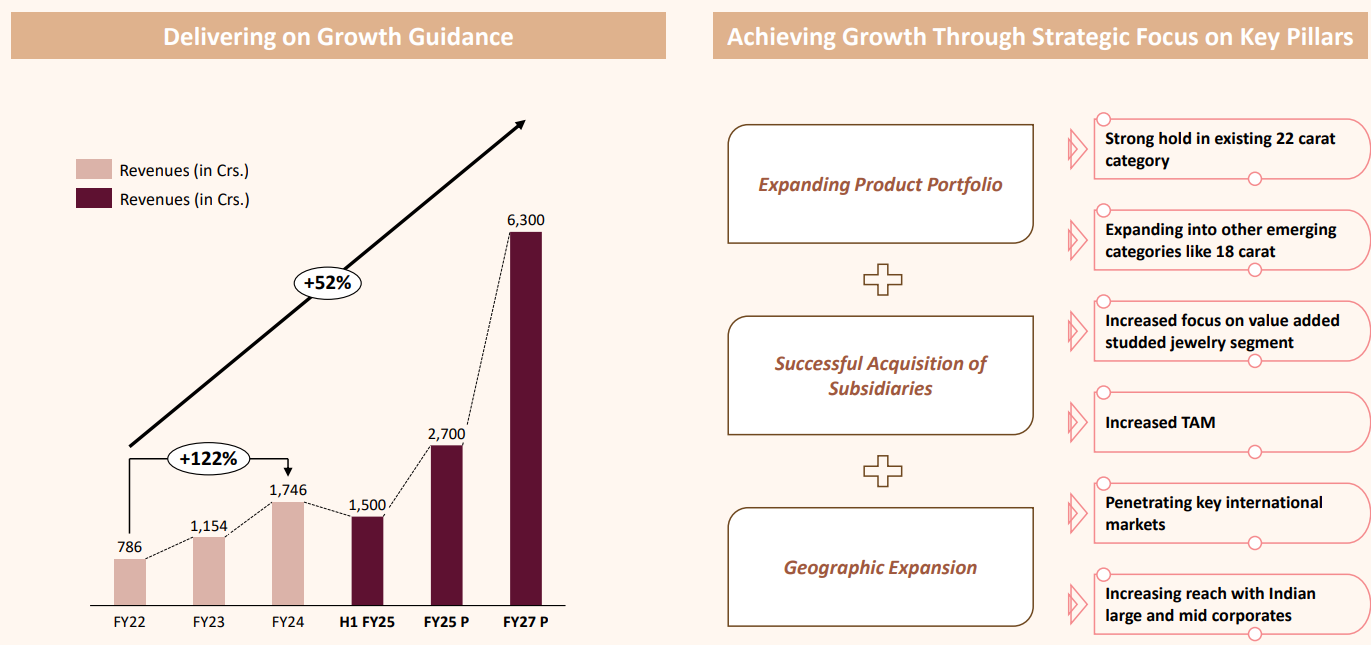

Revenue of ₹3,300 crore for FY25, which includes ₹2,700 crore from core operations and ₹600 crore from recently acquired subsidiaries.

The contribution from subsidiaries was limited in Q2, but is expected to be on a full quarter basis from Q3 onwards.

Gross Margin: Sky Gold aims to achieve a gross margin of 8% through an optimised product mix and exports.

EBITDA Margin: The company plans to maintain a long-term EBITDA margin of 5-5.5%.

PAT Margin: Sky Gold expects to improve its PAT margin to 3.5% by reducing interest costs through increased utilization of gold metal loans (GML).

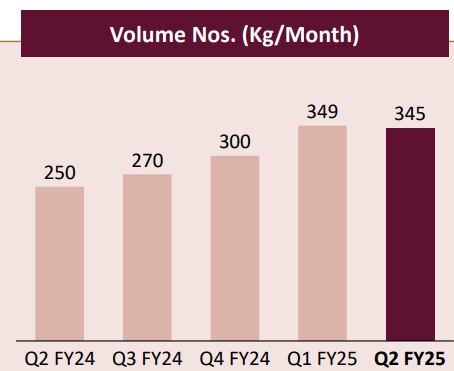

The company expects to reach monthly production volumes of 375-400 kg by the end of FY25.

Sky Gold also projects reaching 550-600 kg per month by FY26.

i. FY24-27: PAT CAGR of 67% & Revenue CAGR of 53%

Revenue growing from Rs 1,745.5 cr in FY24 to Rs 6,300 by FY27 implies a revenue CAGR of 53%

A 3% PAT margin on revenue of Rs 6,300 cr implies a FY27 PAT of Rs 189 cr up from Rs 40.5 cr in FY24, growing at a CAGR of 67%

ii. FY25: PAT growth of 185% & Revenue growth of 93%

FY25 revenue of Rs 3,330 cr from Rs 1745.5 cr in FY24 implies a 89% growth. PAT increasing from Rs 40.5 cr in FY24 to Rs 115.5 cr (3.5%*3,330) implies a 185% growth in PAT. The asking rate for Q4-25 is about Rs 810 cr which looks reasonable given the Rs 998 cr revenue achieved in Q3-25.

Revenue Growth: Consolidated revenues for Q3FY25 reached Rs. 997.97 crores, marking a 116.74% increase year-on-year.

8. PAT growth of 252% & Revenue growth of 103% in H1-25 at a PE of 47

9. Hold?

If I hold the stock then one may continue holding on to SKYGOLD

SKYGOLD has delivered a strong FY24 and is following it up with an equally strong guidance for FY25. Based on 9M-25 performance and an asking rate of Rs 810 cr for Q4-25 to achieve Rs 3300 cr of revenue, SKYGOLD looks on track to deliver on the guidance for FY25.

The guidance for FY27 is equally strong. One can stay in for the long term guidance as SKYGOLD looks on track to deliver the FY27 guidance.

As we progress through FY25, our focus remains on increasing capacity utilization at our Navi Mumbai facility, strengthening our mid-management and regional sales teams, and optimizing financials through gold metal loans. These measures, combined with investments in IT, automation, and ERP systems, position us to achieve our long-term revenue target of INR 6,300 crores by FY27 and expand our production capacity to 1,050 Kgs/month within the next three years.

The business momentum continues to be strong as seen from the gold volumes.

The challenge for SKYGOLD is the ability to deliver strong year on year performances. One can stay on as long as we can see SKYGOLD is broadly on track to deliver as per FY27 guidance.

10. Buy?

If I am looking to enter SKYGOLD then

SKYGOLD has delivered PAT growth of 252% & Revenue growth of 103% in H1-25 at a PE of 47 which makes the valuations reasonable in the short term.

FY25 guidance of PAT growth of 185% & Revenue growth of 89% at PE of 47 makes the valuations reasonable from a FY25 perspective.

Assuming that SKYGOLD achieves its revenue of Rs 3300 cr, the outlook for achieving Rs 6300 cr revenue implies a revenue CAGR of 38% for FY25-27 at a PE of 47 which makes the SKYGOLD valuations reasonable over the longer term

One should be ready for the growth rates in the top-line and bottom-line normalizing in FY26. The challenge for SKYGOLD in FY26 would be to deliver performances which would sustain valuations at 47

Previous coverage of SKYGOLD

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer