Sky Gold Q2-26 Results: Profit Up 83%, FY26 Guidance on Track

Guidance of 46% Revenue CAGR for FY25-27. Minor hiccups in Q2 FY26. SKYGOLD available at attractive forward valuation with potential for re-rating of multiples

1. Manufacturing of Casting Gold Jewelry

skygold.co.in | NSE: SKYGOLD

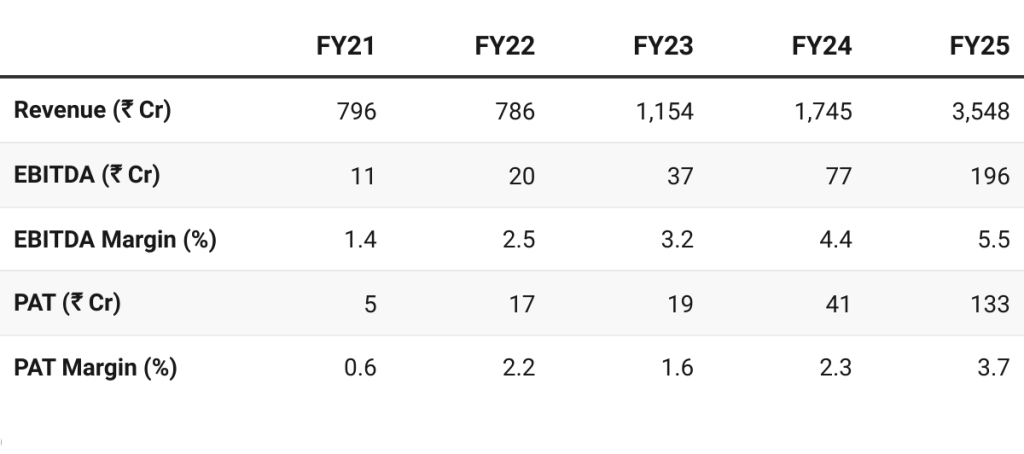

2. FY21–25: PAT CAGR of 129% & Revenue CAGR of 45%

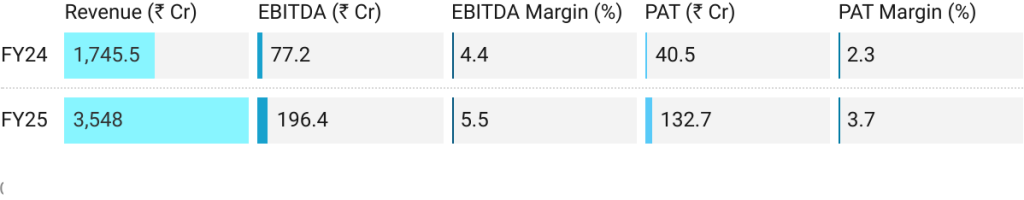

3. FY25: PAT up 228% & Revenue up 103% YoY

Key drivers for PAT margin expansion are advanced gold, gold metal loans, and our high margin diamond business, along with operating leverages from scale

4. Q2-26: PAT up 83% & Revenue up 93% YoY

PAT up 54% & Revenue up 31% QoQ

Record quarterly revenues and significant profit growth.

Strong volume expansion.

Strategic shifts in the product mix

Advanced Gold Model (AGM) — share of business increased from 5% to 7%

Product Mix: 18k business climbed to 7% of revenue, and the diamond jewelry doubled to 1.5% of total revenue.

Initial contributions came from new acquisitions & international expansion efforts

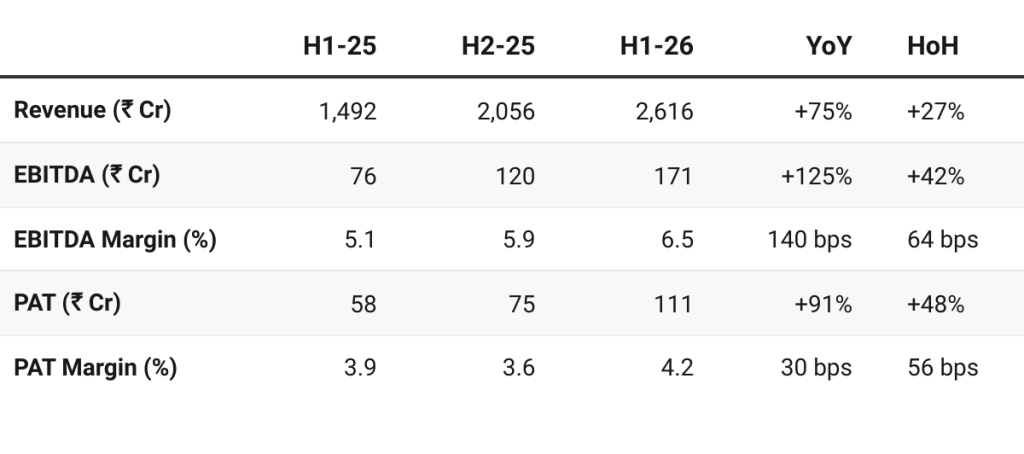

5. H1 FY26: PAT up 91% & Revenue up 75% YoY

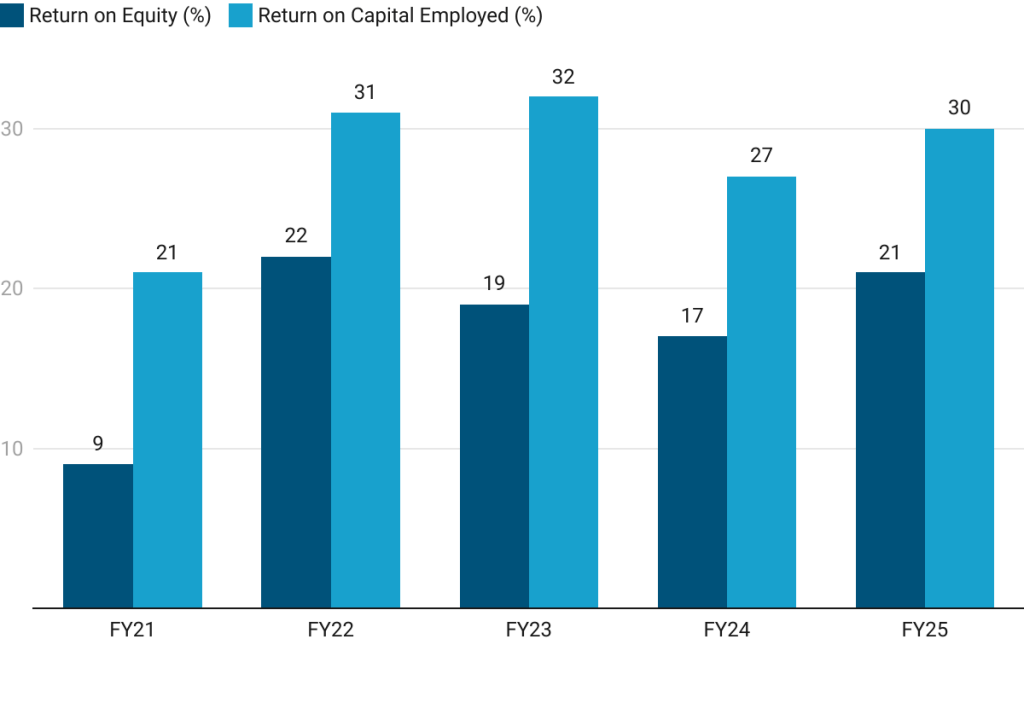

6. Business Metrics: Strong Return Ratios

FY27 ROCE guidance reduce from >30% to >25%

7. Outlook: Revenue CAGR of 46% for FY25-27

7.1 Guidance — Sky Gold & Diamonds

Revenue: Targets remain unchanged

Margin Revised Downwards: PAT margin for FY27 revised to 4.25-4.5% from 4.5% in Q1 FY26

Volume Targets: (kg per month)

Q2 FY26: 580 target vs 554 achieved

Q3 FY26: 630

Q4 FY26: 650

FY27: 900

Export Targets:

10-12% from Q3 FY26

15-20% by March 2027

Future Acquisitions:

No need for any further acquisition for the next 2-4 years

SKYGOLD has all the necessary products on board, covering 80% of products sold in retail stores

Advance Gold Business

Target = 10-12% of total business by FY27.

To reduce working capital cycle and contribute to becoming cash flow positive.

Sweet Bangle (recent acquisition) will adopt 100% advanced gold business

Capital Expenditure and New Facility

Timeline: Construction will start in April 2026. It will take three years to finish. The anticipated opening date is at the end of 2028.

Capacity: Needed when the current 1.2-ton per month capacity is exhausted.

Capex:₹250 Cr:

Construction: ₹150 Cr – funded internally

Rest for furniture, fixtures, and machinery, needed in 2028.

Long-Term Vision: Capacity of 4 to 5 tons by FY31/32.

7.2 H1 FY26 Performance vs FY26 Guidance

On-track FY26 Revenue Guidance, Lagging on Volumes

Revenue: Required run-rate of ~₹2,800 Cr vs ₹2615 Cr in H1

On-track to deliver ₹5,400 Cr revenue guidance for FY26

Margins: H1 FY26 Margins of 4.2% on-track for the 4.25-4.5% PAT guidance for FY27

Volume: Lagging – delivered 554kg per month vs the target of 580

Gold Metal Loan: Lagging – one the causes for the lowered PAT margin guidance from 4.5% to 4.25-4.5% in FY27

Delayed due to documentation delays and supply concerns

8. Valuation Analysis

8.1 Valuation Snapshot — Sky Gold

Current Market Price= ₹332.1; Market Cap = ₹ 5,196.5 Cr

EPS growth in FY26 muted compared to PAT due to increase in equity to fund the acquisition of Speed Bangle

Reasonably priced on a FY26 basis

Attractively priced on a FY27 basis with 15x P/E and 12x EV/EBIDTA

Opportunity to re-rate to to a 20x+ PE based on FY27 EPS.

Sky Gold & Diamonds appears undervalued on FY27 metrics — with re-rating potential as it delivers on FY27 guidance

8.2 Opportunity at Current Valuation

Attractive Forward Valuations: At FY27 P/E of ~15x, EV/EBIDTA of ~12x the valuations don’t seem to be discounting FY27 guidance

Potential for re-rating of multiples based on FY27 execution

Capacity Expansion: With a vision of 4-5 ton capacity from the current 1.2 ton per month capacity by FY31/32 indicates a much larger opportunity beyond FY27

Large Headroom for Growth:

Transition toward organized jewellery retail is a structural tailwind

Creates opportunities for SKYGOLD, which has <0.5% market share

Global Optionality:

Target 25%+ by FY27

Dubai office to cut gold costs

Distributor in Malaysia scaling up

Faster receivables (<15 days) improve cash flow

8.3 Risk at Current Valuation

Execution Risks: Its an emerging red-flag, needs to be watched carefully

FY27 PAT margin from 4.5% to 4.25-4.5%

Q2 FY26 gold volume below guidance given in Q1

Delay in Gold Metal Loans

Any delay in client ramp-up, order conversion, or export scale-up limit near-term upside.

Capacity Expansion: The new capacity will come up by 2028 end. Its a multi-year project. Delays will mute the opportunity in SKYGOLD

Negative Operating Cash Flow:

SKYGOLD promising to be cash flow positive in FY28

A miss will put a question mark on the quality of earnings

Previous coverage of SKYGOLD

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer