Sky Gold Q3-26 Result: Profit Up 121%, Guidance Revised Upward

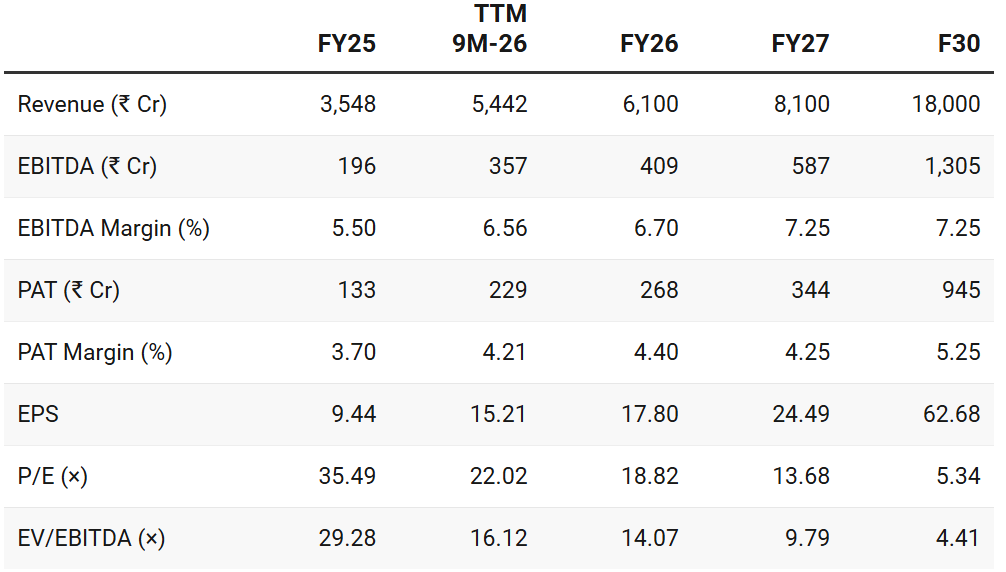

Guidance of 48% PAT CAGR for FY25-30. SKYGOLD available at attractive forward valuation with potential for re-rating of multiples based on FY26 guidance

1. Manufacturing of Casting Gold Jewelry

skygold.co.in | NSE: SKYGOLD

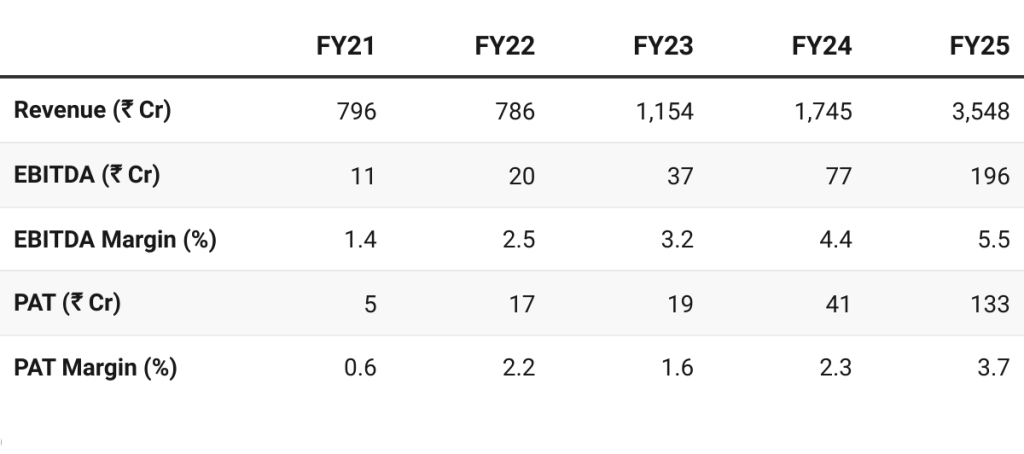

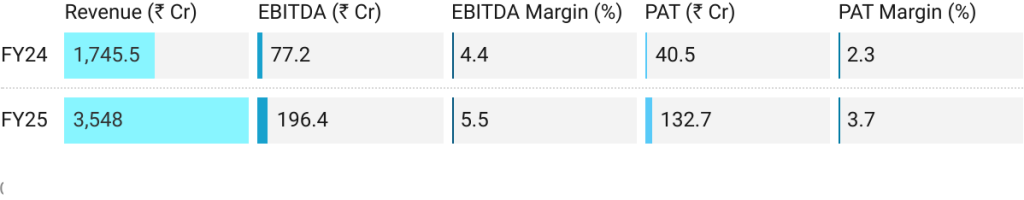

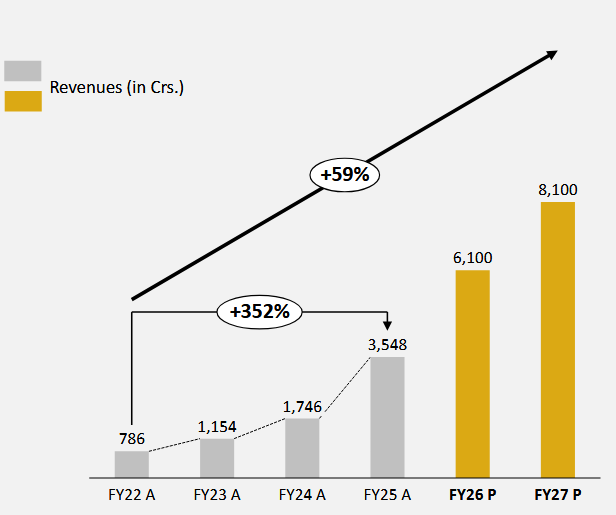

2. FY21–25: PAT CAGR of 129% & Revenue CAGR of 45%

3. FY25: PAT up 228% & Revenue up 103% YoY

Key drivers for PAT margin expansion are advanced gold, gold metal loans, and our high margin diamond business, along with operating leverages from scale

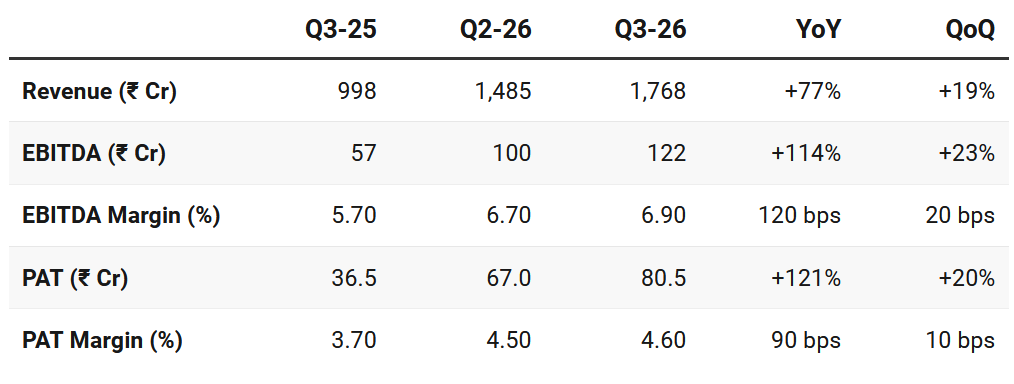

4. Q3-26: PAT up 121% & Revenue up 77% YoY

PAT up 20% & Revenue up 19% QoQ

Margin Expansion driven by

reduction in gold loss

Contribution from “advanced gold” business or job work — 12% of total volume

Value-added products (18k, 14k, and diamond-studded jewelry) account for 50%+ of total revenue

18-karat jewelry made up 20% of the product mix in Q3

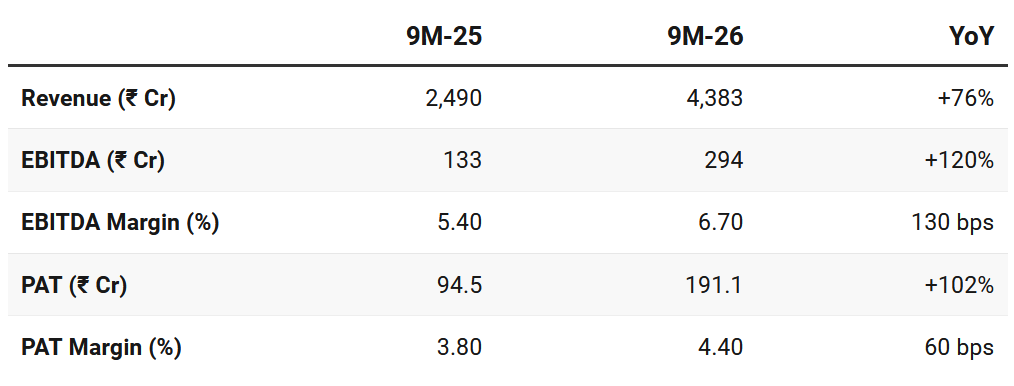

5. 9M FY26: PAT up 102% & Revenue up 76% YoY

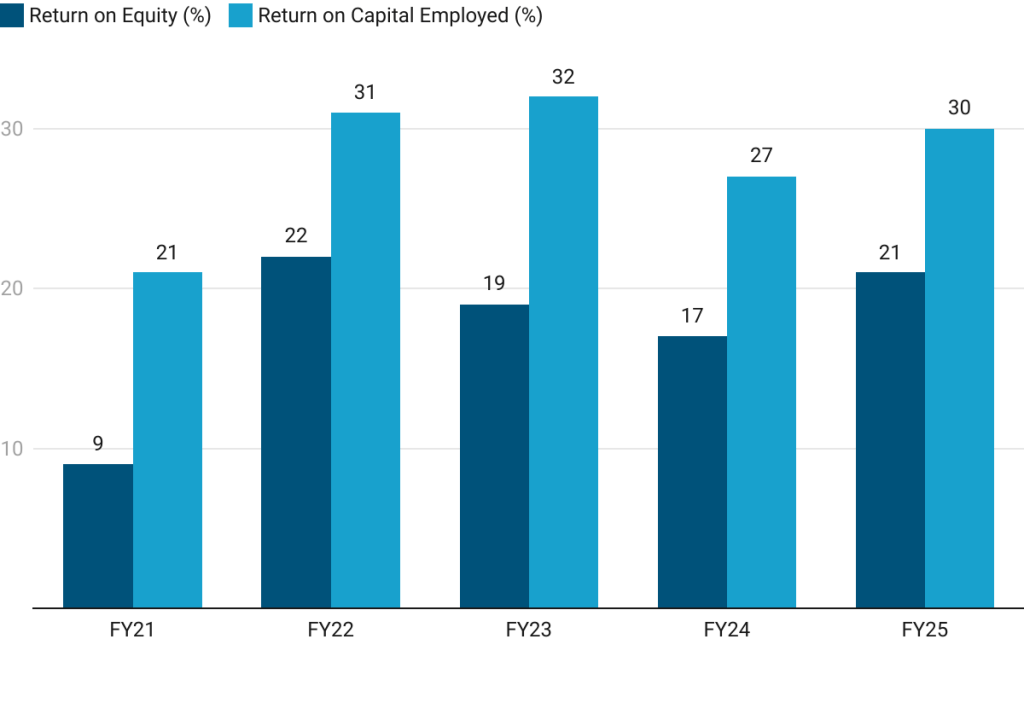

6. Business Metrics: Strong Return Ratios

ROCE guidance of 27% by FY30

7. Outlook: PAT CAGR of 48% for FY25-30

7.1 Guidance — Sky Gold & Diamonds

FY26/27 Guidance (Revised Upwards):

FY26/ FY27 Revenue projected at ~₹6,100/ 8,100 crore

EBITDA margin expected in the range of ~7.0-7.5%

PAT margin guided at 4.25% +

FY30 Guidance (New Addition)

Revenue expected to be ~₹18,000 -19,000 crore

PAT margin projected to be ~5.25%+, aggregating to ₹ 945 crores

ROCE of 27% +

CFO/PAT of ~20% +

Net debt positive, driven by improvements in the working capital cycle

Focusing on international expansion and growth funded entirely by internal capital generation, with no further equity dilution planned through 2030.

To become net debt-free by 2030

Expects to be cash flow neutral by March 2026 and cash flow positive thereafter.

Gold Metal Loans (GML): Utilization is at ₹80 Cr with a limit of ₹150 Cr.

Aim to scale this to ₹350 Cr within four quarters despite administrative delays from banks.

Exports: Currently 10% of revenue — target of 30%.

Opened an office in the Dubai Gold Souk

Targeting the EU and US markets by 2028-2029.

7.2 9M FY26 Performance vs FY26 Guidance

On-track Upgraded FY26 Revenue Guidance

Revenue: Guidance for FY26 and FY27 increased. New guidance for FY30

Margins: 9M FY26 = 4.4% ahead of PAT margin guided at 4.25%+

Volume Targets: (kg per month)

Back on track after lagging in Q2

Q2 FY26: 580 target vs 554 achieved

Q3 FY26: 630 vs 631 achieved

Q4 FY26: 650

FY27: Reduced to 750 in Q3-26 guidance from 900 earlier

8. Valuation Analysis

8.1 Valuation Snapshot — Sky Gold

Current Market Price= ₹335; Market Cap = ₹ 5,187.9 Cr

Attractively priced on a FY26 basis

Attractively priced on a FY27 basis with 15x P/E and 12x EV/EBIDTA

Opportunity to re-rate to to a 25x+ PE based on FY27 EPS.

Sky Gold & Diamonds appears undervalued on FY26 metrics — with re-rating potential as it delivers on FY26 guidance

8.2 Opportunity at Current Valuation

The guidance for FY26,FY27 has not yet been discounted in the price

Multi-year visibility: Guidance for FY30 (though far away) provides a longer term view on the stock

Attractive Forward Valuations: At FY26 P/E of ~19x, EV/EBIDTA of ~14x the valuations don’t seem to be discounting FY26 guidance

Potential for re-rating of multiples based on FY26 execution

Large Headroom for Growth:

Domestic

Transition toward organized jewellery retail is a structural tailwind

Regional Growth: Sales office was opened in Thrissur — strengthen position in the South Indian market.

Exports

Currently 10% of revenue — targets 30%.

Opened an office in the Dubai Gold Souk

Targeting the EU and US markets by 2028-2029.

8.3 Risk at Current Valuation

Market does not believe in the SKYGOLD guidance even though forward valuations look attractive

The market may keep disbelieving the forward guidance

This disbelief is reflected in the price movement over the last 1 year

Gold Metal Loan (GML) Delays: Ramp-up of GML usage — slower than planned due to administrative hurdles — will mute the proposed margin expansion

Capability Gaps for Western Markets: EU and US markets requires specific designs and high-quality standards that SKYGOLD does not yet have

Will take one-and-a-half years to adapt their product for these regions

Previous coverage of SKYGOLD

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer