Sky Gold Q1-26 Results: Profit Up 105%, FY27 Guidance on Track

PAT CAGR of 61% thru FY27 to deliver ₹7,600 Cr revenue driven by exports, advance gold & design-led growth. Valuation upside depends on execution & demand ramp-up

1. Manufacturing of Casting Gold Jewelry

skygold.co.in | NSE: SKYGOLD

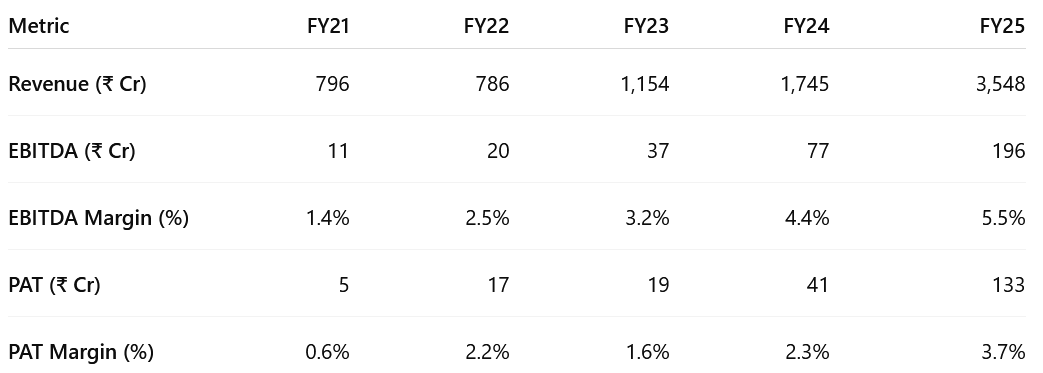

2. FY21–25: PAT CAGR of 129% & Revenue CAGR of 45%

2.1 What Changed Between FY21–25

Export Expansion: Entered UAE, Singapore, and Malaysia. Exports hit 8% of revenue in FY25; targeting 15%+.

Product Mix Shift: Added 18k rose/white gold, diamond, and lab-grown jewellery to core 22k offerings—targeting younger, value-driven buyers.

Capacity Growth: Scaled monthly output from ~350 kg to 950 kg across three facilities.

Corporate Wins: Revenue from institutional clients rose from 65% to 80%+ with ABNL, CaratLane, Pothys onboarded.

Working Capital Gains: ERP + bullion-supplied model cut cycle by 25%. Targeting 45–50 days by FY27 via gold metal loans and client mix shift.

Model Upgrade: Transitioned from gold-funded to client-supplied bullion, boosting capital efficiency and EBITDA scalability.

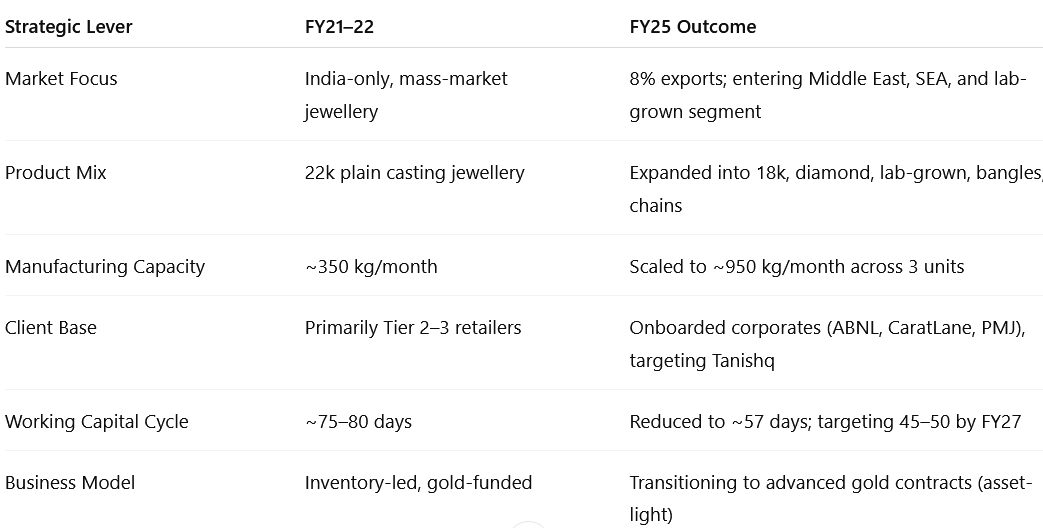

3. Strong FY25: PAT up 228% & Revenue up 103% YoY

Key drivers for PAT margin expansion are advanced gold, gold metal loans, and our high margin diamond business, along with operating leverages from scale

Broad-Based Growth: Driven by volume, client additions, and capacity scale-up.

Export Contribution: Share rose to 8% of revenue, with strong recurring traction.

Product Expansion: 18k, diamond, and lab-grown added margin-accretive growth.

Capital Efficiency: ERP, gold metal loans, and client-funded models improved cycle.

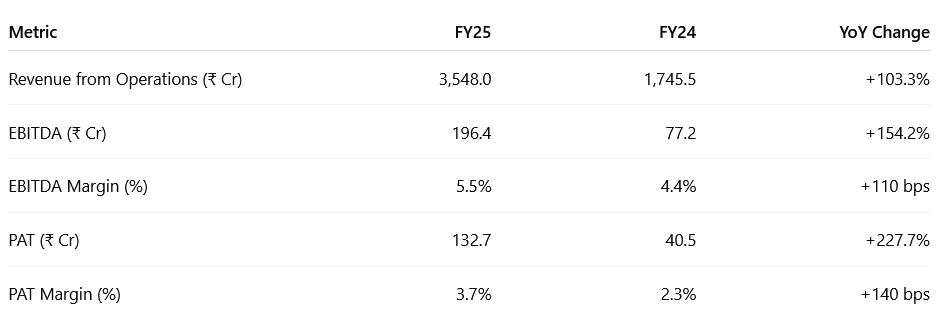

4. Q1-26: PAT up 105% & Revenue up 57% YoY

PAT up 14% & Revenue up 7% QoQ

Sky Gold & Diamonds Limited has delivered a strong Q1 FY26 performance, marking a solid start to the fiscal year and continuing its sharp upward trajectory from FY25.

Operational Highlights & Strategic Drivers

Export Acceleration

Exports rose to 12% of revenue (vs 8% in FY25).

Growth led by orders from Malaysia, Singapore, and Middle East.

Company targets 25% export share by FY27.

Dubai office launch and advanced gold model will further accelerate this.

Advanced Gold Model Scaling

5–6% of Q1 volumes were on advanced gold (client-supplied bullion).

This model improves cash flow and PAT margins.

Key clients onboarded under this model

Margin Expansion Levers

Operational efficiency: employee productivity up, gold loss down to ~0.5%.

Design-led model enables premium pricing.

ERP rollout improving control over gold flow, receivables, and inventory.

GML (Gold Metal Loans) to gradually replace working capital debt.

Capacity & Client Growth

Monthly production scaled up to ~900 kg.

Monthly volumes expected to double by FY27

Ongoing 4.5x expansion will unlock 4 tons/month capacity by FY28.

New clients onboarded in Q1: Reliance Retail, PMJ Jewellers, Pothys, Vega, CaratLane, Aditya Birla etc.

24-carat design innovation for domestic players with regional dominance.

Key Risks to Monitor

Margin pressure from rising competition and customer concentration.

Execution risks tied to 4x capacity expansion.

FX volatility and gold rate fluctuation impacting exports and procurement.

Slower ramp-up of advanced gold volumes or diamond segment contribution.

Q1 FY26 confirms that Sky Gold is scaling with discipline and speed. With strong revenue momentum, a lean cost model, and strategic levers like advanced gold and ERP in place, the company is well-positioned to hit its FY27 targets without aggressive assumptions. Execution and client ramp-up will remain critical in the next 2–3 quarters.

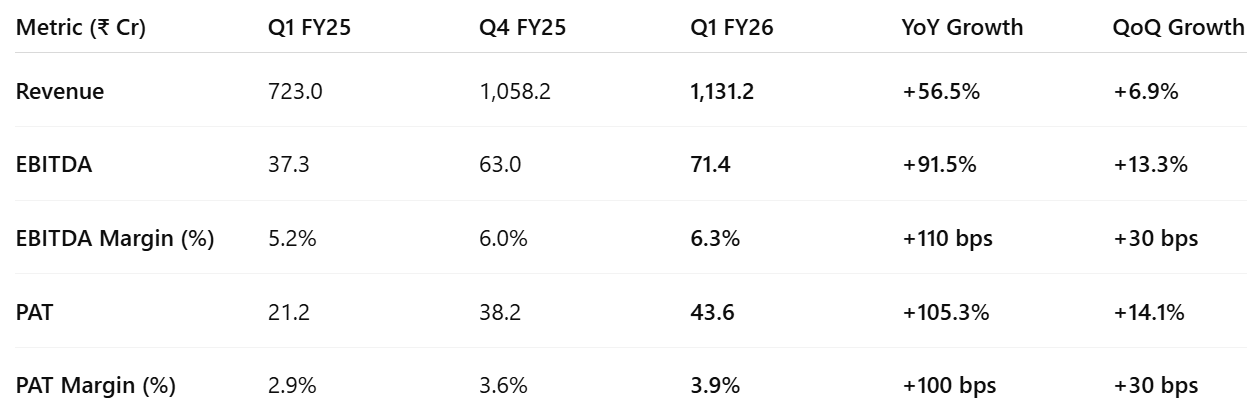

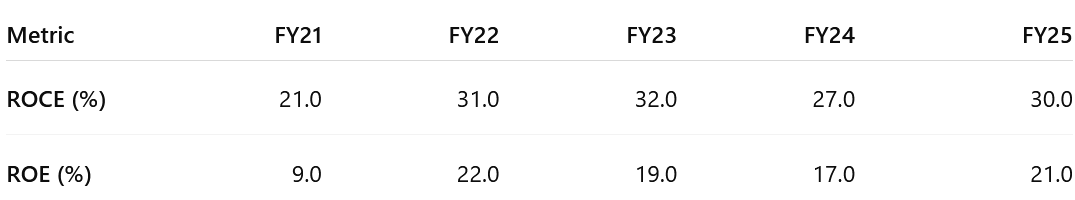

5. Business metrics: Strong return ratios

Return Ratios dipped in FY24 despite rising profits due to a 2.5× increase in equity (fund infusion).

Return Ratios recovered in FY25 as earnings growth outpaced capital expansion.

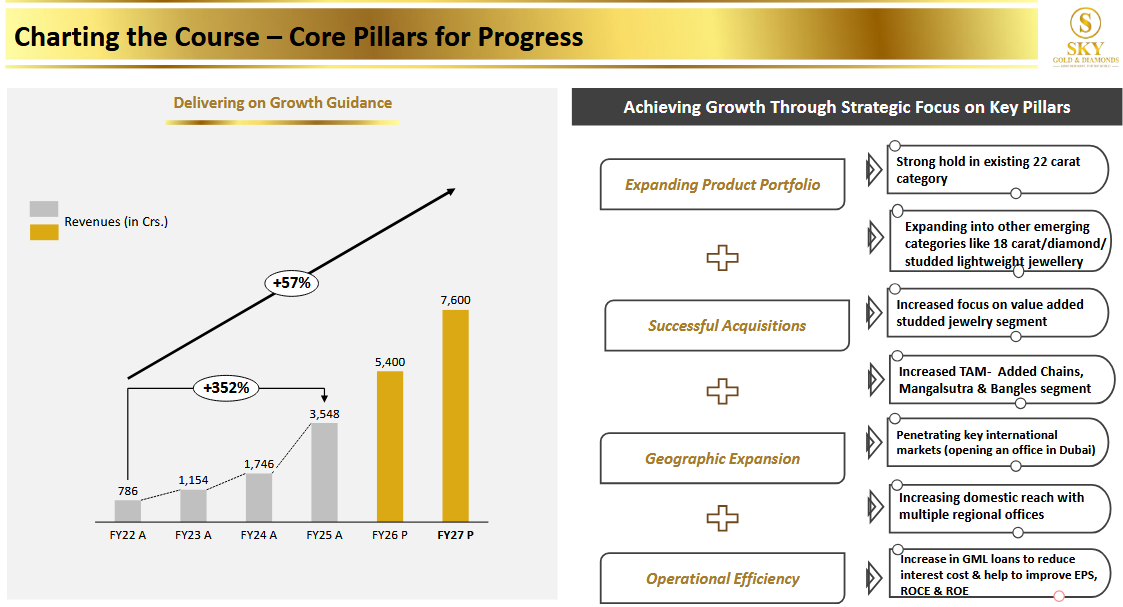

6. Outlook: PAT CAGR of 61% for FY25-27

Our Q1 FY26 performance aligns with our vision of building a ₹7,600 crore enterprise by FY27. We’re seeing strong traction in exports, product innovation, and client acquisition.

With exports poised to contribute 25% of revenues in the coming two years, our Dubai expansion will position us among the top integrated gold jewellery manufacturers from India.

FY27 Revenue Target: ₹7,600 Cr

PAT Margin Target: 4.5%

Export Revenue Target: 25% by FY27

Working Capital Days: To reduce from 72 to 52–55 days

ROCE Target: >30%

Revenue Growth: FY26= 52% | FY25-27= 46% CAGR

So we have given the guidance of Rs. 5,400 crores for FY26 and Rs. 7,600 crores for FY27

Margin: FY25-27= 61% PAT CAGR

So we are at current 3.7% PAT and we are expecting to go to 4.5% conservatively by FY ’27 March. EBITDA, we are now 5.7% approximately, 5.67%, and we will go up to 6.2%, 6.3% of EBITDA, conservative 6.2%

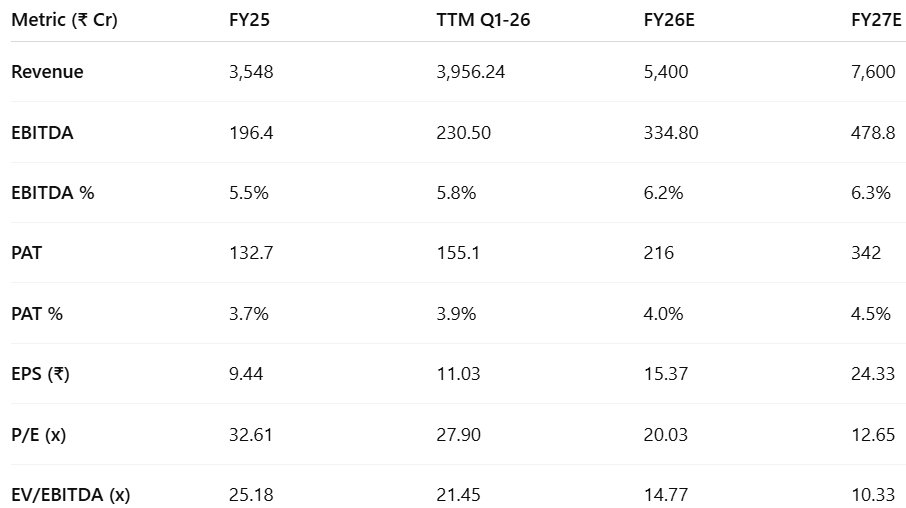

7. Valuation Analysis

7.1 Valuation Snapshot — Sky Gold

EV assumed constant at ₹4,945.92 Cr for FY25–FY27, based on latest market cap and debt/cash data.

P/E Ratio

FY25 P/E = 32.6× is rich, but reflects investor confidence in future earnings.

FY26E P/E = 20.0× suggests strong earnings growth is beginning to catch up with valuation.

FY27E P/E = 12.6× is in line with fair valuations for high-growth manufacturing firms, implying scope for re-rating as execution continues.

PEG ratio (P/E to earnings growth) looks favorable. PAT CAGR FY25–FY27 is ~59.5%, much higher than the P/E trajectory → stock could rerate as PAT expands.

EV/EBITDA

Declining from 25.2× in FY25 to 10.3× in FY27E.

This signals operating leverage kicking in and valuation derating risk reducing.

EV/EBITDA ~10× is typically considered fair for:

Scalable B2B models

High working capital businesses (like jewellery)

Margin expansion trajectory

If EBITDA margins are delivered as guided, Sky Gold may look undervalued in FY27, assuming execution on exports, ERP, and gold loan optimization.

Growth numbers, suggesting:

Solid operating leverage

Smart capital deployment post-QIP

Strong tailwinds from formalization + exports

Sky Gold & Diamonds appears undervalued on FY27 metrics — with re-rating potential as it delivers on revenue, margin, and capital discipline.

PAT CAGR of nearly 60%

FY27 P/E ~12.6× and EV/EBITDA ~10.3×

Tailwinds from exports, formalization, diamond mix, and advanced gold contracts

Operational improvements (ERP, gold loss reduction, GML rollout) in motion

7.2 Opportunity at Current Valuation

Growth Visibility

PAT CAGR of ~59.5% (FY25–27) driven by:

Ramp-up in advanced gold contracts and diamond/18KT jewellery.

New large clients: Reliance, Aditya Birla, CaratLane, etc.

Export share rising from 8% (FY25) to 25% (FY27).

ROE/ROCE >30% by FY27 on margin improvement and low capital intensity.

Asset-Light Execution

₹400 Cr capex fully equity-funded via QIP + promoter warrants.

Zero debt or dilution risk ahead.

ERP-enabled control on gold loss, inventory, and receivables.

Global Optionality

Exports at 12% in Q1 FY26; target 25%+ by FY27.

Dubai office to cut gold costs (~$10/oz arbitrage).

Distributor in Malaysia scaling to 200kg/month.

Faster receivables (<15 days) improve cash flow.

Margin Expansion

Gross margin up from 3% (FY20) to 7% (FY25).

18KT, diamond mix and co-created designs drive better pricing.

Gold loss down to 0.5%, ERP improves productivity.

PAT margin: 3.9% (Q1 FY26) → 4.5% by FY27.

Export + Advanced Gold Flywheel

Advanced gold at 6% of volumes, targets 10%+ by FY27.

Improves margins, reduces capital employed.

Dubai-to-India job-work model exploits global cost arbitrage.

Faster turnaround and design IP ensure client stickiness.

Valuation Comfort

Trades at 20.0× FY26E and 12.7× FY27E EPS.

EV/EBITDA: 14.8× (FY26E) → 10.3× (FY27E).

PEG < 0.5, strong execution reduces risk. Re-rating likely.

7.3 Risk at Current Valuation

Valuation Leaves Limited Room for Misses

FY27E multiples:

P/E: 12.7×, EV/EBITDA: 10.3×, PEG < 0.5

While not expensive, valuation assumes smooth execution across exports, advanced gold, and capacity ramp.

Any delay in client ramp-up, order conversion, or export scale-up could limit near-term upside.

Execution Bottlenecks

4× capacity expansion (to 4.5 tons/month) is back-ended; meaningful benefit only from FY27.

Dubai office and international distributor model are early-stage; demand visibility remains shallow.

ERP implementation and GML rollout are still being integrated — success depends on adoption across functions.

Margin Compression Risk

PAT margin improved to 3.9% in Q1 FY26, but execution is thin-margin and volume-sensitive.

Sharp rise in gold prices could:

Shrink conversion demand

Disrupt order timelines

Widen working capital gaps for domestic clients

Diamond mix is margin accretive but slower to scale due to longer receivable cycles.

Dependence on New Client Monetization

FY26–27 growth hinges on timely order flow from new clients (Reliance, Aditya Birla, etc.).

Early wins don’t guarantee sustained volumes; delays in procurement cycles or design approvals may hurt run-rate.

Working Capital Discipline Required

Receivables spiked to 72 days in Q4 FY25; while normalized to ~60 days, full control is pending.

Even with advanced gold model, domestic B2B jewellery carries inherent working capital risk.

Demand & FX Sensitivity

Export demand is sensitive to gold price volatility, regional FX swings, and distributor inventory cycles.

Gold arbitrage model (Dubai sourcing) depends on regulatory clarity and smooth inter-country logistics.

Normalization Risk

FY25 and Q1 FY26 saw strong operating leverage; current run-rates may not fully reflect normalized opex and receivable pressures.

In a lower demand environment, EPS could drop 10–15%, which would push effective multiples higher.

While Sky Gold offers strong earnings momentum and margin levers, valuation assumes linear execution across new geographies, clients, and models. Any slip in capital discipline or demand momentum could cap re-rating in the near term.

Previous coverage of SKYGOLD

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer